Here is an essay on the ‘Financial Services in India’ for class 8, 9, 10, 11 and 12. Find paragraphs, long and short essays on the ‘Financial Services in India’ especially written for school and college students.

Financial Services in India

Essay Contents:

- Essay on Financial Intermediation

- Essay on Non-Recourse Financing

- Essay on Off-Balance Sheet Financing

- Essay on Special Purpose Vehicle (SPV)

- Essay on Takeout Financing

- Essay on Reverse Mortgage

- Essay on Consortium Lending

- Essay on Bridge Loans

- Essay on Credit Rating

- Essay on Merchant Banking

- Essay on Loan Syndication

- Essay on Venture Capital

- Essay on Private Equity (PE)

- Essay on Meaning and Definition of Depositories

- Essay on Depository Participant (DP)

- Essay on Scripless Trading System

- Essay on Physical and Dematerialized Share Trading

- Essay on Bank Account and Depository Account

- Essay on Credit Cards

- Essay on Refinancing

- Essay on SIDBI

- Essay on NBFCs

1. Essay on Financial Intermediation:

ADVERTISEMENTS:

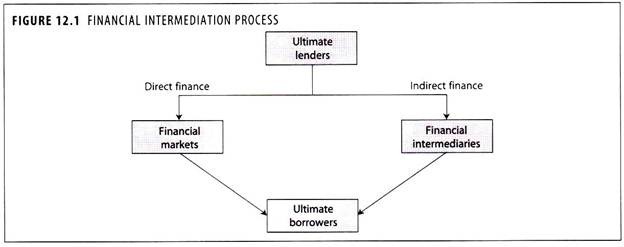

It is a sort of indirect financing in which savers deposit funds with financial institutions rather than directly buying bonds or mortgages and the financial institutions, in turn, lend to the ultimate borrowers.

Financial intermediaries are in a better position than individuals to bear and spread the risks of primary security ownership.

Because of their large size, intermediaries can diversify their portfolios and minimize the risk involved in holding any one security.

The commercial banks, financial institutions, finance and investment companies, insurance companies, unit trusts, pension funds etc., are the examples for financial intermediation.

ADVERTISEMENTS:

Financial dis-intermediation is the reverse where savers take their funds out of financial institutions and buy the primary securities themselves.

2. Essay on Non-Recourse Financing:

Traditionally, the debt component of the standard project finance package has been of the full-recourse variety.

ADVERTISEMENTS:

The Development Finance Institution have had full recourse to even non-project related assets, as finance is extended either on the basis of the overall strength of the balance sheet of the company, or on the basis of the guarantees of other group companies.

Under non-recourse financing a loan whose servicing is dependent solely on the profitability of the underlying project.

Sophisticated lenders have moved away from such inefficient modes of lending.

Global best practices require the extension of project finance largely on a non-recourse basis.

ADVERTISEMENTS:

And much of the external commercial borrowings by Indian corporate is in this form. The servicing and repayment of a non-recourse loan is solely dependent on the profitability of the underlying project.

Advantages:

1. The merits of the project, rather than the creditworthiness of the borrower, will determine the cost of capital.

2. Non-recourse financing translates into off-balance sheet financing for the parent company. Not only does this enhance the parent firm’s borrowing capacity, it also allocates project specific risks to parties that are better equipped, or more willing, to manage such risks.

ADVERTISEMENTS:

ADVERTISEMENTS:

3. Essay on Off-Balance Sheet Financing:

The off-balance sheet financing is defined as “the funding or refinancing of a company’s operations in such a way that, under legal and existing accounting conventions, some or all of the finance may not be shown on its balance sheet.”

It is described as the descriptive phrase for all arrangements where strict recognition of legal aspects of the individual contract results in the exclusion of liabilities and associated assets from the balance sheet.

Many accountants and financial analysts, consider off-balance sheet financing to be undesirable because under such circumstances, the substance of the transaction is ignored.

ADVERTISEMENTS:

The required disclosures for companies that use off-balance sheet financing have been in different forms and schemes.

There are a variety of reasons why companies are induced to make complex arrangements for keeping finance off the balance sheet.

Keeping debt-equity ratio in the line of expectations is one of the important motivations in off-balance sheet financing.

4. Essay on Special Purpose Vehicle (SPV):

ADVERTISEMENTS:

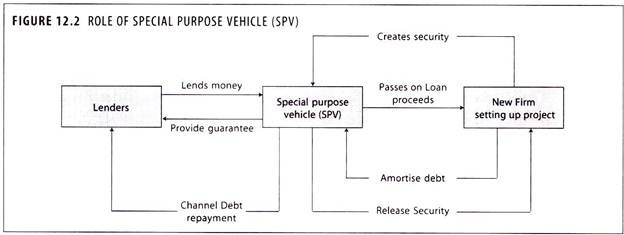

A SPV is a company set up (or acquired) as a ‘shell company’ which does not trade, but which borrows money and passes it on to another company to use.

A business can make use of a SPV by guaranteeing the loans which it takes out and controlling the companies which then use the funds. Often this will involve the use of associated companies.

The SPVs are created for the special purpose of raising funds from the market for specific projects and are structured in a special manner.

SPV is used to raise money in the market on behalf of Development Institutions, Corporate and State Governments.

In case of Development Institutions and Corporate, SPV is often associated with asset securitization and in the case of State Governments it is used as a vehicle to raise money from a large basket of investors.

ADVERTISEMENTS:

Advantages:

(i) Greater security for lenders and improves credit rating.

(ii) Lowers the cost of capital.

(iii) Better management of debt repayment.

(iv) Enables new ventures to raise funds.

Disadvantages:

ADVERTISEMENTS:

(i) Less control over cash flows generated by project.

(ii) Tax treatment of SPV still unclear.

(iii) Administration fees can be high.

(iv) Requires intensive monitoring by SPV.

5. Essay on Takeout Financing:

Commercial banks mobilize deposits for short durations. Inevitably it cannot lend for long-term since it would create problem of ‘asset-liability match’.

ADVERTISEMENTS:

Infrastructure projects essentially require long-term funds which commercial banks in the past were finding it difficult to supply funds because of asset-liability mismatch.

The innovation in this context was takeout financing which consists a few banks joining hands in a manner of consortium and taking over the loan portfolio in turns.

For example, SBI, ICICI and HDFC can finance an infrastructure project requiring a ten year loan by each one taking turns to lend for three years and four months each. This arrangement will fulfill the object of all concerned.

6. Essay on Reverse Mortgage:

It is not a conventional loan product. It is a loan product where the senior citizen mortgages his/her own residential property to a primary lending institution such as scheduled commercial bank or housing finance company and gets entitled for the payment of a loan either for a fixed period or on a lump sum basis, or by a line of credit, or a combination of all.

This is dependent on three major parameters viz., age of the borrower, value of the property and interest rates prevailing in the economy.

ADVERTISEMENTS:

The interplay of all these factors determines the quantum of reverse mortgage loan and eligibility for the loan.

With increase in the age of the borrower or the value of the property, the senior citizen will be entitled for a higher loan.

For a relatively younger senior citizen, or with the fall in value of the property, it will be vice versa.

For a lender, the main risk is longevity.

The longer a person lives, the more difficult it will be for the financial institution as it will have to source- out long-term funds to match its assets.

At the same time, the property price fluctuation risk will be another major risk for the lender. In addition to this there is a legal risk i.e. the risk of not being able to bring the property to sale.

ADVERTISEMENTS:

Reverse mortgage is a new avenue for the cash poor but asset rich senior citizens to mortgage their equity in residential property to meet their increased living expenses.

7. Essay on Consortium Lending:

When the individual bank finds it difficult to meet the huge financial requirements of a borrower, it gives rise to multiple banking which may be in the form of ‘consortium lending’.

When the financial needs of a single unit are more than a single bank can cater the needs, then more than one bank come together to finance the unit jointly spreading the risk as well as sharing the responsibilities of monitoring and finance.

The arrangement is called the ‘consortium lending’ and it enables the industrial units to mobilize large funds for its operations. This is generally formalized by a consortium agreement.

8. Essay on Bridge Loans:

Bridge loans are available from the banks and financial institutions when the source and timing of the funds to be raised is known with certainty.

When there is a time gap for access of funds, then for speeding up of implementation of the projects, bridge loans will be provided, such loans are repaid immediately after the raising of funds.

Bridge loans are normally provided by the commercial banks to the corporate for a short period until the disbursement of long-term loans, which are already sanctioned by the financial institutions but disbursal of loan amount takes time.

In case of companies raising funds in the primary capital market, there is a time gap in between the opening of the issue and availability of funds for practical use.

In such cases also the companies may go for bridging the finance from commercial banks.

The bridge loans are temporary loans which are repaid out of the proceeds which are expected to receive.

The cost of bridge loans is normally higher than the working capital facilities provided by banks and the rate of interest is higher as compared to long-term financing.

The bridge loans are secured by having lien on the funds to be raised, hypothecation of movable assets, pledging the promoters shares, personal guarantees from directors, demand promissory notes.

9. Essay on Credit Rating:

Credit rating has assumed an important place in the modern and developed financial markets. It is a boon to the companies as well as investors.

It facilitates the company in raising funds in the capital market and helps the investors to select their risk- return trade off.

Fund procurement is one of the key functions of a business undertaking.

Among the various sources of fund, long-term debt, debentures, bonds, fixed deposit and commercial paper, besides, share capital are worth mentioning.

The issuer of these instruments approaches capital market, financial institutions and various agencies to raise necessary finance at certain terms and conditions.

As investors are concerned with the timely payment of interest and principal, credit rating indicates the creditworthiness of a borrower.

Credit rating, essentially, indicates the risk involved in a debt instrument as well as its qualities.

Higher the credit rating greater is the probability that the borrower will make timely payment of principal and interest and vice versa.

Thus, a credit rating is not a general evaluation of the issuing organization.

It essentially reflects the probability of timely repayment of principal and interest by a borrower company.

The credit rating is not a one-time evaluation of credit risk of a security. The rating agency may change the rating considering the changes periodically.

Types of Credit Rating:

Credit rating are of different types, depending upon the requirements of the rater and the rated.

The following are the common types of credit rating:

1. Bond Rating:

Rating the bonds or debt securities issued by a company, governmental or quasi- governmental body is called ‘bond rating’. This occupies the major business of credit rating agencies.

2. Equity Rating:

The rating of equity of capital market is called ‘equity rating’.

3. Commercial Paper Rating:

It is mandatory on the part of a corporate body to obtain the rating of approved credit rating agency to issue commercial paper.

4. Rating the Borrowers:

This includes rating a borrower to whom a loan/credit facility may be sanctioned.

5. Sovereign Rating:

This includes rating a country as to its creditworthiness, probability to risk etc.

Rating of Financial Services Companies:

The rating methodology for non-banking financial services companies is based on CAMEL model encompassing, Capital adequacy, Asset quality, Management, Earnings and Liquidity. The nature and accessibility of funding sources is also considered.

Benefits of Credit Rating:

The benefits to various parties concerned with credit rating are listed below:

Investors:

1. It enables the investors to get superior information at low cost.

2. It enables the investors to take calculated risk in their investments.

3. It encourages the common man to invest his savings in corporate securities and get high returns.

Corporate Borrowers:

1. It facilitates companies with good rating enter the capital market confidently and raise funds at comparatively cheaper rates.

2. It can be used as a marketing tool.

3. It facilitates foreign collaborations.

4. It encourages discipline among the corporate borrowers.

Credit Rating Companies:

The existence and development of credit rating companies largely depends upon their performance. Honest and impartial credit rating agencies would definitely thrive, as long as they sustain their credibility.

Government:

1. Fair and good ratings motivate the public to invest their savings in company shares, deposits and debentures. Thus, the idle savings of the public are channelized for productive uses.

2. It facilitates formulation of public policy guidelines on institutional investments.

3. Credit rating system plays a vital role in investor protection without casting burden for that responsibility on the government.

Limitations of Credit Rating:

1. Credit rating does not bound the investor to decide whether to hold or sell an instrument as it does not take into consideration factors such as market prices, personal risk preferences and other consideration which may influence an investment decision.

2. It does not create any fiduciary relationship between the rating agency and the user of the rating.

3. A credit rating agency does not perform an audit but relies on information provided by the issuer and collected by the analysts from different sources hence it does not guarantee the completeness or accuracy of the information on which the rating is based.

4. In determining a rating, both qualitative and quantitative analysis are employed.

5. The judgement is qualitative in nature and the role of the quantitative analysis is to help make the best possible overall qualitative judgement or opinion.

6. The reliability of the rating depends on the validity of the criteria and the quality of analysis.

7. The quality of credit rating mainly depends upon quality of the rating agency and rating elements also.

10. Essay on Merchant Banking:

A merchant bank is a bank whose function is provision of long-term equity and loan finance for industrial and other companies, particularly new securities.

Merchant banker acts as a financial intermediary in providing long-term finance to the corporate.

The merchant banks are called as ‘investment banks’ in U.S.

The activities performed by merchant bankers include the following:

(i) Management of issue of corporate securities of existing companies and newly floated companies.

(ii) Offering financial expertise in mergers, takeover, capital reorganization to corporate sectors.

(iii) Management of investment trusts.

(iv) Handling insurance business.

(v) Loan syndication and Corporate advisory services.

(vi) Portfolio management.

(vii) Custodial and Depository services.

(viii) Broking of corporate securities.

(ix) Attraction of foreign investment.

(x) Liquidity management.

(xi) Underwriting of securities.

(xii) Bill discounting.

(xiii) Lease financing.

(xiv) Arrangement of venture capital.

(xv) Acting as trustees for debentures.

(xvi) Mobilization of public deposits and managing fixed deposits etc.

The scope of merchant banking activities has been expanding in India over the years.

The recent changes in the Indian economy and financial markets has given further impetus to the faster development of the merchant banking.

Merchant bankers benefit corporate clients in a number of ways.

They help in releasing valuable management time by looking into the legal and procedural complications involved in the securities issues and raising of loans.

They also provide professionally competent advice to corporate clients.

Merchant bankers also help in cultivating investment attitude and climate as well as financial innovativeness in the individual investors as well as corporate clients.

Merchant bankers deal with individual and corporate clients.

They require a high degree of integrity, transparency and accountability in their dealings with clients.

There is a need for the prudent regulation of the merchant banking activity. SEBI has been entrusted with the task of regulating the merchant banking.

It has provided for a code of conduct, specified obligations and responsibilities and is empowered to inspect the operations of merchant bankers.

Role of Merchant Bankers in Public Issues:

Merchant bankers are specialized agencies, whose main business is to attract public money to capital issues.

They usually render the following services while acting as merchant bankers to an issue:

1. Drafting of prospectus.

2. Appointment/assisting in appointing bankers, underwriters, brokers, advertisers, printers etc.

3. Obtaining the consent of all the concerned agencies involved in the public issue.

4. Holding brokers’ conference/investors’ conference.

5. Deciding the pattern of advertising.

6. Deciding the branches where application money should be collected.

7. Obtaining consent of stock exchange(s) for deciding basis of allotment.

11. Essay on Loan Syndication:

Loan syndication refers to the services rendered by the financial service expert or firm in procurement of term loans and working capital facilities from financial institutions, banks and other financing and investment firms for its clients.

The loan syndication services are rendered by the merchant bankers, financial and management consultants etc.

The service is rendered on fee base and generally as a percentage on the loan amount syndicated.

These services are rendered for both existing companies as well as new projects.

This will save the time of the management and the promoters in raising necessary finance for the business.

The expertise of the syndicators can be used for the advantage of the concern for at a reasonable cost of raising finance.

The major activities involved in syndication of loans consists of the following:

(i) Preparation of project reports and other necessary information with the help of his client.

(ii) Scouting for location or identification of source of finance.

(iii) Short-listing the providers of funds and preliminary discussion with them about the possibilities of finance and viability of the proposal.

(iv) Selection of financial institutions for loan syndication.

(v) Preparation and filing of loan applications with the finance firms which shows interest in financing.

(vi) Submission of all necessary information for appraisal of the proposal.

(vii) Obtain in principle letter sanctioning the loan.

(viii) Getting the loan documentation completed between the lender and the borrower, and also help in creation of security for the loan.

(ix) Compliance of terms and conditions for avail of loan.

(x) Getting disbursement of loan to the client.

(xi) Ensure the clients in complying with the terms and conditions as per the loan agreement entered.

The syndicator of loan will charge his client the fee for the services rendered.

12. Essay on Venture Capital:

The venture capital can be defined as the “long-term equity investments in business which displays potential for significant growth and financial return”.

Broadly, it can be interpreted as the investment of long-term equity finance where the venture capitalist earns his return from capital gain.

The nature of financing i.e., long-term equity, implies that the investor bears the risk of venture, but would earn a return commensurate with its success.

This definition incorporates the three main features that distinguishes venture capital investment from other forms of capital investment.

They are:

(i) Supporting entrepreneurial talent by providing finance.

(ii) Providing business management skills.

(iii) A return in the form of capital gains.

Venture capital is generally regarded as a risk capital.

The venture capital investor thus looks for markets with tremendous growth potential to be exploited with entrepreneur towards a highly rewarding relationship.

To foster the growth of better technology new risky lines of business need support in the form of venture capital.

The venture capital investment is a medium term high risk investment.

The concept of venture capital has gained momentum in high risk oriented industrial wheel of the world economy during last five decades and it is of recent takeoff in the horizon of Indian financial systems.

Activities Eligible for Venture Capital Support:

In general the following activities are eligible for venture capital support:

1. Evaluation of new process or product on a commercial scale.

2. Technological up-gradation leading to lesser material consumption, cost reduction, improved international competitiveness, energy conservation and innovative indigenous technology.

3. Adoption of imported technology appropriate to Indian conditions with indigenous efforts.

4. Commercial exploitation of laboratory proven technology at recognized research laboratory and university subsequent to successful implementation of venture on pilot scale.

5. Risky ventures in technology development and long gestation technology development projects.

Stages in Venture Capital Financing:

1. The object of venture capital is to generate substantial capital appreciation through investment in early stage companies capable of achieving rapid growth.

2. Venture capital supports the early stage of a company’s life cycle.

3. However, the timing of investment may be at seed stage, early development stage or turnaround stage.

Thus, the investment may be during:

(i) Product concept to product development stage

(ii) Commercial scale implementation

(iii) Post commercialization stage.

Forms of Financial Assistance from VC Funds:

The venture capital institutions provide finance in the following forms:

1. Seed capital for industrial set ups and support a concept or idea.

2. Additional capital to new businesses at various stages of their growth.

3. Bridge finance/project financing.

4. Equity financing to management groups for taking over other companies.

5. Capital to new entrepreneurs in foreign operations.

6. Research and development financing for product development.

7. Start-up capital for initial production and marketing.

8. Development financing for facilitating public issue.

9. Acquisition or buy-out financing for acquiring another firm for further growth.

10. Turnaround financing for turning around a sick unit.

Advantages of VC Finance:

The advantages of venture finance over other forms of finance are as follows:

1. VC provides a solid capital base for future growth because it injects long-term equity finance.

2. VCs are capable of providing additional rounds of funding required for financial growth.

3. The venture capitalists act like business partners who share the rewards as well as the risks. They are rewarded by capital gain and business success.

4. The venture capitalists provide strategic, operational, tactical and financial advice to the company based on past experience with other companies in similar situations.

5. The venture capitalists have a network of contacts which helps them increase the value to the company.

6. The venture capitalists help in recruitment of the key personnel, improving relationships with international markets, co-investment with other VC firms and in decision making and facilitates additional financing.

7. In case of IPO and book building, the venture capitalists not only facilitate the company in trade sales but also play an important role in the facilitation of various trades.

13. Essay on Private Equity (PE):

PE refers to any type of equity investment in an asset in which the equity is not freely tradable on a public stock market. PE funds refer to the amount invested by the PE firms.

Normally, these funds are invested in limited partnerships or private limited companies.

PE refers to the manner in which the funds have been raised, namely on the private markets as contrasted to the public markets.

Passive institutional investors may invest in PE funds, which are in turn used by PE firms for investment in target companies.

PE investing is always through negotiated deals and, therefore, most of the PE investments are closely held in companies that have not gone public.

PE is finance for medium to long-term provided in return for an equity stake in potentially high growth unquoted companies.

PE fund managers raise money from investors with an aim of investing for the long-term in a portfolio of potentially high-growth private companies.

PE firms are going for listing to take advantage of liquidity and transparency.

The PE firms raise capital mainly from Qualified Institutional Investors such as financial institutions, pension funds, high net-worth individuals.

The institutional investors are the major investors in PE funds. Indian companies are showing interest in PE investments rather than IPO because of strict IPO norms of SEBI.

PE funds not only invest in companies, they also give strategic advice.

PE funds invest their money across the emerging sector and start-ups in different markets allowing a greater scope for higher returns.

At the same time, they are close to the promoters of the companies and have access to insider information which can prove to be profitable.

Criteria for Evaluation of Investment Proposal for PE:

The criteria for choosing Investee Company depends upon the following factors:

1. A superior business or idea.

2. Quality and depth of management.

3. Modern and robust corporate governance.

4. Promoters and their role in company’s success.

5. Management and key managerial personal.

6. Industry scenario and existing position of the company.

7. Financial performance and ratio analysis.

8. Project details.

9. Investment details.

10. Return on PE investment.

11. Exit routes available to PE investor.

Why PE Investment not Popular?

The promoters will not prefer for PE investment for the following reasons:

1. The fear of losing control over the company.

2. Fear of losing confidentiality of internal information of the company.

3. Considered as high cost option.

4. Outsiders involvement in the management is not acceptable.

5. Investor will have more interest in day-to-day operations.

14. Essay on Depositories:

The depository is an organization where the securities of a shareholder are held in the form of electronic accounts, in the same way as a bank holds money.

The depository holds electronic custody of securities and also arranges for transfer of ownership of securities on the settlement dates.

This system is known as ‘scripless trading system’.

Anybody to be eligible to provide depository services must register with SEBI.

A depository transfers securities without physically handling securities, the way a bank transfers funds without actually handling money.

Depository system is concerned with conversion of securities from physical to electronic form, settlement of trades in electronic segment, electronic transfer of ownership of shares and electronic custody of securities.

All securities in the depositories are identical in all respects and are thus fungible.

The ownership and transfer of securities take place by means of electronic book entries, avoiding the risks associated with the paper.

Depository system is not mandatory, it is optional and it is left to the investor to decide whether he wants the securities to be dematerialized.

The system results in instant transfer as compared to six to eight weeks-time under physical mode.

Depository carries out its operations through various functionaries called ‘business partners.

Electronic revolution has brought about a number of changes in the functioning of Indian capital market.

The most revolutionary change that was brought in the entire history of the Indian capital market is the introduction of depository system or otherwise it is called ‘scripless trading system’.

15. Essay on Depository Participant (DP):

A DP is an agent of the depository, and functions as the interacting medium between the Depository and the Investor.

A DP is a person registered with SEBI and must possess the requisite qualifications prescribed by the Depository of which he is a Participant.

A DP is responsible for maintaining the investor’s securities account with the Depository and handles the account in accordance with the investor’s written instructions.

A DP could be linked to a broker who deals/trades on the investors’ behalf.

A depository interfaces with market participants e.g. brokers, clearing members, and investors, through its agents called DP.

Anybody wishes to avail the services of depository has to open an account with a DP.

The process of opening a depository account is similar to that of opening a bank account.

According to SEBI regulations, financial institutions, banks, custodians, stock brokers etc. can become DPs.

A person is at liberty to choose any DP of his choice at any location to suit ones convenience.

A person is also at liberty to deal with more than one DP (similar to holding bank accounts with several banks).

Benefits from Depository System:

To the Nation:

1. Growing and more liquid capital markets to provide financing and development stemming from more efficient post-trade systems with reduced transaction costs.

2. Increase in competitiveness in the international market place and attracting investors and fund managers by complying with stipulated international standards calling for an efficient and risk-free trading environment.

3. Improved prospects for privatization of public sector units by creating a conducive environment, and Restoration of faith in the capital markets and its participants to minimize settlement risk and fraud.

4. Considerable reduction of delay in registration which can currently impact trading.

To the Investing Public:

1. Reduction of risks associated with loss, mutilation, theft and forgery of physical scrip.

2. Elimination of financial loss owing to loss of physical scrip.

3. Greater liquidity from speedier settlements and reduction of delays in registration.

4. Greater opportunities for investment offered by new instruments and services.

5. Faster receipt of benefits and rights resulting from corporate action.

6. Improved protection of shareholder’s rights resulting from more timely communications from the issuer.

7. Reduced transaction costs through greater efficiency.

8. The problem of bad delivery does not arise, since transfer deed and share certificates have been eliminated from the depository system.

9. The depository system does not have stamp duty for transfer of equity instruments and units of mutual funds.

10. The settlement cycle has reduced from 15 days to T + 2 which has enabled a faster turnover of stocks and enhanced liquidity in the hands of investors.

11. Once the securities are credited to the investor’s account on payout, investors become the legal owners of the securities.

To Issuers:

1. Up-to-date knowledge of shareholder’s names and addresses.

2. Savings in costs of new issues from reduction in printing and distribution costs.

3. Increased efficiency of registrars and transfer agents functions.

4. Better facilities for communication with shareholders, conveying benefits of corporate actions and information notices.

5. Improved ability to attract international investors without having to incur the expenditure of issuance in overseas markets.

To Securities Industry Intermediaries:

1. Less risky settlement with implementation of collateral based payment systems.

2. Greater profits from increased trading volume made possible with reduced operational cost per transaction and reduced risk.

3. Improved cash flow from not having funds tied up for long periods.

4. Elimination of forgery and counterfeit with attendant reduction in settlement risk.

5. Opportunity for development of more sophisticated custodial services which can be offered to the small investor.

6. Opportunity for development of retail brokerage business.

7. Standardized communications between depository, registrars and other intermediaries.

8. Ability to arrange pledges without movement of physical scrip and further increase overall level of trading activity, liquidity and profits.

9. Improved protection of shareholder’s rights resulting from more timely communications from the issuer.

10. Reduced transaction costs through greater efficiency.

16. Essay on Scripless Trading System:

The traditional and long prevalent system in our country that involves an enormous paper work involving share certificates in paper form and transfer deeds (physical form).

The system is not an investor friendly and therefore, a revised system is to be implemented.

The scripless trading system provides many benefits to investors, which are as follows:

(i) No bad deliveries.

(ii) Immediate transfer of shares because of no requirement of filling up transfer deeds and lodging for shares.

(iii) No stamp duty on transfer of shares.

(iv) Handling of large volumes of papers greatly reduced.

(v) Eliminates risks associated with physical certificates such as loss, theft, mutilation, forgery, fire etc.

(vi) Reduction in transaction costs.

(vii) Faster payment in case of sale of shares.

(viii) No courier/postal charges.

(ix) Dematerialization shares can be pledged/hypothecated by making an application to the DP.

17. Essay on Physical and Dematerialized Share Trading:

The major differences between physical and dematerialized share trading systems are as follows:

Physical:

1. Actual delivery of shares is to be exchanged.

2. Open delivery can be kept.

3. For sale transactions, no charges other than brokerage are levied.

4. For buy transaction, delivery is to be sent to company for registration.

5. Stamp charges @ 0.5% are levied for transfer.

6. Processing time is too long.

Dematerialized:

1. No actual delivery of shares is needed.

2. Not at all possible to keep delivery open.

3. Sale transactions are also charged.

4. No need to send the document to the company for registration.

5. No stamp charges are required for transfer.

6. Processing time is very less.

18. Essay on Bank Account and Depository Account:

The depository system enables an investor to convert his shareholdings in demat shares by opening an account with a Depository Participant (DP) which is similar to the opening of a bank account because it requires same formalities like photograph, introduction of account holder, signing, prescribed form etc.

Shares are transferred electronically between the seller, share-broker, clearinghouse and buyer by debiting the seller’s account and crediting the buyer’s depository accounts.

A depository account can be compared to a bank as follows:

Bank:

1. Functions through branches.

2. Allocates Account Number.

3. Issues account statement and pass book

4. Holds funds in accounts.

5. Transfers funds between accounts.

6. Transfer without physical handling of money.

7. Minimum balance is required.

8. Charges commission/service charges.

9. Provides interest to the Account holder.

Depositor:

1. Functions through Depository participants.

2. Allocates Client ID Number.

3. Issues account statement i.e. Statement of holding and Statement of transactions.

4. Holds securities in accounts.

5. Transfers securities between accounts.

6. Tr. without physical handling of securities.

7. Normally no minimum balance is required.

8. Depository Participant Charges:

i. Account Opening and Closing Fee.

ii. Demat and Remat Fee.

iii. Transaction Fee (Buy, sale & off market).

iv. Custody charges.

9. In future, through stock lending, it will be possible to earn income on Depository A/c.

19. Essay on Credit Cards:

The development of the credit card is probably the most significant phenomenon of the modern financial services sector.

In India credit cards are mainly issued by the public sector commercial banks and some foreign banks and private sector organizations have also issued the credit cards.

It is a natural extension of ordinary banking facilities credit card is a convenient and easy way for the everyday shopper to make his payments for all kinds of goods and services without the use of cash.

Now credit card is popular throughout all sections of the country.

There are three quite distinct parties to a credit card operation viz., card holder, the merchant and the card-issuing organization.

There is an element of free credit granted to cardholders because:

(a) Accounts are settled monthly covering purchases of goods or services since the last monthly statement, and

(b) The cardholder is allowed say, 15 days from the date of his monthly statement to settle the outstanding amount.

It follows that if a cardholder’s statement is normally prepared on say, the 15th of the month, any purchases made on 16th of the month could carry the benefit of 45 days free credit.

When a person applies for a credit card, he will be asked to supply details of his financial circumstances and, subject to satisfactory references, he will be given a card with an appropriate credit limit.

Advantages to the Cardholder:

1. A card is a convenient method of payment as an alternative to cash or cheques. It is simple to operate, convenient to carry and reasonably immune to financial loss compared with losing cash or a cheque book.

2. It is a convenient source of credit if desired, involving no formalities. Owing to the revolving nature of the credit, the customer can take advantage of it as and when he pleases, within the credit limit sanctioned.

3. It reduces the activity on the customers banking account considerably because all monthly purchases are covered by one payment.

4. It is an aid to budgeting because the cardholder can pay a fixed amount each month according to his circumstances and plan accordingly.

5. The monthly statements in narrative form are a great help to domestic and even business book keeping.

6. The acceptability of the leading cards in so many countries of the world is an aid to business and holiday travel.

Advantages to Merchants:

From the merchant’s point of view, there are a number of advantages in operating a credit card system:

1. By accepting a credit card, the merchant has a guarantee of payment and his account is immediately credited with the cleared funds on payment of the vouchers into his bank.

2. He can use the card system as an alternative to other means of allowing credit and thus avoid bad debts.

3. The acceptance of a card in lieu of cash reduces the security risk.

4. A merchant who accepts credit cards may expect to increase his turnover, as more and more people accept the practical advantages of credit cards and turn to those traders who will accept cards in settlement.

5. A credit card system permits the merchant to offer his customers the facility of taking credit without involving himself in the expense, administration or risk of setting up his own credit arrangements.

6. The merchant is able to expand his business to include overseas visitors.

7. He will also have the support of the credit card company in advertising campaigns and other promotional activities.

8. The credit cards record of purchases is a convenience for book keeping.

20. Essay on Refinancing:

The All India Financial Institutions channel the funds mobilized by them into productive avenues.

They make available funds in bigger lots to needy industrial sector.

They normally provides direct finance by way of term loans, both in rupees and foreign currencies besides providing support by way of underwriting and direct subscription to shares/debentures and in the form of deferred payment guarantees.

They also refinances term loans given by state level institutions/banks to medium scale units and rediscounts/discounts, bills of exchange and promissory notes arising out of sale/purchase of machinery and equipment.

In India IDBI and NABARD provides finance indirectly through refinancing.

21. Essay on SIDBI:

Small Industries Development Bank of India (SIDBI), a wholly owned subsidiary of Industrial Development Bank of India (IDBI), set up by an Act of Parliament, is the principal financial institution for the promotion, financing and development of industry in the small, tiny and cottage sectors and for coordinating the functions of the institutions engaged in similar activities.

It commenced its operations on April 2,1990 by taking over the outstanding portfolio and activities of IDBI pertaining to the small scale sector and has emerged, over the years as the main purveyor of credit to small, tiny and cottage sectors.

While continuing with the schemes operated by IDBI under Small Industries Development Fund (SIDF), the bank took initiatives by identifying the gaps in existing credit delivery system and devised tailor-made schemes for direct lending to small scale sector so as to supplement the efforts of Primary.

Lending Institutions (PLIs), which include State Financial Corporation (SFCs), State Industrial Development Corporation (SIDCs) (including twin function IDCs), Scheduled Commercial Banks (SCBs) both in public and private sector, State Co-operative Banks, Scheduled Urban Co-operative Banks and Regional Rural Banks (RRBs).

22. Essay on NBFCs:

The Committee on Banking Sector Reforms, popularly known as the Narasimham Committee-II, made a number of recommendations to streamline and strengthen Indian banking system. The Committee also recommended that Development Financial Institutions (DFIs), over a period of time, should convert themselves into banks and be subjected to the same discipline of regulatory and prudential norms as applicable to the commercial banks. Envisaging that there will be only two types of financial intermediaries in future, viz., commercial banks and non-banking finance companies (NBFCs), the Committee suggested that those DFIs, which do not become banks, would be categorised as NBFCs.