Everything you need to know about the theories of capital structure. Capital structure theories seek to explain the relationship between capital structure decision and the market value of the firm.

There are conflicting opinions regarding whether or not capital structure decision (or leverage or proportion of debt and equity) affects the value of the firm (or shareholder’s wealth).

There is a viewpoint that strongly supports the close relationship between capital structure decision and value of a firm. There is an equally strong body of opinion which believes that capital structure decision has no impact on the value of the firm.

Some of the theories of capital structure are:-

ADVERTISEMENTS:

1. Static Trade-Off Theory 2. Pecking Order Theory 3. Modified Pecking Order Theory 4. Net Income (NI) Approach 5. Net Operating Income Approach 6. Traditional Approach 7. Modigliani and Miller Approach with illustrations, formulas, calculations and graphs.

List of Capital Structure Theories

Theories of Capital Structure – Static Trade-Off Theory, Pecking Order Theory, Modified Pecking Order Theory (With Graphs)

1. Static Trade-Off Theory:

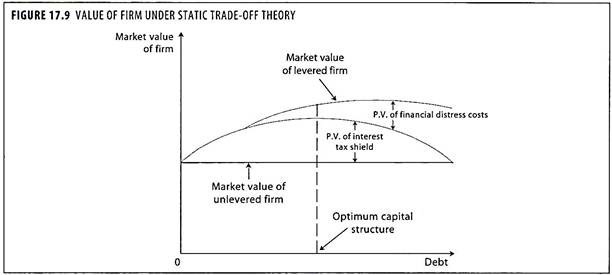

The horizontal base line in figure 17.9 expresses Modigliani and Miller’s idea that market value of firm (V) is the aggregate of market value of all its outstanding securities and should not depend on leverage when assets, earnings and future investment opportunities are held constant.

The static trade-off theory says that the value of firm depends on the tax deductibility of interest payments which induces the firm to borrow to the margin where the present value of interest tax shields is just offset by the value of loss due to agency costs of debt and the possibility of financial distress.

Most business people agree that borrowing saves taxes and that too much debt can lead to cost trouble i.e. financial distress. The static trade-off theory suggests the strong inverse correlation between profitability and financial leverage. Generally, high profits mean low debt. But the static trade-off theory would predict just the opposite relationship.

ADVERTISEMENTS:

Higher profits mean more amount available for debt service and more taxable income to shield. They should mean higher target debt ratios. The theory sounds in theory, but in practice business would prefer to avoid financial distress and situations of bankrupting.

Financial Distress and Agency Costs:

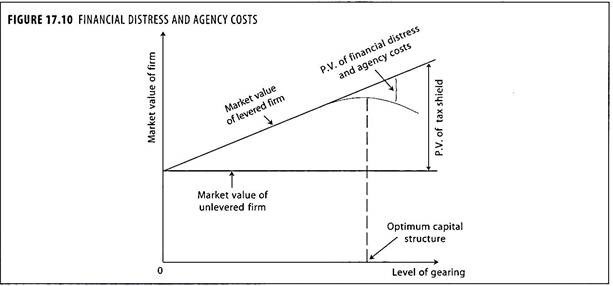

The assumption is that when firm has very high level of borrowing they are more likely to run into the costs of financial distress and costs of bankruptcy.

When the leverage of the firm is extremely high, then it is very likely that at some stage it will not be able to make annual interest payments and loan repayments. Dividends for shareholders can be bypassed but failure to pay interest on loans often gives the lender the right to claim on the firms operating assets thereby preventing the firm’s continuity of activity.

The market value of levered firm can expressed as follows:

Market Value of Levered Firm = (Market value of Unlevered firm + P.V. of Tax-shield) – (P.V. of Financial costs + P.V. of Agency costs)

Financial Distress and Bankruptcy Costs:

ADVERTISEMENTS:

As firm increases its debt level, the providers of debt may demand for higher rates of interest to compensate for accepting greater financial risk. Due to high cost of debt, the firm may forgo acceptable projects, which constitutes an opportunity cost.

The following illustrative list of activities which may cause increase in costs of the firm:

I. Successive borrowing beyond the company’s target debt-equity ratio

II. Borrowing higher levels of interest

ADVERTISEMENTS:

III. Skip-off or cut in dividend which may cause the fall of market rate of shares

IV. Loss of trade credit from suppliers

V. Distress sale of highly profitable instruments

VI. Abandonment of promising new projects.

ADVERTISEMENTS:

VII. Reduced credit period resulting in loss of business

VIII. Corporate image may be tarnished

IX. Demand for withdrawal of loans made to the firm previously

X. Reduction in stock levels result in reduction in sales etc.

ADVERTISEMENTS:

Bankruptcy costs can be classified into direct and indirect costs. The direct costs include costs paid to debtors in the bankruptcy and restructuring process. The indirect costs are associated with loss of customers, suppliers and key employees. It includes the managerial effort extended to manage the firm in its distressed condition.

Agency Costs:

Agency theory models a situation in which a principal (a superior) delegates decision-making authority to an agent (the subordinate) who receives reward in return for performing some activity on behalf of the principal. The outcome of the agents effects the principals welfare in some way, for example sales revenue, output or contribution margin.

The principal attempts to combine a reward system with an information system, in order to motivate the agent to choose the action which maximises the principal’s welfare. In respect of debt finance, the suppliers of debt are much concerned, about their investment in the company, about the risks involved in financing debt to the company.

In order to minimise the risks in debt finance, the suppliers of loan will impose restrictive conditions in loan agreements that restricts management’s freedom of action and it is known as ‘agency costs’. The more money the suppliers of debt lend to the company – then the more constraints they are likely to impose on the management’s freedom in order to secure their investments.

Therefore, agency costs are more in highly geared firms. Van Horne (1988) admitted that a firm could enhance the market price of share through the judicious use of leverage. At the same time, he mentioned that bankruptcy costs work to the disadvantage of extreme leverage. However he affirmed that a combination of the net tax effect with bankruptcy costs will result in an optimal capital structure.

2. Pecking Order Theory:

ADVERTISEMENTS:

The pecking order theory was first proposed by Donaldson in 1961. The theory was further developed by Myers in 1984. According to the theory, a firm may not have a particular target or optimal capital structure. The theory asserts that a company’s capital structure is more dependent on internal cash flows, cash dividend payments and acceptable investment opportunities (i.e. NPV > 0). According to the theory, a firm will link its dividend policy with its capital gearing and investment decisions. The theory emphasizes costs involved in raising of funds for investment.

The theory suggests that when a company is looking to finance its long-term investments, it has well defined order of preference with respect to the sources of finance it uses. Initially the firm will prefer to use internally generated funds rather than externally raised finances.

If the internal funds are insufficient to meet its investment requirements, then it will prefer to raise external funds in the form of term loans and then in the form of non-convertible debentures and bonds and then in the form of convertible debt instruments. After exhausting all the previous sources, the company would opt for raising finances in the form of new equity capital.

The pecking order theory of capital structure says that:

i. Dividend policy is ‘sticky’.

ii. Firms prefer internal to external financing. However, they seek external financing if necessary to finance real investments with a positive net present value (NPV).

ADVERTISEMENTS:

iii. If firms do require external financing, they will issue the safest security first, that is, they will choose debt before equity financing.

iv. As the firms seeks more external financing, it will work down the pecking order of securities from safe to risky debt, perhaps to convertibles and quasi-equity instruments, and finally to equity as a last resort.

Assumptions:

The major assumptions of the theory are summarized below:

i. There are no costs involved in using internally generated funds, since there are no issue costs involved in using retained profits.

ii. It is expensive to raise external funds.

ADVERTISEMENTS:

iii. Raising of debt is relatively cheaper than raising of equity funds.

iv. Raising of term loans from banks and financial institutions is cheaper than issuing debt securities for raising finances.

v. Issue of equity capital involves relatively high issue cost.

vi. Servicing of debt funds is cheaper than servicing of equity funds.

3. Modified Pecking Order Theory:

Myers (1984) suggested that the firm will follow a ‘modified pecking order’ in their approach to financing. He suggested that the order of preference stemmed from the existence of asymmetry of information between the company and markets.

Myers suggested asymmetric information as a reason for heavy reliance on internally generated funds. Due to asymmetry of information, the firm’s projects may be undervalued by the market, therefore the managers would prefer to finance its projects with internal finances and the market finally sees the true value of the project and then the existing shareholders will benefit.

ADVERTISEMENTS:

If internal funds are insufficient to finance firm’s projects, it will choose to raise funds in the form of debt, since due to asymmetric information the project may be undervalued by the market and issue of new equity shares is interpreted by the market as bad news.

If the managers considers that project is over valued by the market, they will tend to issue new shares at what they consider to be the over valued price. Myer argued that a levered firm mostly takes sub-optimal investment decision because of the existence of fixed interest obligation.

At the initial stage of the project the expected cash inflows may not be sufficient to meet the interest charges when the stockholders interest would be adversely affected. The probability of earning less than what is required to protect the existing stockholders restrains the firm to accept the project whose estimated initial inflows is relatively lower though the same may yield an ultimate positive NPV.

Considering this situation he pointed out that optimal capital structure is attained at a point where the expected value of tax shield on additional debt is equal to the expected value of investment opportunity given up.

Theories of Capital Structure – Net Income, Net Operating Income, Traditional, Modigliani and Miller Approach (With Calculations)

Capital structure theories seek to explain the relationship between capital structure decision and the market value of the firm. There are conflicting opinions regarding whether or not capital structure decision (or leverage or proportion of debt and equity) affects the value of the firm (or shareholder’s wealth).

There is a viewpoint that strongly supports the close relationship between capital structure decision and value of a firm. There is an equally strong body of opinion which believes that capital structure decision has no impact on the value of the firm. Capital structure theories have been pro-founded by various authors like David Durand, Ezra Solomon, Modigliani and Miller.

ADVERTISEMENTS:

Although there are various theories but the important ones are:

1. Net Income Approach

2. Net Operating Income Approach

3. Traditional Approach

4. Modigliani and Miller Approach.

Out of these theories, Net Income approach and traditional approach strongly support the viewpoint that there exists a relationship between capital structure of a firm and its market value. Whereas, Net Operating Income Approach and Modigliani and Miller rule out any relationship between capital structure and market value.

Theory # 1. Net Income Approach:

According to the Net Income (NI) Approach, as suggested by Durand, the capital structure decision is relevant for the valuation of the firm, In other words, a change in the financial leverage (i.e. the ratio of debt to equity) will lead to a corresponding change in the value of the firm as well as the overall cost of capital. According to this approach, if the ratio of debt to equity is increased, the cost of capital will decline, while the value of the firm as well as the market price of equity shares will increase.

Conversely, a decrease in the ratio of debt to equity will cause an increase in the overall cost of capital and a decline both in the value of the firm as well as the market price of equity shares. Hence, a firm can minimise the cost of capital and increase the value of the firm as well as market price of its equity shares by using debt financing to the maximum possible extent.

This approach is based upon the following assumptions:

(i) The cost of debt is lower than the cost of equity.

(ii) The risk perception of investors is not changed by the use of debt.

(iii) There are no corporate or personal income taxes.

The main contention in favour of net income approach is that an increase in the proportion of debt financing in capital structure results in an increase in the proportion of a cheaper source of funds. This, in turn, results in the decrease in overall cost of capital leading to an increase in the value of the firm. The main reasons behind the assumption of cost of debt to be less than the cost of equity are that the interest rates are usually lower than dividend rates due to higher risk on equity shares and also since the interest on debt is a deductible expense, the company gets the tax benefits on it.

The financial leverage is thus, according to the Net Income Approach, an important variable to the capital structure of the firm. With a judicious mixture of debt and equity, a firm can evolve an optimum capital structure which will be the one at which the overall cost of capital is lowest and market value of the firm is highest. At that structure, the market price per share would be maximum.

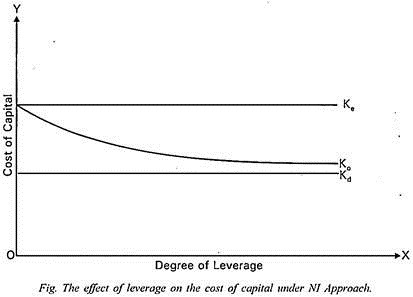

Net Income (NI) approach is explained graphically as follows:

In the above figure, the degree of leverage is plotted along the X-axis, while the percentage rates of Ke (Cost of Equity), Kd (Cost of Debt) and Ko (Overall cost of Capital) are shown on Y-axis. The figure shows that Ke and Kd remain unchanged as the degree of leverage (proportion of debt in comparison to equity) is increased and we find that both the curves remain parallel to the X-axis.

But as the degree of leverage increases, cost of capital Ko decreases and approaches the cost of debt Kd. Ko however cannot touch Kd as there cannot be all debt firm. The optimal capital structure is one at which Ko is nearest to Kd i.e., at which the proportion of equity capital is insignificant. At this level, the firm’s overall cost of capital would be lowest and the market value of the firm and market value per share is highest.

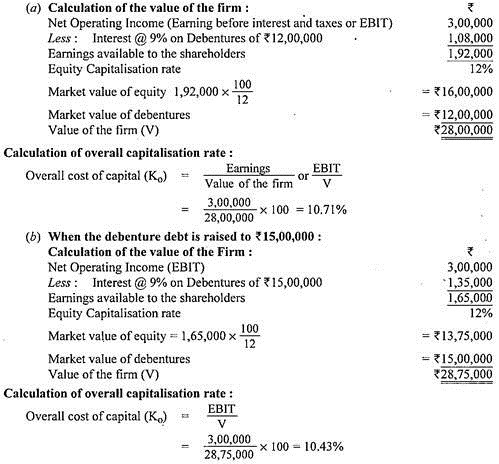

The Net Income approach is made further clear by the following illustration:

Illustration 1:

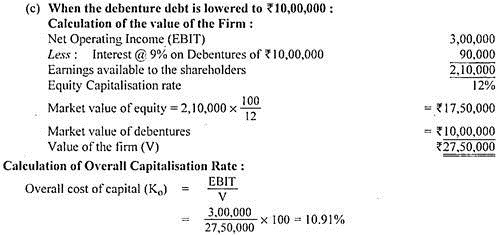

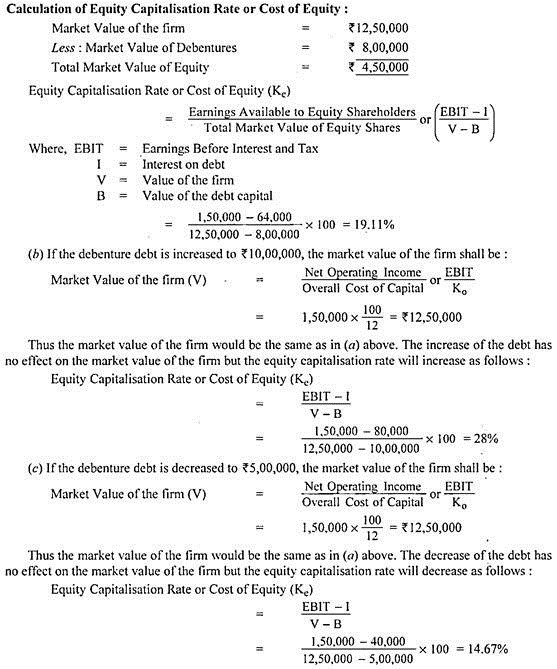

(a) A company’s expected operating income (EBIT) is Rs.3,00,000. It has Rs. 12,00,000, 9% debentures. The equity capitalisation rate of the company is 12%. Calculate the value of the firm and overall capitalisation rate according to the Net Income Approach (Ignore Income Tax).

(b) If the debenture debt is increased to Rs. 15,00,000, what shall be the value of the firm and overall capitalisation rate according to the Net Income Approach?

(c) If the debenture debt is decreased to Rs. 10,00,000, what shall be the value of the firm and overall capitalisation rate according to the Net Income Approach?

Solution:

Hence, we can see that with an increase in the ratio of debt to equity the value of the firm has increased and consecutively the overall cost of capital has decreased.

Hence, we can see that with a decrease in the ratio of debt to equity the value of the firm has decreased and consecutively the overall cost of capital has increased.

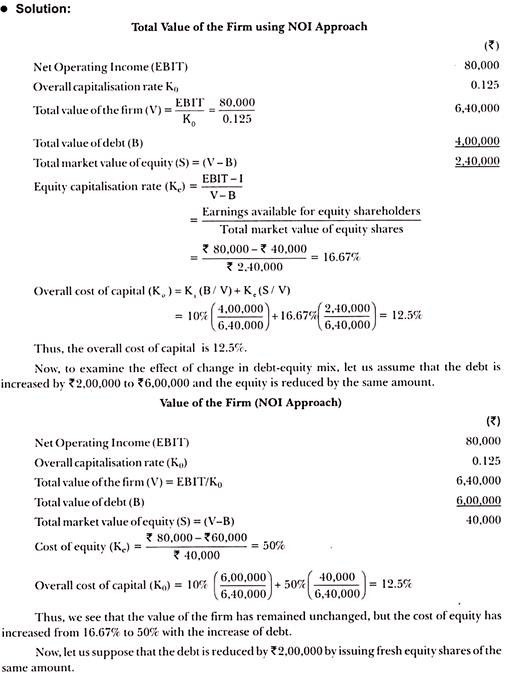

Theory # 2. Net Operating Income Approach:

Another theory of capital structure, as suggested by Durand, is the Net Operating Income (NOI) Approach. It is diametrically opposite to the net income approach. The essence of this Approach is that the capital structure decision of a firm is irrelevant. Any change in the capital structure of the company does not affect the market value of the firm and the overall cost of capital remains constant irrespective of the method of financing.

It means that the overall cost of capital would remain same whether the debt-equity mix is 50 : 50 or 30 : 70 or 60 : 40. Thus the total value of the firm, the market price of shares as well as the overall cost of capital is independent of the degree of leverage.

This approach is based upon the following assumptions:

(i) The cost of debt is lower than the cost of equity.

(ii) Risk perception of lenders of debt do not change with the change in financial leverage and consequently the cost of debt remains constant at all levels of financial leverage.

(iii) The market capitalises the value of the firm as a whole. Thus, the split between debt and equity is not important.

(iv) There are no corporate or personal income taxes.

The Net Operating Income (NOI) approach advocates that the cost of equity (Ke) increases with the increase in the financial leverage. This is due to increased risk assumed by the equity shareholders due to the use of more debt by the firm. To compensate for increased risk, shareholders would expect a higher rate of return on their investments. As such, the cost of equity (Ke) increases as a result of increased financial leverage whereas the cost of debt (Kd) remains constant as the financial risk of lenders is not affected.

Therefore, the advantage of using the cheaper source of funds, i.e. the debt is exactly offset by the increased cost of equity. Consequently, the overall cost of capital (Ko) remains constant at all degrees of financial leverage. Since the value of the firm is measured as a whole on the basis of overall cost of capital and since the overall cost of capital (Ko) remains constant, the value of the firm (V) also remains same at all degrees of financial leverage.

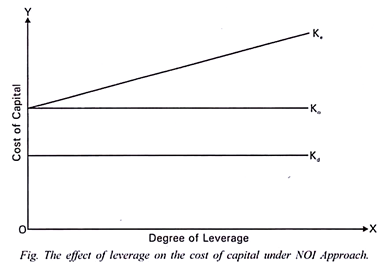

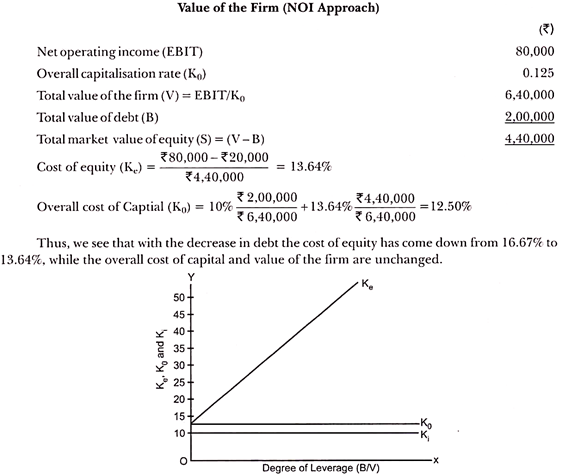

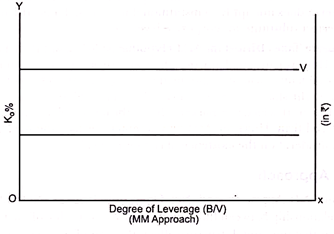

Net Operating Income (NOI) approach is explained graphically as follows:

In the above figure, the degree of leverage is plotted on X-axis, while the percentage rates of Ke (Cost of Equity), Kd (Cost of debt) and Ko (Overall cost of Capital) are shown on Y-axis. The figure shows that Kd and Ko remain constant as the degree of leverage is increased and we find that both the curves are parallel to the X-axis.

Cost of equity (Ke) is equal to Ko when leverage is zero. But with the increase in the leverage the cost of equity (Ke) rises in such a manner so as to offset (or Neutralise) the advantage of using cheaper debt capital. As a result, Ko and the value of firm (V) remain unchanged by the increase in the financial leverage.

The market price of shares will also not change with the change in leverage. Since KO is constant, this approach implies that there is not any unique optimum capital structure. In other words, as KO is the same at all capital structures, every capital structure is optimum.

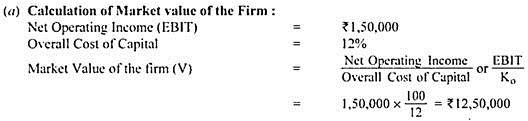

The Net Operating Income approach is made further clear by the following illustration:

Illustration 2:

(a) A company expects a net operating income (EBIT) of Rs. 1,50,000. Its debts amount to Rs.8,00,000 and its cost of debt is 8%. The overall capitalisation rate is 12%. You are required to calculate the value of the firm and the equity capitalisation rate (cost of equity) according to the Net Operating Income Approach.

(b) What will be the effect on the value of the firm and the equity capitalisation rate if the debenture debt is increased to Rs. 10,00,000?

(c) What will be the effect on the value of the firm and the equity capitalisation rate if the debenture debt is decreased to Rs. 5,00,000?

Solution:

Theory # 3. Traditional Approach:

The traditional approach establishes a compromise or a midway between the Net Income Approach and the Net Operating Income Approach. It resembles Net Income (NI) Approach in arguing that overall cost of capital and the value of the firm are both affected by capital structure decision.

But it does not subscribe to the view of NI Approach that use of debt in capital structure to any extent will necessarily decrease the overall cost of capital and increase the value of the firm. It resembles Net Operating Income (NOI) Approach that beyond a certain degree of leverage, the cost of equity (Ke) increases. But it differs from the NOI Approach that overall cost of capital (Ko) and the value of the firm are constant for all degrees of leverage.

The crux of the traditional approach is that through judicious use of debt, a firm can reduce its overall cost of capital (Ko) and can increase the value of the firm. The rationale behind this view is that debt is a relatively cheaper source of funds as compared to equity shares. A change in the leverage, that is, using more debt in place of equity causes a decline in overall cost of capital.

However, it occurs within a reasonable limit of debt. If the proportion of debt is increased beyond a certain point the overall cost of capital starts increasing and firm’s market value begins to decline. Thus, an optimum capital structure exists, and it occurs at that degree of financial leverage where overall cost of capital is minimum and the value of the firm is maximum.

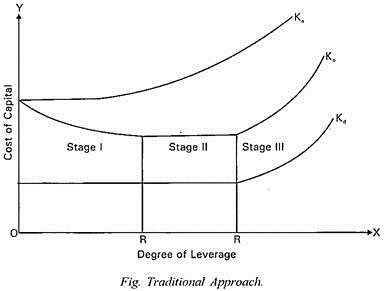

According to the traditional approach, the manner in which the overall cost of capital and the value of the firm react to changes in the degree of financial leverage can be divided into three stages:

First Stage:

In the first stage, increase in financial leverage, i.e. the use of increased debt in the capital structure results in decrease in the Overall Cost of Capital (Ko) and increase in the Value of the Firm. This is because, a relatively cheaper source of funds debt replaces a relatively costlier source of funds equity. In this stage, cost of equity (Ke) remains constant or rises negligibly. Cost of debt (Kd) also remains constant or rises negligibly since the market considers the use of debt as a reasonable policy at this stage.

Second Stage:

Once the firm has reached a certain degree of financial leverage, increase in leverage does not affect the Overall Cost of Capital and the Value of the Firm. This is because the increase in the cost of equity (Ke) due to added financial risk completely offsets the advantage of using cheaper debt capital. Within that range or at a particular level of leverage the overall cost of capital will be minimum and the value of the firm will be maximum. This range or level represents optimum capital structure.

Third Stage:

In the third stage, the further increase in debt will lead to increase in Overall Cost of Capital and will reduce the Value of the Firm. This happens due to two factors – (i) Owing to increased financial risk, Ke will rise sharply and (ii) Kd would also rise because the lenders will also raise the rate of interest as they may require compensation for higher risk.

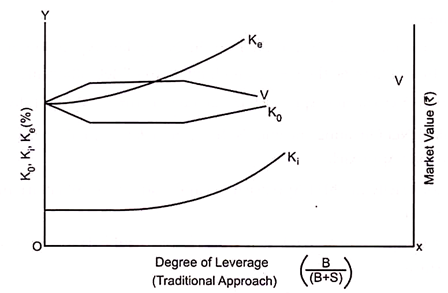

The behaviour of Kd, Ke and Ko has been graphically shown in the following figure:

Figure depicts that cost of equity (Ke) rises negligibly in the initial stage but starts rising sharply in the later stages. Cost of debt (Kd) remains constant upto a certain degree of leverage and thereafter it also starts rising. The overall cost of capital (Ko) curve is saucer-shaped with a horizontal range RR. The optimum capital structure of the firm is represented by range RR because in this range the overall cost of capital (Ko) is minimum and the value of firm is maximum.

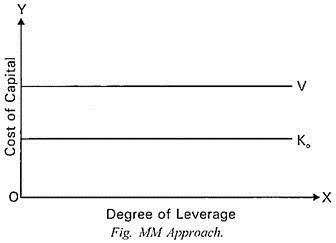

Theory # 4. The Modigliani-Miller Approach:

The Modigliani-Miller Approach is similar to the net operating income approach when taxes are ignored. The theory proves that there is no relationship between the capital structure decision and the value of the firm and its overall cost of capital. However it is an improvement over the net operating income approach as it provides the behavioural justification for the contention that capital structure decision is not related to overall cost of capital. In other words, it justifies the proposition that overall cost of capital remains constant at any level of debt-equity ratio.

(i) The Modigliani-Miller Approach – When the Taxes are Ignored:

The theory propounds that a change in capital structure (i.e., debt-equity ratio) does not affect the overall cost of capital and the total value of the firm. The reason behind the theory is that although the debt is cheaper to equity, with the increased use of debt as a source of finance, the cost of equity increases and this increase in the cost of equity offsets the advantage of the low cost of debt.

Thus, although the change in the debt-equity ratio affects the cost of equity, the overall cost of capital remains constant. The theory further propounds that beyond a certain limit of debt, the cost of debt increases (due to the increased financial risk) but the cost of equity falls thereby again keeping the overall cost of capital constant.

The following diagram shows that in the absence of taxes, a firm’s total value and its overall cost of capital will be same at all debt-equity ratios:

Assumptions:

MM Approach is based on the following assumptions:

1. Capital markets are perfect – Securities are traded in a perfect capital market situation.

A perfect market implies that:

(a) Securities are infinitely divisible;

(b) The investors are free to buy or sell securities;

(c) There are no transaction costs, i.e., the cost of buying and selling securities do not exist;

(d) The investors can borrow without restrictions on the same terms and conditions as the firms can;

(e) Information is perfect and freely available to the investors; and

(f) Investors behave rationally.

2. Homogeneous risk classes of firm – Firms can be grouped into homogeneous risk classes. In other words, the expected earnings of a group of firms have identical risk characteristics.

3. Expectations about the net operating income – All the investors have same expectations about the net operating income of the firm with which to evaluate its value.

4. 100% payout ratio – The dividend payout ratio is 100%, i.e. all the earnings are distributed to the shareholders.

5. No corporate taxes – There are no corporate taxes. (This assumption is later withdrawn.)

6. The rate of investment – The cut-off rate of investment in a firm is the capitalisation rate.

Behavioural Justification for Irrelevance of Capital Structure Decision – The Arbitrage Process:

The fundamental theory of the MM Approach, if we ignore the taxes, is that the total value of a firm must be constant irrespective of the degree of leverage, i.e. debt-equity ratio. In other words, the basic preposition of the MM Approach is that the capital structure decision is irrelevant.

Modigliani and Miller provide behavioural justification for the irrelevance of the capital structure decision and are not content with merely stating the preposition. The justification lies in the arbitrage process. Arbitration process involves buying and selling of those securities which are out of equilibrium in the capital market.

It involves buying of securities whose prices are lower (undervalued securities) and selling those securities whose prices are higher (overvalued securities). Buying of undervalued securities will increase their demand and will result in raising their prices and the selling of overvalued securities will increase their supply thereby bringing down their prices. This will continue till the equilibrium is restored. The arbitrage process ensures that the securities of two identical firms cannot sell at different prices for long.

The arbitrage process can be explained with an example of two firms X and Y which are exactly similar in all respects except that X has leverage (i.e., debt) in its capital structure whereas Y is an all equity firm. Further assume that the value of the firm X is higher than the value of firm Y. According to MM approach the total value of these two firms cannot remain different for long because of arbitrage process. The investors of firm X will sell their shares and will buy the shares of Y whose shares are undervalued. This will help them in earning the same return at lower outlay with the same perceived risk or lower risk.

The behaviour of the investors of firm X will have the effect of- (i) increasing the share prices of the firm Y whose shares are being purchased; and (ii) lowering the share prices of the firm X whose shares are being sold. The sale and purchase will continue till the market prices of the two identical firms i.e., X and Y become identical. Thus, arbitrage process ensures that two firms which are exactly similar in all respects except leverage cannot have different values. Hence, capital structure decision of a firm does not affect its market value.

Arbitrage Process Reversal:

According to the MM theory, the debt financing has neither any advantage nor any disadvantage, thus just as the total value of a levered firm cannot be more than that of an unlevered firm, the value of an unlevered firm can also not be greater than the value of a levered firm.

This is because the arbitrage process will set in and decrease the value of the unlevered firm and increase the value of the levered firm. The arbitrage would, thus, operate in the opposite direction. Here, the investors will dispose of their holdings in the unlevered firm and obtain the same return by acquiring proportionate share in the equity capital and the debt of the levered firm at a lower outlay and without any increase in the risk.

(ii) MM Approach – When Corporate Taxes are Assumed to Exist:

Modigliani and Miller agree that the value of the firm will increase and cost of capital will decline with the use of debt if corporate taxes are considered. Since interest on debt is tax-deductible, the effective cost of borrowing will be less than the rate of interest. Hence, the value of the levered firm would exceed that of the unlevered firm by an amount equal to the levered firm’s debts multiplied by the tax rate.

Limitations or Criticism of MM Approach:

(i) Risk Perceptions of Personal and Corporate Leverages are Different:

It is incorrect to assume that ‘personal leverage’ is a perfect substitute for ‘corporate leverage’. Liability of an investor is limited in corporate enterprises whereas the liability of an individual borrower is unlimited as even his personal property is liable to be used for payment to lenders. Hence, the risk to the individual borrower is higher.

(ii) Difference in Cost of Borrowing by the Firm and Individuals:

The assumption that firms and individuals can borrow at the same rate of interests does not hold good in practice. Because of the substantial holding of fixed assets, firms have a higher credit standing. As a result, they are able to borrow at lower rates of interest than individuals.

(iii) Convenience:

The corporate borrowing is more convenient to the investor because the formalities and procedures in borrowing are to be observed by corporates while these will be the responsibility of the individual in case of personal borrowing.

(iv) Transaction Costs:

The existence of transaction costs interferes with the working of arbitrage process. Because of brokerage fees and other costs in the buying and selling securities, it would become necessary to invest a greater amount in order to earn the same return. As a result, the levered firm will have a higher market value.

(v) Institutional Restrictions:

Institutional restrictions stand in the way of a smooth operation of arbitrage process. Several institutional investors such as Life Insurance Corporation of India, Unit Trust of India, and Commercial Banks and so on are not allowed to engage in personal leverage.

(vi) Existence of Corporate Tax:

Since interest on debt is tax deductible, the levered firm would have a greater market value than an unlevered firm.

Capital Structure Theories: With Assumptions, Illustrations and Calculations

Capital structure theories explain the relationship among the capital structure, the cost of capital and value of the firm. The capital structure of a firm should be such as it maximises the value of the firm (shareholders wealth). Such a capital structure is called optimum capital structure.

There are different theories which explain the relationship among capital structure or financing mix (debt-equity ratio), cost of capital and valuation of a company. According to one school of thought, the capital structure affects cost of capital of a company and its value.

According to the other school of thought, there is no relationship among the capital structure, cost of capital of a company, and its value. There are four approaches which explain the relationship between the capital structure and value of a firm.

These approaches are as follows:

1. Net Income Approach

2. Net Operating Income Approach

3. Modigliani – Miller Approach

4. Traditional Approach

These approaches shall be explained here:

1. The company uses only two sources of funds that is debt and equity.

2. There are no corporate taxes.

3. The firm’s total assets are given and they do not change. In other words, the investment decisions are assumed to be constant.

4. The dividend payout ratio is 100 per cent which means that whole of the earnings are distributed as dividends and there are no retained earnings.

5. The operating profits (EBIT) of the company are given and not expected to grow.

6. The company’s total financing remains constant. The company can change its capital structure either by redeeming the debentures with the help of issuing shares or by raising more debt and reducing the equity capital.

7. The business risk remains constant and is assumed to be independent of capital structure and financial risk.

8. All investors have the same probability distribution of future expected operating earnings (EBIT) for a given firm.

9. The firm has a perpetual life.

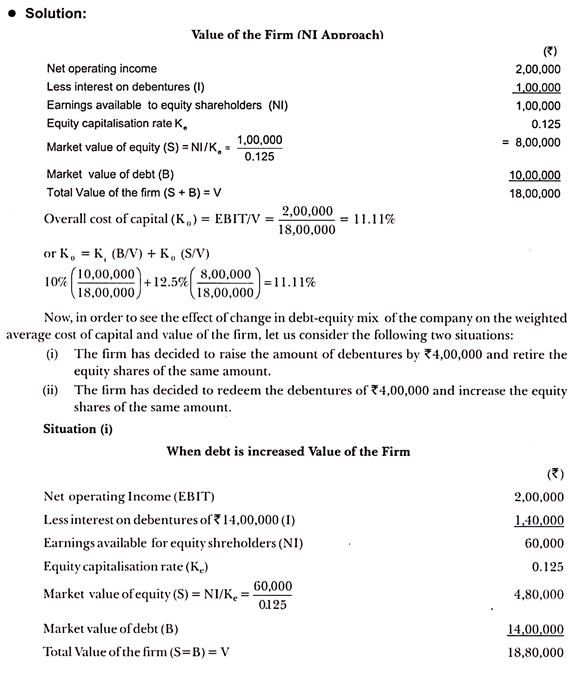

Theory # 1. Net Income (NI) Approach:

This approach was given by Durand. According to this approach, capital structure decision affects the value of the firm. A change in the capital structure (Financial leverage or Debt-equity ratio) causes a change in the overall cost of capital and the value of the firm.

Use of higher debt in the capital structure will decrease the overall cost of capital and increase the value of the firm and the market price of equity shares. On the other hand, a decrease in the use of debt in capital structure will lead to an increase in the overall cost of capital and a decrease in the value of the firm and the market price of equity shares.

This approach is based on three assumptions:

(a) There are no taxes.

(b) The cost of debt is less than the cost of equity.

(c) The use of debt does not change the risk perception of investors.

According to NI approach, financial leverage is an important variable in capital structure decision of a company. By making a judicious use of debt and equity, a company can achieve an optimum capital structure. The optimum capital structure is one at which the overall cost of capital (K0) is minimum and the value of the firm is maximum. At this capital structure, the market price of the equity share will be the highest.

According to NI approach, the value of the firm can be determined as follows:

V = S + B

V = Total market value of the firm

S = Total market value of equity

B = Total market value of debt

Market value of equity (S) = NI/ Ke

NI = Earnings available for equity shareholders

Ke = Equity capitalisation rate

A company has an expected annual operating income (EBIT) of Rs.2,00,000. The firm has Rs.10,00,000, 10% debentures. The cost of equity capital (Ke) is 12.5%. You are required to calculate the value of the firm under NI approach.

Theory # 2. Net Operating Income (NOI) Approach:

This approach was also suggested by Durand but it is opposite to Net Income approach. According to this approach, the value of the firm is independent of its capital structure. The change in capital structure does not cause change in the value of the firm, market price of shares and weighted average cost of capital.

According to this approach, the market values the firm as a whole and it does not split the value of the firm into value of the equity and value of the debt. The overall cost of capital (K0) is constant for all degrees of financial leverage.

The value of the firm is ascertained as follows:

V = EBIT / K0

The value of equity is residual, which is calculated by deducting the value of debt (B) from the total value of the firm (V).

Thus, total value of equity (S) = V – B

When a company increases the proportion of debt in its capital structure, it increases the financial risk for equity shareholders. As a result of increase in the financial risk, the equity- shareholders expect higher rate of return from the company to get compensated for higher risk. It means, it increases the cost of equity Ke. In this way, the benefit of using cheaper debt is neutralised by the implicit cost of equity, as a result of which overall cost of capital remains the same.

Equity capitalisation Rate Ke = (EBIT-Interest) / (V-B)

According to NOI approach, there is nothing like optimum capital structure as the total value of the firm and market price of shares are not affected by the level of financial leverage.

Assumptions:

This approach is based on the following assumptions:

1. The overall cost of captial K0 remains constant for all degrees of financial leverage or debt-equity ratio.

2. There are no corporate taxes.

3. The investors values the firm as a whole and do not split the value of the firm into value of equity and value of debt.

4. The increase of proportion of debt in the capital structure results in an increase in the financial risk which causes an increase in the cost of equity Ke.

5. The weighted average or overall cost of capital (K0) remains constant.

This approach can be understood with the help of the following illustration:

A Co. Ltd. has an operating income of Rs.80,000 and outstanding debt of Rs.4,00,000 at 10% rate of interest. If the overall capitalisation rate is 12.5 per cent, calculate the value of the firm and cost of equity.

Theory # 3. Modigliani-Miller (MM) Approach:

The Modigliani-Miller (MM) approach is also similar to the net Operating Income approach. However, the NOI approach does not provide operational justification for irrelevance of capital structure to the valuation of the firm and it is of definitional nature while MM approach provides behavioural justification for constant cost of capital and value of the firm.

In other words, MM approach says that the weighted average cost of capital and hence, the total value of the firm does not change with the change in the capital structure. The behavioural justification in MM approach lies in the arbitrage process. Arbitrage means buying an asset in one market at lower price and selling the same in another market at higher price. This arbitrage process restores equilibrium in both the markets.

Assumptions:

The MM approach is based on the following assumptions:

1. The dividend payout ratio is 100%, that is, there are no retained earnings.

2. There are no corporate taxes.

3. The capital markets are perfect. It means-

(a) There are no transaction costs.

(b) The investors are free to buy and sell the securities.

(c) The investors can borrow without restrictions on the same terms as the firm can.

(d) All investors have the same information without cost.

(e) The investors are rational in behaviour.

4. All investors have the same expectation of a firm’s net operating income (EBIT) and evaluate the firm on that basis.

5. All firms can be divided into equivalent or homogeneous risk class. It means that the expected earnings have similar risk characteristics.

The MM approach has the following three propositions:

1. The overall cost of capital (K0) and the value of the firm (V) are independent of the capital structure of the firm. It means that for all levels of debt-equity mix, the overall cost of capital and value of the firm will remain constant.

2. The cost of equity (Ke) is equal to capitalisation rate of a free equity stream plus a premium for financial risk. The financial risk increases as the proportion of debt is increased in the capital structure.

3. The cut off rate for investment purposes is totally independent of the manner in which an investment is financed.

The operational justification in MM approach is provided by the ‘arbitrage process’. Arbitrage means buying an asset or security in one market at lower price and selling it in another market at higher price. This activity will increase the price in the market where it is low due to more demand and decrease the price in the market where it is higher due to increase in supply.

This will make the price in the two markets equal. On the same basis, the market price of the securities of the two firms exactly similar in all respects except the capital structures (debt-equity ratio) cannot remain different in different markets for long. It implies that a security cannot sell at different prices in different markets.

Arbitrage process will bring the price into equilibrium. The total value of the homogeneous firms which differ only in terms of capital structure will be the same due to arbitrage. By selling the shares of the overvalued firm (higher price) and buying the shares of the undervalued firm (lower price) the investor can earn the same return at lower investment without bearing additional risk.

He will borrow additional funds personally to purchase the shares of the undervalued firm. The use of personal debt, by the investor is called personal leverage or homemade leverage.

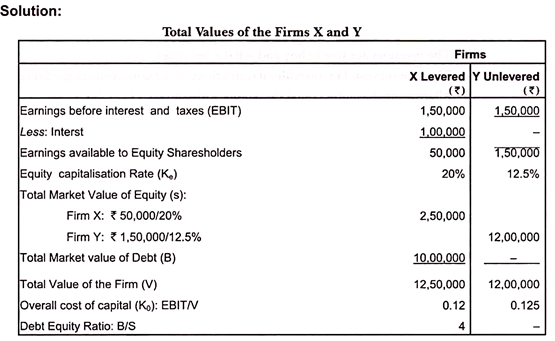

It will be explained with the help of following illustration:

There are two firms X and Y which are similar in all respects except that firm X has 10 per cent Rs.10,00,000 debentures. The earnings before interest and taxes (EBIT) of both the firms are the same, that is Rs.1,50,000. The equity capitalisation rate of firm X is 20% while that of firm Y is 12.5%.

You are required to ascertain the total market value of each firm.

The above calculations show that the value of the levered firm x is higher than that of unlevered firm Y. However, according to MM approach this difference in values of both the firm will not continue for long because of arbitrage process. The arbitrage process will make the values of both the firms equal.

Arbitrage Process:

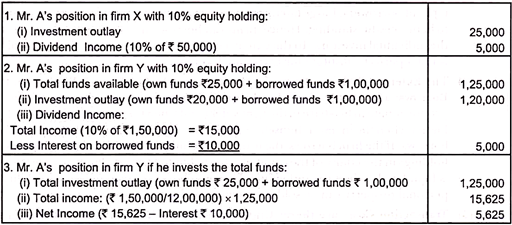

Suppose an investor Mr. A holds 10 per cent of outstanding shares of the levered firm X. His holdings would be Rs.25,000 (10% of Rs.2,50,000) and his share of earnings (Dividend) belonging to equity shareholders will be Rs.5,000 (10% of Rs.50,000).

Because the EBIT of both the firms are the same but the market value of firm Y (unlevered) is lower than that of firm X (levered), the investor will sell his holdings in firm X and invest in unlevered firm Y. As firm Y has no debt in capital structure, the financial risk for the investor will be less in comparison to firm X.

To have the same level of financial risk as of firm X, he would borrow additional amount equal to his proportionate share in the levered firm’s debt in his personal capacity. It means that the investor will use his personal leverage for the firm’s leverage. The effect would be the same whether the firm uses the debt or the investor borrows on personal account.

Thus, Mr. A will borrow Rs.1,00,000 at 10% rate of interest. The proportionate holdings of Mr. A in firm Y will be Rs.1,20,000 (i.e., 10% of Rs.12,00,000) and he will receive a dividend income of Rs.15,000. Out of this dividend income from firm Y he will pay Rs.10,000 as interest on his personal loan. In this way, he will be having same income of Rs.5,000 which he was getting from levered firm X. However, his investment expenditure in unlevered firm Y is less.

It is explained as follows:

The above analysis explains that Mr. A can earn higher income if he shifts from firm X to firm Y. Other investors will also indulge in the same activity. They will start purchasing the shares of firm Y and selling the shares of firm X. As a result, the demand for the shares of firm Y and the supply of the shares of firm X will increase.

This will bring down the price of shares of firm X and increase the price of shares of firm Y. This process will continue till the market price of both the firms becomes equal. After this point, these will be no arbitrage.

In this way, according to MM, the value of levered firm cannot be more than that of the unleavered firm. Similarly, the value of the unlevered firm cannot be more than the value of the levered firm because of the working of arbitrage process, which will decrease the value of the unlevered firm and increase the value of the levered firm.

The graphical presentation of MM approach is as follows:

Limitations of MM Approach:

The operational justification for MM approach is the arbitrage process.

However, the arbitrage process fails to bring equilibrium due to the following limitations:

(1) Cost of borrowing is not the same for individuals and firms:

In MM approach, it is assumed that personal leverage can be substituted for corporate leverage, that is, the investor is able to borrow the funds on his personal account at the same rate of interest at which the firm can. In actual practice, it is not so. Lending cost is not the same for all types of borrowers.

Large borrowers are able to raise funds at lower rate of interest due to better credit standing. Hence, firms can borrow funds at lower rate of interest than the individual investors. To the extent cost of borrowing differs, the personal leverage is not a perfect substitute for corporate leverage.

(2) The extent of risk is not same for the investor when he himself borrows or the firm borrows:

The degree of risk for the investor is not the same when he himself borrows proportionate to his share in the firm’s debt and when the firm itself borrows. The risk is higher when the investor himself borrows in comparison to the situation when the firm borrows.

If the firm borrows, the investor’s liability will be confined to his proportionate holdings in the equity of the company due to limited liability clause in case the company is liquidated. When the individual borrows, he has to face unlimited liability and his personal property can be sold for payment of his creditors.

(3) Transaction costs are there:

Under MM approach, it is assumed that there are no transaction costs. But in actual practice, when securities are purchased or sold, transaction costs in the form of brokerage are incurred. As a result of transaction costs, the net amount received by the investor from sale of the shares of the levered firm would be less.

Similarly, when the shares of the unlevered firm are purchased, transaction costs are incurred, as a result of transaction cost, the net amount received by the investor from sale of the shares of the levered firm would be less. Similarly, when the shares of the unlevered firm are purchased, transaction costs are incurred, as a result of which less amount will be available for investment.

(4) Institutional restrictions:

The financial institutions like Unit Trust of India, Life Insurance Corporation of India, Commercial Banks, etc. are not allowed to use personal leverage. In this way, the switching option from levered firm to unlevered firm and vice-versa does not apply to institutional investors. Thus, the personal leverage is not the perfect substitute for corporate leverage.

(5) Corporate taxes distort the MM hypothesis:

MM assume that there are no corporate taxes. However, in actual practice, these are corporate taxes. Interest on borrowed funds is tax deductible, whereas the dividend on equity shares is not. As a result of this, the return to the shareholders of a levered firm is higher in comparison to the unlevered firm.

Due to this fact, the market value of the levered firm will be higher than that of the unlevered firm. However, MM also accepted his fact and gave another theory, taking into consideration the existence of corporate taxes.

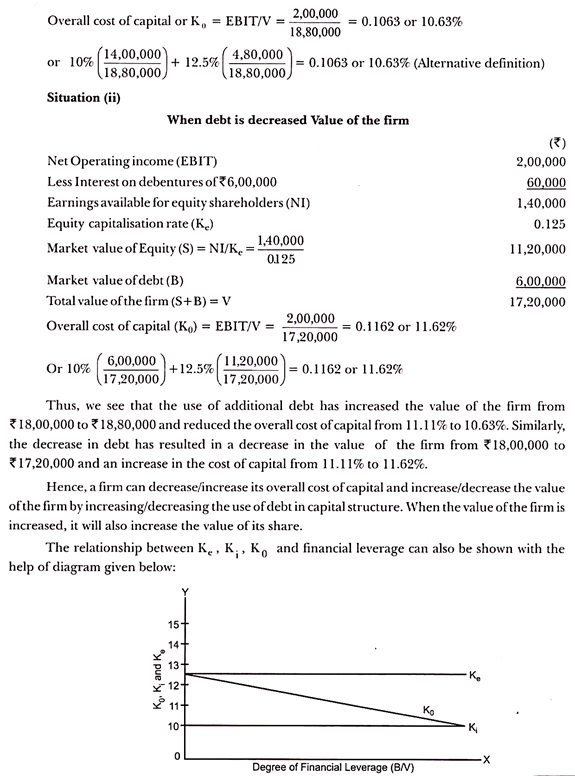

Net Income (NI) Approach and Net Operating Income (NOI) Approach are the two extremes of the relationship between the capital structure and value of the firm. While Net Income Approach explains that the capital structure affects the overall cost of capital and the total value of the firm, the Net Operating Income Approach suggests that the capital structure is totally irrelevant.

The MM Approach supports the NOI Approach. But due to the assumptions of MM approach it does not appear to be fully applicable in actual practice. Traditional Approach is a compromising viewpoint between Net Income Approach and Net Operating Income Approach. Partly it has the features of both the approaches.

Therefore, it is a mid-way approach. The Traditional Approach is similar to the NI Approach to the extent that it says that leverage affects the overall cost of capital and total value of the firm.

However, it does not accept the viewpoint of NI Approach that the value of the firm will necessarily increase for all degrees of financial leverage, it is similar to the viewpoint of NOI Approach that beyond a certain degree of leverage, the overall cost of capital increases, as a result of which the total value of the firm decreases. But it is different from the NOI Approach as it does not accept the view that the overall cost of capital is constant for all degrees of leverage.

The essence of the Traditional Approach is that a firm by making a judicious use of debt and equity in its capital structure can increase its total value and decrease the overall cost of capital. This is because debt is a cheaper source of finance due to tax deductibility of interest in comparison to equity shares.

The use of cheaper source of funds (debt) by replacing equity capital will reduce the overall cost of capital. However, if the debt is raised further, it will increase financial risk for the investors, leading to a higher equity capitalisation rate (Ke). But the increase in equity capitalisation rate (Ke) may not be so high as to offset the benefit of cheaper debt.

But, if the debt is increased further, it will increase financial risk both for equity shareholders and creditors. They will demand higher rate of return from the firm. In other words, it will increase the equity capitalisation rate (Ke) as well as the cost of debt (Ki). Thus, the use of debt beyond a certain point will raise the overall cost of capital and decrease the value of the firm.

Hence, the use of debt upto a certain point will increase the value of the firm and beyond that point it will decrease the value of the firm. At this level of debt-equity mix, the capital structure of the firm would be optimum. At this level, the overall cost of capital would be the minimum. At this level, the marginal real cost of debt (both implicit and explicit) would be equal to the real cost of equity.

In conclusion, it can be said that financial leverage is favourable upto a certain level but after a certain point it starts operating adversely.

The graphical presentation of Traditional Approach is shown below: