The following points highlight the factors that influence interest rate movements in the economy. The factors are: 1. Inflation 2. Rate Signals from the RBI 3. Banking System Liquidity 4. Deposits in the Banking System 5. Fiscal Deficit and Government Borrowings.

Factor # 1. Inflation:

Inflation refers to the increase in the price levels in the economy. It refers to the erosion of purchasing power of money. In other words, a rupee in your hand would be worth much less tomorrow, than it is today.

While Government Securities are free from credit risks, they are not immune to interest rate risks. The yield expected by investors in Government Securities always includes a premium for current inflation as well as expected inflation during the time horizon of the security.

Factor # 2. Rate Signals from the RBI:

RBI rate action usually has a direct impact on the yields. Commercial Banks comprise the largest investors in the Government Securities apart from Mutual Funds, Insurance companies, certain Provident Funds, etc. Further, the RBI acts as a bellwether to banks in their decision on deposit and lending rates.

ADVERTISEMENTS:

When the RBI increases policy rates, the RBI is effectively voicing its intention about increasing the deposit and lending rates by banks. An increase in RBI Repo Rates, increases cost of funds for banks. This increase in finance cost gets factored in the yields expected by banks and thus results in an upward movement in the yields.

On the other hand, an increase in the RBI Reverse Repo Rate makes it more lucrative for Banks to park their funds with the RBI. This increases the opportunity cost for investing in the Government securities resulting in an increase in the yields.

Factor # 3. Banking System Liquidity:

Liquidity in the banking system can be a difficult thing to measure with precision. However, a good reference point of evaluating the liquidity situation of banks is to look whether banks are net borrowers or investors in the ‘Liquidity Adjustment Facility'(LAF) maintained by the RBI. For example, consider the LAF auction results of 9 March 2012 as published on the website of the RBI.

As can be seen in the row (2) (ii) the amount of Repo auction (amount of securities purchased by the RBI effectively infusing money in banks) was more than the amount of Reverse repo auction (amount of securities sold by the RBI effectively absorbing money from banks). This is a situation which indicates a liquidity deficit in banks.

ADVERTISEMENTS:

The RBI, through its Liquidity Adjustment Facility, ensures that there is adequate liquidity in the banking system. In case of a situation of liquidity shortfall with banks, the RBI tries to ensure that government borrowings do not crowd out private sector borrowings and also that the shortage does not impact bank lending.

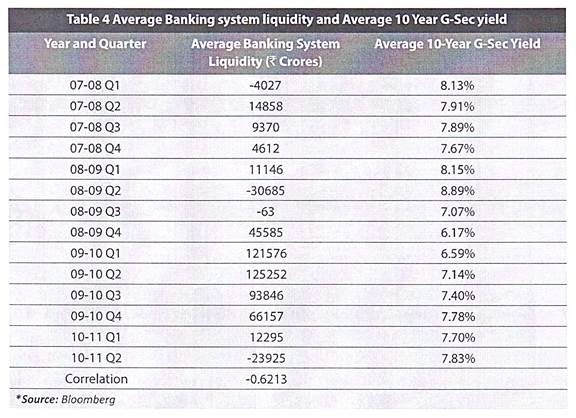

In case of a situation of liquidity surplus with banks, the RBI tries to ensure that the surplus is within acceptable levels. The table below shows absorption of excess liquidity by the RBI (positive figure) or the net infusion of liquidity into the system by the RBI (negative figure) per quarter. It also gives the corresponding average yields on the 10-year Benchmark Securities.

Thus the correlation between the 10-year Government Security Yield and the average liquidity in the system is -62.13%.

ADVERTISEMENTS:

This in only natural, because, if the banking system liquidity is taken as an indicator of the liquidity in the economy, an increase in the banking system liquidity as referred to above (i.e. the RBI trying to absorb more liquidity) would indicate an excess liquidity in the economy culminating into a higher demand for Government Securities. A higher demand for a given level of supply of Government Securities would mean an increase in the price of these securities and the consequent fall in their yields.

Factor # 4. Deposits in the Banking System:

The aggregate demand and time deposits available with the banking system is a technical factor that affects yield values because of its implications on the demand for Government Bonds. Investment in Government Securities is one of the most common means by which banks maintain their statutory reserve requirements.

Thus an increase in the deposits with the banking system automatically results in an increase in the demand for Government Securities. This effectively results in a fall in the yields of Government Securities.

Factor # 5. Fiscal Deficit and Government Borrowings:

ADVERTISEMENTS:

Another important factor affecting the benchmark yields is the fiscal deficit and related government borrowings. The fiscal deficit affects the debt raising plans of the government, which in turn determine the supply of the government securities in the market.

A reduction in the fiscal deficit of the government as a percentage of the GDP would mean that the government would need to issue a lesser amount of fresh government papers. This would reduce the supply of government securities and should ideally result in an increase in the prices of these securities and a consequent fall in their yields.

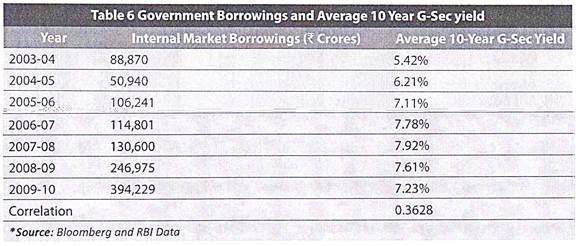

The table below shows the Internal Market borrowings made by the Central Government to finance its fiscal deficit for the past 7 financial years ending 2009-10.

As seen in the table above, the correlation between the Central Government’s internal market borrowings and the 10-year benchmark yield is 36.28%. Although the correlation does not seem too strongly positive, a scatter graph would provide a better understanding of the relation between the two variables. Chart below shows the scatter graph of the two variables.

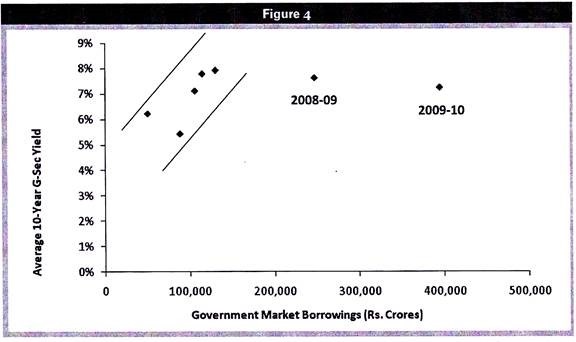

The scatter plot clearly shows that while usually, there has been a strong positive correlation in the Government Borrowings and the bond yields; the lower correlation is basically because of the two extreme outliers in the sample.

These points represent the government borrowings and corresponding yields for the past two years i.e. 2008-09 and 2009-10. These two years have indeed been significant and exceptional, when the government Borrowings increased substantially while the yields kept falling by a few basis points.

While providing fiscal stimulus to the economy for dealing with the global financial crisis as well as providing debt waivers in the agricultural sector, the internal borrowings raised by the government shot up by almost 89% year on year (Y-O-Y) in the year 2008- 09 and almost 60% Y-O-Y in the year 2009-10.

ADVERTISEMENTS:

In fact the total borrowings in these two years were more than the cumulative borrowing for preceding 5 years. A possible explanation for the yields to fall in these two years in spite of the exceptional increase in the borrowings can be attributed to the substantial monetary tightening by the RBI. In fact, the correlation between the Internal Government Borrowings and the Benchmark Yields, excluding the two outlier years comes to 73.91%.

The total average system liquidity absorbed by the RBI in the financial years 2009-10 and 2008-09 was in excess of the total average system liquidity absorbed in the five preceding years!

Tracking of these Determinants, Practically:

So, these are the factors that have an impact on the market interest rates of Government securities and in effect on all other securities. However, this is not an exhaustive list. There might be several other factors that may impact interest rates.

ADVERTISEMENTS:

Further, some of these factors will have a larger impact on certain types of securities than others. For example, the liquidity driven factors such as banking system liquidity will have a direct and significant impact on money market instruments such as treasury bills. Factors such as fiscal deficits and government borrowings will have a much significant impact on dated government securities as compared to money market instruments.

It is also important to note that while yields on government securities will determine the general direction of interest rates in the economy, certain factors specific to a particular type of security or industry sector will affect the interest rates of those particular fixed income securities.

For Example:

a. Apart from the general market level of interest rates (determined by the government bond yields) the yields on a particular rating category may vary depending on the demand for and supply of securities in that category. An excess of demand of AAA rated securities may result in lowering of yields in that category (although it is unlikely that the yields will fall below comparable G-Sec yields).

b. Depending on the fundamental factors affecting a sector, the yields on securities issued by issuers in that sector will vary as compared to other securities. For instance, consider a certain sector that is not doing too well. In such case, the yield of an AA rated fixed income security offered by an issuer in the troubled sector may be higher than the yields on a comparable AA rated security offered by an issuer in another sector.

While we have carried out all this analysis of interest rate determinants, it may not be feasible for a common investor to carry out such an analysis before investing in fixed income securities.

ADVERTISEMENTS:

Nonetheless, we would try and tell you a few practical factors that you might consider in respect of a few of these interest rate determinants:

i. Inflation:

The Wholesale Price Index (WPI) is the statistical figure that is widely tracked in India as a measure of Inflation. This figure is released every month by the Ministry of Commerce and Industry of the Government of India. Even if you may not want to track this figure by reading the press releases of the ministry, it is widely reported in the news media and can be easily obtained.

ii. Fiscal Deficit and Government Borrowings:

Fiscal deficit and government borrowings are budgeted a released at the beginning of each financial year (when the Finance Minister presents the Union Budget before the parliament). The budget figures are quite widely reported in the news media and can be easily tracked.

However, the actual auctions carried out by the RBI on a periodic basis are not much reported and can be difficult to track. However, the RBI releases an auction calendar of government securities on a half yearly basis and does make a press release before each auction. This can be easily accessed on the RBI’s website.

ADVERTISEMENTS:

iii. Rate Signals from the RBI:

The RBI carries out a quarterly review of its monetary policy which is released to the press. The RBI even carries out a monetary policy review in the middle of a quarter if the situation demands. In the US, the Federal Reserve (Fed) expresses its policy actions plans quite clearly in terms of what their policy actions would be in the near future.

As against this, the RBI did not previously provide any direction about its future policy action course. However, the RBI now does provide guidance on its intended course of action. For example; look at the statements made by the RBI in a policy review about the future course of action and its actual actions in the future periods.