In this article we will discuss about environmental analysis and diagnosis. Learn about:- 1. Introduction to Environmental Analysis & Diagnosis 2. Factors that Need Close Attention 3. Process of Environmental Scanning 4. Types of Environmental Scans 5. Different Approaches to Environmental Analysis & Diagnosis 6. Techniques 7. Competitor Analysis.

Introduction to Environmental Analysis & Diagnosis:

In order to survive and flourish in a highly competitive and turbulent environment, every organisation must strike a happy balance between environment, values and resources (Thompson). Because organisations are open systems, environmental factors inevitably influence them, and it is up to managers to ensure that this influence is harnessed in a positive way, leading to organisational success (P.S. Thomas).

Environmental analysis is the process of monitoring an organisational environment to identify both present and future threats and opportunities that may influence the firm’s ability to reach its goals.

ADVERTISEMENTS:

Properly used environmental analysis can help ensure organisational success in many ways:

1. It helps firms to adjust to environmental change at a right time, that is, encashing opportunities as they arise and eliminating the negative impacts of environmental threats through proactive planning.

It helps an organisation to come out with an early warning system to ward off threats from competitive forces and develop suitable strategies to turn problems into opportunities.

2. It tries to improve organizational performance by making managers and divisional managers aware of issues that arise in the firm’s environment, by having a direct impact on planning and by linking corporate and divisional planning (Certo and Peter).

ADVERTISEMENTS:

3. It helps strategists to focus on alternatives that help achieve predetermined goals and eliminate those options that are not in line with anticipated opportunities or threats.

Environmental Analysis and Diagnosis # Factors that Need Close Attention:

The basic purpose of environmental scanning/diagnosis is to help a firm decide its strategic direction in future. Scanning simply involves reviewing and evaluating whatever information about internal and external environments can be gleaned from several distinct sources.

Environmental scanning, in a way, is a mixture of events, trends, issues and expectations that directly or indirectly shape organisational responses from time to time.

i. Important events that have shaped the outcomes in various sectors of an economy

ADVERTISEMENTS:

ii. Major trends that are influencing various elements of environment

iii. Significant issues that need to be looked into in order to deal with events and trends influencing organisational actions

iv. Expectations of stakeholders and demands made by other interest groups in response to organisational actions

Scandals and scams in recent times are major events that have affected the lives of corporate chiefs in sectors such as infrastructure, telecommunication, electronics and construction.

ADVERTISEMENTS:

The earlier trend to ignore corruption at high places—as something part of the system to get things done—is being put aside now in view of the arrest of some of the big guns of politics and industry—including high profile corporate executives and ministers holding key portfolios.

Every major corporate house is made to critically examine their actions—almost forcing those to take a 360 degree view of every action that they intend to take in order to get certain jobs done through shady deals—which have come to acquire a kind of legalized corruption.

Thanks to social activists like Anna Hazare, corruption at high places is not being viewed as something that can be put aside as a trivial, insignificant issue. The people involved in such scams are being dragged to courts, put behind bars and asked to explain the reasons behind such reckless, careless behaviour.

The stakeholders—in this case, the public at large—are making their voice heard almost everywhere—making it necessary for every corporate house to examine and re-examine their actions in public and also behind the curtain carefully. The political, legal and social, economic and cultural environment of business, as a result, seems to be undergoing a dramatic change.

ADVERTISEMENTS:

Firms which tend to ignore such trends, issues, concerns and expectations may have to pay a heavy price in the years to come if they continue to conduct their operations—showing scant respect to ethics, values and scruples.

Environmental Analysis and Diagnosis # Process of Environmental Scanning:

As environmental change has a direct link to planning, it is essential that environmental scanning forms an integral part of an organization’s strategic planning.

Albright (2004) suggests five fundamental steps in a formal environmental scanning process:

1. “Identify the environmental scanning needs of the organization.” Before launching the scanning process, a few items must be determined – purpose of scanning, participants, and time and resources allocation.

ADVERTISEMENTS:

2. “Gather the information.” Translate the needs of the organization into specific information and a list of questions, select the information sources and collect the information.

3. “Analyze the information.” Information gathered should be analyzed for trends and issues that may affect the organization.

4. “Communicate the results.” Potential effects should be communicated to decision-makers in a concise format and manner that fit their preference.

5. “Make informed decisions.” Based on the information provided, decision-makers can take corresponding steps to equip the organization to be responsive to potential opportunities or threats.

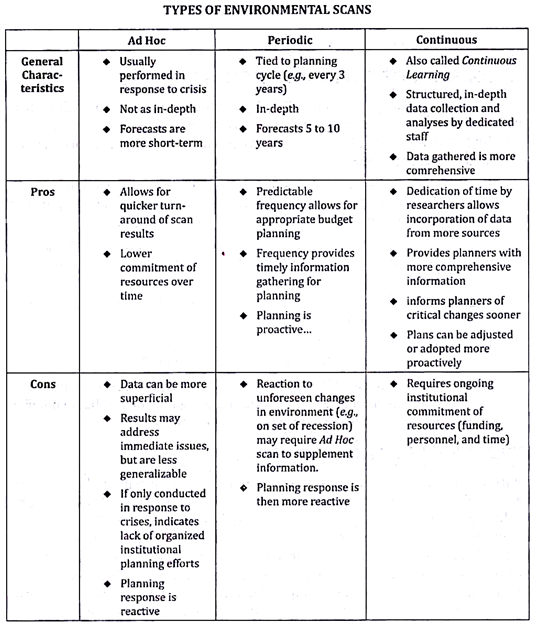

Environmental Analysis and Diagnosis # Types of Environmental Scans:

ADVERTISEMENTS:

Environmental scanning is the acquisition and use of information about events, trends, and relationships in an organization’s external environment, the knowledge of which would assist management in planning the organization’s future course of action.

Organizations scan the environment in order to understand the external forces of change so that they may develop effective responses which secure or improve their position in the future.

They scan in order to avoid surprises, identify threats and opportunities, gain competitive advantage, and improve long-term and short-term planning. To the extent that an organization’s ability to adapt to its outside environment is dependent on knowing and interpreting the external changes that are taking place, environmental scanning constitutes a primary mode of organizational learning.

Environmental scanning includes both looking at information (viewing) and looking for information (searching). It could range from a casual conversation at the lunch table or a chance observation of an angry customer, to a formal market research programme or a scenario planning exercise. It could be conducted in an ad hoc manner undertaken periodically or carried out continually by examining factors influencing the firm’s operations in a systematic way.

Environmental Analysis and Diagnosis # Different Approaches to Environmental Analysis & Diagnosis:

There are a number of ways to conceptualize scanning.

ADVERTISEMENTS:

Aguilar (1967) identified four types of scanning:

1. Undirected viewing consists of reading a variety of publications for no specific purpose other than to be informed.

2. Conditioned viewing consists of responding to this information in terms of assessing its relevance to the organization.

3. Informal searching consists of actively seeking specific information but doing it in a relatively unstructured way.

4. These activities are in contrast to formal searching, a proactive mode of scanning entailing formal methodologies for obtaining information for specific purposes.

Other experts simplified Aguilar’s four scanning types as either passive or active scanning. Passive scanning is what most of us do when we read journals and newspapers.

ADVERTISEMENTS:

However, the organizational consequences of passive scanning are that we do not systematically use the information as strategic information for planning, and we miss many ideas that signal changes in the environment. Active scanning focuses attention on information resources that span the task and industry environments as well as the macro-environment.

Scanning can also be examined from another angle—as something irregular, periodic, and continuous. Irregular systems are used on an ad hoc basis and tend to be crisis initiated. These systems are used when an organization needs information for planning assumptions and conducts a scan for that purpose only.

Periodic systems are used when the planners periodically update a scan, perhaps in preparation for a new planning cycle. Continuous systems use the active scanning mode of data collection to systematically inform the strategic planning function of the organization.

The rationale undergirding active scanning is that potentially relevant “data” are limited only by your conception of the environment. These data are inherently scattered, vague, and imprecise and come from a host of sources. Since early signals often show up in unexpected places, your scanning must be ongoing, fully integrated within your institution, and sufficiently comprehensive to cover the environments important to your decision makers.

Sources:

Environmental scanning, when carried out in a systematic manner— would require decision makers to look into sources such as newspapers, magazines, journals, books, newsletters of trade and industry associations, customer feedback, field reports of sales and marketing professionals, market research agencies, consultants, research papers from academicians and trade experts, government publications, annual reports of companies, international agencies like WTO, UNCTAD, UNDP, UNIDO, ILO, WHO, IMF, UNCTAD; rating agencies such as Fitch, Moody’s, Standard & Poor, CRISIL, ICRA Internet etc.

ADVERTISEMENTS:

In addition to the above several institutional publications are also available such as reports of The Centre for Monitoring Indian Economy, The National Council for Applied Economic Research, The Confederation of Indian Industry, Federation of Indian Chambers of Commerce & Industry, Association of Chambers of Commerce & Industry, The National Association of Software and Services companies, Automotive Tyre Manufacturers Association and The Annual Survey of Industries published by the Hindu, and other reports published by newspapers and magazines such as The Economic Times, The Financial Express, The Business Standard, Business Today, Business World, Business India etc.

Companies use, now a days, surveys and opinion polls to collect information regarding tastes and preferences, habits, preferred destinations, routes etc. Mass media agencies like TV, Radio are being put to use to get relevant information about end users.

Some companies collect information from their own employees, suppliers, distributors, agents about the general public and competing products, competitive moves etc. environmental data could also be collected from external trade bodies, industry associations etc.

If a company wants to look into a problem or trend more closely, it can sponsor a special research study for this purpose and based on the findings of that study it can reevaluate its current position and future strategy.

Environmental Analysis and Diagnosis # Techniques of Environmental Analysis & Diagnosis:

Environmental analysis or scanning, is a process by which organisations monitor their internal and external environments to spot opportunities and threats affecting their business.

The basic purpose is to help management determine the future direction of the organisation. Scanning simply involves reviewing and evaluating whatever information about internal and external environments can be gleaned from several distinct sources.

ADVERTISEMENTS:

The following techniques are generally pressed into service while carrying out environmental scanning:

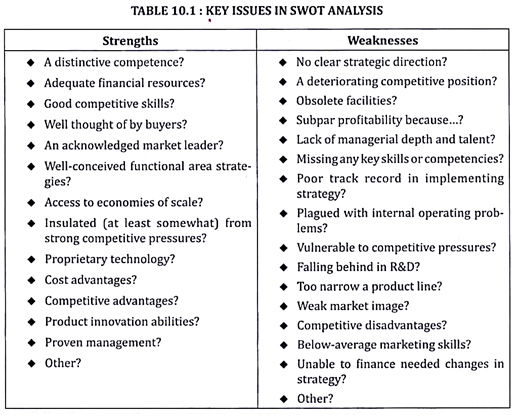

1. SWOT Analysis:

SWOT is an acronym for the internal strengths and weaknesses of a firm and the external opportunities and threats facing that firm. SWOT analysis helps managers to have a quick overview of the firm’s strategic situation and assess whether there is a sound fit between internal resources, values and external environment.

A good ‘fit’ maximizes a firm’s strengths and opportunities and minimizes its weaknesses and threats. The primary purpose of SWOT analysis is to identify the key internal and external factors that are important to achieving the goals. One useful way of putting SWOT analysis to good effect is to exploit market opportunities by leveraging on the strengths of a firm.

At the same time a firm can also convert its weaknesses or threats into strengths or opportunities by proactively taking appropriate steps. An example of such a conversion strategy is to find new markets. If the threats or weaknesses cannot be converted a firm should try to minimize or avoid them.

Key Issues in SWOT Analysis:

ADVERTISEMENTS:

In order to carry out a good SWOT, the firm should look into certain key issues (Thompson).

Usefulness:

SWOT Analysis helps managers finding answers to questions such as: What the firm is good at doing? What the firm is weak at doing; What kind of opportunities need to be exploited keeping the strengths and weaknesses of the firm in mind; What strategies have to be chalked out to ward off environmental threats etc. It is a strong tool that certainly helps in strategy formulation and selection.

Successful firms, as well know, exploit market opportunities proactively putting their best foot forward. They are pretty sure about where their strengths lie and what helps them move closer to the hearts of customers. While doing so they do everything possible to avoid getting into markets or situations where they are relatively weak or where the threats seem to be insurmountable.

They generally keep a close watch over the business environment and exploit new opportunities faster their rivals. SWOT analysis can also play a key role in how a firm sets its objectives and develops strategies to achieve them. Above all, SWOT is easy to conduct—anyone with a basic understanding of the business can perform this analysis.

Limitations:

One major problem with the SWOT analysis is that while it emphasizes the importance of the four elements associated with the organizational and environmental analysis, it does not address how the company can identify the elements for their own company. Many organizational executives may not be able to determine what these elements are, and the SWOT framework provides no guidance.

For example, what if a strength identified by the company is not truly a strength? While a company might believe its customer service is strong, they may be unaware of problems with employees or the capabilities of other companies to provide a higher level of customer service.

Weaknesses are often easier to determine, but typically after it is too late to create a new strategy to offset them. A company may also have difficulty identifying opportunities. Depending on the organization, what may seem like an opportunity to some, may appear to be a threat to others.

Opportunities may be easy to overlook or may be identified long after they can be exploited. Similarly, a company may have difficulty anticipating possible threats in order to effectively avoid them.

While the SWOT framework does not provide managers with the guidance to identify strengths, weaknesses, opportunities, and threats, it does tell managers what questions to ask during the strategy development process, even if it does not provide the answers.

Managers know to ask and to determine a strategy that will take advantage of a company’s strengths, minimize its weaknesses, exploit opportunities, or neutralize threats. Some experts argue that making strategic choices for the firm is less important than asking the right questions in choosing the strategy. A company may mistakenly solve a problem by providing the correct answer to the wrong question.

2. TOWS Matrix:

The TOWS matrix is used for strategic planning and helps marketers identify opportunities and threats and measure them against internal strengths and weaknesses. It is actually a variant of the SWOT analysis which focuses attention on external opportunities and threats and compares them to a company’s internal strengths and weaknesses.

(SWOT analysis aims to use strengths and weaknesses to reduce threats and maximize opportunity). TOWS and SWOT are acronyms for different arrangements of the words Strengths, Weaknesses, Opportunities and Threats.

TOWS, basically, tries to answer the following four questions:

1. Strengths and Opportunities (SO)- How can your current strengths help you to capitalize on your opportunities?

2. Strengths and Threats (ST)- How can your current strengths help you identify and avoid current and potential threats?

3. Weaknesses and Opportunities (WO)- How can you overcome your current weaknesses by using your opportunities?

4. Weaknesses and Threats (WT)- How can you best diminish your weaknesses and avoid current and potential threats?

SWOT and TOWS use the same factors for analysis, and the terms are sometimes used interchangeably without regard to the order that strengths, weaknesses, threats and opportunities are examined.

SWOT or TOWS analysis. It helps managers and for that matter individuals too. The TOWS matrix can be used in any type of business or industry, as well as for a piece of a business or a project, as long as clear factors are defined.

It helps to answer the following questions in an appropriate manner:

1. Make the most of your strengths?

2. Circumvent your weaknesses?

3. Capitalize on your opportunities?

4. Manage your threats?

3. WOTS-UP Analysis:

As mentioned previously a SWOT analysis is a strategic planning tool that assesses an organization’s Strengths, Weaknesses, Opportunities and Threats. Two other terms are interchangeably used in business analysis to convey the same; TOWS analysis or WOTS up analysis. Regardless, the elements in each abbreviation are the same.

The basic purpose of a SWOT analysis is to evaluate the internal and external environment of a project, business or organization. The Strengths and Weaknesses are the internal factors, while Opportunities and Threats refer to the external factors. This analysis helps organizations summarize supportive and unsupportive factors.

All types of organizations, including businesses, non-profit groups and government agencies, can use SWOT/TOWS/WOTS-up analysis SWOT or WOTS-up analysis helps an organisation to think strategically and capitalize on its strengths, assess opportunities and minimize threats. It also helps managers avoid, if not alleviate, weaknesses.

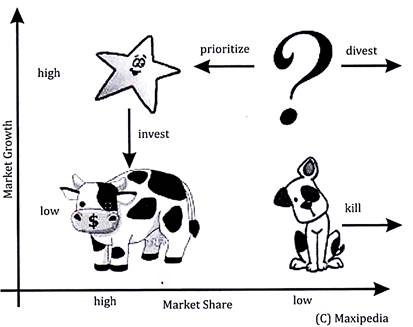

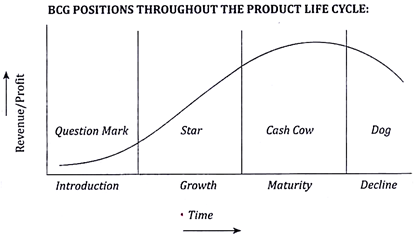

4. BCG Matrix:

The BCG Matrix was developed by The Boston Consulting Group, a strategic management consulting firm, to analyze the performance of products. The BCG Matrix compares various businesses in an organization’s portfolio on the basis of relative market share and market growth rate.

Relative market share is determined by the ratio of a business’s market share (in terms of unit volume) compared to the market share of its largest rival. Market growth rate is the growth in the market during the previous year relative to growth in the economy as a whole.

The combinations of high and low market share and high and low business growth rate provide four categories for a corporate portfolio. The matrix measures product performance by growth and market share.

It is a two-by-two graph, with market growth shown on the vertical axis and market share charted on the horizontal axis. The quadrants are then labelled as four business categories: cash cows, dogs, question marks and stars.

i. Stars:

(High share, high growth) SBU that are stars have a high share of a high-growth market and typically require large amounts of cash to support their rapid and significant growth. They have additional growth potential and so profits should be ploughed back into this business for future growth and profits.

For example software, entertainment, electronics and telecommunications are some of the industries which have a very high growth rate. The appropriate strategy for stars is to maintain the market share through large closes of investment (both internal as well as external).

ii. Cash Cows:

(High share, low growth) SBUs that are ‘cash cows’ (provide lot of cash for the firm) have a high market share in a slowly growing market. As a result, they tend to generate more cash than is necessary to maintain their market position. Cash cows are often former stars and can be valuable in a portfolio because they can be ‘milked’ to provide cash for other riskier and struggling businesses.

iii. Question Marks:

(Problem child or wild cat—low share, high growth) SBUs that are ‘question marks’ have a small share of a high growth market. The question mark business is risky, since there is already a leader in that business.

As such it requires lot of funds to invest in plant, equipment and personnel in order to keep pace with the fast-growing market. The term question mark is well conceived, because at every stage the organization has to think hard about whether to keep investing funds in the business (to turn it into a star) or to get out.

iv. Dogs:

(Low share, low growth) SBUs that are ‘dogs’ have a relatively small share of a low-growth market. They may barely support themselves, or they may even drain cash resources that other SBUs have generated. Usually dogs are harvested, divested or liquidated (if turnaround is not possible).

After the SBUs of an organization are plotted on the growth-share matrix, the next step is to evaluate whether the portfolio is healthy and well-balanced. A balanced portfolio; obviously, has a number of stars and cash cows and not too many question marks or dogs.

Depending on the position of each SBU, four basic strategies can be formulated while building a balanced portfolio:

1. Build- Heavily invest in Stars. High market share and high industry growth mean higher probability of future success.

2. Hold- Maintain cash cows because they provide resources for future growth-in- vestment in wild cats and stars. Here the company invests just enough to keep the SUB in its present condition.

3. Harvest- Here the company reduces the amount of investment with a view to maximize the short terms cash flows and profits from the SBU. It is a strategy best suited to cash cows that are weak or which are in a market with bleak prospects.

It also used on occasions when the first in need of cash and is willing to forgo the future of the product in the interest of short term requirements. Harvesting is also used for question marks when there seem to be few real opportunities to turn them into stars and for dogs.

4. Divest- Here the attempt is to get rid of the dogs and use the capital the firm gets to invest in stars and question marks.

As time passes, SBUs change their position in the growth-share matrix. Successful SBUs have a life cycle. They start as question marks, become stars, then cash cows, and finally dogs towards the end of their life cycle. Therefore, companies should keep on eye not only on the current positions of their businesses but also on their moving positions.

Each business should be examined as to where it was in past years and where it will probably move in the years ahead. If the expected journey of a business is going to be a tough one, alternative plans must be kept ready.

The growth-share matrix, thus, becomes a useful planning framework for strategists. They can use it to try to assess each SBU and assign the most reasonable objective in the light of past experiences, current situation and future trends.

Mistakes, however, could turn the tide against the above theoretical reasoning especially in cases where all SBUs are asked to aim for the same growth rate or return level. As we all know, the very basis of SBU analysis is that each business has a different potential and requires its own objective.

Further mistakes would include:

i. Leaving cash-cow business with too little in retained funds, in which case they grow weak; or leaving them with too much in retained funds, in which case the company fails to invest enough in new growth business.

ii. Making major investments in dogs hoping to turn them around but failing each time.

iii. Maintaining too many question marks and underinvesting in each; question marks should either receive enough support to achieve segment dominance or be dropped.

Shortcomings of BCG Matrix:

The BCG Matrix suffers from a number of shortcomings:

(1) It does not directly address the majority of businesses that have average market shares in markets of average growth (the matrix talks about only two categories, high and low for each dimension).

(2) Generalizations based on the model also may be misleading, since organizations with low market shares may not necessarily be question marks. For example, in India the Ford Ikon, Mitsubishi Lancer managers may raise car production only after careful debate, lest the models lose their exclusive image.

(3) Likewise, businesses with large market shares in slow growth markets may not necessarily be cash cows because they may actually need substantial investments to retain their market position.

Consider the dilemmas of Hindustan Lever in maintaining its supremacy in Toilet Soaps where (it has a market share of sixty per cent) both the topline and bottom line growth has slowed down considerably in recent years due to competition from regional players, discount wars and aggressive promotional efforts.

(4) The matrix, further, does not offer guidance regarding which question marks to support and which dogs to salvage.

(5) The terminology used is somewhat prohibitive. “If you call a business a dog, it will respond like one. It is one thing to know that you are an ugly duckling, much worse to be told explicitly that you are”. (Gupta; Hambrick)

(6) The data to position products/SBUs accurately on the matrix are not always available.

(7) Finally, growth and market share are not the only factors which make markets attractive and which give companies strength in markets.

Environmental Analysis and Diagnosis # Competitor Analysis:

Competitor analysis seeks to assess the strengths and weaknesses of current and potential competitors of any business. The goal of competitor analysis is to be able to predict a competitor’s probable future actions, especially those made in response to the actions of the focal business.

Competitor analysis is always about detecting change in and around competitors and assessing what change implies for the competitor itself, for the market place in general, or for your own business.

For identifying competitors:

1. Whom does one usually compete against? Who are firm’s most intense competitors? Who are less intense but can still impact firm’s performance? Who are the ones that come out with substitutes?

2. Is it possible to divide various competitors into strategic groups on the basis of their skills, capabilities, and strategies?

3. Who are the potential competitors or potential entrants? Is it possible to check their entry?

For understanding and evaluating competitors:

1. What are the objectives and strategies of competitors?

2. What about their size? Growth profile?

3. What about competitors’ organisational culture?

4. What is the cost structure of competitors? Do they enjoy any cost advantage? What about their profitability picture?

5. Information regarding competitors’ image and current positioning? And their current and past strategies?

6. Who are the most successful competitors in the market currently? Reasons for their competitive success?

7. Are they able to exploit our weaknesses and serve customer needs better than us? How are they doing this? Any possibility of competitors’ becoming stronger and stronger?

8. What kind of capabilities and skill sets are being deployed by competitors to outwit others in the market place currently?

The principal task of a marketer while carrying out a competitor analysis is to correctly assess the magnitude of existing competition and put appropriate strategies in place so as to meet the present and potential needs of customers.

Analyzing the strengths and weaknesses of competitors—by setting up a competitive intelligence wing specially for this purpose collecting information from various sources such as trade and professional sources, channel members, customers, investors, bankers, shareholders and government agencies—would help a firm prepare a strategic profile in terms of current strategies, resource strengths, capabilities and competitive shortcomings etc.

The information obtained through competitor analysis often helps a firm, understand, interpret and predict its competitor’s actions and initiatives

How Should Organisations Respond?

Given the myriad issues, problems and opportunities in an organisation’s environment, how should the organisation adapt? Each organisation must assess its own unique situation and adapt according to the wisdom of its top management.

It is not easy to come out with clear cut answers because the relationships between the organisation and its many environments are multifarious and difficult to predict. Even more difficult is the task of stating exactly what an organisation should do in response to a particular situation in the environment.

For example, the removal of quantitative restrictions on consumer items, agricultural products, and import of second-hand vehicles is going to impact a number of domestic organisations w.e.f 1-4-2001. In such a scenario, the number of possible organisational responses are too numerous to be catalogued in a specific way.

However, certain commonly used organisational responses could be stated thus:

1. Boundary-Spanning Response:

In every organisations, there are certain positions called boundary roles that link the organisation with its various external constituencies. These roles are filled by public- relations representatives, sales people, purchasing agents etc. These boundary spanners spend a great amount of time with external groups and help present the organisation’s interest in dealings with the environment.

They also convey the information about the environment to the organisation’s management. They, thus, help the firm to scan the environmental forces closely and take steps proactively, in order to survive and progress in a complex and dynamic environment.

2. Strategic Responses:

Another way that an organisation adapts to its environment is through a strategic response. The options here include maintaining the status quo (even after removal of quantitative restrictions.

Bajaj Auto, for example, may not curtail production of scooters because management may feel that it is doing very well currently), altering strategy a bit (say cut the prices a bit and advertise aggressively highlighting quality, service and reliability aspects more prominently) or adopting an entirely new strategy (reduced emphasis on scooters and expand the motor cycle market in line with global trends, or even venture into an alliance with an international car manufacturer).

If the market that a company currently serves is growing rapidly (as is the case with motor cycle segment), the firm might decide to invest even more heavily in products and services for that market. The firm may like to pursue new markets for old products, introduce new products to old markets, or introduce new products to new markets.

Alternatively, if a market is shrinking or does not offer reasonable possibilities for growth (say, the moped market) the company may decide to cut back, or to get out of competition altogether.

Firms also indulge in domain shifts (changes in the mix or products and service offered so that the firm will interface with more favourable environmental elements) to regain the lost glory. Moving out of current products or services or locations into a more favourable domain, diversification, expansion of product/service portfolio are all parts of this strategy.

3. Flexible Structural Designs:

An organisation may also respond to environmental changes by altering its structural form. A firm that operates in an environment with relatively low levels of uncertainty might use a bureaucratic design putting emphasis on rules, order and conformance.

Alternatively, a firm that operates in a turbulent environment might favour an organic structure, emphasising informality, team structure, risk taking, initiative and creativity at various operating levels.

4. Mergers, Takeovers, Acquisitions and Alliances:

A Company may also engage in these kinds of strategies for a variety of reasons, such as gaining entry into new markets, expanding its presence in a current market, enhancing its market share, consolidating its position in a particular region or segment, etc.