EFR is calculated with the help of following formula, when other ratios remain constant:

Where,

A/S = Total assets/Sales

ADVERTISEMENTS:

L/S = Current liabilities and provisions/Sales

∆S = Expected increase in sales over current year (S-S1)

S = Sales of current year

S1 = Projected sales of next year

ADVERTISEMENTS:

D = Dividend payout ratio

M = Net profit margin

The expected changes in investments, miscellaneous expenditure and scheduled repayment of terms loans and debentures are assumed to be zero while computation of EFR, as above.

Problem 1:

ADVERTISEMENTS:

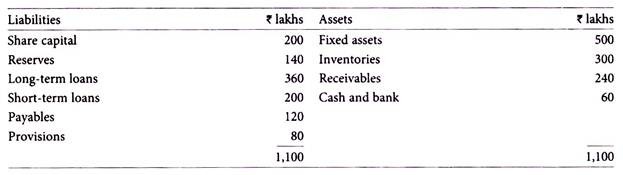

The Balance sheet of Anubhav Ltd. as on March 31, 2016 is as follows:

Sales for the year were Rs.600 lakhs. For the year ending on March 31, 2017 sales are expected to increase by 20%. The profit margin and dividend payout ratio are expected to be 4% and 50% respectively.

You are required to:

ADVERTISEMENTS:

(i) Quantify the amount of external funds required.

(ii) Determine the mode of raising the funds given the following parameters:

(a) Current ratio should at least be 1.33.

(b) Ratio of fixed assets to long-term loans should be 1.5.

ADVERTISEMENTS:

(c) Long-term debt to equity ratio should not exceed 1.05.

(iii) The funds are to be raised in the order of short-term bank borrowings, long-term loans and equities.

Solution:

(i) Quantification of the Amount of External Funds Required:

ADVERTISEMENTS:

The external funds requirement (EFR), is calculated by applying the following formula:

Where,

A = Total assets = Rs.1,100 lakhs

ADVERTISEMENTS:

L = Payables and provisions = RS. 120 lakhs + Rs.80 lakhs

S = Sales for current year = Rs.600 lakhs

S1= Projected sales for next year = Rs.720 lakhs

∆S = Expected increase in sales = 120 lakhs

M = Profit Margin = 4% or 0.04

D = Dividend payout ratio = 50% or 0.5

ADVERTISEMENTS:

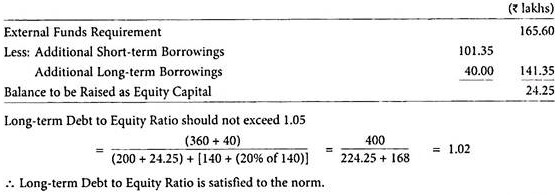

EFR = (1100/600 – 200/600) 120 – (0.04 x 720 x 0.5) = (1.5 x 120) – 14.4 = 165.60

... External funds requirement = Rs.165.60 lakhs.

(ii) Determination of Mode of Raising Funds:

(a) Short-Term Borrowings:

Current ratio should at least be 1.33

1.33 (240 + x) =720

319.2 + 1.33 x = 720

1.33 x = 720 – 319.2

1.33 x = 400.8

X = 400.8/1.33 = 301.35

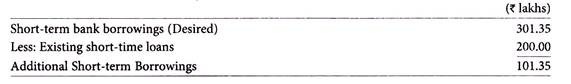

... Short-term Bank Borrowings = Rs.301.35 lakhs

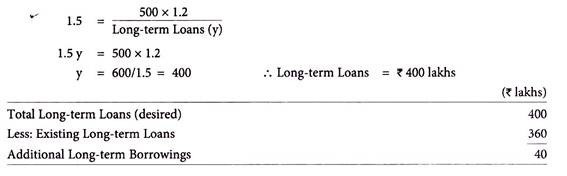

(b) Long-Term Debt:

ADVERTISEMENTS:

Ratio of Fixed Assets to Long-term Loans should be 1.5

(c) Equity:

(iii) Funds to be Raised in Order of STBB, LTL and Equity:

Problem 2:

The following information are available for Rainbow Ltd.:

A/S = 0.8

M = 0.04

∆S = Rs.60lakhs

S1 = Rs.500

ADVERTISEMENTS:

L/S = 0.5

D = 0.6

Where,

A/S = Current and fixed assets as a proportion of sales

∆S = Expected increase in sales

L/S = Current liabilities, provisions and bank borrowings as a proportion of sales

M = Net profit margin

S1 = Projected sales for the next year

D = Dividend payout ratio

There will be no change in the level of investments and no repayment of the term loans in the next year.

(a) Estimate the external funds requirement for the next year.

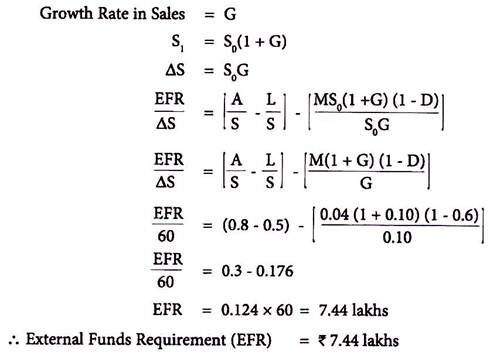

(b) Suppose the growth rate of net profit margin is 10% for Rainbow Ltd. for the next year in the above case, what then will be the external funds requirement?

Solution:

(a) Estimation of the External Funds Requirement for the Next Year:

External Funds Requirement (EFR) = (A/S – L/S) ∆S – MS1 (1-D)

Where,

A/S = Current and fixed assets as a proportion on sales = 0.8

∆S = Expected increase in sales = RS. 60 lakhs

L/S = = Current liabilities and bank borrowings as proportion of sales = 0.5

M = Net profit margin = 0.04

S1 = Projected sales for next year = Rs.500 Lakhs

D = Dividend payout ratio = 0.6

EFR = [(0.8 x 60) – (0.5 x 60)] – [(0.04 x 500) (1 – 0.6)] = 48 -30-8 = 10

... External Funds Requirement = Rs.10 lakhs

(b) Estimation of the EFR for Next Year when Growth Rate of Net Profit Margin (G) is 10%.