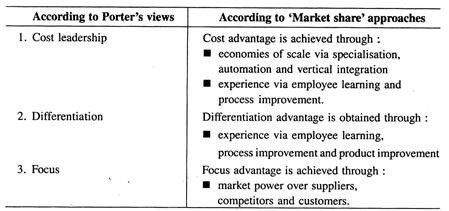

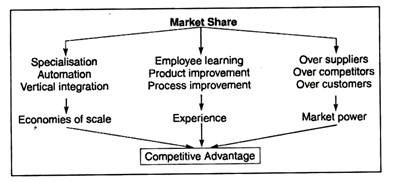

The evidence of researches so far made provides two major approaches to achieving competitive advantage:- 1. Market share approach, and 2. Synergy approach.

Major sources of competitive advantage for each of these approaches are indicated in the diagrams next—

Market Share Approach:

Let us now briefly examine the sources and arguments concerning market share and implications for strategy:

ADVERTISEMENTS:

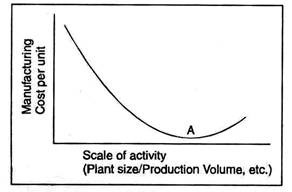

1. Scale Economies:

ADVERTISEMENTS:

Large firms produce and sell in greater quantity than smaller firms in the same industry. So, they operate on a larger scale. Research has shown that increasing the scale of almost any business activity can favourably impact ROI by reducing the cost of carrying out the activity. This phenomenon is called economies of scale.

A typical economies of scale curve is given below:

How does the scale produce such economies? By way of illustration, let us consider the manufacturing function.

ADVERTISEMENTS:

A large manufacturing scale allows more specialisation, automation, and vertical integration.

Specialisation:

A large manufacturing plant generally requires more employees than a small one. Employees, therefore, have greater opportunities to specialise (i.e. to narrow the range of tasks they perform).

This narrowing leads to productivity increases and employees becoming more experts in their task performance. This phenomenon is clearly evident in assembly-type/jobbing industries. This increased specialisation leads to lower unit cost.

ADVERTISEMENTS:

Automation:

Because of larger volume of production, a business firm can afford to invest in labour-saving devices. Such investment is economical because its cost can be spread over a large number of units produced. Thus, robotics find their uses in many manufacturing situations characterised by high volume and extreme task specialisation.

Vertical Integration:

ADVERTISEMENTS:

Because of large scale operations and more volume of components used in the production process, a large business firm is in a better position to manufacture the components themselves instead of buying from outside. This vertical integration allows it to reduce its transaction costs, a considerable savings for itself.

Comments:

A business cannot reap economies of scale indefinitely. At a certain point, point A in the scale curve, ‘diseconomies of scale’ usually creep in. Beyond A, per unit cost tends to go up because of variety of factors, internal and external.

Problems of morale, coordination, communication, and motivation and more layers of bureaucracy to maintain control are internal factors. And external factors may be local operations vs. national operations and basic economics of business.

ADVERTISEMENTS:

2. Experience:

Because of large scale of operations, a business firm gets a greater opportunity to gain experience in all its activities.

ADVERTISEMENTS:

Such experience can provide the following benefits:

Employee learning:

Experience through learning, like economies of scale, tends to have a beneficial impact on cost. Research has shown that the number of direct labour hours per unit of work, because of repetitions of the same type of work units, declines and labour costs decline. This is known as ‘learning or experience curve’ to describe the effect.

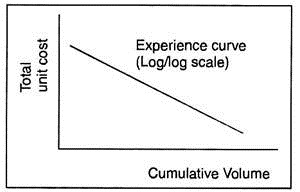

Graphically, it looks like:

Product/Process Improvements:

ADVERTISEMENTS:

Learning curve benefits extend even to the engineering and technical work. Because of growing familiarity with manufacturing processes, product features and designs, the technical staff can learn more to simplify them and to bring in improvement. All these contribute to reduced cost of manufacture.

Comments:

Experience is thus a potentially important source of competitive advantage for a large firm. However, its realisation in specific competitive situations will depend on a variety of factors like manufacturing labour intensity, stage of industry evolution, managerial skill and effort in realising experience benefits.

3. Market Power:

Cost is not the only variable determining ROI. ROI is also influenced by price and investment levels. To understand the impact of a large market share for a competitive advantage, we should know the implications of price and investment.

As regards price, market leaders are frequently able to charge systematically higher prices than their smaller rivals. For reasons of both experience and scale, market leaders often have a product quality edge over their smaller rivals.

ADVERTISEMENTS:

Again for their largeness, market leaders are well known in the market. All these factors give those market leaders a competitive edge to have a large market share, which is often referred to as ‘market power’.

As regards investment, market leaders can normally make additional investments, whenever necessary, in the areas of technology research and development, manpower development, and marketing development—coupled with scale and experience—which tend to reduce per-unit investment.

In sum, market power available with a large firm can exercise strong influence over the suppliers, customers, and competitors.

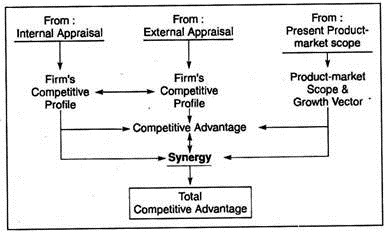

Synergy Approach:

Let us now briefly examine the sources and arguments concerning synergy as an approach to achieving a firm’s competitive advantage.

The diagram in relation to synergy identifies the sources and factors that provide synergy as another route to securing competitive advantage.

ADVERTISEMENTS:

1. Competence Profile:

The competence profile is the basic reference profile for the firm. It is relatively permanent and will need updating only when major changes occur in the capabilities.

It is a ‘strength and weakness’ profile only relative to specific areas of competences and skills. It does not concern strengths and weaknesses with particular product-market position, since different industries or firms require different balances of capabilities.

It is the profile of distinctive skills and competences in basic areas: facilities and equipment, R&D personnel, organisation, and management. Internal appraisal of a firm can identify and quantify them.

2. Competitive Profile:

ADVERTISEMENTS:

The competitive profile is the capability profile that describes the qualitative pattern of skills and competences present in the five basic areas stated above.

An external appraisal of a firm provides to it opportunities and threats in a business environment. The profile of very skills and competences that are extremely necessary for success and competitive stance in such business environment is a competitive profile of a firm.

3. Product-Market Scope and Growth Vector:

They refer to the firm’s current product-market posture and the probable growth and profitability characteristics associated with market penetration, product development, market development and diversification. Proper identification of particular properties of individual product-markets and their growth prospects can give a firm a strong competitive position.

ADVERTISEMENTS:

4. Superimposition of Profiles:

The competence and the competitive profiles, when superimposed, determine the areas in which the firm is either outstanding or deficient. These are the strengths and weaknesses relative to the present product-market posture.

5. Synergy:

It is the approach through which the combined performance of business units joined together exceeds that which would be possible if the businesses were operated on their own.

If a new business can share a resource (for example, finance, marketing skills, or technology) in any one or more areas, obtained through the superimposition of profiles, with the firm’s original product-market scope and growth trends, then the two businesses operating together can generate a larger and more sophisticated resource base than either business could support separately.

Sharing of this common resource provides a synergistic effect to achieve competitive advantage. This condition, though essential, is not sufficient. To achieve a lasting competitive advantage, the resource shared by a firm’s businesses must be strategically significant to them;—that is, it must contribute importantly to their competitive success.

Michael. E. Porter’s Views on Competitive Strategy and Competitive Advantage:

Porter has identified, from the broader point of view, three internally consistent general (generic) strategies that a firm can adopt either singly or in combination for creating a sustainable competitive position in the long run and outperforming the competitors in the industry.

These are:

1. Cost Leadership:

It implies that the firm will outstrip its competition by being the low-cost producer. It will build efficient-scale facilities, pursue cost control policies, avoid marginal customers and generally be cost conscious in all areas of the business. In other words, the firm will emphasize efficiency and productivity. With lower costs, the firm can offer lower prices and with lower prices, generate larger sales volume.

2. Differentiation:

It involves the firm in creating products that consumers perceive to be unique. The perception of uniqueness (differentiation) can be based upon a variety of factors, such as brand image, product features, customer service, and dealer network.

To be effective, differentiation requires creativity, basic research skill, strong marketing, and a reputation for quality. Differentiation strategy does not imply that cost control is ignored, only that it is not the primary strategic consideration. The emphasis on differentiation requires flexible response to changing customer preferences and perceptions.

3. Focus:

It involves achieving either cost leadership or differentiation or both in a particular segment of the market. Rather than compete throughout the market, the firm focuses on one segment. While in cost focus the firm seeks cost advantage in its target segment, in differentiation focus the firm seeks differentiation in its target segment.

Comments:

It is interesting to note that Porter’s prescription of three generic strategies is in no way different conceptually from what has been mentioned under ‘Market Share’, an approach in creating and sustaining a competitive advantage of a firm.

The conceptual similarities between the two approaches are expressed as follows: