Here is a term paper on ‘Balance of Payments’. Find paragraphs, long and short term papers on ‘Balance of Payments’ especially written for school and college students.

Term Paper # 1. Introduction to the Balance of Payments:

Balance of Payments or BOP is a historical summary of a country’s foreign exchange inflows and outflows that occurred during a particular time period (usually one year). It is a record of the cross-border activities between a country and the rest of the world and is prepared by its central bank. The BOP holds a central position in International Finance.

It influences the economic strength of a country and the strength of the domestic currency in the foreign exchange market. The IMF extends multilateral aid to member-countries based on the severity of their BOP imbalances. The BOP position also affects a country’s sovereign rating, the availability and cost of overseas funding. A country is judged by its BOP position and its augury for the future.

Balance of trade is just one component of Balance of Payments (BOP). If a country’s BOT is positive but its BOP is negative, what is the effect on the exchange rate? Will the domestic currency appreciate or depreciate, irrespective of whether the country follows a fixed exchange rate or a floating exchange rate? How relevant is BOP in explaining the exchange rate? This article considers such issues.

ADVERTISEMENTS:

Features of BOP:

The BOP is a statistical record of a country’s past inflows and outflows of foreign currency. Examining trends in a country’s BOP of over a number of years and comparing it with trends of other countries, permits an assessment over time and across countries.

i. Trends in a country’s BOP affect international expectations. Trends have a ‘signalling’ effect, and indicate that the country’s future prospects are bright or bleak. If India consistently runs a BOP surplus over the next five years, international investors will conclude that the government’s policies of liberalization and privatization have paid off, and that the country is a safe investment destination.

If, on the other hand, India continues to run a negative BOB and the size of the BOP deficit has been increasing, it will be viewed less favourably. International investors will expect the country to request multilateral aid, implemented aid conditionalities, and possibly face civic and political unrest. This will make them decide on other investment destinations.

ADVERTISEMENTS:

ii. The BOP is an account and has a debit side and a credit side. All inflows of foreign currency are shown as credits and all outflows of foreign currency are shown as debits. Foreign exchange inflows create a demand for domestic currency (since the foreign currency is sold and the domestic currency is purchased). Foreign exchange outflows create a supply of domestic currency (since the foreign currency is purchased and the domestic currency is sold). The net inflows (foreign exchange inflows minus foreign exchange outflows) or the ‘balance’ over a period can be positive, zero or negative.

iii. When the sum of credits exceeds the sum of debits, net inflows of foreign exchange are positive and the country accumulates foreign exchange reserves (called official reserves). When the sum of credits is equal to the sum of debits, net inflows of foreign exchange are zero and there is no change in foreign exchange reserves. When the sum of credits is lower than the sum of debits, net inflows of foreign exchange are negative and the country’s foreign exchange reserves shrink.

iv. The BOP is an ex-post analysis of the flow of foreign exchange. It merely records past information of activities between a country and the rest of the world. As such it has limited relevance as a corrective tool. Policy makers use this trend to calibrate or alter economic policies, and to assess policy changes in terms of their impact on the BOP position. The IMF uses a country’s BOP position as a basis for granting a loan.

The BOP contains a list of debit balances and a list of credit balances. The balances can be shown in the country’s domestic currency, or in an internationally accepted currency such as the US dollar. The RBI’s website presents India’s BOP in rupee terms, and again in dollar terms. How is the BOP prepared?

ADVERTISEMENTS:

Consider the following transactions shown in dollar terms:

1. Items that cause a country’s foreign exchange reserves to go down (that is, cause foreign exchange outflows).

Such transactions during a particular year (for example, in 2011-12) are:

a. Imports by Indian companies – $15 million.

ADVERTISEMENTS:

b. Gifts made by Indians to persons overseas – $1 million.

c. Indian residents bought $4 million of equity shares on the New York Stock Exchange.

d. The Indian government gave aid of $6 million, to an African country that suffered from severe floods.

e. Indian companies paid dividend to overseas investors – $2 million.

ADVERTISEMENTS:

f. Indian banks lent $12 million to companies overseas.

g. Indian companies invested $20 million in outbound FDI to Latin America.

2. Items that cause a country’s foreign exchange reserves to go down (that is, cause foreign exchange outflows).

Such transactions during a particular year (for example, in 2011-12) are:

ADVERTISEMENTS:

a. Exports by Indian companies – $30 million

b. Gifts of $3 million given by persons overseas to Indian citizens.

c. Foreign institutional investors bought $5 million of equity shares on the National Stock Exchange.

d. The Indian government received $10 million as aid from the US government.

ADVERTISEMENTS:

e. Indian residents received dividend of $7 million from companies overseas.

f. Indian companies borrowed $50 million through external commercial borrowings (repayable after 7 years).

g. Foreign companies made inbound FDI investments in India $30 million.

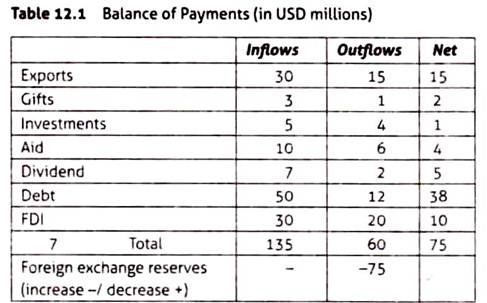

The foreign exchange inflows and outflows balances are summarized in the Balance of Payments as shown in Table 12.1.

Since the country’s net receipts were $75 million ($135 million — $60 million), the country had a BOP surplus in 2011—12. But this ordering of items does not distinguish between short-term (one year or less) and long-term items. The distinction is important because the government and monetary authorities plan for repayments, and on how to invest foreign exchange surpluses.

ADVERTISEMENTS:

Sometimes, ad hoc measures are resorted to, and this is an indication of the dire straits a country is in. In 1991, India had foreign exchange reserves enough to pay only a few weeks’ worth of its import bill. This forced the government to pledge gold as collateral overseas, and borrow money to meet repayments. Therefore, the BOP is divided into two components—the current account and the capital account.

Term Paper # 2. Components of the BOP:

The current account records short-term foreign exchange inflows and outflows. When the net inflows are positive, there is a current account surplus, and there is a deficit when the net inflows are negative. The capital account records long-term foreign exchange inflows and outflows. When the net inflows are positive, there is a capital account surplus, and when the net inflows are negative, there is a capital account deficit.

The BOP reflects the overall balance for both accounts put together. When the current account and the capital account each have a surplus, the BOP is positive. When the current account and the capital account each have a deficit, the BOP is negative. When the current account has a surplus (or deficit) and the capital account has a deficit (or surplus), the BOP will be positive when the surplus exceeds the deficit. The BOP will be negative when the surplus is less than the deficit.

Current Account:

Short-term foreign exchange inflows and outflows are grouped into visible and invisible items.

Trade in Goods and Services:

ADVERTISEMENTS:

Exports and imports of merchandise and gold (known as visibles) are an extremely important contributor to BOP surplus or deficit. The difference between exports and imports is Balance of Trade (BOT). If the exports during a period exceed imports, there is a favourable BOT. If exports are less than its imports during a period, the country is said to have an unfavourable BOT. In general, a favourable BOT can ensure that the current account balance is also favourable.

The composition of a country’s exports and imports is extremely important. Export prices relative to import prices are called terms of trade. If the prices of exports are greater than the prices of imports, the country enjoys favourable terms of trade. Primary goods (such as agricultural products) are vulnerable to negative terms of trade.

A country whose principal exports are primary products is more likely to experience a negative BOT. The greater the range of goods exported and the higher up the value chain the goods are, the less vulnerable the country is to negative (unfavourable) terms of trade. BOT can be improved by broad-basing exports, improving the quality of domestic goods and services, charging competitive prices in international markets, and by moving up the value chain in terms of exports.

Invisibles consist of five subgroups:

1. Services:

These include travel, transportation, insurance, business financial, communication and miscellaneous services. Residents use foreign exchange for travel overseas (tourism, medical treatment, education) and it causes foreign exchange outflows. When residents from other countries travel to India, they bring foreign exchange which is converted into domestic currency.

ADVERTISEMENTS:

2. Transfers:

These refer to unilateral movement of funds such as gifts from residents (or government) to overseas residents (or overseas government) and by non-residents (or overseas government) to domestic residents (or government).

3. Income:

Investment income refers to payment of dividend and interest to overseas holders of domestic securities, and receipt of dividend and interest by domestic residents holding overseas securities.

4. Royalty and Fees:

Fees and royalty paid overseas cause foreign exchange outflow, and those received from overseas cause foreign exchange inflow.

ADVERTISEMENTS:

5. Repatriation of Profits:

When Indian affiliates of foreign companies remit the profits to the parent company overseas, there is an outflow of foreign exchange. When parent Indian companies get their share of profits from overseas affiliates, there is an inflow of foreign exchange.

Capital Account:

Inflows and outflows on the capital account are grouped into two categories:

1. Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI):

When a country experiences ‘inbound’ FDI and FPI, there is an inflow of foreign exchange into the country. When companies in a country expand overseas (outbound FDI) and invest in securities overseas (outbound portfolio investment) there is an outflow of foreign exchange.

ADVERTISEMENTS:

2. Loans:

When residents of a country take short-term, or long-term overseas loans, foreign exchange flows in (periodic payment of interest appear in the current account as an outflow). Similarly when companies, banks, and residents give short-term or long-term loans overseas, there is an outflow of foreign exchange (periodic receipts of interest appear in the current account as an inflow).

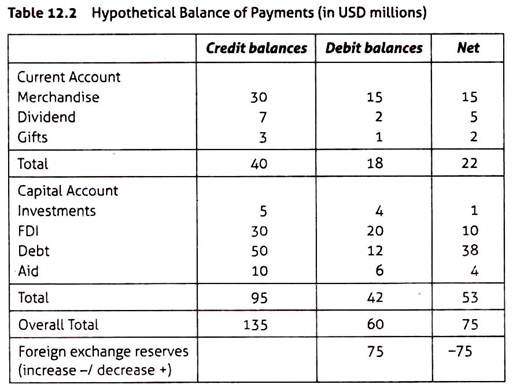

Table 12.2 is the redrawn BOP arranged component-wise. Note that the term ‘merchandise’ is used instead of imports and exports.

Term Paper # 3. India’s Balance of Payments:

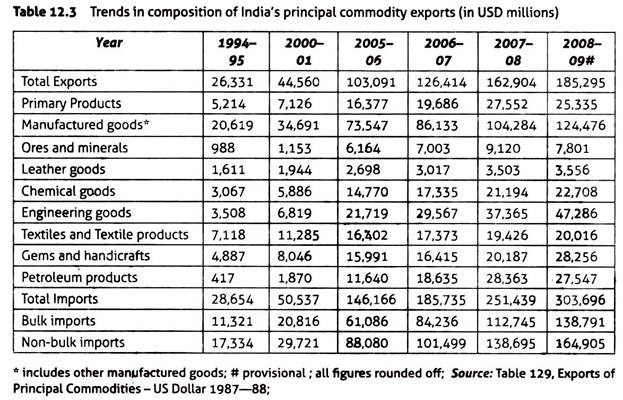

India’s principal exports consist of primary products, leather items, manufactured goods, chemicals, textile and textile products, engineering goods, handicrafts, gems, and petroleum products. Primary products are divided into two categories ― agriculture and allied products (coffee, fruits and vegetables, tobacco, spices, and wheat), minerals and ores (mica, iron ore, and other ores). In 1994-95, 21% of India’s exports were to countries in Asia. In spite of signing several bilateral agreements with Asian countries, and efforts to increase trade with ASEAN countries, this percentage has not increased.

India ran a negative BOT from 1970—71 onwards, attributed to rising petroleum prices and increases in non-oil imports.

In terms of shifts in composition of exports between 1994-95 and 2008-09, following trends were observed:

i. Manufactured goods accounted for 67% of total exports in 2008-09, down from 78%% in 1994-95.

ii. Exports of petroleum products jumped to nearly 15% of total exports in 2008-09 compared to a mere 1.6% in 1994-95.

iii. Exports of primary products exports were 13.6% of total exports in 2008-09, versus 19.8% in 1994-95, indicating that India became less reliant on such items.

Table 12.3 shows the trend in India’s export performance from 1994 to 2009.

India’s imports comprise bulk and non-bulk imports. Bulk imports consist of petroleum products, fertilizers, cereals, edible oils, pulses, non-ferrous metals, paper and paper products, rubber, scrap, ore, and iron and steel.

Non-bulk imports include capital goods, such as machine tools, electrical machinery, computer goods, transportation equipment, electronic goods, and project goods, imports of export related items such as pearls, inorganic chemicals, cashew nuts, textile and yarn, gold and silver, and chemical materials. Between 1999-2000 and 2005-06, imports of petroleum, gold and silver, and gems had a significant share in total imports. Non-bulk imports constituted 60% of imports in 1994-95, and 54% in 2008-09.

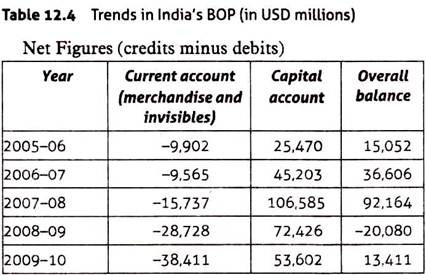

Though the BOP is prepared using the double entry system, the figures do not always add up since data is collected from multiple sources. Therefore, the BOP carries a column titled ‘errors and omissions’. In the above table, the errors in each of the five years were (in USD millions) -516,968, 1,316, 1,401, and -1,746 respectively.

India ran a BOP surplus from 2006-07 to 2009-10, with the exception of 2008-09. The BOP surpluses arose in spite of consistent current account deficits. When compared to current account balances of major emerging market economies, Brazil and China, there is scope for substantial improvement.

In September 2010; India’s foreign exchange reserves were $288 billion, held in multiple currencies and invested in several assets—securities, deposits with other central banks, and deposits with foreign commercial banks. Consistent BOP surpluses, and increase in foreign exchange reserves are indicators of economic wellbeing.

The robustness of BOP and the adequacy of foreign exchange reserves are assessed at a point in time with reference to several parameters:

i. Ratio of Short-Term Debt to Foreign Exchange Reserves:

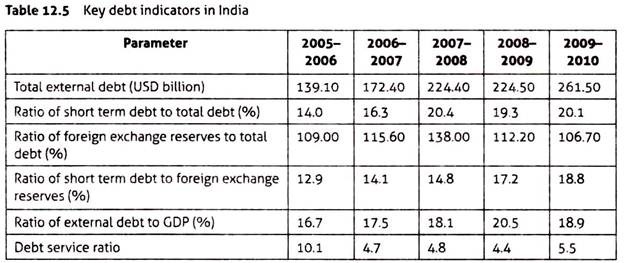

India showed substantial improvement in this ratio—from 146.5 % in March 1991 to 12.9% in 2005-06 reaching 18.8% in 2009-10 (Table 12.5).

ii. Ratio of Volatile Capital Flows to Foreign Exchange Reserves:

Volatile capital consists of foreign portfolio outflows, and short-term overseas debt. In September 2006 the ratio was 42% in India compared to 146.6% in March 1991, according to the Report on FCAC (2006).

iii. External Debt to GDP Ratio:

External debt is the amount that the residents of a country are contractually obligated to pay to non-residents. India’s external debt forms 11% its sovereign debt, and most of it is from bilateral and multilateral sources. According to the Status Report on India’s External Debt 2009-10 (Ministry of Finance), India’s debt to GDP ratio fell from 38.7% in 1991-92 to 18.9 % in 2009-10.

iv. Debt Service Ratio:

There was a tremendous improvement in India’s ratio; it fell from 302% in 1991-92 to 5.5% in 2009-10.

v. Composition of Sovereign Debt:

Eighty-nine percent of India’s sovereign debt is from domestic sources, out of which 51% is held by commercial banks and 22% by insurance companies.

Term Paper # 4. Role of BOP in Deciding Exchange Rate:

The BOP affects the exchange rate through the overall supply of foreign currency. Inflows of foreign exchange increase the demand for the domestic currency and outflows of foreign exchange increase the supply.

If the inflows exceed the outflows, then increase in demand for domestic currency exceeds the increase in supply of domestic currency. When net foreign exchange inflows are positive, the supply of foreign currency increases and the price of foreign currency decreases. Since the price of foreign currency is expressed through the exchange rate, the domestic currency will appreciate against the foreign currency.

When net inflows of foreign currency are negative, the supply of foreign currency decreases and the price of foreign currency increases. Since the price of foreign currency is expressed through the exchange rate, the domestic currency will depreciate against the foreign currency.

So, when net inflows are positive, the demand for domestic currency increases, the price of domestic currency increases, and the domestic currency appreciates. When net inflows are negative, the demand for domestic currency decreases, price of the domestic currency falls, and the domestic currency depreciates. Thus, the BOP is one of the many factors (in addition to money supply, expectations, interest rates and asset preference) that affect the exchange rate.

BOP and Floating Exchange Rate Regime:

The central bank need not maintain foreign exchange reserves, because the exchange rate is determined by market forces. But many countries on a managed float (including India) continue to hold foreign exchange reserves as they are viewed as a necessity. They provide a cushion against shocks which could arise from changes in global oil prices, uncertain monsoons, and high levels of public debt.

In a floating exchange rate system, the exchange rate changes throughout each business day. Though the BOP is published annually, the BOP figures shape expectations. The overall trend in the direction of a floating exchange rate is influenced by the BOP position.

In general when the BOP is favourable, a country’s leverage in world markets rises. Investors perceive the country as being worth the risk, and international rating agencies raise the credit rating of the country (sovereign rating) based on its improved credit worthiness. This in turn means that funds can be raised at lower rates in the Eurocurrency market and in the American market.

BOP and Fixed Exchange Rate:

The central bank maintains the peg through intervention in the foreign exchange market. It steps in to buy or sell the foreign currency. The central bank’s foreign exchange reserves are augmented when it buys foreign exchange and depleted when it sells foreign exchange. This is a matter of great concern for policy-makers since the country may be unable to pay for its imports.

When there are net foreign exchange inflows, the central bank accumulates foreign exchange reserves by buying foreign exchange and selling the domestic currency. The result is an increase in money supply and inflation. The fixed exchange rate will not reflect the value of the domestic currency.