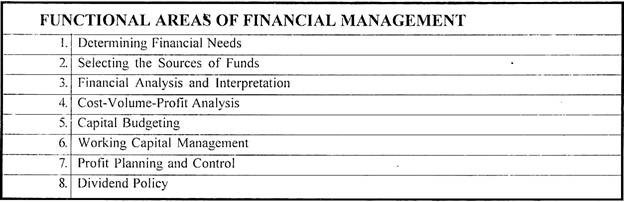

This article throws light upon the top eight functional areas of financial management. The functional areas are: 1. Determining Financial Needs 2. Selecting the Sources of Funds 3. Financial Analysis and Interpretation 4. Cost-Volume-Profit Analysis 5. Capital Budgeting 6. Working Capital Management 7. Profit Planning and Control 8. Dividend Policy.

Financial Management: Functional Area # 1.

Determining Financial Needs:

A finance manager is supposed to meet financial needs of the enterprise. For this purpose, he should determine financial needs of the concern. Funds are needed to meet promotional expenses, fixed and working capital needs. The requirement of fixed assets is related to the type of industry.

A manufacturing concern will require more investments in fixed assets than a trading concern. The working capital needs depend upon the scale of operations, larger the scale of operations, the higher will be the needs for working capital. A wrong assessment of financial needs may jeopardise the survival of a concern.

Financial Management: Functional Area # 2.

ADVERTISEMENTS:

Selecting the Sources of Funds:

A number of sources may be available for raising funds. A concern may resort to issue of share capital and debentures. Financial institutions may be requested to provide long-term funds. The working capital needs may be met by getting cash credit or overdraft facilities from commercial banks. A finance manager has to be very careful and cautious in approaching different sources.

The terms and conditions of banks may not be favourable to the concern. A small concern may find difficulties in raising funds for want of adequate securities or due to its reputation. The selection of a suitable source of funds will influence the profitability of the concern. This selection should be made with great caution.

Financial Management: Functional Area # 3.

Financial Analysis and Interpretation:

ADVERTISEMENTS:

The analysis and interpretation of financial statements is an important task of a finance manager. He is expected to know about the profitability, liquidity position, short-term and long-term financial position of the concern. For this purpose, a number of ratios have to be calculated.

The interpretation of various ratios is also essential to reach certain conclusions. Financial analysis and interpretation has become an important area of financial management.

Financial Management: Functional Area # 4.

Cost-Volume-Profit Analysis:

Cost-volume-profit analysis is an important tool of profit planning. It answers questions like, what is the behaviour of cost and volume? At what point of production a firm will be able to recover its costs? How much a firm should produce to earn a desired profit? To understand cost- volume profit relationship, one should know the behaviour of costs.

ADVERTISEMENTS:

The costs may be subdivided as: fixed costs, variable costs and semi-variable costs. Fixed costs remain constant irrespective of changes in production. An increase or decrease in volume of production will not influence fixed costs.

Variable costs, on the other hand, vary in direct proportion to change in production. Semi-variable costs remain constant for a period and then become variable for a short period. These costs change with the change in output but not in the same proportion.

The first concern of a finance manager will be to recover all costs. He will aspire to achieve break-even point at the earliest. It is a point of no-profit no-loss. Any production beyond break-even point will bring profits to the concern.

The volume of sales, to earn a desired profit, can also be ascertained. This analysis is very helpful in deciding the volume of output or sales. The knowledge of cost-volume profit analysis is essential for taking important decisions about production and profits.

Financial Management: Functional Area # 5.

Capital Budgeting:

Capital budgeting is the process of making investment decisions in capital expenditures. It is an expenditure the benefits of which are expected to be received over a period of time exceeding one year. It is an expenditure incurred for acquiring or improving the fixed assets, the benefits of which are expected to be received over a number of years in future.

Capital budgeting decisions are vital to any organisation. An unsound investment decision may prove to be fatal for the very existence of the concern.

The crux of capital budgeting is the allocation of available resources to various proposals. The crucial factor which influences the capital budgeting decision is the profitability of the prospective investment.

ADVERTISEMENTS:

For making correct capital budgeting decisions, the knowledge of its techniques is essential. A number of methods like payback period method, rate of return method, net present value method, internal rate of return method and profitability index method may be used for making capital budgeting decisions.

Financial Management: Functional Area # 6.

Working Capital Management:

Working capital is the life blood and nerve centre of a business. Just as circulation of blood is essential in the human body for maintaining life, working capital is essential to maintain the smooth running of business. No business can run successfully without an adequate amount of working capital.

Working capital refers to that part of the firm’s capital which is required for financing short- term or current assets such as cash, receivables and inventories. It is essential to maintain a proper level of these assets. Finance manager is required to determine the quantum of such assets. Cash is required to meet day-to-day needs and purchase inventories etc.

ADVERTISEMENTS:

The scarcity of cash may adversely affect the reputation of a concern. The receivables management is related to the volume of production and sales. For increasing sales, there may be a need to give more credit facilities. Though sales may go up but the risk of bad debts and cost involved in it may have to be weighed against the benefits.

Inventory control is also an important factor in working capital management. The inadequacy of inventory may cause delays or stoppages of work. Excess inventory, on the other hand, may result in blocking of money in stocks, more costs in stock maintaining etc. Proper management of working capital is an important area of financial management.

Financial Management: Functional Area # 7.

Profit Planning and Control:

Profit planning and control is an important responsibility of the financial manager. Profit maximisation is, generally, considered to be an important objective of a business. Profit is also used as a tool for evaluating the performance of management. Profit is determined by the volume of revenue and expenditure. Revenue may accrue from sales, investments in outside securities or income from other sources.

ADVERTISEMENTS:

The expenditures may include manufacturing costs, trading expenses, office and administrative expenses, selling and distribution expenses and financial costs. The excess of revenue over expenditure determines the amount of profit.

Profit planning and control directly influence the declaration of dividend, creation of surpluses, taxation etc. Break-even analysis and cost-volume-pro fit relationship are some of the tools used in profit planning and control.

Financial Management: Functional Area # 8.

Dividend Policy:

Dividend is the reward of the shareholders for investments made by them in the shares of the company. The investors are interested in earning the maximum return on their investments whereas management wants to retain profits for further financing. These contradictory aims will have to be reconciled in the interests of shareholders and the company.

The company should distribute a reasonable amount as dividends to its members and retain the rest for its growth and survival. A dividend policy is influenced by a number of factors such as magnitude and trend of earnings, desire and type of shareholders, future requirements of the company, government’s economic policy, taxation policy, etc.

Dividend policy is an important area of financial management because the interests of the shareholders and the needs of the company are directly related to it.