In this article we will discuss about Central Public Sector Enterprises:- 1. Introduction to Central Public Sector Enterprises 2. Performance of CPSEs 3. Board Structure 4. Corporate Governance 5. Professionalization of Boards 6. Wages/Salaries and Employees Welfare 7. Employment 8. Counseling, Retraining and Redeployment 9. MoU System 10. Mega and Major Projects under Implementation 11. Market Capitalisation of CPSEs Stocks.

Contents:

- Introduction to Central Public Sector Enterprises

- Performance of CPSEs

- Board Structure of CPSEs

- Corporate Governance in CPSEs

- Professionalization of Boards of CPSEs

- Wages/Salaries and Employees Welfare in CPSEs

- Employment in CPSEs

- Counseling, Retraining and Redeployment in CPSEs

- MoU System

- Mega and Major Projects under Implementation

- Market Capitalisation of CPSEs Stocks

- Investment in Central Public Sector Enterprises

- International Operation of CPSEs

- Delegation of Enhanced Financial Powers to CPSEs

- Revival and Restructuring of Sick/Loss Making CPSEs 16.

- Future Strategies of CPSEs

1. Introduction to Central Public Sector Enterprises:

The Central Public Sector Enterprises (CPSEs), besides statutory corporations, comprise those Government companies (defined under Section 617 of the Companies Act, 1956) wherein more than 50 per cent equity is held by the Central Government. The subsidiaries of these companies are also categorized as CPSEs.

ADVERTISEMENTS:

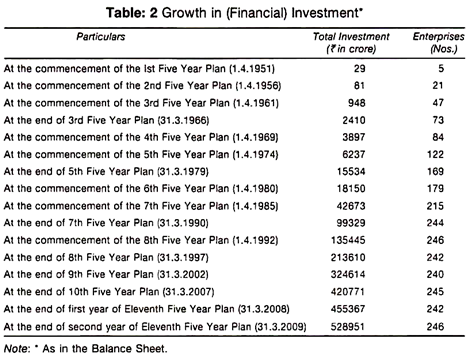

However, departmentally run public enterprises like banking institutions and enterprises wherein Central Government equity is less than or equal to 50 per cent are generally not categorized as CPSEs. As on 31.3.2009, there were 246 CPSEs (excluding seven Insurance Companies) with a total investment of Rs.528951 crore.

The increase in both the number of enterprises and the total investment in CPSEs can be gauged by the fact that on the eve of the First Five Year Plan, there were only 5 CPSEs with a total investment of Rs.29 crore.

A large number of CPSEs have been set up as Greenfield projects consequent to the initiatives taken during the Five Year Plans. CPSEs, such as National Textile Corporation Ltd., Coal India Ltd. (and its subsidiaries) have, however, been taken over from the private sector consequent to their ‘nationalization’.

Industrial units, such as, Indian Petrochemicals Corporation Ltd., Modern Food Industries Ltd., Hindustan Zinc Ltd., Bharat Aluminum Company Ltd., Maruti Udyog Nigam Ltd. etc. on the other hand, which were CPSEs earlier ceased, to be CPSEs after their ‘privatization’.

ADVERTISEMENTS:

Along with other public sector majors, such as, State Bank of India in the banking sector, Life Insurance Corporation in the insurance sector, Indian Railways in transportation, the CPSEs are the leading companies of India with significant market- shares in sectors such as petroleum products, (ONGC, GAIL and Indian Oil), mining (Coal India Ltd. and NMDC Ltd.), power generation (NTPC Ltd. and NHPC), power transmission (POWERGRID), nuclear energy (Nuclear Power Corporation of India Ltd.), heavy engineering (BHEL), aviation industry (Hindustan Aeronautics Ltd. and NACIL), storage and public distribution system (Food Corporation of India and Central Warehousing Corporation), shipping and trading (Shipping Corporation of India Ltd. and State Trading Corporation Ltd.) and telecommunication group (BSNL and MTNL).

With economic liberalization, post-1991, sectors that were exclusive preserve of the public sector enterprises were opened to the private sector. The CPSEs, as such, are faced with competition from both the domestic private sector companies (some of which have grown very fast) and the large multinational corporations (MNCs).

These large corporations enjoy the advantage of ‘economies of scale’ as well as have superior technology. Competition in the markets has, therefore, made the CPSEs also spend on Research & Development (R&D), go for technological collaboration and look for growth opportunities within India and abroad. In the case of some CPSEs, however, turnover has been declining over the years and their market share has got much reduced.

CPSEs like National Textile Corporation Ltd., Cement Corporation of India Ltd., HMT Ltd. have currently a market share of less than five percent in the domestic market. The two main elements of the government’s policy have been devolution of full managerial and commercial autonomy to successful, profit-making companies and modernization and restructuring of sick PSUs as well as sell-off or closure of chronically sick CPSEs.

ADVERTISEMENTS:

The government has introduced a series of measures for enhancement of financial delegation to Navratnas, Miniratnas, and profit-making CPSEs. These include measures for creation of and disinvestment in subsidiaries, transfer of assets to such subsidiaries, and floating of fresh equity.

2. Performance of CPSEs

:

Some parameters of CPSEs as on 31.3.2009 are- Total paid up capital in 246 CPSEs—Rs. 1,38,843 crore; Total Share application money pending allotment—Rs. 3,867 crore in 41 CPSEs; Total investment (equity plus long term loans) in all CPSEs—Rs. 5,28,951 crore; Capital Employed (net block plus working capital) in all CPSEs—Rs. 7,94,105 Crore; Total turnover of all CPSEs during 2008-09—Rs. 12,63,405 crore; Total income of all CPSEs during 2008-09—Rs. 13,07,366 crore; Profit of profit making CPSEs during 2008-09—Rs. 98,652 crore; Loss of loss incurring CPSEs during 2008-09—Rs. 14,424 crore; Reserves & Surplus of all CPSEs—Rs. 5,35,840; Net worth of all CPSEs—Rs. 5,88,217 crore; Contribution of CPSEs to Central Exchequer by way of excise duty, customs duty, corporate tax, interest on Central Government loans, dividend and other duties and taxes in 2008-09—Rs. 1,51,728 crore; Foreign exchange earnings through exports of goods and services in 2008-09—Rs. 74,184 crore; Foreign exchange outgo on imports and royalty, know-how, consultancy, interest and other expenditure during 2008-09—Rs. 4,28,821 crore; Number of people employed by CPSEs—15.35 lakh (excluding casual workers and contract labours); Salary and wages in all CPSEs in 2008-09—Rs. 82,735 crore; Total Market Capitalisation (M_Cap) of 41 listed CPSEs, based on the stock price in Bombay Stock Exchange—Rs. 8,13,530 crores.

In terms of Gross Block, the top ten enterprises as on 31.3.2009 were Oil & Natural Gas Corporation Ltd., Bharat Sanchar Nigam Ltd., NTPC Ltd., Indian Oil Corporation Ltd., Power Grid Corporation of India Ltd., Steel Authority of India Ltd., Nuclear Power Corporation of India Ltd., NHPC Ltd., National Aviation Company of India Ltd., and Hindustan Petroleum Corporation Ltd. The gross block of these enterprises inclusive of Capital-work-in progress amounted to Rs. 6,73,864 crore. This was equal to 68.92 per cent of the total gross block in all CPSEs.

ADVERTISEMENTS:

In terms of sector-wise and cognate group-wise cumulative investment in CPSEs, the service sector has highest share of 46.12 per cent in financial investment, followed by the electricity sector (26.19 per cent) and manufacturing (18.07 per cent).

Mining, under construction, and agriculture had a combined share of less than 10 per cent. While the CPSEs have monopoly in nuclear power generation, they have a major share in domestic/national output in coal, petroleum, power generation, telecommunication, and fertilizers.

The net profit of all CPSEs (aggregate net profit minus aggregate net loss) stood at Rs. 84,228 crore in 2008-09. Cognate group-wise, the best results were achieved by the ‘manufacturing’ sector followed by the ‘electricity’ sector. The other sectors of ‘mining’ and services recorded significant decline in profits.

In the manufacturing sector as well, CPSEs belonging to industries such as steel, petroleum refinery, medium and light engineering, and consumer goods recorded significant decline in their profits. CPSEs contribute to the Central Exchequer by way of dividend payment, interest on government loans and payment of taxes and duties.

ADVERTISEMENTS:

3. Board Structure of

CPSEs:

ADVERTISEMENTS:

The Department of Public Enterprises (DPE) formulates policy guidelines on the Board structure of Public Enterprises and advises on the shape and size of organizational structure of CPSEs. The public enterprises are categorized in four Schedules namely ‘A’, ‘B’, ‘C’ and ‘D.

The initial categorization of CPSEs in the mid-Sixties was made on the basis of their importance to the economy and complexities of their problems. Over the years the DPE has evolved norms for the purpose of categorization/re-categorization of CPSEs.

Categorization is based on criteria such as quantitative factors (like investment, capital employed, net sales, profit, number of employees) and qualitative factors (like national importance, complexity of problems, level of technology, prospects for expansion and diversification of activities and competition from other sectors, etc.) In addition, other factors such as strategic importance of the CPSE, etc. is also taken into account.

ADVERTISEMENTS:

The present procedure involves consideration of the proposals in the administrative Ministry concerned and the Department of Public Enterprises which consults the Public Enterprises Selection Board.

The pay scales of Chief Executives and full time Functional Directors in CPSEs are determined as per the Schedule of the concerned enterprise. Proposals received from various administrative Ministries/Departments for initial categorization/upgradation of CPSEs in appropriate schedule, personal upgradation, creation of posts in CPSEs, etc. are considered in DPE in consultation with the Public Enterprises Selection Board (PESB).

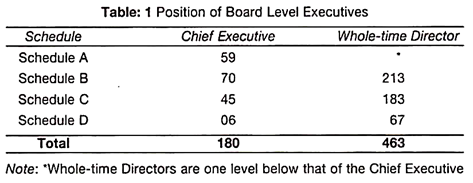

As on 31.1.2010, out of the 246 CPSEs, there are 59 in Schedule ‘A’, 70 CPSEs in Schedule ‘B’, 45 CPSEs in Schedule ‘C’ and 6 CPSEs in Schedule ‘D’. The rest 67 are covered under the uncategorized category. The details of the Board level posts (whole time) in the categorized CPSEs are given in Table 1.

4. Corporate Governance in CPSEs:

ADVERTISEMENTS:

In recent times, the concept of corporate governance has generated a great deal of interest and public debate. Corporate governance is intended primarily to ensure transparency in management of the enterprise and encompasses the entire functioning of the company.

The ‘Guidelines on Corporate Governance for CPSEs’ was brought out by the Department of Public Enterprises (DPE) in June 2007, keeping in view relevant laws, instructions and procedures.

For the purpose of Corporate Governance, the CPSEs have been, furthermore, categorized into two groups, namely- (a) those listed on the Stock Exchanges and (b) those not listed in the Stock Exchanges. The listed CPSEs have to follow the SEBI guidelines on Corporate Governance.

In addition, they may also follow those provisions of the Guidelines brought out by DPE which do not exist in the SEBI guidelines and also do not contradict provisions in the SEBI guidelines. The non-listed CPSEs are to follow the DPE guidelines on Corporate Governance, although these are voluntary in nature. These guidelines are under implementation by the CPSEs.

5. Professionalization of Boards

of CPSEs:

ADVERTISEMENTS:

The Department of Public Enterprises has taken several measures to professionalize the Boards of public enterprises in pursuance to the policy on public sector enterprises being followed since 1991. The guidelines issued by the DPE in 1992 provide for induction of outside professionals on the Boards of CPSEs as part-time non-official Directors.

The number of such Directors has to be at least 1/3rd of the actual strength of the Board. In the case of listed CPSEs headed by an executive Chairman, the number of non-official Directors (Independent Directors) should be at least half the strength of the Board.

The guidelines also provide that the number of Government Directors on the Boards should be not more than one-sixth of the actual strength of the Board subject to a maximum of two. Apart from the above, there should be some functional Directors on each Board whose number should not exceed 50 per cent of the actual strength of the Board.

The proposals for appointment of non-official Directors are initiated by the concerned Administrative Ministries/Departments. In case of Navratna and Miniratna CPSEs, selection of non-official Directors is made by the Search Committee consisting of Chairman (PESB), Secretary (DPE), Secretary of the administrative Ministry/Department of the CPSE, Chief Executive of the concerned CPSE and non-official Members.

For remaining CPSEs (other than Navratna/Miniratna CPSEs), Public Enterprises Selection Board (PESB) makes the selection of non-official Directors. The concerned Administrative Ministry/Department appoints the non-official Directors on the basis of recommendations of Search Committee/PESB after obtaining the approval of competent authority, i.e. Appointments Committee of Cabinet (ACC).

6. Wages/Salaries and Employees Welfare

in CPSEs:

ADVERTISEMENTS:

The Department of Public Enterprises (DPE) functions as the nodal Department in the Government of India, inter alia, in respect of policy relating to wage settlements of unionized employees, pay revision of non-unionized supervisors and the executives holding posts below the Board level as well as at the Board level in CPSEs.

While the CPSEs largely follow the Industrial Dearness Allowance (IDA) pattern scales of pay, the Central Dearness Allowance (CDA) pattern scales of pay is being followed by some CPSEs. The government policy relating to pay scales and pay pattern is broadly that all employees of the CPSEs should be on IDA pattern and related scales of pay.

The DPE had, in July 1981 and July 1984, issued instructions to all the administrative Ministries that as and when a new CPSE is created or established, IDA pattern and related scales of pay should be adopted ab initio. Vide DPE O.M. dated 10.08.2009, it was reiterated and emphasized that ‘appointments’ including ‘promotion’ on or after 01.01.1989 in CDA scales of pay has to be in IDA scales of pay.

Out of the approximately 15.35 lakh workmen, clerical staff and executives in 246 CPSEs (excluding Banks, Insurance Companies under the administrative control of the Central Government), around 96 per cent of the workmen and executives are on IDA pattern and related scales of pay.

A pay revision for the IDA executives and non-unionized supervisors was done w.e.f. 1.1.97 for a period of ten years based on the recommendations of Justice Mohan Committee (1st Pay Revision Committee).

The duration of this pay revision was for 10 years i.e. upto 31.12.2006. The government, after due consideration of the recommendations of the Second Pay Revision Committee (2nd PRC), headed by Justice M. Jagannadha Rao, issued orders on 26.11.2008 and 09.02.2009.

ADVERTISEMENTS:

For the employees of the CPSEs following CDA pattern, the DPE vide its OM dated 14.10.2008, revised the pay scales w.e.f. 01.01.2006, based on government decision in respect of Central Government employees.

The benefit of pay revision was allowed only to the employees of those CPSEs which are not loss making and are in a position to absorb the additional expenditure on account of pay revision from their own resources without any budgetary support from the government.

It was also indicated that the Board of Directors would consider the proposal of pay revision of all the employees in the CPSE, keeping in mind the affordability and capacity of the CPSE to pay and submit a proposal to its Administrative Ministry/Department, which will approve the proposal with the concurrence of its Financial Adviser.

7. Employment

in CPSEs:

One-fourth of the manpower in CPSEs is in managerial and supervisory cadres. Thus, the CPSEs have a highly skilled workforce, which is one of their basic strengths. The CPSEs, in turn, provide lifetime employment to their employees. Since the CPSEs operate under dynamic market conditions, while some of them may face shortage of people, others may have excess manpower.

To help these enterprises to shed excess manpower, the government initiated a Voluntary Retirement Scheme (VRS). The basic parameters of the model VRS which were notified by the Government vide DPE’s O.Ms, dated 5.10.1988 and 6.1.1989 were in force since 1988 till April, 2000.

ADVERTISEMENTS:

The said scheme was improved upon by the government and new VRS schemes were introduced on 5.5.2000 and again on 6.11.2001. Till 31.3.2009, about 3.03 lakh employees opted for VRS. However, many CPSEs, are facing a high rate of ‘attrition’, as employees are leaving to join other organizations on account of higher salaries being offered elsewhere.

8. Counseling, Retraining and Redeployment

in CPSEs:

In the context of more liberalized economies, restructuring of enterprises has become a global phenomenon. This has necessitated rationalization of manpower in many instances. However, the policy of the government has been to implement these reforms with a humane face as they adversely affect the interest of the workers.

Accordingly in February 1992, the government established the National Renewal Fund (NRF) to cover broadly the expenses of VRS and to provide retraining to workers in the organized sector. Priority was given on the needs of CPSEs in the wake of the ongoing restructuring exercises in the central enterprises. Subsequently in February 2000, the NRF was abolished.

Since 2001-02, the scheme for Counseling, Retraining and Redeployment (CRR) is under implementation through DPE. Prior to that, the retraining activity for employees opting for VRS was administered by the Department of Industrial Policy and Promotion.

The Scheme for Counseling, Retraining and Redeployment (CRR) Inter Alia Aims:

ADVERTISEMENTS:

(a) To provide opportunity for self-employment,

(b) To reorient rationalized employees through short duration programmes,

(c) To equip them for new vocations,

(d) To engage them in income generating self-employment and

(e) To help them rejoin the productive process.

For the implementation of CRR, a Plan Fund of Rs. 8 crore was allocated initially during 2001-02, which was enhanced to Rs. 10 crore during 2002-03 and 2003-04. The plan fund was substantially increased to Rs. 30 crore during 2004-05 and 2005-06, and further enhanced to Rs. 31.50 crore during 2006-07. During 2007-08, however, only Rs. 10.00 crore was allocated and during 2008-09, the plan allocation made was Rs. 8.70 crores for the implementation of CRR scheme.

The list of 19 nodal agencies with 46 Employees Assistance Centers (EACs) which are operational and help in implementation of CRR is given below:

1. Academy Suburbia, Kolkata

2. Associated Chamber of Commerce & Industry, New Delhi

3. Association of Lady Entrepreneurs of Andhra Pradesh, Hyderabad

4. Central Institute of Plastics Engineering & Technology, Amritsar

5. Central Institute of Plastics Engineering & Technology, Bhubaneswar

6. Central Institute of Plastics Engineering & Technology, Chennai

7. Central Institute of Plastics Engineering & Technology, Guwahati

8. Central Institute of Plastics Engineering & Technology, Panipat

9. Electronics Service &c Training Centre, Ramnagar

10. Indian Council of Small Industries (ICSI), Kolkata

11. Institute of Entrepreneurship Development, Patna

12. Institute of Labour Development, Jaipur

13. Kalinga Centre for Social Development, Bhubaneswar

14. Madhya Pradesh Consultancy Organisation (MPCON), Bhopal

15. MITCON Consultancy Services Ltd., Pune

16. National Institute for Micro, Small & Medium Enterprises (NIMSEM), Hyderabad

17. National School of Computer Education, Kolkata

18. North India Technical Consultancy Services Ltd., Chandigarh

19. U.P. Industrial Consultants Ltd. (UPICO), Kanpur

9. MoU System:

To ensure a level playing field to the public sector enterprises vis-a-vis the private corporate sector, the Memorandum of Understanding (MoU) system has been introduced. The MoU, as applicable to central public sector enterprises, is a negotiated document between the government and the management of the enterprise specifying clearly the objectives of the agreement and the obligations of both the parties.

The MoU system is aimed at providing greater autonomy to public sector enterprises vis-a-vis the control of the government. The ‘management’ of the enterprise is, nevertheless, made accountable to the government through promise for performance or ‘performance contract’. The government, on the other hand, continues to have control over these enterprises through setting targets in the beginning of the year and by ‘performance evaluation’ at the end of the year.

Performance evaluation is done based on the comparison between the actual achievements and the annual targets agreed upon between the government and the CPSE. The targets constitute of both financial and non-financial parameters with different weights assigned to the different parameters. Performance during the year is measured on a 5-point scale in order to distinguish ‘excellent’ from ‘poor’.

10. Mega and Major Projects under Implementation

:

There were altogether 925 projects in the central sector as on 31.3.2009, of which 102 projects (costing Rs. 500 crores and above) belonged to Central Public Sector Enterprises (CPSEs). Of these 102 projects, 75 were mega projects (costing Rs. 1000 crore and above) and 27 were major projects (costing between Rs. 100 crore and Rs. 1000 crore). The total original cost in respect of these 102 projects of CPSE stood at Rs. 3,02,585 crore, while the revised/anticipated cost is equal to 3,14,798 crore.

There were altogether 33 CPSEs ‘under construction’ as on 31.3.2009, which were yet to go on regular production on a commercial scale. While the total authorized capital of these 33 CPSEs stood at approximately Rs. 14,318 crores as on 31.03.2009, the paid up capital amounted to Rs. 654.92 crores.

A large majority of these CPSEs are subsidiary companies with small authorized and paid-up capital. Some of these subsidiary companies are ‘shell companies’ which have been set up to facilitate the establishment of Ultra Mega Power Projects (UMPP) in the different parts of the country.

The objective of ‘shell companies’ is to develop large capacities of power generation in India and to bring in the potential investors in UMPP after developing such projects to a stage having major clearances. Power Finance Corporation Limited is the Nodal Agency for the development of these projects under the technical guidance of CEA.

11. Market Capitalisation of CPSEs Stocks

:

Stocks of the following 40 CPSEs were being traded on the stock exchanges of India with market capitalization of Rs. 8,13,530 (based on BSE prices) as on 31.03.2009:

1. Andrew Yule and Company Ltd.

2. Balmer Lawri and Co. Ltd.

3. Balmer Lawri Investments Ltd.

4. BEML Ltd.

5. Bharat Electronics Ltd.

6. Bharat Heavy Electrical Corpn. Ltd.

7. Bharat Immunologicals & Biologicals Corpn. Ltd.

8. Bharat Petroleum Corpn. Ltd.

9. Bongaigaon Refinery

10. Chennai Petroleum Corporation Ltd.

11. Container Corporation of India Ltd.

12. Dredging Corporation of India Ltd.

13. Engineers (I) Ltd.

14. Fertilizer & Chemicals (Travancore) Ltd.

15. GAIL (India) Ltd.

16. Hind Copper Ltd.

17. Hind Organic Chemicals Ltd.

18. Hindustan Petroleum Corpn Ltd.

19. HMT Ltd.

20. Indian Oil Corporation Ltd.

21. ITI Ltd.

22. Madras Fertilizers Ltd.

23. Mahanagar Telephone Nigam Ltd.

24. Maharashtra Elecktrosmelt Ltd.

25. Mangalore Refinery and Petrochemicals Ltd.

26. MMTC Ltd.

27. National Aluminium Company Ltd.

28. National Fertilisers Ltd.

29. National Mineral Development Corporation Ltd.

30. Neyvelli Lignite Corpn. Ltd.

31. NTPC Ltd.

32. Oil & Natural Gas Corporation Ltd.

33. Power Finance Corpn. Ltd.

34. Power Grid Corpn. Ltd.

35. Rashtriya Chemicals and Fertilizers Ltd.

36. Rural Electrification Corpn. Ltd.

37. Scooters India Ltd.

38. Shipping Corporation of India

39. State Trading Corpn of India Ltd.

40. Steel Authority of India Ltd.

12. Investment in Central Public Sector Enterprises:

The aggregate real investment in Central Public Sector Enterprises (CPSEs) measured in terms of ‘gross block’ was Rs. 9,77,803 crore in 2008-09. However, in terms of share in ‘gross fixed capital formation’ (GFCF) of the country, the share of gross block in CPSEs shows a decline over the years.

It came down from 10.39 per cent in 2003-04 to 4.96 per cent in 2007-08. But in 2008-09, their share in gross fixed capital formation went up to 6.24 per cent due to investment of Rs. 1,15,572 crore by CPSEs.

Growth in Financial Investment:

The aggregate financial investment in CPSEs comprising paid-up share capital, share application money pending allotment and long term loans has increased from Rs. 29 crore in five enterprises in 1951-52 to Rs. 5,28,951 crore in 246 enterprises in 2008-09. The rise in aggregate financial investment and the number of CPSEs over various Plan periods is given in Table 2.

Components of Financial Investment:

The structure of financial investment in CPSEs has undergone some change over the years. While the share of paid-up capital in total financial investment stood at 32.57 per cent during 2002-03, it declined to 26.25 per cent in 2008-09. The share of long-term loans, on the other hand, went up from 66.56 per cent in 2002-03 to 73.02 per cent in 2008-09.

Sources of Financial Investment:

The Central Government has the majority equity holding in CPSEs which is about 84.49 per cent. Other parties such as the financial institutions, banks, private parties (both Indian and foreign), State governments and holding companies have also been forthcoming with investment in terms of both equity and long term loans.

However, a significant change has been observed in the investment pattern of CPSEs over the period 2004-05 to 2008-09. Whereas the share of Central Government in total (financial) investment stood at 37.78 per cent in 2004-05, it declined to 29.83 per cent in 2008-09.

The share of financial institutions/banks (and ‘others’), on the other hand, that was 39.89 per cent in 2004-05 has gone up to 54.09 per cent in 2008-09. This development, in a way, shows the greater confidence of Foreign Investors and banks in the CPSEs. The share of ‘foreign parties’ in total financial investment has also shown increase from 8.37 per cent in 2004-05 to 8.52 per cent in 2008-09.

In recent years, a major share of investment in CPSEs has been made from internal resources (IR). In absolute terms, Plan outlay in CPSEs, constituting internal resources (IR), extra-budgetary resources (EBR) and Budgetary Support (BS) have showed a continuous increase.

Accordingly, Plan outlay in CPSEs went up from Rs. 59,189.79 crore in 2002-03 to Rs. 1,32,253.31 crore in 2008-09. While the share of IR went up from 55.51 per cent of plan outlay in 2002-03 to 55.06 per cent in 2008-09, the share of Budgetary Support came down from 8.98 per cent in 2002-03 to 1.23 per cent in 2008-09.

Moreover, a perusal of different components of IR shows that the share of ‘retained profit’ has been increasing and it went up from Rs. 27,176.50 crores in 2002-03 to Rs. 69,027.46 crores in 2008- 09. Whereas the share of ‘depreciation’ in IR declined from 48.79 per cent in 2002-03 to 31.03 per cent in 2008-09, the share of ‘retained profit’ in IR went up from 50.07 per cent in 2002-03 to 62.27 per cent in 2008-09.

Cognate group-wise aggregate real investment in CPSEs during 2008-09, as mentioned in terms of gross block showed that the share of ‘manufacturing’ CPSEs in gross block, was the highest at 26.86 per cent followed by ‘mining’ (25.15%), ‘electricity’ (24.58%) and ‘services’ (23.04%).

In terms of national income classification, the share of ‘the industrial CPSEs’, comprising manufacturing, mining and electricity, was the largest at 76.59 per cent followed by ‘the service sector CPSEs’ at 23.41 per cent during the same period.

An analysis of state-wise distribution of ‘gross block’ shows a significant change over the years. While the states of Bihar (21.91 per cent), M.P. (13.04 per cent), West Bengal (6.71 per cent) and Orissa (5.65 per cent) claimed the largest share in investment until 1977, the states of Maharashtra (17.50 per cent), A.P. (6.78 per cent), U.P. (6.77 per cent), Tamil Nadu (6.66 per cent) and Gujarat (5.60 per cent) had the largest share had in terms of investment during the year 2008-09.

These changes, in good measure, have occurred mainly on account of higher investments in oil exploration (e.g. Mumbai High), power projects and telecommunications vis-a-vis investments in steel, heavy engineering and coal mining made in the earlier years.

Some changes in investment pattern have also occurred due to bifurcation of states like Bihar into Bihar and Jharkhand, Madhya Pradesh into Madhya Pradesh and Chhattisgarh and Uttar Pradesh into Uttar Pradesh and Uttrakhand as well as closing down of some CPSEs and conversion of other CPSE into joint ventures with private companies. In absolute terms, however, there has generally been increase in investments in most states.

13. International Operation of CPSEs

:

The CPSEs are increasingly engaging in ‘international trade’ in goods and services, which has a direct bearing on earnings and expenditure of foreign exchange. During the year 2008-09, 146 out of the 246 operating CPSEs had either foreign exchange earnings or foreign exchange expenditure.

Out of the 33 CPSEs which were net foreign exchange earners, eight CPSEs, namely ONGC Videsh Ltd., NALCO, Shipping Corporation of India Ltd., Airport Authority of India Ltd., IRCON International Ltd., Cotton Corporation of India Ltd., RITES Ltd. and Kudremukh Iron Ore Co. Ltd., earned (net) foreign exchange of more than Rs. 100 crore during 2008-09.

In terms of gross foreign exchange earnings during 2008-09, Indian Oil Corporation Ltd. earned Rs. 14,962.63 crore, followed by Mangalore Refinery & Petrochemicals Ltd. which earned Rs. 11,636.18 crore. Export of merchandise was the major source of foreign exchange earnings with its share in total earnings amounting to 95.15 percent (Rs. 70,588.47 crores) in 2008-09.

Indian Oil Corporation Ltd. also topped the list of CPSEs in terms of gross foreign exchange expenditure with expenses of Rs. 14,994.33 crore. Other CPSEs which had large gross foreign exchange expenditure during 2008-09 were BPCL, HPCL, MRPL, CPCL, ONGC, GAIL (all oil sector companies), SAIL, HAL, BHEL, RINL, SCI, BEL, RCF, NTPC, POWERGRID, BSNL and NPCIL. The expenditure was mainly on account of import of goods and services from the rest of the world.

The share of ‘raw materials’/crude oil claimed the largest share (around 83.36%) of gross foreign exchange expenditure in 2008-09. Exchange rate fluctuation and change in commodity prices have been also impacting the earnings and expenditures of CPSEs.

International Finance and Investment:

International finance mainly relates to external commercial borrowings and raising of resources through the equity market abroad. International investment comprises off-shore investment by CPSEs by way of joint venture, merger and acquisition and for operation of Indian subsidiaries abroad.

In view of an increasing realization among Indian companies that mere organic growth is not enough to propel them towards growth, several CPSEs covering various cognate groups have formed joint ventures or have set up subsidiaries abroad for consolidating their international operations.

14. Delegation of Enhanced Financial Powers to CPSEs

:

Under the Articles of Association, the Board of Directors of CPSEs enjoy certain amount of financial powers and autonomy in respect of recruitment, promotion and other service conditions of below Board level employees.

The Board of Directors of a CPSE exercises the delegated powers subject to broad policy guidelines issued by government from time to time. The government has granted enhanced powers to the Boards of Navratna, Miniratna and other profit making enterprises. In August 2005, the delegated powers were substantially enhanced.

Under the Navratna scheme, the government has delegated enhanced powers to CPSEs having comparative advantage and the potential to become global players.

The powers presently delegated to the Boards of Navratna CPSEs are as under:

i. Capital Expenditure:

The Navratna CPSEs have the powers to incur capital expenditure on purchase of new items or for replacement, without any monetary ceiling.

ii. Technology Joint Ventures and Strategic Alliances:

The Navratna CPSEs have the powers to enter into technology joint ventures or strategic alliances and obtain by purchase or other arrangements, technology and know-how.

iii. Organizational Restructuring:

The Navratna CPSEs have the powers to effect organizational restructuring including establishment of profit centers, opening of offices in India and abroad, creating new activity centers, etc.

iv. Human Resources Management:

The Navratna CPSEs have been empowered to create and wind up all posts up to E-6 level and make all appointments up to this level. The Boards of these CPSEs have further been empowered to effect internal transfers and re-designation of posts.

The Board of Directors of Navratna CPSEs have the power to further delegate the powers relating to Human Resource Management (appointments, transfer, posting, etc.) of below Board level executives to subcommittees of the Board or to executives of the CPSE, as may be decided by the Board of the CPSE.

v. Resource Mobilization:

These CPSEs have been empowered to raise debt from the domestic capital markets and for borrowings from international market, subject to condition that approval of RBI/Department of Economic Affairs, as may be required, should be obtained through the administrative Ministry.

vi. Joint Ventures and Subsidiaries:

The Navratna CPSEs have been delegated powers to establish financial joint ventures and wholly owned subsidiaries in India or abroad with the stipulation that the equity investment of the CPSE should be limited to- (i) Rs. 1000 crore in any one project, (ii) 15 per cent of the net worth of the CPSE in one project, and (iii) 30 per cent of the net worth of the CPSE in all joint ventures/subsidiaries put together.

vii. Mergers and Acquisitions (M and A):

The Navratna CPSEs have been delegated powers for Mergers and Acquisitions subject to the conditions that- (i) it should be as per the growth plan and in the core area of functioning of the CPSE, (ii) conditions/limits would be as in the case of establishing joint ventures/subsidiaries, and (iii) the Cabinet Committee on Economic Affairs would be kept informed in case of investments abroad. Further, the powers relating to M&A are to be exercised in such a manner that it should not lead to any change in the public sector character of the concerned CPSE.

viii. Creation/Disinvestment in Subsidiaries:

The Navratna CPSEs have powers to transfer assets, float fresh equity and divest shareholding in subsidiaries subject to the condition that the delegation will be in respect of subsidiaries set up by the holding company under the powers delegated to the Navratna CPSEs and further to the proviso that the public sector character of the concerned CPSE (including subsidiary) would not be changed without prior approval of the government and such Navratna CPSEs will be required to seek government approval before exiting from their subsidiaries.

ix. Tours Abroad of Functional Directors:

The Chief Executives of Navratna CPSEs have been delegated powers to approve business tours abroad of functional directors up to 5 days duration (other than study tours, seminars, etc.) in emergency under intimation to the Secretary of the administrative Ministry.

The above mentioned delegation of powers is subject to the following conditions and guidelines:

(a) The proposals must be presented to the Board of Directors in writing and reasonably well in advance, with an analysis of relevant factors and quantification of the anticipated results and benefits. Risk factors, if any, must be clearly brought out.

(b) The government Directors, the Financial Directors and the concerned Functional Director(s) must be present when major decisions are taken, especially when they pertain to investments, expenditure or organizational/capital restructuring.

(c) The decisions on such proposals should preferably, be unanimous.

(d) In the event of any decision on important matters not being unanimous, a majority decision may be taken, but at least two thirds of the Directors should be present, including those mentioned above, when such a decision is taken. The objections, dissents, the reasons for overruling them and those for taking the decision should be recorded in writing and minute.

(e) No financial support or contingent liability on the part of the government should be involved.

(f) These CPSEs will establish transparent and effective systems of internal monitoring, including the establishment of an Audit Committee of the Board with membership of non-official Directors.

(g) All the proposals, where they pertain to capital expenditure, investment or other matters involving substantial financial or managerial commitments or where they would have a long term impact on the structure and functioning of the CPSE, should be prepared by or with the assistance of professionals and experts and should be appraised, in suitable cases, by financial institutions or reputed professional organizations with expertise in the areas. The financial appraisal should also preferably be backed by involvement of the appraising institutions through loans or equity participation.

(h) The exercise of authority to enter into technology joint ventures and strategic alliances shall be in accordance with the government guidelines as may be issued from time to time.

(i) The Boards of these CPSEs should be restructured by inducting at least four non-official Directors as the first step before the exercise of the enhanced delegation of authority.

(j) These public sector enterprises shall not depend upon budgetary support or government guarantees. The resources for implementing their programmes should come from their internal resources or through other sources, including the capital markets. However, wherever government guarantee is required under the standard stipulations of external donor agencies, the same may be obtained from the Ministry of Finance through the administrative Ministry.

Such Government guarantee shall not affect the Navratna status. Further, budgetary support to implement government sponsored projects of national interest and government sponsored Research and Development projects will not disqualify CPSEs from retaining their Navratna status. However, for such projects, investment decisions will be taken by the government and not by the CPSE concerned.

In October 1997, the government decided to grant enhanced autonomy and delegation of financial powers to some other profit making companies, called Miniratnas, subject to certain eligibility conditions and guidelines to make them efficient and competitive. CPSEs which have made profit in the last three years continuously, have a pre-tax profit or Rs. 30 crore or more in at least one of the three years, and have a positive net worth are called Category-I Miniratna companies.

CPSEs that have made profit for the last three years continuously and have a positive net worth are called Category-II Miniratna companies. Both the categories of Miniratna companies are eligible for the enhanced delegated powers provided they have not defaulted in the repayment of loans/interest payment on any loans due to the government.

The Miniratna companies shall not depend upon budgetary support or government guarantees. The Boards of these CPSEs should be restructured by inducting at least three non-official Directors as the first step before the exercise of enhanced delegation of authority.

The administrative Ministry concerned shall decide whether a Public Sector Enterprise fulfilled the requirements of a Category-I/Category-II company before the exercise of enhanced powers.

The delegation of decision-making authority available at present to the Boards of these Miniratna CPSEs is as follows:

i. Capital Expenditure:

The power to incur capital expenditure on new projects, modernization, purchase of equipment, etc., without government approval is upto Rs. 500 crore or equal to net worth, whichever is less, for Category-I. For Category-II, government approval is not required for amounts upto Rs. 250 crore or equal to 50 per cent of the networth, whichever is less.

ii. Joint Ventures and Subsidiaries:

Category-I CPSEs- The power to establish joint ventures and subsidiaries in India with the stipulation that the equity investment of the CPSE in any one project should be limited to 15 per cent of the networth of the CPSE or Rs. 500 crore for Category-I (Rs. 250 crore for Category- II), whichever is less. The overall ceiling on such investment in all projects put together is 30 per cent of the networth of the CPSE.

iii. Mergers and Acquisitions (M and A):

The Board of Directors of Miniratna CPSEs have the powers for M&A, subject to the conditions that- (a) it should be as per the growth plan and in the core area of functioning of the CPSE, (b) conditions/limits would be as in the case of establishing joint ventures/subsidiaries, and (c) the Cabinet Committee on Economic Affairs would be kept informed in case of investments abroad. Further, the powers relating to M&A are to be exercised in such a manner that it should not lead to any change in the public sector character of the concerned CPSEs.

iv. Scheme for HRD:

To structure and implement schemes relating to personnel and human resource management, training, voluntary or compulsory retirement schemes, etc. the Board of Directors of these CPSEs have the power to further delegate the powers relating to Human Resource Management, viz. appointments, transfer, posting, etc. of below Board level executives to subcommittees of the Board or to executives of the CPSE, as may be decided by the Board of the CPSE.

v. Tour Abroad of Functional Directors:

The Chief Executives of these CPSEs have the power to approve business tours abroad of functional directors up to 5 days duration (other than study tours, seminars, etc.) in emergency, under intimation to the Secretary of the administrative Ministry.

vi. Technology Joint Ventures and Strategic Alliances:

The power to enter into technology joint ventures, strategic alliances and to obtain technology and know-how by purchase or other arrangements, subject to government guidelines as may be issued from time to time.

vii. Creation/Disinvestment in Subsidiaries:

To transfer assets, float fresh equity and divest shareholding in subsidiaries subject to the condition that the delegation will be in respect of subsidiaries set up by the holding company under the powers delegated to the Miniratna CPSEs and further to the proviso that the public sector character of the concerned CPSE (including subsidiary) would not be changed without prior approval of the government, and such Miniratna CPSEs will be required to seek government approval before exiting from their subsidiaries.

The above delegation of powers is subject to similar conditions as are applicable to Navratna CPSEs.

Those CPSEs which have earned profit in each of the 3 preceding accounting years and have a positive net worth are categorized as ‘other profit-making CPSEs’.

These CPSEs have been delegated enhanced powers as under:

I. Capital Expenditure:

These CPSEs have the power to incur capital expenditure up to Rs. 150 crore or equal to 50 per cent of the net worth, whichever is less. The above delegation is subject to- (a) inclusion of the project in the approved Five Year and Annual Plans and outlays provided for the same; (b) the required funds can be found from the Internal Resources (IR) of the company or from Extra Budgetary Resources (EBR), and the expenditure is incurred on schemes included in the capital budget approved by the government.

II. Tours Abroad of Functional Directors:

The Chief Executives of these CPSEs have the power to approve business tours abroad of functional directors up to 5 days duration (other than study tours, seminars, etc.) in emergency, under intimation to the Secretary of the administrative Ministry. In all other cases including those of Chief Executive, tours abroad would continue to require the prior approval of the Minister of the Administrative Ministry/Department.

The current criteria for grant of Navratna status are size neutral. Over the years, some of the Navratna companies have grown very big and have considerably larger operations than their peers. The CPSEs which are at the higher end of the Navratna category and have potential to become Indian Multinational Companies (MNCs) are being recognized as a separate class, i.e. Maharatna.

It is hoped that the new categorization will act as an incentive for other Navratna companies, provide brand value and facilitate delegation of enhanced powers to CPSEs. The main objective of the Maharatna scheme is to empower Mega CPSEs to expand their operations and emerge as global giants. The scheme will empower big sized CPSEs to expand their operations and emerge as global giants.

The eligibility criteria for CPSEs to be considered for Maharatna status is:

(a) Having Navratna status,

(b) Listed on Indian stock exchange with minimum prescribed public shareholding under SEBI regulations,

(c) An average annual turnover of more than Rs. 25,000 crore during the last three years,

(d) An average annual net worth of more than Rs. 15,000 crore during the last three years,

(e) An average annual net profit after tax of more than Rs. 5,000 crore during the last three years, and

(f) Should have significant global presence/international operations.

The procedure for grant of Maharatna status as well as their review is similar to that in vogue for the grant of Navratna status. The Boards of Maharatna CPSEs, in addition to exercising all powers to Navratna CPSEs, will exercise enhanced powers in the area of investment in joint ventures/subsidiaries and creation of below Board level posts up to E-9 level.

The Boards of Maharatna CPSEs will have powers to- (a) make equity investment to establish financial joint ventures and wholly owned subsidiaries in India or abroad and (b) undertake mergers and acquisitions, in India or abroad, subject to a ceiling of 15 per cent of the net worth of the concerned CPSE in one project, limited to an absolute ceiling of Rs. 5,000 crore. The overall ceiling on such equity investments and mergers and acquisitions in all projects put together will not exceed 30 per cent of the net worth of the concerned CPSE.

15. Revival and Restructuring of Sick/Loss Making CPSEs

:

Sickness in CPSEs has been the continuing concern of the Government as some of the CPSEs have been incurring losses continuously for the last several years. The accumulated loss in many of these cases has exceeded their net worth. However, over the years, there has been significant improvement in the overall condition of these enterprises. In comparison to 105 loss making CPSEs in March 2002, there were 54 loss-making CPSEs in March 2009.

Reasons for Sickness:

The reason for sickness varies from enterprise to enterprise. In some cases, the cause of sickness is historical, for example, textile companies which were taken over from the private sector on social consideration for protecting employment of workers in early seventies could not be modernized quickly.

British India Corporation, Bird Jute and Exports and NTC belong to this group. Besides theses textile companies, there have been other enterprises that were taken over from the private sector but could not be modernized. These include engineering and refractory enterprises like Andrew Yule and Co., Bharat Wagons and Engineering, Biecco Lawrie, Praga Tools, Burn Standard, Braithwaith and Co., Richardsan and Crudass Ltd., drug companies like Bengal Chemicals and Pharmaceuticals Ltd., transportation/shipping companies like Hooghly Dock and Port Engineering Ltd., Central Inland Water Transport Corporation and consumer goods companies like Tyre Corporation of India and Hooghly Printing Co. Ltd.

The other group of sick companies (other than those taken over) is Greenfield companies. These CPSEs became sick, over the years, on account of high manpower cost, high cost of production due to inefficiencies and competition from private sector.

These include fertilizer companies like Fertilizer Corporation of India, Hindustan Fertilizer Corporation, Pyrites, Phosphates and Chemicals Ltd., chemicals and drugs companies like Indian Drugs and Pharmaceuticals Ltd., Hindustan Insecticides Ltd., and Hindustan Antibiotics Ltd.

The third group of loss-making CPSEs is those which have had macro-economic objectives to serve like development of backward areas, providing remunerative prices to farmers, etc. Some of these companies are the Nagaland Pulp and Paper Company Ltd., Manipur State Drugs and Pharmaceuticals Ltd., and North Eastern Regional Agricultural Marketing Corporation Limited, etc.

In addition to these reasons, most sick and loss-making CPSEs have been facing common problems like adverse market/stiff competition, obsolete technology/machines, high manpower costs, weak marketing strategies and slow decision making process. Attempts have, therefore, been made to overcome ‘sickness’ in these CPSEs through various policy initiatives including the Statement on Industrial Policy (1991).

Strategies for Revival/Restructuring:

Some of the strategies that have been adopted for restructuring/revival of sick CPSEs are:

1. Financial Restructuring:

The government has made investment in CPSEs through equity participation, providing loan (plan/non-plan) grants and/or write-off of past losses as well as changing the debt equity ratio. Measures such as waiver of loan/interest/penal interest, conversion of loan into equity, conversion of interest including penal interest into loan, moratorium on payment of loan/interest, government guarantee, sale of fixed assets including excess land, sacrifices by State Government, one-time settlement with banks/financial institutions, etc.

2. Business Restructuring:

On a case to case basis, the government has undertaken measures like change of management, hiving off viable units from CPSEs for formation of separate company, closure of unviable units, formation of joint ventures by induction of partners capable of providing technical, financial and marketing inputs, change in product mix, improving marketing strategy, etc.

3. Manpower Rationalization:

Since salaries and wages are often a major component of cost for an enterprise, CPSEs have often resorted to Voluntary Retirement Scheme (VRS) from time to time to shed excess manpower. Voluntary Separation Scheme (VSS) has also been introduced in case of CPSEs which are found unviable and where a decision has been taken to close the unit. However, retrenchment of employees is adopted only as the last resort and in exceptional circumstances.

4. Revival Packages:

In 2005-06, the government granted revival packages amounting to Rs. 5,221.65 crore. In 2006-07, the package amounted to Rs. 2,438.89 crore, in 2007-08 it was Rs. 769.94 crore, and in 2008-09 it was Rs. 6,698.49 crore in 2008-09. These packages have helped the sick and loss making enterprises in a big way in improving their conditions. Some of them have even turned around and recorded profit during the last two years.

16. Future Strategies of CPSEs:

In a globalized economy as of today, cost-cutting strategic acquisitions and mergers are vital for facing international competition. CPSEs should be given full autonomy and functional powers to take investment decisions and to take advantage of the opportunities offered by the competitive international market.

There is a need to constitute an independent Advisory Board to look after the government’s interests in the CPSEs and leaving them to manage the corporation with the help of strong independent directors.

Although substantial progress has been made in the revival of sick CPSEs, close monitoring is needed to ensure that the restructuring plans are successfully implemented. While considering the revival of the remaining sick CPSEs, greater caution is necessary as it has been observed that a few of the rehabilitated units are not performing in accordance with expectations.

Further, there is a need to review the investment behaviour of the large profit-making CPSEs. It is because several CPSEs appear to prefer investing in financial assets or reducing their debt burden instead of investment which would contribute to capital formation. The government has set up a special mechanism of an Empowered Committee of Secretaries in Ministries of Petroleum and Natural Gas, Ministry of Finance, and DPE for considering projects in the oil sector involving financial decisions above a certain threshold.

The recommendations of this Empowered Committee are submitted to the CCEA directly for approval. The supervisory body (that is, independent Advisory Board) suggested above could also be given the task of guiding and facilitating the investment decisions in all profit-making CPSEs.

The system of MoUs between CPSEs and the government has proved to be ineffective and dysfunctional. While the CPSEs are expected to perform in accordance with the norms, the government’s commitments are marginal and not effectively monitored. Hence, there is a need to review and overhaul the system to ensure effective operational autonomy and functioning of the CPSEs. Financial delegations, particularly of the profit- making CPSEs, also need to be enhanced.

Profitability alone could not be a judge of public sector enterprises. Growth with social justice is the laudable objective of public sector. They have served as pace setters in the technological advancement and industrial growth of the country. They have also acted as instrument of social change. By better utilization of their capacities, they may act as model enterprises in the country.