Underwriting of capital issues in India has become very popular in recent years but its growth had been very slow in the initial years as compared to the developed countries like U.S.A. and U.K. Securities were underwritten for the first time in U.S.A. in the year 1860 and it was only in 1900 that English Companies Act legalised the payment of underwriting commission.

Underwriting of securities, in India, had its beginning in 1912 when a firm of stock brokers named M/ s Batliwala and Kami underwrote the shares of the Central India Spinning and Weaving Co. Ltd. But, the availability and use of underwriting services became significant in India only after 1960.

In the earlier period, underwriting was not done in the real sense of undertaking guarantee for taking up the unsubscribed shares; it was adopted merely as a device to pay commission to some parties. But, now underwriting provides genuine support to the issues of capital.

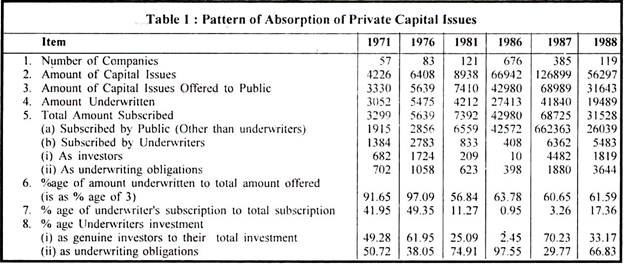

Reports, available indicate that proportion of issues underwritten in India was 31.8% in 1956.91% in 1961, 98.10% in 1966 and 89.3% in 1970. Table prepared from the RBI, Report on Currency and Finance, 1988- 89 reveals that proportion of private capital issues underwritten was 91.65% in 1971,97.09% in 1976, 56.84% in 1981, 63.78% in 1986, 60.65% in 1987 and 61.59% in 1988.

ADVERTISEMENTS:

We can also make analysis from the Table about the, total investment made by underwriters in the capital issues during this period as investors and as underwriting obligations. The proportion of amount underwritten which devolves on underwriters indicates the public response to new capital issues.

The table reveals that underwriter’s subscription in capital issues out of total amount subscribed was 41.95% in 1971, 49.35% in 1976, 11.27% in 1981, 0.95% in 1986, 3.26% in 1987 and 17.36% in 1988. Another important point revealed is that underwriters have subscribed not only as underwriters obligations but also as genuine investors.

The percentage of genuine investment by underwriters (out of their subscription) has been 49.28 in 1971, 61.95 in 1976, 25.09 inl981, 2.45 in 1986, 70.23in 1987 and 33.17 in 1988. The balance of underwriter’s subscription has been towards meeting underwriting obligations which was 50.72 in 1971, 30.05 in 1976, 74.91 in 1981, 97.55 in 1986, 29.77 in 1987 and 66.83 in 1988.

ADVERTISEMENTS:

The Govt. of India had set up the Securities and Exchange Board of India (SEBI) in April 1988 to control and regulate the securities market and to promote its healthy growth.