After reading this essay you will learn about:- 1. Introduction and Necessity of Book-Keeping 2. Definition and Systems of Book-Keeping 3. The Journal and the Ledger 4. Trial Balance 5. Trading Account 6. Financial Statement.

Contents:

- Essay on the Introduction and Necessity of Book-Keeping

- Essay on the Definition and Systems of Book-Keeping

- Essay on the The Journal and the Ledger

- Essay on the Trial Balance

- Essay on the Trading Account

- Essay on the Financial Statement

Essay # 1. Introduction and Necessity of Book-Keeping:

It is apparent that in the accounting department there is a large amount of routine work to be performed. Cash accounting must be strictly controlled and the various day books and ledgers must be entered. As the size of the business grows, no businessman can remember all his transactions and thus he realises the necessity of proper book-keeping. Book-keeping is also necessary in order to satisfy the income-tax authorities.

Proper book-keeping or properly maintained business records show:

(i) All purchases, sales and returns in the financial year.

(ii) Quantity and value of goods available with the concern.

(iii) Transactions with creditors and debtors.

(iv) Information about assets and liabilities of the concern.

(v) Profit and loss accounts.

(vi) Cash available with the concern.

(vii) The financial soundness of the concern.

Essay # 2. Definition and Systems of Book-Keeping:

Book-keeping may be defined as the art and science of recording all the dealings related to money, goods and services in a systematic manner so that any information pertaining to the business can be easily supplied to the management or the owner of the concern.

Systems of Book-Keeping:

The following two systems of book-keeping may be used:

1. Single Entry System:

Every transaction is between two persons or two concerns. Every transaction, thus, affects two accounts. Single entry system records only one side of the transaction and hence it does not provide complete information about a transaction. This system of book-keeping is not generally used.

2. Double Entry System:

Double entry system records both the sides of the transaction and thus provides complete information of the business transaction.

The two sides of a business transaction are:

(i) The credit side.

(ii) The debit side.

In double entry system, the value of an asset will appear on the left hand side and the value of liability on-the right hand side of an account.

Essay # 3. The Journal and the Ledger:

Every business transaction is recorded on the same day (it takes place) in a book called the JOURNAL. Thus, a journal is simply a chronological listing of transactions. The journal constitutes the original record of transactions. A journal records many accounts related to many persons or firms and thus it is very difficult to trace easily the accounts/transactions related to one person/firm.

From the journal, the transactions related to each person or firm are sorted out, classified, and entered in a book called LEDGER.

Thus:

(i) Ledger contains the same information (as given in journal) but properly arranged according to each person/firm it is related to.

(ii) In other words, the ledger furnishes a record of transactions grouped according to accounts. Each account reveals the effect of all transactions involving that particular item.

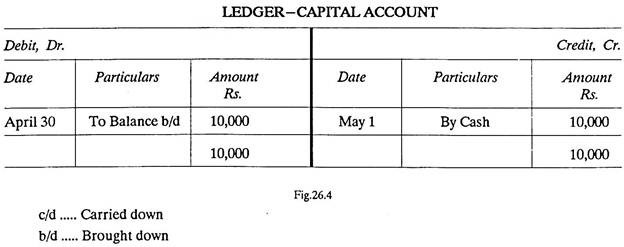

(iii) The ledger is split into two halves; the debit (Dr.) side being on the left and the credit (Cr.) side on the right.

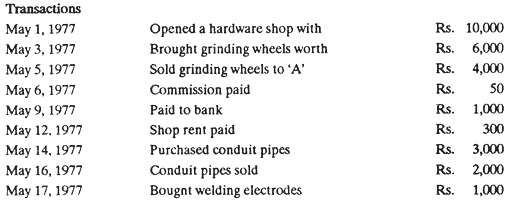

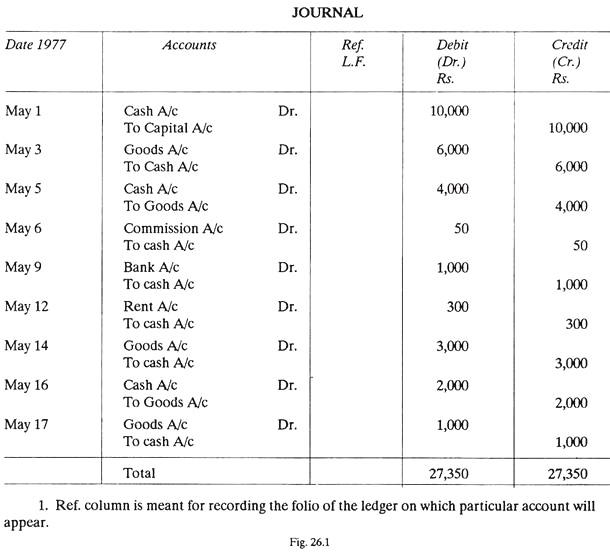

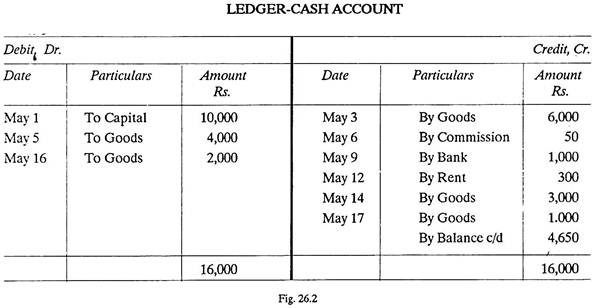

4. Fig. 26.1 and 26.2 show an extract from a journal and a Ledger respectively.

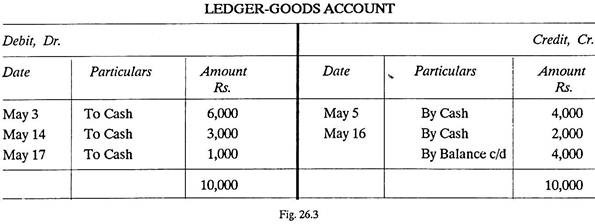

Example 1:

Record the following transactions, in a journal and then post the journal entries in the ledger of cash accounts, goods account and capital account:

Solution: (See Fig. 26.1 to 26.4):

The transactions have been recorded in the journal (refer Fig. 26.1). The next step is to transfer the amounts to the respective ledger accounts through a process known as Posting. Posting is the process of sorting and collecting the journal entries to various accounts and their recording in the respective ledger accounts. Fig. 26.2 to 26.4 show respective ledgers.

Essay # 4. Trial Balance:

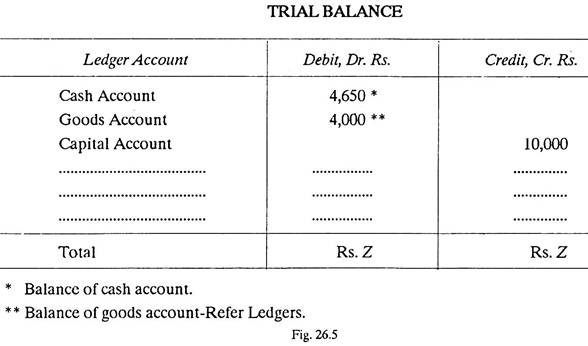

After posting all journal entries into the ledger, a statement called Trial Balance is prepared to check the accuracy of posting into the ledger. Trial balance checks the arithmetical accuracy of the entries. Trial balance is simply a list of the accounts and their balances at any given date. Trial balance is used to test the equality of balances because at any time the debits and credits should be equal in value.

Besides checking the accuracy of posting into the ledger, the trial balance prepares material for formulating financial statements such as profit and Loss Account and Balance Sheet. Fig. 26.5 shows Trial Balance prepared from the Ledgers (Fig. 26.2 to 26.4).

A trial balance discloses the following types of errors:

(i) An item posted two times.

(ii) A mistake in posting.

(iii) A mistake in addition.

(iv) An item left from being posted.

(v) Money value wrongly recorded (i.e., Rs. 160.0 in place of Rs. 1,600).

A trial balance will not disclose the following types of errors:

(i) Errors of Commission:

Errors in posting to wrong accounts or compensating errors (i.e., mistake of same amount on debit and credit side.)

(ii) Errors of Omission:

Items completely omitted from the books of account.

(iii) Errors of principle:

Errors due to lack of knowledge of accounting principles, i.e., treating revenue items as capital, etc.

Essay # 5. Trading Account:

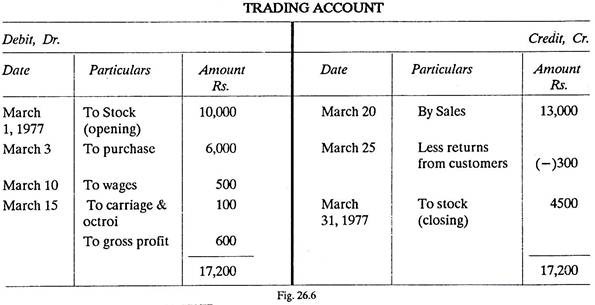

The trading account shows the gross profit or gross loss on trading for the period covered.

The trading account shows debit on the left hand side and credit on the right hand side (refer Fig.26.6). The debit side includes opening stock, the purchase, direct expenses, etc. The credit side marks sales, closing stock, etc. The difference between debit and credit sides shows either gross profit or gross loss. Fig. 26.6 illustrates trading account.

Essay # 6. Financial Statement:

Financial statement of a business enterprise constitutes the general purpose, external reports of that enterprise. Financial statements are prepared for both internal dissemination within the corporation and for external distribution to the shareholders, creditors, the government and others having an interest in the financial position of the corporation.

Financial statements have significance because:

(i) They are of interest to managers, owners, the lenders, the employees, the creditors and almost everybody who is concerned with the business.

(ii) Many business decisions are made only after consulting the financial statements or after financially justifying the move.

Financial statements usually include:

1. Income statements (or the profit-and-loss statement)

2. Balance sheet.

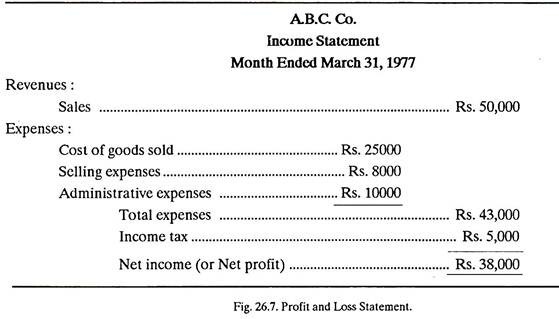

1. Profit and Loss Statement:

Income statement or profit and loss statement is a statement of revenues and expenses for a specified period of time. The income statement reports the results of operations of a given period. The statement starts with a report of the income for the period, from which are deducted all the costs incurred as a result of operations. The net figure is the profit or loss for the period. Fig. 26.7 shows a simplified income statement or profit and loss account.

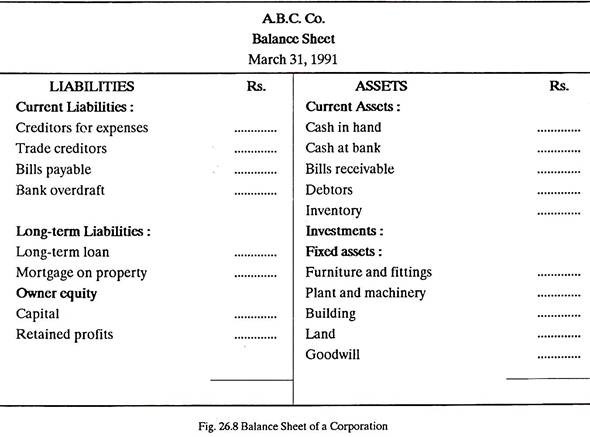

2. Balance Sheet:

A balance sheet is a statement showing the financial status of the company at any given time. A balance sheet is a statement of assets, liabilities and capital (or net worth) at a specified date. In other words, the balance sheet shows a summary of the sources of the (business) enterprise resources and of the investment of those resources in various assets.

Balance sheets are prepared at least annually but may be done so more often and on specific occasions when the need exists in connection with making decisions concerning large project investments, dividend distribution, etc. Fig. 26.8 shows a simplified balance sheet.