In this article we will discuss about:- 1. Introduction to Stock Index Futures 2. Stock Index Futures World Over 3. Features of Stock Index Futures 4. Trading in Stock Index Futures 5. Pricing of Stock Index Futures Contract 6. NSE’s Volatility Index: India VIX 7. Speculation in Stock Index Futures Trading 8. Hedging with Stock Index Futures 9. Reasons for Popularity of Stock Index Futures and Other Details.

Contents:

- Introduction to Stock Index Futures

- Stock Index Futures World Over

- Features of Stock Index Futures

- Trading in Stock Index Futures

- Pricing of Stock Index Futures Contract

- NSE’s Volatility Index: India VIX

- Speculation in Stock Index Futures Trading

- Hedging with Stock Index Futures

- Reasons for Popularity of Stock Index Futures

- Criteria for Stock Market Derivatives Trading

- Stock Index Derivatives Market in India

1. Introduction to Stock Index Futures:

A stock index is a composition of select securities traded on an exchange, e.g. Sensex is a composition of 30 blue- chip securities being traded on BSE. Therefore, a stock index futures contract is simply a futures contract where the underlying variable is a stock index such as BSE Sensex, S&P CNX, NIFTY etc.

ADVERTISEMENTS:

The value of stock index futures derives its value from a stock index value. Theoretically, an investor who buys a stock index futures contract agrees to buy the entire stock index and the seller agrees to sell the entire stock index. The SEBI has taken a landmark decision permitting the use of derivatives based on L.C. Gupta Committee Report. The SEBI has suggested phased introduction of derivatives starting with Stock Index Futures to be followed by Stock Index Options.

2. Stock Index Futures World Over:

Stock index futures are one of the varieties of futures contracts. The first stock index futures contract based on value line index was introduced by Kansas City Board of Trade (KCBT) on 24th February, 1982.

It was followed two months later by the S&P 500 Index Futures contract introduced by the Chicago Mercantile Exchange (CME). At present, S&P 500 Index Futures is the most actively traded futures contract.

ADVERTISEMENTS:

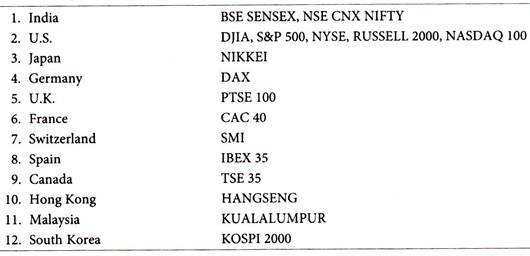

The following Stock Index Futures are the most actively traded financial derivatives the world over:

3. Features of Stock Index Futures:

Distinguishing features of Stock Index Futures contract are as follows:

ADVERTISEMENTS:

1. Multiple or Market Lot Size:

The Stock Index Futures can be bought or sold only in a specified lot size. The market lot size for Nifty futures is 200. It means that if on a day Nifty futures is quoting at a price of Rs. 1,400 then the value of one Nifty futures contract shall be Rs.2,80,000 i.e. (200 x Rs.1,400).

2. Margin Requirement and Mark to the Market:

Like any other futures contract a Stock Index Futures contract is also characterized by margin requirement. The traders in a Stock Index Futures market are required to keep good faith deposits which are adjusted on a daily basis to account for the gains or losses.

ADVERTISEMENTS:

There are three types of margins in a futures market:

(a) Initial Margin:

It is the margin amount initially required to open a margin account for trading.

(b) Maintenance Margin:

ADVERTISEMENTS:

It is the minimum amount of margin money that must be maintained in a margin account. If balance in margin account falls below this level, a margin call is made and the trader is required to deposit additional amount so as to restore the balance in margin account back to the level of initial margin.

(c) Variation Margin:

Variation margin is the amount of ‘margin call’ required to be deposited by the trader in case balance in margin account falls below maintenance margin level.

(d) Cash Settlement:

ADVERTISEMENTS:

A Stock Index Futures contract does not entitle physical delivery of stocks and the contract is settled in cash on the settlement date. This is because it is virtually impossible to deliver all the stocks comprising the Stock Index and that too in the same proportion in which they appear in the index at the time of settlement.

(e) Specifications:

On a Stock Index Futures contract indicate the underlying index, contract size, price steps or tick size, price bands or price range, trading cycle, expiry day, settlement basis and settlement price. These specifications make a Stock Index as a tradable security that can be bought or sold.

(f) Contract Lifetime:

ADVERTISEMENTS:

The lifetime of each series is generally three months worldwide. At any point of time there are three series open for trading.

4. Trading in Stock Index Futures:

Trading in Sensex or Nifty futures is just like trading in any other security. An investor is able to buy or sell futures on the BSE – Bolt terminal or the NSE – NEAT screen with his broker. The order will have to be punched in the system and the confirmation will be immediate like the existing system.

Since the tick size and market lot size in futures is similar to individual stock, the feel of trading in Stock Index Futures is the same as trading on stocks. Separate bid and ask quotations are available like shares.

You simply have to punch in your order of the required quantity at a price you wish to buy, sell or execute the same at the market price. On execution of the order you would receive a confirmation of the same. A trader can carry the Stock Index Futures contract till maturity or square it off at any time before expiry.

5. Pricing of Stock Index Futures Contract:

ADVERTISEMENTS:

Theoretical or fair price of a Stock Index Futures contract is derived from the well celebrated cost of carry model.

Accordingly, Stock Index Futures price depends upon:

1. Spot index value

2. Cost of carry or interest rate

3. Carry return i.e. dividends expected on securities comprising the index.

Mathematically:

ADVERTISEMENTS:

F = Se (r – y)t

Where, F = Future Price

S = Spot value of index

e = Exponential constant with value

r = Cost of carry or interest cost

y = Carry return e.g. dividend income

ADVERTISEMENTS:

t = Time to maturity in years

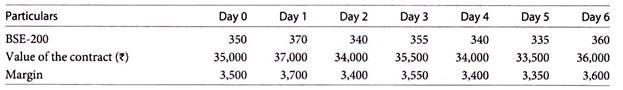

Stock index futures are the most popular equity derivatives where the contract value is based on the stock index value. For instance if BSE-200 is currently trading at 350 points then the contract value will be Rs.35,000 which is derived by multiplying index value of 350 by 100 which is fixed.

The investor has to deposit a margin of say 10% of the contract value which is Rs.3,500. As the margin is mark to market, the margin requirements shall be calculated daily linked to the value of the stock index. Thus, if the BSE-200 moves in the following manner over the next 6 days the margin requirement will be calculated accordingly.

In the above case the profit to the investor over a period of 6 days shall be Rs.1,000 (i.e. 36,000 – 35,000).

As the settlement is done on cash basis the risk of fake certificates, forgery and bad deliveries can be avoided. Secondly, the investment to be made is low which is restricted to the margin amount.

ADVERTISEMENTS:

Thirdly, the stock index is difficult to be manipulated and the possibility of cornering is reduced. Fourthly, as the Stock index is an average, it is much less volatile than individual stock prices. Lastly, as the stock index futures enjoy great popularity they are likely to be more liquid than all other types of equity derivatives.

6. NSE’s Volatility Index: India VIX:

The Chicago Board Options Exchange was the first to develop volatility index in 1993. The CBOE Volatility Index is a key measure of market expectations of near-term implied volatility conveyed by S&P 500 Stock Index Options prices. Implied volatility increases when the market is bearish and decreases when the market is bullish. This is due to the common belief that bearish markets are more risky than bullish markets.

NSE introduced volatility index called ‘India VIX’ into Indian stock market. A volatility index reflects the market’s expectation of volatility in the near term. Volatility index is a measure of the amount by which an underlying index is expected to fluctuate in the near term, based on the order book of the underlying index options.

It is a volatility index based on the Nifty 50 index option prices. From the best bid/ask prices of Nifty 50 options contracts (which are traded on the F&O segment of the NSE), a volatility figure percentage is calculated, which indicates the expected market volatility over the next 30 calendar days. Higher the implied volatility, higher the India VIX value and vice versa. Options prices themselves change with changes in spot prices and volatility.

There are some differences between a price index, such as the Nifty 50 and India VIX. Nifty 50 is calculated based on the price movement of the underlying 50 stocks, which comprises the index.

ADVERTISEMENTS:

India VIX is calculated based on the bid-offer prices of the near-and mid-month Nifty 50 Index Options. While Nifty 50 signifies how the markets have moved directionally, India VIX indicates expected near-term volatility and how the volatility is changing from time to time.

7. Speculation in Stock Index Futures Trading:

An investor can speculate by trading in Stock Index Futures based on his expectations of market rise or market fall. Suppose an investor expects market to rise then he can buy Stock Index Futures. For instance if the BSE-200 rises from 350 to 400 over a contract period of 3 months then the investor makes a profit of Rs.5,000 [(400 – 350) x 100] on a contract value of Rs.35,000.

Supposing if the investor buys 10 BSE-200 at 350 points cash, then he makes a profit of Rs.50,000 [(400 – 350) × 100 × 10]. On the other hand if the investor expects market to fall then he can sell Stock Index Futures. Thus, without the backing of a commercial position an investor can make profits by speculation. However, if the investor makes a wrong judgment regarding the movement of the market, then he loses in the case of speculation.

8. Hedging with Stock Index Futures:

Hedging technique is very useful in the case of high net worth entities such as mutual funds having a portfolio of securities. For instance if the investor wants to reduce the loss on his holding of securities due to uncertain price movements in the market, then he can sell futures contracts.

In such a case if the market comes down then the losses incurred on individual securities shall be compensated by profits made in the futures contract. On the contrary if the market rises, then the loss incurred in the futures contract shall be compensated by profit made on the individual securities.

Supposing if the value of a portfolio of a mutual fund is Rs.10 crores and the BSE-200 is currently trading at 350 then the number of futures contracts to be sold shall be Rs.10 crores/350 × 100 = 2857.14 contracts. However, it is not possible to have a perfect hedge as the contracts cannot be traded in fractions. Hence, the mutual fund can sell 2857 or 2858 futures contracts.

9. Reasons for Popularity of Stock Index Futures:

The Stock Index Futures is the most preferred derivatives in India owing to the undernoted reasons:

1. The portfolio hedging is given priority by the institutional and other enormous equity-holders.

2. The most cost-efficient hedging is the Stock Index Futures.

3. Stock index is almost beyond the scope of manipulation whereas it is very easy to manipulate the individual stock price.

4. The most liquidity featured Stock Index Futures are the most popular in India and abroad.

5. The remote possibility of bankruptcy in Stock Index Futures has been guaranteed by the clearing house effects.

6. The Stock Index Futures are cash settled all over the world and its value is derived independently from the cash market and safely accepted as the settlement price, where as in the case of individual stock the outstanding positions remaining on expiration date have to be settled by physical delivery. But these settlements by means of physical delivery in case of Stock Index Futures are not practically accepted globally as it is cash settled.

7. The volatility of Stock Index Futures is much lower than the individual stock price.

8. The Individual Stock Futures are always used for manipulating their prices in cash market.

9. The less volatility featured Stock Index Futures has lowered the requirement of capital adequacy and margin in comparison to Individual Stock Futures.

10. The well regulatory framework for Stock Index Futures ensures less complexity and thereby growing popularity for equity derivatives.

Stock Index Futures offer implementation advantages and incremental returns to portfolios only because of the fact that some useful strategies are available for institutions using Stock Index Futures.

They are:

1. The benefits of the lowest possible transaction costs are attractive.

2. The actual disposing of equity holdings may be made gradually subject to the market conditions.

3. The low commission rate on stock index futures trading and the high level of liquidity in Stock Index Futures market offers the potential for significant savings.

4. The portfolio construction via Stock Index Futures contract offers the specific advantage of actually buying the index i.e. the purchase of Stock Index Futures lead to exposure to all stocks being bought.

5. In Stock Index Future approach of index-fund construction gives an advantage of not reinvestment of dividends as dividends are already priced within the future contract.

6. The Stock Index Futures can considerably take care for investing the funds raised by floating a new scheme with suitable securities at reasonable price without losing time.

7. Stock Index Futures allow the unit holders to liquidate a part of portfolio in case of open-end fund.

8. Stock Index Futures offer an attractive strategy for maintaining the desired stock market exposure of the portfolio at all points of time.

9. Stock Index Futures are strategically used for insuring against market risks.

10. Stock Index Futures offer an effective ‘beta’ control to the portfolio manager for having advantages of:

(a) The optimal stock mix;

(b) Considerable lower transaction costs; and

(c) Achieving the portfolio target ‘beta’ through buying targeted futures.

11. Stock Index Futures offer the most productive as well as effective asset allocation strategy to the portfolio manager in order to maximize the investors’ wealth by minimizing the market risks.

12. The market volatility can be effectively managed by Stock Index Futures by making transactions with greater speed with lower implementation cost.

13. The market disruptions caused by the external investment managers can effectively be reduced with the strategic use of Stock Index Futures.

14. The most important advantage of Stock Index Futures is that less money needs to be involved to alter the asset- mix due to the leveraged impact of contracts.

10. Criteria for Stock Market Derivatives Trading:

In the derivatives market there shall be a two-level system of members viz., clearing members and non-clearing members. The clearing member takes the responsibility for settlement of trades on behalf of the non-clearing member. Thus, the clearing member acts as a guarantor for the non-clearing member.

The clearing member shall have a minimum net worth of Rs.300 lakhs as per the SEBI’s definition and shall made a deposit of Rs.50 lakhs with the exchange/clearing corporation in the form of liquid assets such as cash. Fixed deposits pledged in the name of the exchange, or other securities. Bank guarantees in lieu of such deposit may also be accepted.

The broker members/dealers in the derivatives market should have passed a certification program considered adequate by SEBI. Moreover, they should be registered with SEBI as brokers/dealers of derivative exchange apart from their registration as brokers/dealers of any stock exchange. The stock exchange should have minimum of 50 members to start derivatives trading.

11. Stock Index Derivatives Market in India:

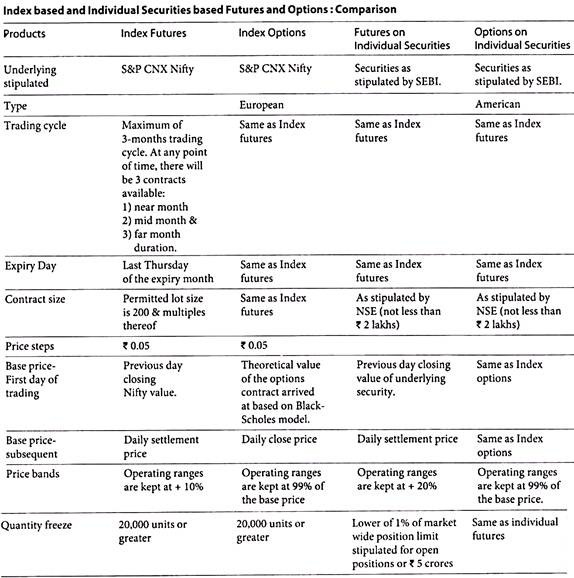

The most notable development concerning the secondary segment of the Indian capital market is the introduction of derivatives trading in June 2000. SEBI approved derivatives trading based on futures contracts at both BSE and NSE in accordance with the rules/by laws and regulations of the stock exchanges.

A beginning with equity derivatives has been made with the introduction of stock index futures by BSE and NSE. Stock Index Futures contract allows for the buying and selling of the particular stock index for a specified price at a specified future date. Stock Index Futures, inter alia, help in overcoming the problem of asymmetries in information.

Information asymmetry is mainly a problem in individual stocks as it is unlikely that a trader has market-wide private information. As such, the asymmetric information component is not likely to be present in a basket of stocks.

This provides another rationale for trading in stock index futures. Trading in index derivatives involves low transaction cost in comparison with trading in underlying individual stocks comprising the index.

While the BSE introduced Stock Index Futures for S&P CNX Nifty comprising 50 scrips. Stock Index Futures in India are available with one month, two month and three month maturities. While derivatives trading based on the Sensitive Index (Sensex) commenced at the BSE on June 9, 2000, derivatives trading based on S&P CNX Nifty commenced at the NSE on June 12, 2000.

SIF is the first attempt in the development of derivatives trading. This was followed by approval for trading in options based on these two indices and options on individual securities. The trading in index options commenced in June 2001 and trading in options on individual securities is scheduled to commence in July 2001.