Budget is a financial statement that provides detailed information about the revenue and expenditure of a particular year.

However, there is no single rule or pro forma available to prepare budget, as in case of balance sheet and profit and loss account. You should note that different organizations follow different rules and methods to prepare their budgets.

For example- government organizations usually go for zero-based budgeting; whereas, a large-scale organization prepares performance budget. In addition to different rules, the budget of an organization depends on various factors, such as size, sales, purchases, and market situations.

Some of the types of budget are as follows:-

ADVERTISEMENTS:

1. Functional Budget 2. Master Budget 3. Fixed Budget 4. Flexible Budget 5. Basic Budget 6. Current Budget 7. Long-Term Budget 8. Short-Term Budget 9. Sales Budget 10. Production Budget

11. Selling and Distribution Cost Budget 12. Production Cost Budget 13. Purchase Budget 14. Labour Cost Budget 15. Production Overhead Budget 16. Capital Expenditure Budget 17. Cash Budget 18. Factory Overhead Budget and a Few Others.

Types of Budget: Functional Budget, Master Budget, Fixed Budget, Flexible Budget, Basic Budget and Other Details

Types of Budget – Top 8 Types: Functional Budget, Master Budget, Fixed Budget, Flexible Budget, Basic Budget, Current Budget, Long-Term Budget and a Few Others

Type # 1. Functional Budgets:

These budgets relate to the individual functions in an organisation, such as sales, production, purchase, research and development, capital expenditure and cash, etc.

A list of frequently prepared functional budgets is given below:

ADVERTISEMENTS:

a. Sales budget

b. Production budget (in units)

c. Direct material usage budget

d. Direct material purchase budget

ADVERTISEMENTS:

e. Direct labour budget

f. Factory overhead budget

g. Plant utilisation budget

h. Production cost budget

ADVERTISEMENTS:

i. Stock budgets – raw material, work-in-progress and finished goods

j. Cost of goods sold budget

k. Selling and distribution cost budget

l. Administration cost budget

ADVERTISEMENTS:

m. Research and development cost budget

n. Capital expenditure budget

o. Cash budget

The above is only an illustrative list of functional budgets. Many other functional budgets such as maintenance cost budget, advertising budget, etc., may be prepared to carry out the production and sales functions successfully.

Type # 2. Master Budget:

ADVERTISEMENTS:

The master budget is a consolidated summary of various functional budgets. The Chartered Institute of Management Accountants, London, defines the master budget as “The summary budget incorporating its components as functional budgets and which is finally approved, adopted and employed.”

When all functional budgets are consolidated and summarized they produce two budgets – budgeted income statement (operating budget) and budgeted balance sheet (financial budget). These taken together are called master budget. The master budget when finally approved by the budget committee becomes the target for the company during the budget period.

Type # 3. Fixed Budget:

The fixed budget is a budget for a given level of activity 6r capacity. It does not provide for any change in expenditure arising out of changes in the level of activity or capacity. When the actual level of activity differs from the budgeted level of activity, the use of fixed budget as a basis of performance evaluation does not give correct picture. This budget can be used only when budgeted and actual activity levels are the same.

Type # 4. Flexible Budget:

A flexible budget, also called variable budget, is that which changes with the level of activity attained. According to CIMA, London, flexible budget is, “A budget which by recognizing different cost behaviour patterns, is designed to change as volume of output changes.”

Type # 5. Basic Budget:

ADVERTISEMENTS:

Basic budget is established for unaltered use over a long period of time. It is not of much practical utility for control purpose.

Type # 6. Current Budget:

Current budget is related to current conditions and is established for use over a short period of time. As compared to basic budget, a current budget is more useful for control purposes as it takes into consideration current conditions in setting the targets.

Type # 7. Long-term budget:

A budget, which is prepared for a period longer than a year, is called long-term budget. Such a budget is used for future forecasting and forward planning. Capital expenditure and research and development cost budgets are generally prepared for a long period.

Type # 8. Short-Term Budget:

It is a budget prepared for less than a year and is very useful to lower levels of management for control purpose. Cash budget, sales budget, production budget, etc., are generally prepared for a short period.

Types of Budget – Functional and Master Budgets, Fixed and Flexible Budgets, Basic Budget, Current Budget, Long-Term Budget and Short-Term Budget

1. Functional and Master Budgets:

Master Budget:

A master budget is the summary budget for the entire enterprise and embodies the summarised figures for various activities. It is the consolidation of all functional budgets. A functional budget is a budget which relates to any of the functions of an undertaking, e.g., production, sales, finance etc.

ADVERTISEMENTS:

Functional Budgets:

Principal functional budgets may be stated thus:

(a) Sales Budget – The sales budget is a forecast of total sales expressed in terms of money and quantity. In practice, quantitative budget is prepared first, then it is translated into monetary terms.

(b) Production Budget – It is a forecast of the production for the budget period. It may be expressed in units or standard hours. A standard hour is the quantity of output or amount of work which should be performed in one hour. While preparing the production budget, the production executive will take into account the physical facilities like plant, power, factory space, materials, labour available for the period.

(c) Materials Budget – It shows the details of raw materials to be consumed. It is expressed in terms of physical quantities and values of materials to be issued from the stores for production purpose. This budget provides that right materials of right quantity and quality are procured.

(d) Labour Budget – It shows the details of labour requirements in quantity, with estimated costs. This budget gives detailed information relating to the number of employees, rates of wages and cost of labour hours to be employed.

ADVERTISEMENTS:

(e) Manufacturing Overhead Budget – It shows the estimated costs of indirect materials, indirect labour and indirect manufacturing expenses during the budget period to achieve the predetermined targets.

(f) Administration Cost Budget – This comprises the salaries and expenses of administrative office and management for a specified period. It is prepared with the help of past experience and expected changes in figure.

(g) Selling Expenses Budget – All expenses concerned with sale of products to customers are included in this budget. It is generally prepared territory wise by the sales manager of each territory, on the basis of past records.

(h) Research and development budget – This budget lists all the research and development activities together with their likely costs.

(i) Capital Expenditure Budget – This budget shows the estimated expenditure on fixed assets like plant, land, machinery, building etc. It is a long term budget. The capital is necessitated on account of demand for products, expansion of industry, adoption of new technology, replacement of old machines etc.

(j) Cash Budget – It is prepared after all the functional budgets are prepared by the chief accountant either on a monthly or weekly basis. It shows the sum total of the requirements of cash in respect of various functional budgets and of estimated cash receipts for a stipulated period.

2. Fixed and Flexible Budgets:

ADVERTISEMENTS:

A budget may be established, either as a fixed budget or a flexible budget. A fixed budget is a budget designed to remain unchanged irrespective of the level of activity actually attained. It does not change with the change in the level of activity. However, the fixed budget becomes unrealistic when the level of activity actually attained does not conform with the budgeted one.

As a result, fixed budgets can be established only for a small period of time when the actual output is not anticipated to differ much from the budgeted output. Obviously, fixed budgets have only limited application and are ineffective as managerial tools.

A flexible budget is a budget designed to change in accordance with the level of activity actually attained. It is also known as variable or sliding scale budget. It is prepared in such a way as to present the budgeted cost for different levels of activity. It is more realistic and practical in that the changes expected at various levels of activity are given due weightage.

3. Basic Budgets:

Basic budget has been defined as ‘a budget which is prepared for use unaltered over a long period of time’. It does not take into consideration the current conditions and can be attainable under standard conditions.

4. Current Budgets:

ADVERTISEMENTS:

A current budget can be defined as ‘a budget which is related to the current conditions and is prepared for use over a short period of time’. It is more useful than basic budget, as the target it may down will be corrected to current conditions.

5. Long-Term Budgets:

A long term budget can be defined as a ‘budget which is prepared for periods longer than a year’. These budgets help in business forecasting and forward planning. Capital expenditure budgets and research developments budgets are examples of long term budgets.

6. Short Term Budgets:

It is a budget which is prepared for a period less than a year and is very useful to lower levels of management for control purposes. In an ideal situation a short term budget should perfectly fit into a long terms budget.

Types of Budget – 5 Main Types: Sales Budget, Production Budget, Master Budget, Fixed Budget and Flexible Budget

Type # 1. Sales Budget:

A sales budget is a detailed schedule (produce-wise, region-wise) showing the expected sales in units at their expected selling price. An accurate sales budget is the key to the entire budgeting process. It is the cornerstone of budget preparation as an organisation can complete the plan for other activities (e.g., units to be produced) only after determining the expected level of sales. The sales budget triggers a chain of reactions that leads to the development of the other budgets.

At the time of preparing sales budget, extreme care must be taken. If sales budget is sloppily done, then the rest of the budgeting process is nothing but wastage of time, energy and money. The starting point in preparing a sales budget is sales forecasts.

Type # 2. Production Budget:

Production Budget is prepared after the Sales Budget. The production budget is a plan for the production of different items based on the sales budget and the management’s decision on the level of stocks to be carried during the budget period. In case of a multi-product company, production budget is prepared for each product separately.

ADVERTISEMENTS:

Before the finalisation of the Production Budget, the production manager should assess the feasibility of the budgeted production after taking into consideration the availability of man and machine. In the event that the budgeted production is greater than the maximum capacity available, the management should either revise the sales target or find alternatives (e.g., outsourcing) to satisfy the demand.

If the plant capacity is greater than the budgeted production, the management may let out the unused capacity for earning some revenue after considering the pros and cons.

Direct Materials (Usage / Consumption) Budget:

The material consumption budget will require data from the production budget to determine the quantity of each product to be produced and the materials to be consumed per unit of production after taking the anticipated production loss into consideration.

Direct Materials Purchase Budget:

A material purchase budget details the raw materials that must be purchased to fulfill the production budget after keeping materials in stock as per the company’s policy. The material purchase budget will be based on the material consumption budget including cost per unit of materials to determine the total material cost.

Direct Labour (Requirement and Cost) Budget:

The direct labour requirement budget is also developed from the production budget.

Total labour hours required for budgeted production is calculated as follows:

Total Labour Hours Required = Budgeted Production x Labour Hours per unit

In many cases, different types of labour (e.g., skilled, unskilled and semi-skilled) are required. In such a case, separate calculations are to be made for different types of labour.

Direct labour requirement must be calculated in advance. If this is done, the management will be able to know whether sufficient labour hours are available to meet production needs. If the hours are not sufficient, the management will take necessary action (e.g., negotiation with trade union for overtime, new recruitment, etc.). Labour cost budget is developed on the basis of labour hours required.

It is calculated as follows:

Total Labour Cost=Total Labour Hours Required x Budgeted Labour Rate per Hour

Production overhead includes all costs of production excluding direct materials and direct labour.

The production overhead costs are more difficult to budget because of its nature. We know direct materials and direct labour will vary with the production. However, production overheads are less consistent. Some of the production overhead costs will vary with the production such as – indirect material / labour. Other production overhead costs, such as – depreciation, rent, rates and taxes of the factory premises are fixed.

At the time of preparing production overhead budget, variable portion is to be calculated on the basis of budgeted production and fixed portion is to be calculated taking into consideration all items individually.

Administrative Overhead Budget:

Administrative overhead cost budgets are likely to present few problems as the expenses they cover consists largely of staff salaries and other expenses of the office which are fixed in nature. Administrative overhead cost budgets would be a compilation of many smaller, individual budgets submitted by different department covering main administrative activities such as – accounting, human resource, legal, secretarial work and so on.

At the time of preparing this budget, it will be necessary to consider the existing number of staff of each department, their future pay scale, etc; changes in price level and future recruitments are also to be taken into consideration.

Selling and Distribution Overhead Budget:

Selling and distribution overhead cost budget shows the planned costs of achieving sales and retaining customers for the budget period. It is closely associated with the sales budget. Selling and distribution overhead costs consists largely of salesmen’s salaries, commissions and hotel expenses, depreciation and running cost of delivery vans, sales management cost and advertising costs.

This budget would be a compilation of many smaller and individual budgets submitted by the managers of the different sales area.

At the time of preparing selling and distribution overhead cost budget, the projected sales of the budget period, the expected number of salesmen and their pay scale, cost of fuel, extent of advertisement, etc., are to be taken into consideration.

Type # 3. The Master Budget:

In most organisations, the master budget (or summary budget) will comprise the following:

i. The Cash Budget

ii. The Budgeted Profit and Loss Account

iii. The Budgeted Balance Sheet

Holding adequate cash on hand is very important for the survival and growth of a business organisation. The entire financial activity of a business enterprise rests upon the successful management of cash inflow and cash outflow.

For example, not keeping sufficient balance in the current account, because of wrong planning, might lead to the unwanted consequences of some suppliers’ cheque being dishonoured. As a result, these suppliers may take legal action or may not be interested in future to supply on credit.

It is not always possible to purchase in cash and it is extremely dangerous to lose Creditworthiness. Because, it means that, at some time in the near future, the company might not be able to buy sufficient quantity of materials and would not be able to produce adequate quantities, thus ultimately losing some important business opportunities.

The cash budget is the first element of a master budget. It depicts the forecast of expected cash receipts and cash disbursement during a budget period. By preparing a cash budget, the management can take steps in advance, to carry out the planned activities.

ii. The Budgeted Profit and Loss Account:

The second element of a master budget is the ‘Budgeted Profit and Loss Account’. A Budgeted Profit and Loss Account is prepared from the summary of different functional budgets. For example, sales in the budget period will be available from sales budget.

Similarly, purchases in the budget period will be available from purchase budget and so on. The Budgeted Profit and Loss Account is a very important document in the budget process. It will project the coming budget period’s profit. It stands a benchmark against which actual performance is compared.

iii. The Budgeted Balance Sheet:

The Budgeted Balance Sheet is the last element of a master budget. A Budgeted Balance Sheet is prepared after preparing not only the functional budgets but also Cash Budget and Budgeted Profit and Loss Account.

Starting point of the Budgeted Balance Sheet is the opening balance of different assets and liabilities as per last Balance Sheet. These figures are adjusted after taking into consideration of data from different budget which affects the assets and liabilities figures.

For example, the opening balance of plant and machinery is Rs. 4, 00,000. Budgeted capital expenditure on plant and machinery is Rs. 5, 00,000 during the budget period. The total plant and machinery figure in the Budgeted Balance Sheet will be Rs. 9, 00,000. Similarly, budgeted net profit will be added with the opening balance of Profit and Loss Account and final figure will be shown in the Budgeted Balance Sheet.

Type # 4. Fixed Budget:

A fixed budget is one which is prepared for one level of activity for a certain period of time. A fixed budget is suitable when the organisation’s activity can be estimated accurately. However, in a dynamic condition this type of budget has limited usefulness as a control tool.

Type # 5. Flexible Budget:

A flexible budget is one which is prepared in such a way that it will be possible to determine the budgeted cost for any level of output.

The CIMA (UK) terminology has defined ‘flexible budget’ as – ‘a budget which by recognising different cost behavior patterns, is designed to change as volume of output changes.’

A flexible budget is much more effective as an aid in controlling costs than the fixed budget. It assists in forecasting the effect of different level of activity on the profits and the cash position.

In order to prepare a flexible budget, the cost accountant must be in a position to classify the cost under consideration into its fixed and variable component. The preparation of flexible budget is similar to that of a fixed budget except that a flexible budget is prepared for each level of activity from possible 40% to 100% capacity. The variable component will vary with output / activity and fixed component will remain the same.

Types of Budget – 4 Most Important Types: Functional Budget, Master Budget, Basic and Current Budget, Short-Term and Long-Term Budget, Fixed and Flexible Budget

1. Functional Budgets:

A functional budget refers to a budget which relates to any of the functions of an undertaking, e.g., sales, production, finance, purchases, administration etc. In a manufacturing concern, generally the following detailed functional budgets are prepared –

(a) Sales Budget:

Under the system of budgetary control, the starting point is the preparation of Sales Budget. Sales budget is the forecast of sales during a given period, both in quantity and value. Sales budget is said to be the most difficult budget to prepare since it is not easy to estimate consumer’s demand, especially in case a new product is being introduced in the market.

The responsibility for the preparation of the sales budget lies with the Sales Manager. This budget is classified under a number of headings, namely-product or product group, territories, areas and countries, type of customer, e.g., National Government, State Governments, export, country customers, salesman and period etc.

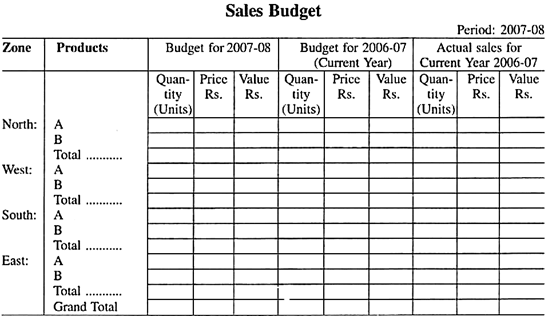

The specimen of a sales budget has been given below:

(b) Selling and Distribution Cost Budget:

This budget shows the cost of selling and distribution for the quantities shown in the sales budget. The main factors which affect the selling and distribution cost budget are the channels through which sales are to effected, the sales promotion plan to be pursued, the sales territories to be covered and the mode of dispatch of products to the customers.

Selling and distribution cost budget is drawn up by the Sales Manager and in the compilation, he is assisted by Distribution Manager, Advertising Manager, Sales Office Manager and the Accountant. For compiling this budget, the expenses are grouped according to elements e.g., direct selling expenses, sales office expenses, distribution expenses and advertising expenses.

A Production Budget is defined as an estimate of quantity of goods that must be produced during the budget period. This budget is prepared by the Production Manager keeping in view the following factors –

(1) Estimated sales.

(2) Expected opening stock and desired closing stock of each article.

(3) Available physical resources of plant, power, factory space, materials and machines.

(4) The policy of the management regarding manufacture or purchase of components.

The production budget may be classified under following heads:

(i) Products

(ii) Manufacturing Departments

(iii) Months, Quarters etc.

(d) Production Cost Budget:

This budget is also known as Factory Cost Budget and it shows the estimated cost of carrying out the production plan given in the Production Budget. The production cost includes direct materials cost, direct labour cost, direct expenses and factory overheads. Production Cost Budget is generally classified under the following headings –

(1) Products

(2) Manufacturing Departments

(3) Months, Quarters etc.

(4) Elements of Costs.

(e) Purchases Budget:

The purchases budget represents the total purchases to be made during the budget period. These purchases represent the requirements of direct and indirect materials, fixed assets, services and finished goods for resale but the most important item is that of raw materials. The requirements of the items to be purchased are expressed in terms of quantities as well as money.

This budget is prepared on the basis of Sales, Production Cost, Capital Expenditure, Research and Development Cost Budgets. Purchases budget facilitates the management of finances by defining the cash requirements in respect of the purchases to be made during the budget period and enables the Purchases Department to plan its purchases in time so that long-term forward contracts may be made when advantageous.

The Labour Cost Budget represents in terms of money, number and grades of personnel, number of working hours or other appropriate units, the direct and indirect labour required to carry out the programme laid down in the Sales, Production, Capital Expenditure and Research and Development Expenditure Budgets. Thus, this budget is a forecast of planned outlay on direct and indirect labour of a concern during the budget period.

Plant Utilisation Budget forecasts the plant and machinery requirements to meet the Production Budget. This budget is expressed in terms of working hours or other convenient units and it indicates the machine load on each manufacturing department, machine or group of machines and the extent of over-loading or under-loading so that the management may take corrective action.

(h) Administration Cost Budget:

This budget is a forecast of general administration costs of the undertaking during the budget period. General administration cost includes the cost of formulating the policy, directing the organisation and controlling the operations of an undertaking. Most of the items of administration cost are fixed in nature but a clear distinction shall have to be made between ‘fixed’ and ‘variable’ items.

(i) Capital Expenditure Budget:

This budget expresses in detail the anticipated expenditure to be incurred on fixed assets during the budget period e.g., plant and machinery, land, buildings, patents etc. Capital Expenditure Budget is normally a long-term budget providing for the acquisition of the assets necessitated by the replacement of existing assets, additions to the existing assets, or by the installation of an improved type of machinery to take the advantage of new production techniques.

(j) Research and Development Cost Budget:

This budget is a planned outlay on research and development activities of an undertaking and expresses in terms of money, the permissible limits within which the research and development activities are to be pursued and the directions for the same.

(k) Cash Budget:

The cash budget is a forecast of the cash position for a period and represents the cash receipts and payments and the estimated cash balance each month of the budget period. This budget is practically the nerve centre of the whole budgetary control system since the most carefully prepared budgets are incapable of fulfilment if adequate cash is not available at proper time.

This budget is prepared after all the functional budgets have been drawn up.

Cash Budget of a business concern can be prepared by Receipts and Payments Method, Adjusted Profit and Loss Method and Balance Sheet Method. But the Receipts and Payments Method is the most popular method and is commonly used by business concerns. Under this method, cash budget is prepared just like a summarised cash book.

For the purpose of preparing cash budget, all types of ‘Cash Receipts’ or ‘Cash Inflows’ (including opening balance of cash/bank) are to be estimated in a logical manner period-wise, keeping in view the past figures, existing trends and expected changes in future. Similarly, all types of ‘Cash payments’ or ‘cash outflows’ are also estimated period-wise.

Thereafter, a comparison of total estimated cash receipts and total estimated cash payments is made to ascertain the amount of excess or shortage of cash. In case of expected shortage or shortfall, arrangements shall be planned to raise funds by means of short-term loans or bank overdraft etc.

2. Master Budget:

A Master Budget is a summary of all the functional budgets. It is defined as the Summary Budget, incorporating its components functional budgets, which is finally approved, adopted and employed. When the Master Budget is complete, its details shall be considered by the Budget Committee and if approved, it will be submitted to the Board of Directors. However, once it is finally approved, it becomes the target for the organisation during the budget period.

The master budget is usually prepared in the form of a Budgeted Profit and Loss Statement. It begins with the sales budget figures, from which Production Cost Budget figures and overheads are deducted in order to arrive at the figure of budgeted profit.

3. Basic Budget and Current Budget:

Basic budget is a budget which is established for use unaltered over a long period of time while a current budget is one which is established for use over a short period of time and is related to current conditions.

4. Short-Term Budget and Long-Term Budget:

A short term budget is one which is prepared for a period of one year or less than one year. Such budgets cover those expenses or activities, the trend in which is difficult to be foreseen over longer periods. Cash Budget and Materials Budget are the examples of short term budgets.

A long term budget is that which is prepared for a period longer than a year. Long term budgets normally help in business forecasting and future planning. Capital Expenditure Budget and Research and Development Expenditure Budget are the examples of long term budgets.

4. Fixed Budget and Flexible Budget:

The Institute of Cost and Management Accountants has defined fixed budget as “a budget which is designed to remain unchanged irrespective of the level of activity actually attained.” The fixed budget shows an inflexible or rigid plan. There is one set of conditions, one volume of output, and a simple collection of costs and the management expects all conditions etc., to operate without any variation.

On the other hand, flexible budget is a budget which is designed to change in accordance with the level of activity actually attained. The figures used in this type of budget are made adaptable to any given set of operating conditions.

The compilation of flexible budgets requires the classification of all costs or expenses into fixed, variable and semi-variable. Fixed costs remain fixed or constant at all levels of activity, semi-variable costs vary with different levels of activity while variable costs vary directly in proportion to changes in the volume of output or sales.

Types of Budgets – Sales Budget, Selling and Distribution Budget, Production Budget, Production Cost Budget, Purchase Budget, Labour Cost Budget and a Few Others

Though the numbers of individual budgets vary from firm to firm, the following are the common types of budgets:

i. Sales Budget.

ii. Selling and distribution cost budget.

iii. Production budget.

iv. Production cost budget.

v. Purchase budget.

vi. Labour cost budget.

vii. Production overhead budget.

viii. Capital expenditure budget.

ix. Cash budget.

x. Master Budget.

xi. Fixed Budget.

Xii. Flexible Budget.

i. Sales Budget:

In most of the firms, sales forecasting is the commencement of budgeting. Sales is perhaps the most difficult to forecast and yet upon the accuracy of this budget depends the success of the entire budget system. A sales budget shows what products will be sold in what quantities and at what prices.

The preparation of sales estimates is usually the responsibility of the sales manager assisted by individual salesmen and market research personnel. The sales manager will take into account the past sales, market conditions, advertisement campaigns, competitions, etc., and will exercise the best possible judgment. The budget is usually prepared in quantities and then evaluated at budgeted unit prices.

ii. Selling and Distribution Cost Budget:

This budget forecasts the cost of selling and distributing the company’s products during the budget period. This budget is closely connected with the sales budget in as much as it mainly depends upon volume of sales forecasts for the period. The sales manager, advertising manager and distribution manager will co-operate in the preparation of this budget.

iii. Production Budget:

The production budget is usually based on the sales budget and the desired inventory levels. After sales have been budgeted, it is possible to determine the quantity of goods that may be produced to meet the sales forecast. A production budget may be defined as an estimate of quantity of goods that must be produced during the budget period. While preparing a production budget, the factors like sales forecast, budgeted stock requirements, plant capacity, purchase of components, etc., are taken into account. Production budget forms the basis of production cost budget.

iv. Production Cost Budget:

Production cost budget shows in detail the estimated cost of carrying out the production plans as per production budget. It will show cost broken into elements – material, labour and overheads. Overheads are usually further sub-divided into fixed, variable and semi-fixed. Costs are analysed by departments and/or products.

v. Purchase Budget:

Purchase budget is concerned with purchases for the budget period. Several interpretations are given to what is meant by a purchase budget. Sometimes it includes purchases of raw materials only. In other cases, the purchases of all direct and indirect materials, fixed assets and services like electricity and gas, etc., are also included. The object is to formulate a plan which will allow all the necessary materials and other items to be purchased at the minimum cost.

vi. Labour Cost Budget:

Labour budget embodies the estimate of labour requirements to meet the demands of the company during the budget period. Although some firms prepare a labour budget that includes both direct and indirect labour requirements, it is preferable to prepare a direct labour budget and to include indirect labour into manufacturing expense budget. Labour budget is useful as it defines the labour force required. It also enables the personnel department to plan ahead for recruitment and training of labour.

vii. Production Overhead Budget:

The budget represents the forecast of all production overheads to be incurred during the period. All factory overheads are apportioned into fixed, variable and semi-variable. Semi-variable overheads are further segregated into fixed and variable components. While preparing this budget, consideration should be given to the level of activity likely to be achieved, because with big changes even fixed costs will change.

viii. Capital Expenditure Budget:

Capital expenditure budget expresses the detailed plans of the top management concerning additions, improvements and replacement of all fixed assets during the budget period. This budget may include such items as plant additions, new buildings, land and such intangibles as patents, etc. Since capital expenditure is frequently planned a number of years in advance, the budget period in this case may differ from that of other budgets. The budget provides a tool for controlling capital expenditure and enables the company to establish a system of priorities in expenditure.

ix. Cash Budget:

Control of cash position is a vital phase of the financial management of a concern. There must be a balance between cash and cash demanding activities. Cash budget represents the cash requirements of the business during the budget period. It compares the estimated cash receipts and estimated cash disbursements of the company over the budget period and shows the resultant periodical cash position as the budget period develops. It is a device for coordinating and controlling the financial side of the business to ensure solvency and provides a basis for planning the finance required to cover up any deficiency in cash.

x. Master Budget:

When all the functional budgets have been prepared, a summary of all these budgets is prepared which is known as a master budget. Thus a master budget shows the overall plan of the business for the next period.

The C.I.M.A. London has defined a Master Budget as – “the summary budget incorporating its functional budgets, which is finally approved, adopted and employed”. The budget generally contains details regarding sales, production costs, cash position and key account balances like fixed assets, debtors, stock, etc. This budget also shows important accounting ratios and gross and net profit figures.

A master budget is commonly prepared in the form of projected profit and loss account and balance sheet. It is also known as summary budget.

xi. Fixed Budget:

Fixed budget is one which “is designed to remain unchanged irrespective of the level of activity actually attained”. This type of budget is prepared for a specific planned activity and is not adjusted according to the level of activity actually attained. It is most suited for fixed expenses which have no relation to the volume of output. A fixed budget has a very limited application and is ineffective as a tool of cost control.

xii. Flexible Budget:

Flexible budget is that which “is designed to change in accordance with the level of activity actually attained”. It is prepared in such a manner that budget cost for any level of activity can be determined. Here the costs are classified into fixed, variable and semi-variable so that cost figures can be modified according to the actual performance.

Thus the main difference between fixed and flexible budget is that fixed budget is prepared keeping in mind one level of output, while flexible budget is prepared for various levels of output and is adaptable to actual performance. A flexible budget is, therefore, more realistic than a fixed budget.

The object of a flexible budget is to assess what the cost should have been in view of the level of output actually attained. This is because figures used in a flexible budget are adaptable to any given set of operating conditions. A flexible budget is more elastic, practical and useful.

Flexible budgets are also necessary for control purposes. The actual performance of a manager can only be compared with what he should have achieved in the actual circumstances prevailing and not with what he should have achieved under quite different circumstances. From this point of view, flexible budgeting is a very effective tool of cost control.

Types of Budgets – Sales Budget, Production Budget, Cost of Production Budget, Factory Overhead Budget, Administrative Overhead Budget and a Few Others

There are various types of budgets.

Some of the important ones have been discussed below:

Type # 1. Sales Budget:

The Sales Budget, generally, forms the fundamental basis on which all the other budgets are built up. The budget is essentially a forecast of sales to be achieved in a budget period. The Sales Manager should be made directly responsible for the preparation and execution of this budget.

The Sales Manager, after taking into consideration all these factors, will prepare the Sales Budget in terms of quantities and money, distinguishing between products, periods and areas of sale.

Type # 2. Production Budget:

This budget provides an estimate of the total volume of production product wise with the scheduling of operations by days, weeks and months and a forecast of the closing finished product inventory. Generally the production budget is based upon the sales budget but in case of companies which find it difficult to forecast sales on account of frequent changes in style and fashions, it is based upon past experience. The responsibility of the Total Production Budget lies with Works Manager and that of Departmental Production Budgets lies with Departmental Works Managers.

The production budget may be expressed in quantitative or financial units or both.

Type # 3. Cost of Production Budget:

After determining the volume of production, it is necessary to determine the cost of procuring this output. Cost of production includes materials, labour and overheads and, therefore, separate budgets for each of these items will be prepared.

i. Materials Budget:

Materials may be direct or indirect. The materials budget generally deals only with the direct materials. Indirect materials are generally included in the works overhead budget.

Material requirements are estimated regarding each class of products by multiplying the exact material requirement for each class of product by the number of units of that class. The total quantity required for the budget period is first estimated and then is further broken down by component time period (months and quarters) in the materials budget. The break-up and length of the period should be in uniformity with the production budget.

In case of concerns whose raw materials requirements can be standardised, the materials budget can be prepared exactly on this basis. In case it is not possible, the percentage of raw materials to total cost of products should be calculated on the basis of the historical data.

On the basis of this information a rough estimate can be made regarding the raw materials required for the budgeted output. The figure should further be adjusted taking into account the current price trends and the normal wastage of materials in the course of production.

The Buying Department should proceed to find the most profitable means of procuring the requisite quantity and quality of raw materials. Consideration must also be given to the amount of stock to be carried forward.

The materials budget can be classified into two categories – (a) materials requirement budget (b) materials procurement or purchase budget. The former tells about the total quantity of materials required during the budget period; while the latter tells about the materials to be acquired from the market during the budget period. Materials to be acquired are estimated after taking into account the closing inventory and the opening inventory of the materials for which orders have already been placed.

ii. Direct Labour Budget:

The direct labour budget tells about the estimates of direct labour requirements essential for carrying out the budgeted output. In preparation of this budget previous records of the percentage labour cost in the total cost of each product, group or department will be considerably helpful.

The budget may give details regarding direct labour costs only, or both direct labour hours and cost. In the former case the cost can be calculated by making an estimate of cost per unit of production. The cost per unit multiplied by the budgeted units will give the estimated cost of direct labour. In the latter case estimates will have to be made about (i) direct labour hours and (ii) average wage rate.

Internal factors such as the method of wage payment, the type of production process and the available costing records will determine whether and how it is possible to express production in terms of direct labour hours. The average wage rate payable for a particular product or department, will be calculated on the basis of the historical ratio between wages paid and direct labour hours worked in the department or for the product after taking into account the current conditions.

Direct Labour Budget (like Direct Materials Budget) may be divided into two categories – (i) Direct Labour Requirement Budget (ii) Direct Labour Procurement Budget. The former tells about the total direct labour required in terms of quantity or/and value while the latter will state the additional direct workers to be recruited.

Type # 4. Factory Overhead Budget:

Manufacturing or Factory overheads include the cost of indirect labour, indirect material and indirect expenses. The manufacturing overheads can be classified into three categories, (i) Fixed i.e., which tend to remain constant irrespective of any change in the volume of output (ii) Variable i.e., which tend to vary with the output and (iii) Semi-Variable i.e., which are partly variable and partly fixed.

The manufacturing overheads budget will provide an estimate of all these overheads to be incurred in the budget period. Some of items like non-cash items e.g., depreciation, repairs and maintenance may be budgeted for, if the size and types of assets are large and too many.

Fixed manufacturing overheads can be estimated without much difficulty on the basis of the past information and knowledge of any changes which are likely to occur during the ensuing budget period. Variable overheads are estimated after considering the scheduled production and operating conditions in the budget period.

Type # 5. Administrative Overhead Budget:

The budget covers expenses of all administrative offices, and of management salaries. A careful analysis of the needs of all administrative departments of the enterprise is very necessary. The minimum requirements for the efficient operation of each department can be estimated on the basis of costs for prior years, and after a study of the plans and responsibilities of each administrative department for the budget period.

The budget for the entire administrative division will be prepared by totalling the separate budgets of all administrative departments. At times, if some of the individual items require detailing e.g., transportation, communication, electricity expenses etc. separate budgets can be prepared in regard thereto, particularly in case of big businesses.

Type # 6. Selling and Distribution Overhead Budget:

The budget includes all expenses relating to selling, advertising, delivery of goods to customers etc. It is better, if such costs are analysed according to products, types of customers, territories, and the sales departments in the organisation itself. The responsibility for the preparation of this budget rests with the executives of the sales departments.

There must be a co-ordination of selling expenses with the volume of sales expected and an effort should be made to control the costs of distribution. The preparation of the budget would depend on the analysis of the market situations by the management, advertising policies, research programmes and the fixed and variable elements. Advertisement budget may occasionally be separately prepared to in case of large enterprises.

Type # 7. Operating Budget:

After preparing the budgets for different elements of cost separately as also the sales budget, the budget which outlines the total cost of production and budgeted profit may be prepared. It is thus a budgeted cost sheet or operating budget. The budget shows planned operations for the forthcoming period, including revenues, expenses and related changes in inventory. It, thus, includes the sales. Production cost and selling and distribution expense budgets.

Type # 8. Capital Expenditure Budget:

The budget provides a guidance as to the amount of capital that may be needed for procurement of capital assets during the budget period. The budget is prepared after taking into account the available productive capacities, probable reallocation of existing assets and possible improvement in production techniques. If necessary, separate budgets may be prepared for each item of assets, such as a building budget, a plant and equipment budget etc.

The budgeted expenditure to be incurred may require detailing beyond a period of one year, hence long-term budget may be prepared accordingly. The budget may contain not only the amount to be spent but also anticipated returns from the investments to be made. Capital expenditure programme may pertain to business expansion, modernisation, replacement of plant and equipment, acquisition of other enterprises.

While preparing capital expenditure budgets, management must consider the sources of financing the capital projects, evaluate through different techniques the viability of such projects, assess the technical feasibility, business capacities, availability of resources like manpower, managerial skills to handle the projects and a variety of other factors.

The advantages of such budgeting are enormous as the managerial long term policies, when put in terms of black and white, give a clear direction regarding implementation of large capital projects. A careful and intelligent preparation is a must so that control can be exercised over incurrence of huge sums and returns can also be monitored. If the plans are put to action properly, profitability of the business enhances and all stakeholders stand to gain.

Type # 9. Plant Utilisation Budget:

Plant Utilisation Budget is a part of the plant and equipment budget. It represents plant and equipment facility required to meet the budgeted target production during the budget period. The plant capacities or facilities may be expressed in terms of financial units such as working hours or rate of production of number of products.

Type # 10. Cash Budget:

A cash budget is a forecast of the cash position by time periods for a specific duration of time. Cash forecast may be made for a short period or a long duration. The cash budget forms an important part in co-ordinating efficient working of the company. It tells about the working capital required and available at different periods. The budget is prepared by the Chief Accountant.

Cash forecast includes all the sources from which cash is to be received and the channels in which payments are to be made during the budget period, so as to arrive at the logical consolidated cash position.

Type # 11. Research and Development Budget:

Research and development costs are to be incurred so that the products or the methods of production do not become out of date. The research and development budget is a forecast of all such expenses. Research and development plays a key role in maintaining big business and in enabling them to expand their operations. Development of new products, change in product design, improvement in methods of production etc. are feasible with constant research and development.

Preparation of a separate budget is required for incurrence of research and development expenditure, part of which may be a revenue expenditure and part a capital expenditure. Allocation of the sum should be need based. However, a specified percentage of sales or profit may be earmarked for the purpose. Policies are laid down by the management in this regard, which consider various factors like demand for products, national and international economic conditions, level of competition etc.

Type # 12. The Final or Master Budget:

The Master Budget is “a summary of the budget schedules in capsule form made for the purpose of presenting, in one report, the highlights of the budget forecast.” The Chartered Institute of Management Accountants, London, defines it as “the summary budget, incorporating its component functional budgets, which is finally approved, adopted and employed.”

Thus, it is a summary budget which incorporates all other budgets. It sets out the plan of operations for all departments in considerable detail for the budget period. The budget may take the form of a Profit and Loss Account and a Balance Sheet as at the end of the budget period.

The Master Budget requires the approval of the Budget Committee before it is put into operation. It may happen, sometimes, that a number of master budgets have to be prepared before the final one is agreed upon. The budget generally contains details regarding sales (net), production costs, cash position and key account balances (e.g. debtors, stock, fixed assets, bills payable etc.). It also shows the gross and the net profit, and the important accounting ratios.

Type # 13. Fixed Budget:

A budget prepared on the basis of a standard or fixed level of activity is known as a fixed budget. It does not change with the change in the level of activity. Therefore, it becomes an unrealistic measuring yard in case the level of activity (volume of production or sales) actually attained does not conform to the one assumed for budgeting purposes.

The management will not be in a position to assess the performance of different departmental heads on the basis of budgets prepared by them because they can serve as measuring sticks only when the actual level of activity corresponds to the budgeted level of activity. On account of these defects of fixed budgeting, it has become a common practice in case of concerns where sales and production cannot be estimated accurately to give up the concepts of fixed budgeting as it does not provide for automatic adjustments with volume changes.

Type # 14. Flexible Budget:

A budget prepared in a manner so as to give the budgeted cost for any level of activity is known as a flexible budget. Such a budget is prepared after considering the fixed, variable and semi-variable elements of cost and the changes that may be expected for each item at various levels of operation. Thus, when budgeted level of activity is not attainable, flexible budget accommodates itself to the actual level of activity, thereby, it helps in ascertainment of costs, fixation of prices and in ascertaining performance.

Types of Budgets – Production Budget, Material Budget, Cash Budget, Sales Budget, Master Budget, Flexible Budget and Performance Budget

Some of the important types of budget are discussed below:

1. Production Budget

2. Material Budget

3. Cash Budget

4. Sales Overheads Budget

5. Sales Budget

6. Master Budget

7. Flexible Budget

9. Zero-Base Budgeting.

1. Production Budget:

Production budget is a part of master budget and it establishes the level of production for budget period. It fixes the target for the future output. It attempts to estimate the number of units of each product which a company plans to produce during a year. There should be sufficient quantity of goods which may be available at the time of sales. A portion of these goods may already be available in the form of opening stock.

The quantity to be produced is determined after taking into consideration the following points:

(i) Opening and closing stock of goods.

(ii) Quantity required to meet projected sales.

The following points are also to be considered in the preparation of production budget:

a. Production planning.

b. Available storage facilities.

c. Amount of investment required.

d. Maximum production capacity of the concern.

e. Management policy regarding purchase of goods.

f. There should be a close coordination with the sales department of the concern.

Formula – Production (units) = Unit required + Closing stock – Opening finished goods.

2. Material Budget:

Material budget is prepared with a view to ensure regular supply of raw materials, according to the requirements of production schedule. A schedule of materials requirements is prepared. The quantity of material required for production and the required inventory will indicate the quantity of each material, which should be made available.

The inventory of raw materials at the beginning of the budget period is deducted and the balance quantity is produced during the budget period. Materials budget checks wastage of raw material and at the same time helps in the determination of economic order quantity.

Formula – Material budget = Closing stock required.

3. Sales Budget:

The success of any enterprise depends upon the quick turnover of its production. Every company wants to maximise its sales. It is a complicated problem and every efforts are made to achieve the sales targets.

A sales budget is an estimate of future sales expressed in quantity and in money. Every company may have sales projection, which will be made on a periodic basis and the sales budget will be prepared accordingly. Some internal and external factors will affect the sales budget. Management should try to get important information in order to get the changes in sales.

4. Master Budget:

The master budget is expressed in financial terms and set out plan for the operations and resources of the firm. It is a summary of the budget schedules high lighting the budget period.

The master-budget balled the comprehensive budget is the complex blue print of the planned operations of the firm.

Master budget is an overall budget of the firm, which includes all other small departmental budgets. It is a network consisting of many separate budgets. It coordinates various activities of the business. It contains consolidated summary of all the budgets prepared. Such budget is of no use for the departmental executives. It draws the attention to those issues, which provide immediate attention.

Preparation of master budget is a complex process. It includes all preparation of a projected profit and loss a/c and balance sheet.

5. Flexible Budget:

Flexible budget is a budget which, by recognising the difference between fixed, semi variable and variable costs is designed to change in relation to the level of activity attained. A flexible budget is a series of cost budget each prepared for a different level of capacity. It is a statement of low costs change with changes in the activity level. Flexible budgets do not distinguish between variable and fixed overhead.

Flexible budgeting can be incorporated in two ways:

(i) Step Budgets – Budgets are developed for different levels of operation.

(ii) Variable Budget – Where budgets are prepared on a variable cost basis.

Business executives prefer the technique of flexible budgeting, as it can be easily understood by the supervisors at all levels. The main significance of flexible budgeting is that it provides completely realistic budget amounts. There are less chances for variances, which can be the result of inefficient control in operating conditions.

6. Cash Budget:

Cash budget is a forecast related to cash for a certain period. Under it, flow of cash is controlled by estimating cash receipts and payments for a definite period. Cash should be available in sufficient quantity in future. Cash is received from the sale, rent, interest, dividend and sale of assets etc. Cash is paid for creditors, purchases, salaries, rent, taxes and capital expenditures etc.

7. Performance Budgeting:

It was introduced in USA in 1949 by Hoover Commission. According to him budget should be in accordance with the functions, programmes, activities and policies of any organisation. In India performance budgeting was first introduced in the year 1967 on the recommendation of Administrative Reform Commission.

It is an important technique of management accounting which is prepared in accordance with the activities of the organisation. Valuation of various activities are carried out for making the policies more effective. The deficiencies of traditional budgeting are removed under it. Both public and private sectors are free to use this technique. According to this concept, budget is prepared by giving due consideration to activities and functions of various departments. It is a special technique of financial control.