Here is an essay on ‘Risk Management’ for class 11 and 12. Find paragraphs, long and short essays on ‘Risk Management’ especially written for school and college students.

Introduction to Risk Management:

“The concept of risk management is neither concise nor precise. It is amorphous and untidy, wrapped in uncertainty and difficult to unwrap”.

Everyone considers risk as unpleasant and undesirable. The Oxford Dictionary defines risk as “Chance or possibility of danger, loss, injury or other adverse consequence”. But its meaning is different for an economist and for whom the risk means actual outcome of an action being different from the expected outcome and it can be either adverse or advantageous. He always links risk with return.

It is a tradeoff between risk and return. It is generally understood that higher the risk, higher the return and lower the risk lower the return. Low risk activities or financial instrument may be safe, but generate low income. In this book we deal mainly with financial risk resulting in loss of money, property, reputation etc., and the ways and means to reduce its adverse effects.

ADVERTISEMENTS:

People for various reasons differ in their attitude and approach towards risk. The propensity to take risk, otherwise known as risk appetite, may be high for some, average or low for some others. One important issue is whether the society or the government can leave the matter to the individual to take risk and expose one-self to the risks.

The answer is yes and no. The governments of most countries have made laws and regulations on standard accounting practices, transparency, disclosure and also imposed legal requirements or restrictions but did not curb individual’s freedom to take risk.

Opportunities and Risk:

Life is full of opportunities, but also fraught with full of risks. One cannot take advantage of opportunities without facing certain risks. That is the fundamental truth and reality. In fact, people manoeuvre through life in the world of manifold risks. Under the pressures of modern life style, a risk free environment seems to be impossible.

The work place, particularly the factory is beset with various risk factors. Even the well protected homes are not free of risks. There is a need to continuously evaluate such risk exposures to individuals as well as to industrial and commercial enterprises, likelihood or probability of adverse consequences to life, money, assets and manage them to avoid or minimize the effects.

Risk Propensity:

ADVERTISEMENTS:

There are wide variations in people’s response to risk. There are some who are adventurous and wantonly assume risk and take high risk activities and occupations. On the other hand, there are some others who rarely venture out of their comfort zone. There are also persons who are afraid, but willing to take risk and go along, if there are enough safeguards.

Risk, Peril, Hazard and Loss:

The term risk is generally used to refer to a situation where the outcome is uncertain and there is a possibility of loss. The loss is random in nature. The loss occurs by chance. It may happen to any person and property. It may or may not be caused intentionally. Peril is the event like fire, flood, and earthquake which cause economic loss.

Hazard increases the risk. Hazard can be physical or moral, physical hazard relates to insured property (fragile, combustible) and moral hazard relate to insured person (Character, Habit). The uncertainty about its happening, its frequency and severity is referred as risk. Thus risk lies in one’s inability to accurately predict the effects of future events.

Risk Classification:

Risks are classified according to their origin and consequences. Some are predictable and others are unpredictable, some are preventable and others are unpreventable. They can be further classified as pure risk and speculative risk.

ADVERTISEMENTS:

a. Personal Risk:

It is the risk of death, illness, accident, disability, reduced income on retirement, unemployment etc. affecting the individuals.

b. Property Risk:

The risk of loss in the value of assets or fall in income due to physical damage, fire, theft, natural disasters and destruction of property.

ADVERTISEMENTS:

c. Liability Risk:

The risk of legal liability for damages to customers, suppliers, and vendors including the risk relating to compensation payable to employees for injuries and other harm suffered in the work place.

d. Fundamental Risks:

They are impersonal in nature. They are ever present in the society and economy and they are beyond the control of individual efforts. Their effect is all pervasive and usually felt by a number of people (Example: Earthquakes, Tsunami, war, inflation, mass unemployment).

ADVERTISEMENTS:

e. Particular Risk:

It has the origin in individual events which can be partially or fully controlled. It occurs due to the action of an individual. (Example: crossing a busy road, running on slippery ground).

Pure Risk and Speculative Risk:

Pure risks are associated with uncertainties which may cause loss. In a pure risk situation, either a loss occurs or no loss occurs. There is no possibility of gain. The uncertainties may be of the perils like fire, flood, theft, accident etc.

In speculative risk there is possibility of profit or loss.

ADVERTISEMENTS:

In fact, there are three possible outcomes:

(1) Loss,

(2) Gain and

(3) No loss no gain (Example: investing in shares, betting in horse race).

ADVERTISEMENTS:

Pure risks are covered by insurance, but speculative risk are not insurable.

Personal risks affect the individuals physically, mentally or financially. Property risks affect properties of individuals, institutions or business enterprises. Liability risk affect individual or institution or business enterprise. It is mostly legal in nature, although it can also be on moral grounds. In all these cases the risks and consequent loss is quantifiable in financial terms. But psychological sufferings are not quantifiable in money.

Impact of Risk:

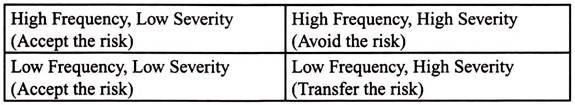

Risks vary in terms of frequency and severity. When the risk is of high frequency and low severity, the element of uncertainty is not there, and the risk can be borne by the individual or the enterprise as the losses are small. When the risk is characterized by high frequency and high severity, the extent of uncertainty is removed, and because of high severity, the individual or the company will suffer huge loss and therefore should take every possible steps to avoid such a risk or seek protection.

When the risk is of low frequency and low severity the individual or the company can bear the risk as the loss will be small. When the risk is of low frequency but high severity, the individual or an enterprise will be unable to bear the consequences. The unpredictability is another difficulty and hence the risk has to be transferred to an insurer. Insurance is the most appropriate response in those situations.

To summarize:

Risk Management:

Risk management means a systematic and logical approach in operations with a view to minimize and mitigate the impact of risk which is fundamentally different from avoiding it totally.

ADVERTISEMENTS:

The strategies involve identification, analysis and control of risks that threaten a person or the property or earning capacity of an enterprise. The importance of Risk Management has been recognized by many organizations and they employ risk managers with specific task of managing the risk.

Risk management process involves the following important steps:

a. Risk Identification

b. Risk Analysis

c. Risk Assessment

ADVERTISEMENTS:

d. Risk Measurement

e. Risk Prevention

f. Risk Reduction

g. Risk Transfer

h. Risk Retention

i. Risk Avoidance

ADVERTISEMENTS:

a. Risk Identification- Every activity is fraught with one or more risks. Identifying those risks, probability of occurrence, and the consequences is risk identification.

b. Risk Analysis means analyzing the risks in terms of their frequency and severity of losses and their impact over time. The losses may be damages to property or person. Loss may arise out of inability to run the business, unexpected legal liability, financial loss due to default of debtors, loss or problems arising out of sudden death of key personnel or disability arising out of injury, sickness, unhealthy competition, new technology etc.

c. Risk Assessment takes into account the extent of risk, scope of loss in terms of men, material and money and duration of impact which can be temporary or permanent, short term or long term.

d. Risk Measurement is the act of determining the extent of loss in terms of financial and non-financial yardstick.

e. Risk Prevention is done by developing appropriate mechanism to eliminate or minimize losses. Here, the cost of control measures should not be more than the potential loss that can occur from the risk.

f. Risk Reduction is thought of when it cannot be prevented. It includes strategies to reduce the possibility of risk as well as lowering the potential loss. For example taking additional safety and preventive measures, to reduce fire accidents by installing fire extinguishers. In order to reduce the impact of risk of financial loss many finance managers hedge the risk through appropriate derivative instruments.

ADVERTISEMENTS:

g. Risk Transfer means transferring the risky work and the probable loss to someone else. The most common method of risk transfer is out-sourcing the risky job. Taking insurance cover is another important method.

h. Risk Retention involves retaining the risk with one-self and dealing with it. Considering the level of the risk, its probability and severity, a conscious decision is taken to create a fund and bear the losses. It is the easiest and cheapest way to deal with small losses and avoid costly and time consuming legal procedures in claim settlements.

i. Risk Avoidance means eliminating the risk by avoiding the processes or activities which may cause the risk. For example; if a person does not drive a car the possibility of motor car accident can be eliminated. But in the day to day social or business life it is not always possible to avoid the risk as it will curtail smooth flow of activities and progress. So the method has its own limitations in risk management.

Banking Business Risks:

When we talk of financial risk it is pertinent to understand and appreciate the role of financial market players and the risks they are exposed to. The major players in the financial market are commercial banks, insurance companies and investment banks.

Major risks in banking business are:

a. Liquidity Risk

ADVERTISEMENTS:

b. Interest Rate Risk

c. Market Risk

d. Credit Risk or Default Risk

e. Asset-Liability Mismatch Risk

f. Legal Regulatory Risk

g. Operational Risks

h. Currency Risk

i. Counter Party Risk

j. Country Risk

a. Liquidity Risk:

Liquidity Risk is defined as the inability to meet cash payment obligations. Liquidity risk arises from acquiring long-term assets (loans and bonds) out of short-term funds (deposits). Liquidity risk management is crucial for banks. Banks have no alternative but to lend long term with short term deposits and borrowings.

The ability to manage the mismatch without serious cash crunch is essential, failing which it may cause run on the bank. In other words, if a bank delays or defaults in its payments, the customers will turn panicky and flock the bank in large numbers to take away their money, thus deepening the crisis and ultimately leading to closure of the bank. Ability to raise resources at short notice reduces the intensity of liquidity risk.

b. Interest Rate Risk:

Interest Rate Risk is the negative impact on the bank’s financial dealings and earnings on account of adverse movements in interest rates. Interest rate risk refers to potential impact on net interest income (i.e., difference between interest paid on deposits and the interest earned on loans) caused by unexpected changes in interest rates.

It is important to note that it is the market which determines the interest rate and not the individual bank or the Central Bank of the country who only responds appropriately to the changes in order to achieve the desired results. In a rising interest rate scenario, interest rate on loans may rise at a particular scale (say on an average of 1%) against the increase in interest rate on deposits (say on an average of 1.5%) resulting in adverse variation in net interest income.

The loan portfolio in banks is funded out of a composite portfolio of short term borrowings and deposits and therefore, causes considerable degree of maturity risk and interest rate risk. Interest rate risk affects in many different ways.

Its impact may be on the earnings of the bank or on the market value of the bank’s assets or both. The problem gets more complicated by application of fixed rates on some and floating rates on other assets (loans) and liabilities (deposits).

c. Market Risk:

Market risk is the risk of adverse changes of the interest rate and the mark to market value (i.e. Market Price) of the securities, equities, commodities and currencies due to market movements. Market risk is also referred to as Price Risk.

In the financial market, bond prices and coupon rates are inversely related. It means when the interest rate goes up the market value of the bonds go down and vice versa. Marketability risk is the risk of assets not being readily saleable in the market.

d. Credit or Default Risk:

Credit Risk is the possibility of a bank borrower or the guarantor failing to meet the repayment obligations in accordance with agreed terms. In the banks the largest and most obvious source of risk is credit risk consisting of unpaid loans and obligations.

e. Asset-Liability Mismatch Risk:

The assets, i.e. loans and investments are long term in nature. They are practically not realizable at short notice. The resources for lending and investments are from deposits and borrowing which are largely short-term in nature.

The mismatch is inherent risk in banks. An intelligent forecast of income on assets and expenditure on liabilities, maturity period for assets and liabilities and the consequent future cash inflow and outflow and the arrangement to raise cash at short notice are the ways to manage asset-liability mismatch.

f. Legal and Regulatory Risk:

It arises out of non-compliance or violations of prevailing laws and regulations of the country. Ignorance of the law is not an excuse for such lapses.

g. Operational Risk:

It consists of several other risks not covered by the risks detailed above. Operational risk is the risk of loss resulting from inadequate or failed internal processes, people and systems or caused by external events. Operational risk may loosely be defined as risks which are not categorized as market or credit risk. Scope of operational risk is very wide. It includes fraud risk, communication risk, documentation risk, competence risk, external events risk, etc.

h. Currency Risk:

Currency risk is the risk that a bank may suffer as a result of adverse exchange rate movements between two currencies. The strength of domestic currency depends on the volume and nature of country’s foreign trade and economic status of the country.

While to some extent each country maintains its currency value through certain measures, market forces and the demand and supply positions determine the ultimate rate of exchange. Most banks hold foreign currencies, and also assets denominated in foreign currency and therefore suffer revenue as well as asset loss, when there is adverse change in exchange rate.

i. Counterparty Risk:

This is a variant of credit risk and is related to non-performance of the customers due to counterparties (usually trading members in stock market/derivatives trade) refusal and/or inability to perform. The counterparty risk is generally viewed as a financial risk associated with trading rather than credit risk.

j. Country Risk:

This is also a type of credit risk where non-performance of a borrower or counterparty arises due to constraints or restrictions imposed by the government of his country. Here reason for non-performance is external on which the borrower or the counterparty has no control.

Risk Management in Banks:

Management of risks involve following five steps:

a. Risk Identification

b. Risk Measurement

c. Risk Pricing

d. Risk Monitoring and Control

e. Risk Mitigation

a. Risk Identification:

Nearly all transactions undertaken by banks would have one or more risks i.e., liquidity risk, interest risk, market risk, default or credit risk, operational risk, etc. with manifestations in different dimensions. In essence, risk identification consists of identifying various risks associated with the transaction and examining impact on the portfolio and capital requirements.

b. Risk Measurement:

It is not an easy job but it still can be done based on probability analysis and past experience. It may be an approximation. But still a valuable tool for risk management. It is essential that the assumptions made in measuring the risk are consistent and practical.

c. Risk Pricing:

Risks in banking transactions impact the banks in several ways. Firstly, banks have to maintain capital based on risk weight as per regulatory requirements. The capital required will cost the bank. Secondly, there is a probability of loss associated with risks. They have to be factored into pricing. In other words, pricing, should take into account cost of funds, operating expenses, loss probabilities and capital cost.

d & e. Monitoring, Control and Risk Mitigation:

All the banks have risk management policy, risk management committee and risk managers to effectively monitor, control and mitigate the risks. However, the responsibilities are not confined to top level but extends to everyone in the bank at various levels and positions and to this end the staff are to be informed, educated, trained and guided.

Derivative Contract:

A derivative contract is derived from or arise out of another contract. Say Mr. A from India is importing certain goods from B in USA. While A’s cost is worked out in rupee terms, he will have to make payment to B in Dollars. The main contract is import of goods from B. The payment for the goods will have to be made in US dollars. There is always fluctuations in the rupee dollar rate.

While on the date of decision to import the currency rate may be Rs.50 per dollar and at the time of actual import the rate may change to Rs.60 per dollar. Consequently import cost will group. In order to avoid this adverse development Mr. A will have enter into another contract (derivative contract) to buy US dollar for delivery at a particular rate in future at Rs.50 per dollar.

Since no one will know with certainty the rupee dollar rate on a future date such contract is the only way to ensure cost stability. Here the second contract to buy dollar on a future date at Rs.50 is a derivative contract. Please note that if another a person who has no need to meet any commitment but trade in currency to take advantage of uncertainty in rate and make profit such contract is a speculative contract and not a derivative contract.

Derivatives for Risk Mitigation:

Derivatives are meant to mitigate or contain the risk in the original transaction. This process is known as hedging. Securitization, particularly without recourse is a risk mitigation measure.

However, derivatives are somewhat complex contracts. Imperfect understanding may cause loss instead of protection. Certain banks trade in derivatives in a limited way. Derivatives trade with speculative motive is risky. Derivative risk can be classified as credit risk, market risk and operational risk.

Derivative credit risks are generated by default in a contract by the counterparty or an unanticipated change in exposure caused by variations in market prices of underlying instruments on which derivative returns depend.

Derivative market risks are the risks of potential losses resulting from liquidity crunch, payment-system breakdowns on account of unusual price changes at the time of settlement or cross-market spillover effects.

Derivative operational risks are the risks owing to the possibility of misguided supervision and lack of oversight of derivatives holdings and trading by bank managers. More importantly it is lack of separation of trading desk and back office desk.

As the transactions are not reflected in the balance sheet the customers and others who deal with the bank may be unaware of large and risky exposure. Another risk faced by banks is miss-selling of derivatives which may result in claims against the banks by clients. Securitization, particularly without recourse is a risk mitigation measure. Credit default swap (CDS) is an instrument to protect the bank against loan default. R.B.I, has issued guidelines on CDS.

Risk Affecting Insurance Companies:

Important risks faced by insurance companies are adverse selection, moral hazard, natural calamities (catastrophe risk) and pending claims on reinsurance companies and investment risk.

Adverse selection means insuring a person or property with high risk or unworthy of being insured.

Moral hazard is caused when the applicant for insurance lacks honesty, integrity or manipulative in nature, or given to unhealthy or hazardous habits.

Natural calamities are generally known as act of god like flood, cyclone, earth-quake, tsunami etc. It is termed as catastrophe risk.

There is always delay or chance of rejection of reinsurance claims. Reinsurance companies may face solvency problem if not bankruptcy.

Investment risks portend serious consequences. Investment comes out of policy holders money. Insurance companies ability to pay claims, meet operating expenses and declare profit depends on investment income. Investments carry market risk, credit risk, interest risk, operation risk and other risks usually faced by commercial banks.

Insurance Risk Management:

(1) Right Selection:

Underwritings should focus more on right selection of risks.

(2) Diversification:

Covering large number of prospects, in a very wide area reduces underwriting risk due to law of average.

(3) Products:

Introduction of multiple products is also a risk management technique.

(4) Reinsurance:

While the insurance companies have trained and experienced personnel, well-laid systems and procedure to underwrite, they still suffer from lack of full information, misleading information, fraudulent act etc. In the circumstances they, in addition to careful selection and processing of insurance proposals, resort to reinsurance. It is a method of insuring the insurance company’s risks.

(5) Investment Policy:

Since a substantial part of company revenue and profit flow from investments high risk investments should be avoided. As the money belongs to the policy holders a prudent investment policy is essential.

Risk Affecting Stock Market Operations:

The risk in stock market operation is the volatility of stock prices. The players in stock markets are stock exchanges, share brokers and investors. The stock exchange is only a facilitator and ensures orderly stock market operations. The share brokers are the intermediaries, helping the investor in the investment of their savings and help the corporates in raising resources.

The investors are those who stake their money and take risk. But in view of volume of transactions, volatile nature of stock prices, speculative activities and greedy corporates, all the three viz., stock exchange, broker and investor suffer the risks, although investor is the worst affected.

Risk Affecting Customers of Bank and Insurance Companies and Investors:

The common man, whether a bank customer, insurance policy holder or investor in stock market suffers a number of financial risks.

(1) Failure of bank or insurance company.

(2) Delay in lending by the bank or executing other transactions and the consequent financial or opportunity loss.

(3) Rejection of insurance claims in part or in full.

(4) Fall in the market price of stocks/shares.

(5) Fraud, theft and malpractices in the bank, insurance company or stock market.

(6) Person without knowledge and understanding of the process or complexities of derivatives being tempted to enter derivative trade.

(7) Miss-selling of insurance policies (say unit linked policy to risk averse person).