Everything you need to know about fringe benefits for an employee. Fringe benefits refer to those benefits and services that are extended by the employer to his/her employees over and above their wages and salaries, such as, housing facility, transportation facility, subsidised meals, medical care, paid holidays, insurance cover etc.

In this article we will discuss about the fringe benefits provided by an employer to his/her employees in an organization.

Learn about:- 1. Introduction to Fringe Benefits 2. Meaning of Fringe Benefits 3. Definition 4. History and Growth 5. Objectives 6. Goals 7. Need 8. Main Features 9. Types 10. Strategies and 11. Scenario in India.

Fringe Benefits for Employees: Meaning and Definition, Features, Objectives, Types and Examples

Contents:

- Meaning and Definition to Fringe Benefits

- Meaning of Fringe Benefits

- Definition of Fringe Benefits

- History and Growth of Fringe Benefits

- Objectives of Fringe Benefits

- Goals of Fringe Benefits

- Need of Fringe Benefits

- Main Features of Fringe Benefits

- Types of Fringe Benefits

- Strategies of Fringe Benefit

- Fringe Benefits Scenario in India

Fringe Benefits – Meaning and Definition

Besides base compensation and incentives, employees are provided various types of benefits and services by the organizations. These benefits and services are not linked to employees’ productivity but are provided to different classes of employees either as a matter of statutory requirement or on voluntary basis or a combination of both.

Such benefits are called by various names such as ‘fringe benefits’, ’employee welfare’, ‘wage supplements’, ‘sub-wages’, ‘supplementary compensation’, ‘social security’, etc. However, the term fringe benefits is more common in practice. The term fringe benefits has not been defined precisely because the items that are included in this category show great variation.

Some of the items are covered by statutory provisions while many others are provided voluntarily. As the literal meaning of the term fringe is marginal, the question arises whether the statutorily-required benefits should be included in the category of fringe benefits.

Because of this nature of fringe benefits, different countries include different items in these. In Indian context, fringe benefits as defined by Employers’ Federation of India in 1968 are taken into account.

Employers’ Federation of India has defined fringe benefits as follows- “Fringe benefits include payments for non-working times, profits and bonus, legally sanctioned payments on social security schemes, workmen’s compensation, welfare cess, and the contributions made by the employers under such voluntary schemes as care for the post- retirement, medical, educational, cultural, and recreational needs of workmen. The term also includes the monetary equivalent of free lighting, water, fuel, etc. which are provided for workers, and subsidized housing and related services.”

Fringe benefits refer to those benefits and services that are extended by the employer to his/her employees over and above their wages and salaries, such as, housing facility, transportation facility, subsidised meals, medical care, paid holidays, insurance cover etc.

These benefits are becoming very important in today’s scenario, rather they form an integral part of the compensation package of an organisation. The various types of fringe benefits protect employees from risks that could jeopardize their health and financial security. They provide coverage for sickness, injury, unemployment, and old age and death.

They may also provide services or facilities that many employees find valuable, such as child care services or a gym or health club. Nearly every organisation provides these benefits to its employees and their importance continues to grow. Although these benefits do cost a lot of expenditure to organisations, they however, provide social security and psychological support to the employees.

Fringe Benefits – Meaning

Management is concerned with attracting and keeping employees, whose performance meets at least minimum levels of acceptability; and at keeping ‘absenteeism’ and ‘turnover’ to tolerable levels. The provision of ‘benefits’ and services’ can be and are important in maintaining the employees and reducing or keeping turnover and absenteeism low.

It is important to note that ‘financial’ incentives are paid to specific employees whose work is above standard. ‘Employee benefits and services’ on the other hand, are available to all employees based on their membership in the organisation. The purpose of such benefits and services is to retain people in the organisation and not to stimulate them to greater effort and higher performance. They foster loyalty and act as a security base for the worker.

These benefits are usually known as “fringe benefits”— as they are offered by the employer to the employee as a “Fringe.” Different terms have been used for these benefits, such as “Fringe Benefits,” “Welfare Expenses,” “Wage Supplements,” “Sub wages” or “Social Charges,” “Perquisites other than Wages,” or “Transpecuniary Incentives.” The other terms used are- “Extra Wages,” “Hidden Payroll” “Non-Wage Labour Costs” or “Selected Supplementary Compensation Practices.”

It is difficult to define what a fringe benefit is, for there is no agreement among the experts on its precise meaning, significance or connotation. The chief area of disagreement is between “wages” and “fringe” on the one hand and between “fringes” and “company personnel services” on the other. There are also differences on whether the benefits which have been legally provided for should be included among the “fringes.”

The Glossary of Current Industrial Relations and Wage Terms has defined fringe benefits as “Supplements to wages received by workers at a cost to employers. The term encompasses a number of benefits paid vacation, pension, health insurance plans, etc. which usually add up to something more than a “fringe,” and is sometimes applied to a practice that may constitute a dubious benefit for workers.”

Fringe Benefits – Definition: As Defined by Important Organisations and Eminent Authors

The International Labour Organisation has defined “fringe benefits” as under:

“Wages are often augmented by special cash benefits, by the provision of medical and other services, or by payments in kind that form part of the wage for expenditure on the goods and services. In addition, workers commonly receive such benefits as holidays with pay, low-cost meals, low-rent housing, etc. Such additions to the wage proper are sometimes referred to as ‘fringe benefits.’ Benefits that have no relation to employment or wages should not be regarded as fringe benefits, even though they may constitute a significant part of the workers’ total income. This is fairly obvious in the case of public parks, sanitation services, and public and fire protection.”

The United States Chamber of Commerce includes five categories of services and benefits under the term fringe benefits.

These are:

(i) Legally required payments old-age pension, survivor benefits, disability pension, health insurance, unemployment insurance, separation pay, and payments made under the Workmen’s Compensation Act;

(ii) Pension and group insurance; and welfare payments;

(iii) Paid rest periods, waste-up time, and lunch periods;

(iv) Payment for time not worked vacations and holidays, for example; and

(v) Christmas bonus.

Belcher defines these benefits as “any wage cost not directly connected with the employees, productive effort, performance, service or sacrifice.”

According to the Employers’ Federation of India, “fringe benefits include payments for non-working time, profits and bonus, legally sanctioned payments on social security schemes, workmen’s compensation, welfare cess, and the contributions made by employers under such voluntary schemes as cater for the post-retirement, medical, educational, cultural and recreational needs of workmen. The term also includes the monetary equivalent of free lighting, water, fuel, etc., which are provided for workers, and subsidised housing and related services.”

Cockman views employee benefits as those benefits which are supplied by an employer to or for the benefits as “those benefits which are supplied by an employer to or for the benefits of an employee, and which are not in the form of wages, salaries and time-rated payments.”

We may define fringe benefit thus:

It is a benefit which Supplements the employees’ ordinary wages, and which is of value to them and their families in so far as it materially increases their retirement benefit.

Fringe benefits help build up a good corporate image. Schemes like housing, educational institutional and recreational activities bring benefits to the society at large. An organisation with the introduction of Fringes seeks to enhance employee morale, remain cost effective, and introduce changes without much resistance.

Coverage of Fringe Benefits:

The term ‘fringe benefits’ covers bonus, social security measures, retirement benefits like provident fund, gratuity, pension, workmen’s compensation, housing, medical, canteen, cooperative credit, consumer stores, educational facilities, recreational facilities, financial advice and so on. Thus, fringe benefits cover a number of employee services and facilities provided by an employer to his employees and in some cases to their family members also. Welfare of employee and his family members is an effective advertising and also a method of buying the gratitude and loyalty of employees. But, while some employers provide these services over and above the legal requirements to make effective use of their work force, some restrict themselves to those benefits which are legally required.

Fringe Benefits – History and Growth

Belcher says that “A Fringe is a catchword attributed to the Regional Director of the War Labour Board (USA) during World War II. The idea caught on and is now widely used in spite of its limited value in describing the present practice.” It sprang up as off-shoot of the industrial wage system.

In the U.K., fringe benefits germinated as the byproduct of Industrial Revolution. In member countries of the I.L.O., the Philadelphia Declaration did influence the origin of these benefits.

In India, the Directive Principles of State Policy enshrined in the Constitution and the subsequent Five Year Plan documents laid considerable emphasis on improvement of wages, social security benefits and other welfare measures, for it was rightly recognised in the words of Peter Drucker, “Larger part of the industrial growth is obtained not from more capital investment but from improvements in men. We get from men pretty much what we invest in them.”

Many other factors also influenced the concept of ‘fringe benefits.’

For instance:

(i) Rising prices and cost of living has brought about incessant demand for provision of extra benefits to the employees.

(ii) Employers too have found that fringe benefits present attractive areas of negotiation when wage and salary increases are not feasible.

(iii) As organisations have developed more elaborate fringe benefits programmes for their employees, greater pressure has been placed upon competing organisations to match these benefits in order to attract and keep employees.

(iv) Recognition that fringe benefits are non-taxable rewards has been a major stimulus to their expansion.

(v) Rapid industrialisation, increasingly heavy urbanisation and the growth of a capitalistic economy have made it difficult for most employees to protect themselves against the adverse impact of these developments. Since it was workers who were responsible for production, it was held that employers should accept responsibility for meeting some of the needs of their employees. As a result, some benefits-and-services programmes were adopted by employers.

(vi) The growing volume of labour legislation, particularly social security legislation, made it imperative for employers to share equally with their employees the cost of old age, survivor and disability benefits.

(vii) The growth and strength of trade unions has substantially influenced the growth of company benefits and services.

(viii) Labour scarcity and competition for qualified personnel has led to the initiation, evolution and implementation of a number of a compensation plans.

(ix) The management has increasingly realised its responsibility towards its employees and has come to the conclusion that the benefits of increase in productivity resulting from increasing industrialisation should go, at least partly, to the employees who are responsible for it, so that they may be protected against the insecurity arising from unemployment, sickness, injury and old age. Company benefits-and-services programmes are among some of the mechanisms which managers use to supply this security.

A “tripartite” concept of individual protection has developed in recent years. First, every individual is expected to be at least partially responsible for his own present and future well-being.

Second, industry is now expected to protect its workers from the hazards of life. Finally, the government is involved in supporting and financing worker assistance programmes. The contribution of these three parties varies in accordance with the nature and purpose of the various employee benefits- and-services programmes.

A number of factors influence the decision to set up a particular employee benefits-and-services programme.

According to Nielson, the criteria governing such a programme are:

(a) Cost;

(b) The ability to pay;

(c) The needs of the employees and their contribution in improving productivity;

(d) The bargaining strength of the trade union;

(e) Tax considerations;

(f) Public relations;

(g) Social responsibility; and

(h) The reactions of the employees.

Fringe Benefits – Objectives

An organisation designs and establishes a benefit-and-service programme to achieve the following ends:

(a) To keep in line with the prevailing practices of offering benefits and services which are given by similar concerns;

(b) To recruit and retain the best personnel;

(c) To provide for the needs of employees and protect them against certain hazards of life, particularly those which an individual cannot himself provide for;

(d) To increase and improve employee morale and create a helpful and positive attitude on the part of workers towards their employers;

(e) To make the organisation a dominant influence in the lives of its employees with a view to gaining their loyalty and co-operation, encouraging them to greater productive efforts;

(f) To improve and furnish the organisational image in the eyes of the public with a view to improving its market position and bringing about product acceptance by it;

(g) To recognise the official trade union’s bargaining strength, for a strong trade union generally constrains an employer to adopt a sound benefits- and-services programme for his employees.

Other Objectives of Fringe Benefits:

1. To create and maintain good industrial relations and industrial peace.

2. To reduce labour turnover and absenteeism rates and retain experienced, efficient and honest workers.

3. To protect the workers from certain unhappy and unpleasant events of life, which the workers individually cannot bear.

4. To boost the employee morale.

5. To protect the health of the employees and to provide safety to them from accidents.

6. To provide security to the employees against social risks like old age, maternity etc.

7. To create a sense of belongingness among the employees and strengthen their loyalty to the organisation.

8. To motivate the employees by identifying and satisfying their unsatisfied long-felt needs.

9. To meet the requirements of various laws relating to fringe benefits.

Fringe Benefits – Top 3 Goals: Social, Human and Macro-Economical Goal

In other words, fringe benefits satisfy three goals, viz.:

1. Social Goal:

Human resource is the most precious of all resources. In the words of the Philadelphia Charter, 1944, “Labour is not a commodity. It is entitled to a fair deal as an active participant in any programme of economic development and social reconstruction.”

Article 43 of the Constitution of Indian provides – “…All workers should be given a living wage, conditions of work ensuring decent standard of life and fuller enjoyment to ensure social and cultural opportunities.”

The fringe benefits act as a social lever in helping conservation of this precious resource, by guarding against its unnatural erosion and providing the climate for its development in a working environment.

2. Human Relations Goal:

The management, through motivation, tries to develop and maintain “human relations”, i.e., “mutual interest, individual differences, motivation and human dignity.” The management provides with an environment which will reasonably meet the economic, social and psychological needs of the employees so that their co-operation could be obtained and productivity of the organisation enhanced.

3. Macro-Economic Goal:

For maintaining the growth and stability in the economy of a country, ideal utilization of the non-human and human resources is imperative. Fringe benefits do provide protection, during periods of contingencies of life, for training and development of the employees, and for good working conditions and assistance to supplement their main income, opportunities for social interaction through cultural recreational facilities, etc

Fringe Benefits to Employees – Need

During the World War II certain non-monetary benefits were extended to employees as means of neutralising the effect of inflationary conditions. These benefits, which include housing, health, education, recreation, credit, canteen, etc., have been increased from time to time as a result of the demands and pressures from trade unions. It has been recognised that these benefits help employees in meeting some of their life’s contingencies and to meet the social obligation of employers.

Most of the organizations have been extending the fringe benefits to their employees, year after year, for the following reasons:

(1) Employee Demands:

Employees demand a more and varied types of fringe benefits rather than pay hike because of reduction in tax burden on the part of employees and in view of the galloping price index and cost of living.

(2) Trade Union Demands:

Trade Unions compete with each other for getting more and a new variety of fringe benefits to their members such as life insurance, beauty clinics. If one union succeeds in getting one benefit, the other union persuades management to provide a new model fringe. Thus, the competition among trade unions within an organisation results in more and varied benefits.

(3) Employer’s Preference:

Employer’s prefer fringe benefits to pay-hike, as fringe benefits motivate the employees for better contribution to the organisation. It improves morale and works as an effective advertisement.

(4) As a Social Security:

Social security is a security that society furnishes through appropriate organisation against certain risks to which its members are exposed. These risks are contingencies of life like accidents and occupational diseases. Employer has to provide various benefits like safety measures, compensation in case of involvement of workers in accidents, medical facilities etc., with a view to provide security to his employees against various contingencies.

(5) To Improve Human Relations:

Human relations are maintained when the employees are satisfied economically, socially and psychologically. Fringe benefits satisfy the worker’s economic, social and psychological needs. Consumer stores, Credit facilities, Canteen, Recreational facilities etc., satisfy the worker’s social needs, whereas retirement benefits satisfy some of the psychological problems about the post-retirement life. However, most of the benefits minimise economic problems of the employee. Thus, fringe benefits improve human relations.

Fringe Benefits – Main Features

1. Fringe benefits are the additional benefits given to the employees by the employer. They are extended to the employees in addition to their wages and salaries.

2. They serve as a motivating factor. They stimulate the employees to improve their work-performance as they make the employees work with enthusiasm and zeal.

3. They constitute an additional expenditure to the employer who can reduce the expenditure by avoiding or deferring certain benefits.

4. Fringe benefits are made available to all the workers irrespective of their efficiency. Because they are the benefits given to the workers for their service, their sickness, problems faced by them during their service etc.

5. They increase the real income of the workers in the organisation. e.g. free medical facilities, free education to the workers children, recreation, low cost meals, low rent housing etc.

Fringe benefits include such benefits as bonus, social security measures, housing, medical, canteen, co-operative credit, educational facilities, gratuity, provident fund contribution, workmen’s compensation, recreational facilities etc. Thus, fringe benefits include monetary and non-monetary benefits and services and hence they are also called ‘benefits and services’.

These benefits cover not only employees but also their family members. Welfare of employees and their family members serves as an effective method of advertising and increasing the goodwill of the organisation and also as a method of buying the gratitude and loyalty of the employees.

But while some employers provide these services and benefits over and above the legal requirements to make effective use of their work-force, some employers restrict themselves to those benefits which are legally only required.

Special Features of Fringe Benefits:

It will be noted that there is some difference between ‘wages and fringe benefits.’ Firstly, wages are directly related to the work done and are paid regularly — usually weekly, fortnightly or monthly. Fringe benefits, on the other hand, are those payments or benefits which a worker enjoys in addition to the wages or salary he receives.

Secondly, these benefits are not given to workers for any specific jobs they have performed but are offered to them to stimulate their interest in their work and to make their job more attractive and productive for them. They boost the earnings of the employees, and put extra spending money in their hands.

Thirdly, fringe benefit represents a labour cost for the employer, for it is an expenditure which he incurs on supplementing the average money rates due to his employees who have been engaged on the basis of time schedules. In the circumstances, everything which a company spends over and above “straight time pay” should be considered a fringe benefit.

A labour cost is a “fringe” only when it is an avoidable factor; that is, when it can be replaced by money wages without determent to a worker’s productive efficiency. Only the legal or union-imposed or voluntary non-wage costs, which can be computed into money wages, are considered to be fringes.

Fourthly, a fringe is never a direct reward geared to the output, effort or merit of an employee. It is offered, not on the basis of the hard work or long hours of work put in by an employee but on the basis of length of service, his sickness, sex, the hazards of life he encounters in the course of his work, etc.

For example, maternity benefits are offered to female workers who have put in a prescribed period of service with a particular employer. Sometimes, the longer an employee’s period of service, the larger the fringe benefits he enjoys. But wages are always fixed and paid regularly.

Fifthly, to be termed a ‘fringe benefit,’ a labour cost should be intended by an employer as a benefit desired by his staff. It is a fringe benefit when it is enjoyed by all the employees. For example, a fringe benefit subsidising non-vegetarian meals taken in the factory canteen is not a fringe benefit for vegetarian employees.

Sixthly, a fringe must constitute a positive cost to the employer and should be incurred to finance an employee benefit. If the benefit increases a worker’s efficiency, it is not a fringe; but if it is given to supplement his wages, it is.

For example, the expenditure incurred on providing better lighting arrangement with a view to increasing a worker’s efficiency is not counted as expenditure incurred on fringe benefits, even though the workers may gain financially as a result of their increased efficiency flowing from the provision of better lighting facilities. Subsidised meals, however, definitely constitute a fringe benefit.

Though these benefits are known as fringes, they are not merely so but are a substantial part of the expenditure incurred on wage and salary administration. They are better known now as ‘Benefits and services’ rather than as ‘Fringe Benefits.’ But since the terms are also used interchangeably, they are synonymous.

The word ‘Benefit’ applies to those items for which a direct monetary value to the employee can be easily ascertained, as in the case of holiday pay, pension, medical insurance or separation pay. The word Services, ‘on the other hand, refers to such items as athletics, company purchasing service, worker’s medical examination, legal aid, housing,’ etc.

Fringe Benefits – Types and Calculations

Organisations provide a variety of fringe benefits. Dale Yoder and Paul D. Standohar classified the fringe benefits under four heads as given hereunder-

(i) For Employment Security:

Benefits under this head include unemployment insurance, technological adjustment pay, leave travel pay, overtime pay, level for negotiation, leave for maternity, leave for grievances, holidays, cost of living bonus, call-back pay, lay-off pay, retiring rooms, jobs to the sons/daughters of the employees and the like.

(ii) For Health Protection:

Benefits under this head include accident insurance, -disability insurance, health insurance, hospitalisation, life insurance, medical care; sick benefits, sick leave, etc.

(iii) For Old Age and Retirement:

Benefits under this category include: deferred income plans, pension, gratuity, provident fund, old age assistance, old age counselling, medical benefits for retired employees, travelling concession to retired employees, jobs to sons/daughters of the deceased employee and the like.

(iv) For Personal Identification, Participation and Stimulation:

This category covers the following benefits: anniversary awards, attendance bonus, canteen, co-operative credit societies, educational facilities, beauty parlour services, housing, income tax aid, counselling, quality bonus, recreational programmes, stress counselling, safety measures etc.

Robert H. Hoge classified the fringe benefits as follows:

(A) Payment for Time Not Worked:

Benefits under this category include: sick leave with pay, vacation pay, paid rest and relief time, paid lunch periods, grievance time, bargaining time, travel time etc.

(B) Extra Pay for Time Worked:

This category covers the benefits such as: premium pay, incentive bonus, shift premium, old age insurance, profit sharing, unemployment compensation, Christmas bonus, Deewali or Pooja bonus, food cost subsidy, housing subsidy, recreation etc.

The following classification of fringe benefits is adopted for discussion about the fringe benefits in India.

Type # 1. Payment for Time Not Worked:

This category includes:

(a) Hours of work;

(b) Paid holidays;

(c) Shift premium;

(d) Holiday pay; and

(e) Paid vacation.

(a) Hours of Work:

No adult worker shall be required to work in a factory for more than 48 hours in any week. The working hours should be 9 hours in any day. In some organisations, the number of working hours are less than the legal requirements.

(b) Paid Holidays:

An adult worker shall have a weekly paid holiday, preferably Sunday. When a worker is deprived of weekly holidays, he is eligible for compensatory holidays of the same number in the same month. Some organisations allow the workers to have two days as paid holidays in a week. Indian organisations provide highest number of paid holidays in a year in Asia-pacific region.

(c) Shift Premium:

Companies operating second and third shifts, pay a premium to the workers who are required to work during the odd hours shift.

(d) Holiday Pay:

Generally, organisations offer double the normal rate of the salary to those workers, who work on paid holidays.

(e) Paid Vacation:

Workers in manufacturing, mining and plantations who worked for 240 days during a calendar year are eligible for paid vacation at the rate of one day for every 20 days worked in case of adult workers and at the rate of one day for every IS days worked in case of child workers.

Type # 2. Employee Security:

Physical and job security to the employee should also be provided with a view to promoting security to the employee and his family members. The benefits of confirmation of the employee on the job creates a sense of job security. Further a minimum and continuous wage or salary gives a sense of security to the sense of job security. Further a minimum and continuous wage or salary gives a sense of security to the life. The Payment of Wages Act, 1936, The Minimum Wages Act, 1948. The Payment of Bonus Act, 1965, provide income security to the employees.

(a) Retrenchment Compensation:

The non-seasonal industrial establishments employing 50 or more workers have to give one month’s notice or one month’s wages to all the workers who are retrenched after one year’s continuous service. The compensation is paid at the rate of 15 days wage for every completed year of service with a maximum of 45 days wage in a year. Workers are eligible for compensation as stated above even in case of closing down of undertakings.

(b) Lay-Off Compensation:

In case of lay-off, employees are entitled to lay-off compensation at the rate to 50% of the total of the basic wage and dearness allowance for the period of their lay-off except for weekly holidays. Lay-off compensation can normally be paid up to 45 days in a year.

Type # 3. Safety and Health:

Employee’s safety and health should be taken care of in order to protect the employee against accidents, unhealthy working conditions and to protect worker’s capacity. In India, the Factories Act, 1948, stipulated certain requirements regarding working conditions with a view to provide safe working environment. These provisions relate to cleanliness, disposal of waste and effluents, ventilation and temperature, dust and fume, artificial humidification, over-crowding, lighting, drinking water, latrine urinals, and spittoons.

Provisions relating to safety measures include fencing of machinery, work on or near machinery in motion, employment of young people on dangerous machines, striking gear and devices for cutting off power, self-acting machines, easing of new machinery, probation of employment of women and children near cotton openers, hoists and lifts, lifting machines, chains, ropes and lifting tackles, revolving machinery, pressure plant, floors, excessive weights, protection of eyes, precautions against dangerous fumes, explosive or inflammable dust, gas, etc. Precautions in case of fire, power to require specifications of defective parts of test of stability, safety of buildings and machinery etc.

Workmen’s Compensation:

In addition to safety and health measures, provision for the payment of compensation has also been made under Workmen’s Compensation Act, 1923. The Act is intended to meet the contingency of invalidity and death of a worker due to an employment injury or an occupational disease specified under the Act at the sole responsibility of the employer. The Act covers the employees whose wages are less than Rs. 500 per month.

Amount of compensation depends on the nature of injury and monthly wages of the employee. Dependants of the employee are eligible for compensation in cases of death of the employees.

Health Benefits:

Today various medical services like hospital, clinical and dispensary facilities are provided by organisations not only to employees but also to their family members.

Employees’ State Insurance Act, 1948 deals comprehensively about the health benefits to be provided. This Act is applicable to all factories, establishments running with power and employing 20 or more workers. Employees in these concerns and whose wages do not exceed RS. 1,000 per month are eligible for benefits under the Act.

Benefits under this Act include:

(a) Sickness benefit- Insured employees are entitled to get cash benefit for a maximum of 56 days in a year under this benefit.

(b) Maternity benefit- Insured women employees are entitled to maternity leave for 12 weeks (six weeks before the delivery and six weeks after the delivery) in addition to cash benefit of 75 paise per day or twice sickness benefit, whichever is higher.

(c) Disablement benefit- Insured employees, who are disabled temporarily or permanently (partial or total) due to employment injury add/or occupational diseases are entitled to get the cash benefit under this head.

(d) Dependant’s benefit- If an insured person dies as a result of an employment injury sustained as an employee, his dependents who are entitled to compensation under the Act, shall be entitled to periodical payments referred to as dependant benefit.

(e) Medical benefit- This benefit shall be provided to an insured employee or to a member of his family where the benefit is extended to his family.

This benefit is provided in the following forms- (a) Out-patient treatment, or attendance in a hospital, dispensary, clinic or other institutions; or (b) By visits to the home of the insured person; or (c) Treatment as in-patient in a hospital or other institution.

An insured person shall be entitled to medical benefits during any week for which contributions are payable, or in which he/she is eligible to claim sickness or maternity benefits or eligible for disablement benefit.

Voluntary Arrangements:

However, most of the large organisations provide health services over and above the legal requirements to their employees free of cost by setting up hospitals, clinics, dispensaries and homoeopathic dispensaries. Company’s elaborate health service programmes include:

(a) Providing health maintenance service, emergency care, on-the-job treatment care for minor complaints, health counselling, medical supervision in rehabilitation, accident and sickness prevention, health education programme, treatment in employee colonies etc.

(b) Medical benefits are extended to employee family members and to the retired employees and their family members.

(c) Small organisations which cannot set-up hospitals or large organisations (in those where hospitals cannot be set-up because of various reasons) provide the medical services through local hospitals and doctors. Sometimes, they provide the facility of reimbursement of medical expenses borne by the employees.

Type # 4. Welfare and Recreational Facilities:

Welfare and recreational benefits include- (a) Dating allowance; (b) Canteens; (c) Consumer societies; (d) Credit societies; (e) Housing; (f) Legal aid; (g) Employee counselling; (h) Welfare organisations; (i) Holiday homes; (j) Educational facilities; (k) Transportation/ Conveyance; (I) Parties and picnics; (m) child care and (n) Miscellaneous.

(a) Dating Allowance:

Some of the software companies in order to enable the employees to select their life partners started providing dating allowance. This allowance has been criticised widely as it is against the culture of India. This allowance results in family problems of already married couples.

(b) Canteens:

Perhaps, no employee benefit has received as much attention in recent years as that of canteens. Some organisations have statutory obligation to provide such facilities that imposes a statutory obligation to employees to provide canteens in factories employing more than 250 workers. Others have provided such facilities voluntarily. Foodstuffs are supplied at subsidised prices in these canteens. Some companies provide lunch rooms when canteen facilities are not available.

(c) Consumer Societies:

Most of the large organisations located far from the towns and which provide housing facilities near the organisation set-up the consumer stores in the employees’ colonies and supply all the necessary goods at fair prices.

(d) Credit Societies:

The objective of setting-up of these societies is to encourage thrift and provide loan facilities at reasonable terms and conditions, primarily to employees. Some organisations encourage employees to form cooperative credit societies with a view to fostering self-help rather than depending upon moneylenders, whereas some organisations provide loans to employees directly.

(e) Housing:

Of all the requirements of the workers, decent and cheap housing accommodation is of great significance. The problem of housing is one of the main causes for fatigue and worry among employees and this comes in the way of discharging their duties effectively. Most of the organisations are located very far from towns where housing facilities are not available.

Hence, most of the organisations built quarters nearer to factory and provided cheap and decent housing facilities to their employees, whilst a few organisations provide and/or arrange for housing loans to employees and encourage them to construct houses.

(f) Legal Aid:

Organisations also provide assistance or aid regarding legal matters to employees as and when necessary through company lawyers or other lawyers.

(g) Employee Counselling:

Organisations provide counselling service to the employee regarding their personal problems through professional counselors. Employee counseling reduces absenteeism, turnover, tardiness etc.

(h) Welfare Organisations and Welfare Officers:

Some large organisations set-up welfare organisations with a view to provide all types of welfare facilities at one center and appointed welfare officers to provide the welfare benefits continuously and effectively to all employee fairly.

(i) Holiday Homes:

As a measure of staff welfare and in pursuance of government’s policy, a few large organisations established holiday homes at a number of hill stations, health resorts and other centres with low charges of accommodation, so as to encourage employee use this facility for rest and recuperation in pleasant environment.

(J) Educational Facilities:

Organisations provide educational facilities not only to the employees but also to their family members. Educational facilities include reimbursement of fee, setting up of schools, colleges, hostels, providing grants-in-aid to the other schools where a considerable number of students are from the children of employees. Further, the organisations provide reading rooms and libraries for the benefit of employees.

(k) Transportation/ Conveyance:

Companies provide conveyance facilities to their employees from the place of their residence to the place of work as most of the industries are located outside town and all employees may not get quarter facility.

(I) Parties and Picnics:

Companies provide these facilities with a view to inculcating a sense of association, belongingness, openness, and freedom among employees. These activities help employees to understand others better.

(m) Child Care:

Career-orientation of women employees has been on increase in the recent times. Consequently the number of working mothers is on increase. Organisations started providing the facilities of child care facilities at the workplace in order to free the working mothers from the inconvenience of taking care of children during working hours.

(n) Miscellaneous:

Organisations provide other benefits like organising games, sports with awards, setting up of clubs, community services activities, Christmas gifts, Deewali, Pongal and Pooja gifts, birthday gifts, leave travel concession and awards, productivity/performance awards etc.

Type # 5. Old Age and Retirement Benefits:

Industrial life generally breaks family system. The saving capacity of the employee is very low due to lower wages, high living cost and increasing aspirations of the employees and his family members. As such, employers provide some benefits to the employees, after retirement and during old age, with a view to create a feeling of security about the old age. These benefits are called old age and retirement benefits.

These benefits include:

(a) Provident Fund;

(b) Pension;

(c) Deposit linked insurance;

(d) Gratuity; and

(e) Medical benefit.

(a) Provident Fund:

This benefit is meant for economic welfare of the employees. The Employee’s Provident Fund, Family Pension Fund and Deposit Linked Insurance Act. 1952 provides for the institution of Provident Fund for employees in factories and establishment- Provident Fund Scheme of the Act provides for monetary assistance to the employees and/or their dependents during post-retirement life.

Thus, this facility provides security against social risks and this benefit enables the industrial workers to have better retired life. Both the employee and the employer contribute to the fund. The employees on attaining IS years of membership are eligible for 100% of the contributions with interest. Generally the organisations pay the Provident Fund amount with interest to the employee on retirement or to the dependants of the employee, in case of death.

(b) Pension:

The Government of India introduced a scheme of Employees Pension Scheme for the purpose of providing Family Pension and Life Insurance benefits to the employees of various establishments to which the Act is applicable. The Act was amended in 1971 when Family Pension Fund was introduced in the Act. Both the employer and the employee contribute to this fund. Contributions to this fund are from the employee contributions to the Provident Fund to the tune of 1.5% of employee wage.

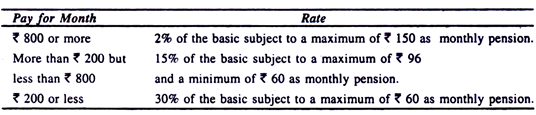

Employee’s Family Pension Scheme 1971 provides for a Family Pension to the family of a deceased employee as per the following rates:

This scheme allows for the payment of a lump sum amount of Rs. 4,000 to an employee on his retirement as retirement benefit and a lump sum amount of Rs. 2,000 in the event of death of an employee as life insurance benefit.

(c) Deposit Linked Insurance:

Employees Deposit Linked Insurance Scheme was introduced in 1976 under the Provident Fund Act, 1952. Under this scheme, if a member of the Employees Provident Fund dies while in service, his dependents will be paid an additional amount equal to the average balancing during the last three years in his account. (The amount should not be less than RS. 1,000 at any point of time). Under the Employees’ Deposit Linked Insurance Scheme, 1976, the maximum amount of benefit payable under the deposit linked insurance is Rs. 10,000.

(d) Gratuity:

This is another type of retirement benefit to be provided to an employee either on retirement or at the time of physical disability and to the dependents of the deceased employee. Gratuity is a reward to an employee for his long service with his present employer.

The Payment of Gratuity Act, 1972 is applicable to the establishment in the entire country. The Act provides for a scheme of compulsory payment of gratuity by the managements of factories, plantations, mines, oil fields, railways, shops and other establishments employing or more persons to their employees, drawing the monthly wages of Rs. 1,600 per month.

Gratuity is payable to all the employees who render a minimum continuous service of five years with the present employer. It is payable to an employee on his superannuation or on his retirement or on his death or disablement due to accident or disease. The gratuity payable to an employee shall be at the rate of 15 days wage for every completed year of service on part thereof in excess of six months. Here the wage means the average of the basic pay last drawn by the employee. The maximum amount of gratuity payable to an employee shall not exceed 20 months wage.

(e) Medical Benefit:

Some of the large organisations provide medical benefits to their retired employees and their family members. This benefit creates a feeling of permanent attachment with the organisation to the employees even while they are in service.

I. Non-Monetary Benefits:

Managements motivate the employees to work efficiently and contribute their human resources to a maximum extent. Individuals enhance their contributions in order to achieve organisational goals. Achievement of organisational objectives enables the managements to provide more benefits and rewards to the employees. This in turn help to achievement of individual objectives. In addition to fringe benefits, managements provide different types of non-monetary rewards.

These non-monetary rewards include:

(i) Treats cover free lunches, festival bashes, coffee breaks, picnics, dinner with the boss, dinner for the family, birthday treats.

(ii) Knick-Knacks cover desk accessories, company watches, tie-pins, brooches, diaries/ planners, calendars, wallets and T-shirts.

(iii) Awards include trophies, plaques, citations, certificates, scrolls, letters of appreciation.

(iv) Social Acknowledgment includes informal recognition, recognition at office get-together, socialisation of advice, suggestions etc.

(v) Office Environment cover redecoration, flexible hours etc.

(vi) Tokens covers movie tickets, vacation trips, early time-offs etc.

(vii) On-the-job rewards include increased responsibility, job rotation, training etc.

Advantages:

Advantages of non-monetary rewards include:

(i) Non-monetary rewards motivate employees to perform better.

(ii) Non-monetary rewards build employee self-esteem.

(iii) Employees become more loyal to the company.

(iv) These benefits create an atmosphere where change is not resented.

(v) These benefits can be provided without any extra cost.

(vi) Create close bondage between the company and employee family.

Disadvantages:

The non-monetary rewards, despite the advantages discussed above, suffer from the following disadvantages:

(i) These benefits demotivate the employees, if the processes are not transparent.

(ii) These rewards may result in short-sighted and hasty decision-making.

(iii) These rewards may result in unhealthy competition among employees.

(iv) Work intrudes on the home life of employees.

(v) Employees feel that managements concentrate on the non-cost programmes, and

(vi) These rewards will not work, if monetary rewards are not adequate.

II. Stock-Option Scheme:

Stock options are common in many countries. This scheme allows the employees to purchase the shares of the company at a fixed and reduced price. Employees are motivated when the company allows them to buy the shares at the concessional price. The stock options are viewed as performance based incentives.

Merits:

The merits of stock-option scheme are:

(i) This scheme links compensation package closely to performance.

(ii) This scheme enables the companies to retain efficient employees with the company.

(iii) It encourages the employees to work even better.

(iv) It inculcates a sense of ownership and responsibility.

(v) This scheme establishes significance of team effort among employees.

Limitations:

The limitations of the scheme are:

(i) This scheme can be used by only the profit-making companies.

(ii) Share prices do not always reflect fundamentals.

(iii) Falling share prices result in loss to employees.

(iv) Unsound stock market conditions cause inconvenience to employees in encashing their investment.

(v) Lack of transparency can earn accusations of favouritism.

Since you are revising the book, you may consider enhancing the rates etc. in the examples. Even sixty years back when this subject was being taught us, these rates in fraction of a rupee were unrealistic.

Also, with the present level of automation, you may explore if such minutely «worked out schemes are at all in vogue you can make your own research not wait for the latest things to appear in books/articles. Just inquire with people in higher ranks in an industry.

Fringe Benefit – Top 3 Strategies: -Benefits mix, Benefits amount and Benefits package

To designing an effective benefits package, a company needs to align its benefit strategy with its overall compensation strategy.

The benefits strategy requires making choices in three areas as given below:

(1) Benefits mix,

(2) Benefits amount, and

(3) Benefits package.

(1) The Benefits Mix:

It is the complete package of benefits that a company offers its employees. According to R.M. McCaffery (1989) at least three issues should be considered when making decisions about the benefits mix – the total compensation strategy, organisational objectives, and the characteristics of the workforce.

The company must choose the market in which it wants to compete for employees and then provide a benefits package attractive to the people in that market. The organisation’s objectives also influence the benefits mix. For instance, if the company philosophy is to minimise differences between low-level employees and top management, the benefits mix should be the same for all employees.

Moreover, the characteristics of the workforce must be considered when choosing the benefits mix. If the firm’s workforce consists largely of parents with young children, it is likely that child care and other family friendly benefits will be important.

(2) The Benefits Amount:

The choice of benefits amount governs the percentage of the total compensation package that will be allocated to benefits as opposed to the other components of the package (basic salary and pay incentives). Once management determines the amount of money available for all benefits, it can establish a benefits budget and decide on the level of funding for each part of the benefits program. Management will then know how much it can contribute for each benefit and how much it will need to ask employees to pay towards that benefit.

(3) Flexibility of Benefits:

The flexibility of benefits choice concerns the degree of freedom employees have to tailor the benefits package to their personal needs. The choice corresponds to the ‘centralisation versus decentralisation’ of the pay decision. Some organisations have a relatively standardised benefits package that gives employees few options.

However, because of the changing demographics of the workforce-more women working full-time, single-parent families etc. there is now a greater variety of employee needs which calls for decentralised benefits package emphasizing choice to employees. So, finally it can be said that fringe benefits are one of the most important motivational incentive given to the employees but it needs to be designed carefully and handled appropriately.

Fringe Benefits – Scenario in India

When the Employers’ Federation of India conducted a study of fringe benefits in this country, it was revealed that, in 1960,981 companies, which were included in the survey, paid a little over Rs.2,148.3 million in wages and fringe benefits, and that the latter was about 21.3 per cent of their total wage bill in that year.

The fringe benefits were high in the mining (24.84 per cent of the wage bill) and plantations industries (24.3 per cent of the wage bill), and were comparatively low in the manufacturing sector (19.99 per cent of the wage bill).

In each of these three sectors, however, variations were considerable. In the mining industry, the percentage of fringe benefits varied from 24.5 to 27.88, while in the manufacturing sector it varied between 13.42 and 32.11, followed by the cigarette industry (31.42) and aluminium, brass and copper industries (30.56).

A break-up of fringe benefits by types revealed that, of the total amount paid on fringe benefits, that which was paid for the time not worked and for profits and bonus was the highest, accounting for a little more than 9 per cent of the total wage bill. Payments which had to be made under legislative enactments were between 6.1 per cent and 7.5 per cent of the total, while voluntary welfare schemes accounted for 5.36 per cent of the wage bill.

In the plantation industry, however, these welfare schemes formed 9.4 per cent of the wage bill, while in the other two (mining and manufacturing industries), they respectively accounted for 4.12 per cent and 3.4 per cent of the total wage bill.

A considerable proportion of fringe benefits was in the shape of monetary bonus and constituted about 5 per cent of the wage bill. The bonus was of various kinds profits bonus, attendance bonus, service bonus, gratuity payments, etc. The quantum of the bonus varied from sector to sector.

Payments for Time Not Worked:

These payments were fairly substantial in the manufacturing industry (5.35 per cent), the mining industry (4.81 per cent) and plantations (3.24 per cent). In the manufacturing sector, the percentage of expenditure on this item varied between 3.06 and 10.42.

Industries which spent a relatively larger sum on this item were cigarette manufacturing and distributing (10.42 per cent), petroleum refining and selling (7.15 per cent), chemicals and allied industries (7.11 per cent) and shipbuilding (6.60 per cent).

1. Statutory Fringe Benefits:

These benefits are generally social security, and include gratuity and pension payments, the employer’s contribution to the employees’ provident fund account and health insurance scheme.

The employers’ contribution to statutory provident fund constitutes by far the largest item of expenditure, accounting for 4.23 per cent of the total wage bill in the plantations, mining and manufacturing industries put together. The expenditure on employees’ state insurance contributions by the manufacturing industries was 0.36 per cent, while that on gratuity account was 0.59 per cent.

The “other expenditure” incurred under statutory regulations and tribunal awards was on compensation paid to workers, welfare cess payments in the coal mining industry and on the supply of protective clothing in the plantations industry. The expenditure on maternity clothing in the manufacturing and mining industries.

2. Voluntary Benefits:

Retirement benefits, medical care, compensation for injuries and disablement, subsidised food and housing, educational and cultural facilities, payment on life insurance premia, the maintenance of canteens, cafeterias, assistance to co-operative societies these are some of the benefits accounted for 9.40 per cent of the total wage bill in the plantations industry against 3.74 per cent and 4.12 per cent in the mining and manufacturing industries respectively. The social security benefits voluntarily provided by companies include provident fund, gratuity and pension.

The medical assistance schemes voluntarily provided by employers were the largest single item of expenditure, and accounted for 1.80 per cent of the total expenditure of 5.36 per cent voluntarily incurred by them.

The plantations industry spent 4.78 per cent of its total wage bill on this particular voluntary service against only 0.84 per cent spent by the manufacturing industries. The latter’s expenditure on canteens, however, was about 0.70 per cent of its total wage bill against that of 0.07 per cent spent by the mining industries.

In the manufacturing industries, nearly two-thirds of the benefits were in the form of profit and bonus, of payments for time not worked and of contributions by employers to social security benefits. In the plantations and mining industries, however, this percentage was 57 and slightly more than 50 respectively.

Apart from the general fringe benefits for employees, there was a wide range of other benefits as well.

Some of these benefits are:

Rifle allowance to watchmen, cycle allowance to peons, free driving licenses for drivers, compensation for a waiting period of three days, free quarters, water and electricity; free uniforms to certain categories of employees, conveyance allowance when no transport is provided by the company, travel concessions, assistance to buy spectacles, provision of snacks during night shifts, shoe allowance of 20 paise and an allowance of 37 paise per hour if a worker attends education classes; sale of company products at concessional rates, benevolent fund assistance if a worker is struck down by tuberculosis or cancer, scholarships to employees’ children; employees’ tours of government projects, study leave, gift of a wrist watch after a meritorious service of ten years, presents to employees on the occasion of their marriage, co-operative bank facilities, festival allowance, free libraries and facilities for inpatient hospital accommodations.

Benefit Programmes for Management:

Special considerations and policies apply to the benefit programmes for the management, for which a different benefit structure is provided because of the fact that many legal considerations do not operate in their case. For example, management personnel do not receive overtime allowance or payment; nor are they governed by trade union considerations or agreements.

Managers generally are not entitled to, nor do they expect, many of the benefits and services to which employees in general are entitled. However, management personnel are generally required to contribute in part to their insurance, gratuity, pension and provident fund. Tax exemptions become more important and meaningful for them as they advance in the management hierarchy.

The personnel department is generally responsible for the coordination of the plans for the administration of these benefits and services. For this purpose, it seeks the advice of the various departments, calls for their suggestions and anticipates the emergence of possible problems. The final approval of the plans formulated for the management personnel, however, is the prerogative of the top authority of an organisation.

Problems Raised by Benefit Programmes:

Many problems arise when these programmes are adopted and administered.

These are:

(i) Charge of Paternalism:

When too many benefits and services are offered to employees, a feeling develops that employers are playing the role of parents and the workers are looked upon as their children. Moreover, the latter sometimes develop the feeling that these benefits and services are their “right” which is not really so.

(ii) Excessive Expenditure:

The administration of these benefits and services is a fairly costly affair, involving large outlays of direct and indirect financial expenditure, and often involves a great deal of paper work.

(iii) Fads Become Fashionable:

With the introduction of these benefits and services in one company, other concerns vie with one another to introduce them as well. Credit unions and severance pay are examples of benefits which were once considered to be novel but are now commonplace in industry.

(iv) Maintenance of the Least Productive Workers:

With an increase in benefits and services, employees, particularly when they are not very productive, tend to stick to their jobs, and are not interested in changing them.

(v) Neglect of Other Personnel Functions:

When a management becomes more concerned about the provision and administration of benefits and services, it often pays very little attention to other aspects of personnel programmes. Overemphasis on these benefits and services may often develop a concern among the employees for their future security rather than for their present productivity.

The relationship between a company’s benefits-and-services programmes and employee motivation for increased production is somewhat weak.

Administration of Benefits and Services:

Organisations fumble while administering employee benefits and services. Organisations have seldom established objectives, systematic plans and standards to determine the viability of the programmes. The main problem is the lack of employee participation. Managers, too, take little interest in the benefits programme and trade unions are almost hostile to the schemes.

Managers are not even aware of the organisation’s policy towards benefits and their contribution to the quality of corporate life. Trade unions entertain a feeling of alleviation as the benefits are likely to erode their base.

These problems can be avoided if steps are taken:

(i) To establish benefit objectives;

(ii) To assess environmental factors;

(iii) To assess competitiveness;

(iv) To communicate benefit information;

(v) To control benefit costs and evaluation.