Some of the frequently asked exam questions on value management and corporate governance are as follows:

Q.1. Explain the term ‘MVA’ in the context of value-based management.

Ans. MVA (known as Market Value Added) is an important indicator, for a listed company, for value creation. If the total market value of a company is more than the amount of capital invested, the company is said to have created shareholder value over a period of time.

Mathematically,

ADVERTISEMENTS:

MVA = (Market Value of Equity + Market value of Debt) – (Book Value of Equity + Book value of Debt). Assuming that market value and book value of Debt is the same, MVA = (Market value of Equity) – (Book value of Debt).

The level of rate of return compared to the cost of capital determines the positive or negative MVA. All this applies to EVA (Economic Value Added). Thus, MVA is nothing other than ‘Present Value of all future EVAs’. And so,

Market Value of Equity = Book Value of Equity + P.V. of all future EVAs.

Q.2. Discuss the combined effect of EVA and MVA which give valuable insights to the management for a corpotare enterprise.

ADVERTISEMENTS:

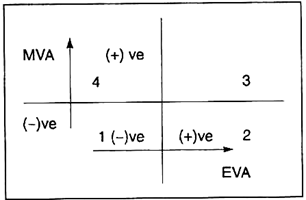

Ans. A corporate, based on both EVA and MVA parameters, can fall in any of the following quadrants.

An organisation falling under the 3rd Quadrant (+ MVA & + EVA) is the best type.

An organisation lying in the 4th Quadrant (+ MVA & – EVA) denotes a company having long-term prospects but with immediate or short-term problem in terms of financial decision making. A new company with high capital investment or a new venture like a purely internet-driven company is likely to have this type of situation.

ADVERTISEMENTS:

The warning signal is that such a venture needs to improve its financial decision process in future in a more prudent manner so that incremental return on future investment is more than the marginal cost of capital.

An organisation lying in the 2nd Quadrant (- MVA & + EVA) denotes a forewarning for a company for an impending danger. The situation signals a company to come out of the industry that is perceived to be stagnant or withering.

Lastly, an organisation lying in the 1st Quadrant (- MVA & – EVA) clearly faces its impending failure.