This article throws light upon the top eleven elements of a contract. The elements are: 1. Item 2. Specifications 3. Dimensions and Tolerances 4. End Usage 5. Quantity 6. Quality 7. Delivery 8. Currency 9. Price 10. Payment 11. Packing.

Element # 1. Item:

This refers to the product name both the commercial and technical. The best way is to use the one, which is referred to in the inquiry.

The word item as referred in international business or any business, relates to various products, which are in variably also referred to as the commodities. “Commodity” is a representative system of classification, which makes it easier to understand the movement of products across the national borders.

This classification was essential for the proper statistical data formulation of the trading nations. The need for this classification was felt long ago when global trade started picking up especially after the formation of the United Nations in which some of the governments of the nations were represented. As the membership steadily grew and covered most of the globe the need for such standards was felt strongly than ever.

ADVERTISEMENTS:

The statistical commission of the Nations finally created a standard form of classification as the Standard International Trade Classification or in short SITC.

Under SITC commodity grouping system each group is assigned a number. The single digit code number representing the broad category. These are called the sections. The double digit representing the sub groups called the divisions of the single digit groups. The three digit numbers are sub groups of the corresponding double-digit sub groups.

Full SITC codes as is used now a days has 3118 basic headings and published in 1986 (rev-3) by the UN Statistical Commission. Under this classification system UN publishes regularly commodity trade statistical yearbook, which serves the standard source of the trade data of various commodities and products of the countries of the world.

Commodities are basically the unprocessed goods, which account for the bulk of the global trade. The term includes products ranging from agricultural and mineral products to crude oil. The products, which are provided by nature, are called the primary commodities. These are unprocessed products.

ADVERTISEMENTS:

When these primary commodities are subjected to “processing” we get another set of products called the processed commodities; they account for the rest 75% of the global trade. The total merchandise trade is therefore composed of the trade in commodities and trade in manufactured products or processed products.

All the commodities and the products have their specific markets, which are defined as primary commodities markets, industrial goods markets, and consumer goods markets. Volume wise primary goods are traded the maximum, but value wise the consumer goods are traded the maximum.

The industrial goods fall in between. The reason is simple, the “processing” on the primary products gives value addition to produce newer products, the level of processing and the intensity of application decides the net market value of these processed products, the hence the larger traded value. The level of consumption also plays important role in expanding the volume of global trade.

There are four things to remember about the “commodities & products”:

ADVERTISEMENTS:

1. Most of them occur naturally.

2. Value addition done on them not only produces new products but also expands their range of application.

3. There are no known commodity or product that has no name and which cannot be described.

4. All known commodities and products can be defined by following common items;

ADVERTISEMENTS:

A. Name (as per industry and standard classification).

B. Specifications (chemical & physical properties, dimensions).

C. Usage.

D. Measurement (weight, volume, packing).

ADVERTISEMENTS:

E. Price.

F. Delivery.

The item 4-A to F, can give you abilities to understand the wide spectrum of commodities and products that you might be dealing in real life, and it will also give you confidence to describe any known product. This knowledge will be of tremendous use to you if or when you deal in global trading in varied products of one stream or a mixture of different streams.

The most important information that you can derive from the knowledge of commodities and products is the inter dependence of products and commodities. The surplus of shortage of one primary product leads to a chain reaction of similar nature on the downstream products whether industrial or consumer.

Element # 2. Specifications:

ADVERTISEMENTS:

Any item, which has a name, has well defined specifications as well. In fact there cannot be any product, which has no specifications. The advancing technology has given birth to numerous products and the number is increasing day by day.

Not only the products but their applications are also diversified constantly. As such the need for their proper classification is a must for proper understanding and study. This is done through standardization, which is based on the chemical composition, physical properties and the end usage.

The term “specification” of a product relates to their chemical composition, physical properties and end usage. This identification is done through well-documented standards.

The most popular standards are:

ADVERTISEMENTS:

i. The American Standards, – ex.ASTM

ii. The British Standards, – ex.BS

iii. The German Standards, – ex.DIN

iv. The Japanese Standards, – ex.JIS

v. The Indian Standards, – ex.IS

The chemical information covers the % contents of the various elements like carbon, iron, manganese, copper etc. The physical properties cover the tensile strength; yield point and the strength of the item. The chemical % figures are mentioned with certain degree of variation like, Carbon 23.57 to 23.88 %, but for the physical properties the figure mentioned is fixed number.

ADVERTISEMENTS:

The variation in the chemical composition is used for determining the net properties of the end product. Under each standard there are many sub groups or grades, each referring to different product.

Though there are various standards but for given product there are equivalent standards, in business when supplier cannot supply against one specific standard, he asks for its equivalent in other standards for which he is familiar.

Though the standards relates to technical studies and usually the engineers are supposed to have thorough knowledge but it is a must for business men as well especially for the products that he is dealing with. This knowledge gives the businessman the competitive edge and added advantage in live wire situations like negotiations and competitive price fixation.

Element # 3. Dimensions and Tolerances:

The dimensions and tolerances are directly related to the performance and economy of operations. These look very elementary but in reality they are the root cause for rejections and/or male functioning of the end product. As a matter of fact most of the rejections at the international level are caused by this factor only.

When any product is designed and is ready for production it is given specific dimensions, which may include length, breadth, height, curvatures etc. These are calculated keeping in view the inter-relationship of various components and sub-assemblies, which must work in unison to perform, pre-determined work or the output.

If any component or sub-assembly is out of tune than the whole unit fails to work in a specified manner. This results in breakdowns or may even cause fatal accidents.

ADVERTISEMENTS:

Whether you are producing components or full machinery it is utmost important that you fully understand the related dimensions and tolerances. Each dimension has certain tolerance figure, which means the finishing liberty that you can enjoy without affecting the performance of the ultimate product. Consider following example for better understanding.

A pipe has following dimensions, Diameter: 10mm tolerance +3 -0, length 100 mm. This means the pipe has been designed in such a way to work at any thickness from 10mm to 13 mm. If you manufacture a pipe with +3.5mm tolerance or -. 05mm tolerance it will fail to work and resultantly the end product will also fail to perform. Resulting in rejection and financial loss to you.

On the other hand suppose you manufacture the pipe with +2 mm tolerance than your pipe will be okay but consider the situation when your competitor can manufacture the same pipe with +0.5mm tolerance. His price will be competitive as compared with yours because he used lesser material to make the same pipe.

As such if you want to avoid problems of rejection and/or loss of business than pay utmost attention to these figures right at the contract stage and carry out religiously at the shop floor and make sure what you packed has the same figures as mentioned in the contract.

The drawings constitute the ultimate depository of the product specifications for the engineered goods. They contain information on material specifications, dimensions & tolerances. They can be for components and/or for the final product.

Each drawing has an identification number, date of production and bears the signature of the authorized signatory for its authenticity. They even contain a mention whether they are production drawings or for estimation purposes.

ADVERTISEMENTS:

The later one is used for making an estimate and is subject to revision but the Production drawings are final drawings and the contract must mention/refer them. Any subsequent revision made by the importer has to be mentioned in the drawings as revision no 1 or 2 etc. with date to identify when the changes were made.

Element # 4. End Usage:

This clause is useful when you are dealing with industrial products especially for the intermediaries. The end usage will define the product in question fully because than the supplier can decide the chemistry and physical properties of the required product.

For instance consider the case of steel products. In the case of Hot Rolled Coils or in short the HRC. This item is used for the fabrication of white goods welded pipes and automotive products/components. The price will vary according to the end usage.

The price for automotive application is the highest and that for pipe manufactures the lowest. Similarly in the case of chemicals there are grades for human consumption and for industrial application. The industrial grades are less refined but those of edible grade are fully refined and expensive. Sometimes the end usage also clarifies the mode of packing and forwarding of the contracted goods.

The clarification on this point is obtained at the beginning of the bid preparation. All computation for price fixation is done on this understanding. Therefore when contract is to be made, you have to make sure that you mention the same name and end usage as negotiated earlier.

Many times the contract does not specify this particular clause, in such cases there are chances of misunderstanding and lengthy communications to resolve the issue.

ADVERTISEMENTS:

Upto this stage of contract formation you have not only specified the actual name of the product but its specifications and end usage fully and comprehensively.

Element # 5. Quantity:

After price and specification, the weight of the contracted goods is perhaps the most important point because it refers to the net goods to be physically transferred to the importer.

As such care must be taken to indicate the specific quantity as mentioned in the contract and based on which the total value of the goods have been calculated. The unit of weight used for price calculation must be same with the one mentioned by the importer in his/her inquiry.

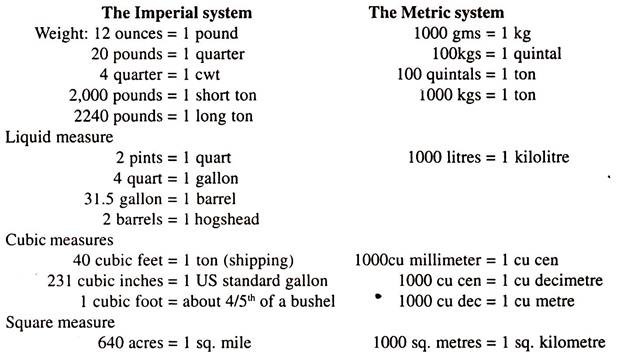

(i) There are two international systems of weight & measures, the imperial and the metric system. Now a day only the metric system is universally used at the international trade level, but in USA and in some other countries the imperial or some other system is also used.

For the comparative study consider following:

Above are some of the most commonly used weights and measures for the international trade.

ADVERTISEMENTS:

(ii) While specifying the measure or weight be specific in what you mention and mean, or what the other party is requesting and what you are offering. The difference between Long ton, Short ton and Metric ton must be clearly understood and used cautiously to avoid any confusion at a later stage.

For instance:

1000 Kgs = 2205 lbs

1 short ton = 907 kgs = 2000 lbs

1016 kgs = 2240 lbs = 1 long ton

Element # 6. Quality:

Definition:

Quality is the integration and utilization of Facilities and minds for perfection of reproducibility of performance with zero defects and compromises. Quality can also be regarded as performance without fault at affordable price.

This is perhaps the most crucial point as far as international business is concerned. Your quality of product and service will decide whether you are in or out of the market. The thumb rule is that quality is what the customer needs.

Your responsibility is to understand those needs and translate them into tangible products, which are acceptable to the customer. On the other hand if the customer is satisfied with your quality level than you have to deliver the same to the customer, nothing less and nothing more.

Therefore while making a contract ask yourself following questions:

i. Have you understood what the customer requires?

ii. Can you engineer the product as per the quality level expected by the customer?

iii. Do you have the infrastructure to produce the required quality products?

iv. Is there any area where commonsense or assumptions are made and not mentioned in the quality format, if so, translate them into written form and get endorsed by the customer?

v. Can you maintain the quality level, if your answer is -yes- than ask your-self “how” and further answer it?

vi. Do you have monitoring system to check at various stages of production whether the quality level is being maintained, if -no- than get it introduced?

vii. If you have a quality control plan, discuss it with your buyer. If he is interested get his comments. May be your customer has better ideas which might be useful to you in future.

If you are affirmative and positive on the above points then you are on the right track. The only thing then you have to do is to put the quality requirements in the contract format.

Generally the quality requirements revolve around following points:

1. Specifications,

2. Drawings,

3. Surface finish or appearance,

4. Testing and reporting procedure, and

5. Acceptance/rejection criteria and procedures.

Take your time to understand accept and endorse on the acceptability level and norms.

Element # 7. Delivery:

This term indicates:

(i) The time period required for transferring the contracted goods to the buyer.

(ii) Terms of delivery or INCOTERMS.

The delivery terms also define the price to be calculated for the contracted goods depending upon how the goods are to be delivered.

(i) The Time Period:

The supplier needs time to make goods ready for delivery to the importer. This time is calculated either from the date of the receipt of the detailed purchase order or the payment order likes Letter of Credit or both, from the importer.

It is generally indicated in months, ex:

Delivery: 8 months from the date of receipt of the purchase order

or

8 months from the date of receipt of the purchase order and L/C

or

8 months from the date of receipt of the L/C.

In some cases the importer may insist on calculation of the delivery period from the date of the purchase order, but mentioning in the purchase order that the L/C will be established say 2 months prior to shipment. The advantage with the importer is that his money is not blocked for the duration of the shipment period.

The disadvantage with the exporter is that till the time they receive the L/C they have to use their own funds or borrow from the bank and/or the financial institutions for meeting the raw material and other utilities requirements.

In some cases there are chances that the exporter has to import certain raw material for meeting the export production commitments. In such cases also he has to depend on the credits from the banking and/or institutions. In all such cases it is upto the exporter to agree or not to agree depending on the business potential and past record of exports to the importer.

In any case the exporter has to make sure the delivery terms at the stage of contract formation, any misunderstanding at this initial stage can result in delayed shipments and resulting penalties for delayed shipments.

(ii) Delivery Terms:

The Incoterms (The International Commercial Terms): These terms basically define the relationship between two interacting parties trying to conduct a particular transaction for the exchange of goods and services.

These terms explain the areas of risk and responsibilities of the seller and those of the buyer in relation to the carriage of the goods and services, division of the costs, and the import & export clearances at the respective ends (importers and exporters).

(a) Background:

The problems covering the carriage of goods are due to the diversity of laws, language and its interpretation across the borders. This was due mainly to the non-uniformity in understanding and interpretation or in other words there was a sense of distortion and imbalance.

The trading nations needed a sense of uniformity in meaning, interpretation and application; rather they all desired universally applicable standards out of such diversity. This prompted international actions amongst the nations to organize the most commonly used trading terms into well-defined and understood terminology so that each term meant same thing to every one dealing in the international trade.

Thus in 1936 for the first time the International chamber of Commerce ICC deliberated on this issue and set up well defined international guidelines for the interpretation of the various trading terms for bringing an order in the trade practices.

These were called the International Commercial Terms or in short the INCOTERMS. These were amended from time to time (1953, 1967, 1976, 1980, 1990) each amendment made these terms more and more fool proof. The latest amendment (INCOTERM 2000) is expected to further strengthen the interpretation and streamline the universal usage.

The major differences between the 1990 and 2000 are in FAS (export clearance obligation on exporter i/o on importer), FCA (exporter’s obligation to load the contracted goods on importer’s collecting vessel and the importer’s obligation to receive the exporter’s arriving vessel unloaded), and DEQ (the import clearance obligation on importer i/o exporter).

In addition the new terms has increased the basic understanding of the terms like FOB, CFR and CIF.

(b) These are universal terms and extensively used for the international business they demarcate the areas of responsibilities and define the risks for the exporters and importers, shippers and the insurers, transporters and the warehouses, etc.

These standard trade terms help a trader to quote prices to the importers clearly indicating on following six accounts:

(i) Cost of the goods,

(ii) Insurance,

(iii) Transportation (road, rail, and sea/air),

(iv) Loading and unloading,

(v) Customs clearance, and

(vi) Duties and tariffs.

These terms influence the net price that an exporter can expect and an importer has to pay. Whenever an offer or a contract is to be made these terms are specifically mentioned in very clear ways so there is no ambiguity and no room for any misunderstanding.

How these terms are related in the contract document, is the final verdict and it over rides anything provided in the rules. If due to any reason there is no mention of any specific term than legally it is understood that the contract is on Ex Works.

(c) There are 13 standard INCOTERMS,

1. EXW = Ex Works

2. FCA = Free Carrier

3. FAS = Free Along Side the Ship

4. FOB = Free On Board

5. CFR = Cost and Freight

6. CIF = Cost Insurance and Freight

7. CPT = Carriage Paid TO

8. CIP = Carriage and Insurance Paid To

9. DAF = Delivered At the Frontier

10. DES = Delivered Ex Ship

11. DEQ = Delivered Ex Quay

12. DDU = Delivered Duty Unpaid

13. DDP = Delivered Duty Paid

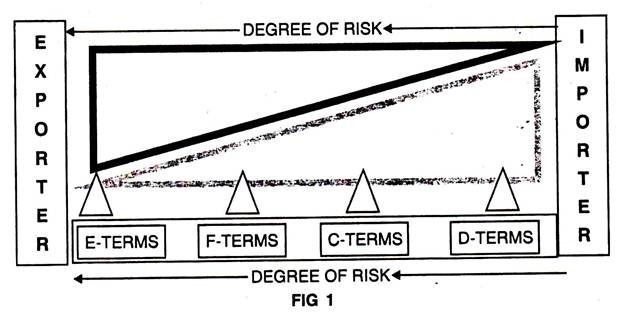

(d) From the above list you can notice the terms are divided into four groups each starting with a particular alphabet, E-terms(also called the dispatch terms), F-terms (there is no provision for the main carriage), C-terms (in these terms the main carriage is paid up) and D-terms (these are also called the arrival terms).

E-terms are the most exporters friendly and D-terms are the most importers friendly. This means for the E-term the exporter has the least risk and the importer has the highest risk. On the other hand for D-terms the exporter has the highest risk and the importer the least.

(e) Explanation on the proportionate degree of risks under four groups.

(f) Explanation on the four deliveries term groups:

E-terms:

This is the most exporter friendly delivery term. The exporter places the contracted goods at the exit point of his premises or any other place indicated by the importer but in close proximity to the exporter’s premises. These goods are not cleared for export but set aside under a commercial invoice favouring the importer, for the export in a way, which is easily identified as such.

The exporter need not arrange the required export license but may assist the importer in doing so but at the risk and cost to the importer. The delivery is done the moment exporter places the goods at the disposal of the exporter at the notified place and time, and duly intimates to the importer for the readiness of the goods to be taken away by the importer.

The loading cost at the exporter’s premises is on importer’s a/c. The risk and costs changes at this moment from the exporter to the importer. The importer has to arrange the export & import licenses, make all the arrangements to insure, collect, clear, arrange carriage and transport the goods from the exporter’s premises (country of origin) up to his premises (country of destination).

F-terms:

These terms are a step further from the EXW in the sense that the exporter’s risk is extended from his premises to the loading point which can be his premises or the loading port, but he is expected to clear and hand over the goods to the importer’s nominated carrier (export license and customs to exporter’s a/c).

The importer is fully responsible to take the goods from the loading point or the port, pay for the carriage and insurance up to his premises. The risk shifts from the exporter to the importer the moment importer takes possession of the goods.

In the case of FCA exporter’s obligations are limited to handing over the goods to the importer’s carrier. The exporter arranges the export license, clears the goods for export and hands over to the importer at the specified named carrier and place where the risk and costs get transferred from the exporter to the importer.

The contract for carriage and insurance is not the responsibility of the exporter, but he may render this service at the risk and cost to the importer. This term is useful for all modes of transport.

In the case of the FAS, the place of delivery is fixed as the importer’s nominated vessel at the loading port. The exporter clears the goods and places them alongside the named vessel and place at the named port in the country of shipment, where the risk and costs shift from the exporter to the importer.

The importer must pay for loading the cargo in the nominated vessel, obtain the import license and arrange for the insurance and carriage up to unloading port and/or his premises in the importing country. This term is used for maritime transport.

In the case of the most extensively used FOB term, the exporter has to obtain the export license, clear the goods for export and load them on board the named vessel under notification to the importer. The moment the goods pass the ship’s rail the risk and cost is transferred from the exporter to the importer and the delivery is said to be done.

The exporter has no responsibility for the contract of carriage and insurance from the moment the goods are loaded into the nominated vessel. If however he has to render this service than it would be to the risk and cost to the importer.

The importer has to get the import license, take the delivery of the goods at the loading port on board the nominated vessel, arrange the insurance and carriage up to the port of destination, or his premises/warehouse, and take away the goods after customs clearance, in the importing country.

C-terms:

There are four terms under this heading (CFR, CIF, CPT, and CIP). Under these terms the exporter is responsible with respect to all actions required to export the goods and the importer is responsible to with respect to all the actions for importation of the goods.

The CIF and CFR are used exclusively for the sea transportation between the loading port and the unloading ports. The other two terms CPT and CIP are used for any mode of transport including the Multimodal transportation, more for the latter case. In this group the destination port is always mentioned but not the loading or original port of loading.

This possess little discomfort for the exporter since he has to get the insurance coverage for the transit period from the point of origin to the point of destination. Under C-Terms the delivery is done and risk shifted once the goods have been shipped on board the vessel, but the exporter has to pay for the sea carriage and insurance but he does not take the risk during the period the goods are in the possession of the carrier.

In the case of CFR the exporter has to obtain the export license, clear the goods from customs and bear the freight up to the destination port but the risks are transferred to the importer the moment the goods pass the ship’s rail at the loading port.

In this case the importer has to clarify at the time of contract formation as to what sort of vessel is to be arranged by the exporter. If left to the exporter he might engage the least costly means (break-bulk carriers or non-liner vessels rather than the liner vessels or even the container vessels).

The importer has to clarify also whether he intends to use containerized cargo or bulk cargo since freight rates are different in both the cases. This term is used for the maritime transport.

After Fob, CIF is the most used shipping term in the international cargo transport, in this case the risks and responsibilities are the same as those of the CFR but the exporter additionally procures and pays for the marine insurance cover. The unloading costs are to be mutually sorted at the time of the contract formation.

The CPT is used for the general and containerized cargo for the Multimodal transport. The exporter pays for loading and the carriage up to the named destination port but the risk passes from the exporter to the importer the moment exporter hands over the goods to the first carrier (in case more than one carrier is used).

The importer in this case accepts the goods the moment exporter hands over to the first carrier. Operationally this term is similar to the maritime term CFR.

Lastly in the case of Multimodal term CIP (which is similar to the CIF maritime term) the exporter pays for the loading (unloading negotiable), carriage and insurance up to the named destination port but the risk passes from the exporter to the importer the moment the cargo is delivered to the first named carrier by the exporter.

The importer has to accept the goods the moment exporter hands them over to the first carrier. This term CIP differs from the CPT only in the sense that under CIP the exporter must arrange for the cargo insurance policy and his risk for any loss or damage to the goods is extended till the agreed point and place of delivery, as decided by the importer.

D-terms: Under D-terms (except DDP) the importer has to undertake all the actions required for importation in his country. The exporter bears all the risks and costs till the goods are placed at the delivery point the importer have selected.

In D-terms there are five variants (DAF, DES, DEQ, DDU, and DDP). DES and DEQ are used for sea transport, DDU and DDP for all modes of transport, and DAF for rail transport where delivery of goods is destined at the frontier post.

These terms are generally used for the manufactured goods where the manufacturer and/or the trader wants to exercise direct control over the movement of the goods, and also to help his distributors in the target market to fight competitively with the competitors, besides when the manufacturer wants to have full control over the way his cargo is loaded, shipped on board, and unloaded at the destination port.

In the case of DAF the exporter makes the custom clearance and places the goods at the named place on the road/rail point for the importer to take possession, the risk is also transferred at this point from the exporter to the importer.

In the case of the DES the exporter clears the goods from the customs, pays for the freight and insurance and puts them on board the named vessel up to the destination port where goods are available to the importer on board the vessel.

The risk shift point occurs at the moment cargo is placed on board the carrier at the destination port and at the point of unloading as agreed upon with the importer. The importer has to unload and make arrangements for clearance of the goods at the destination port.

DEQ is one step further to DES; in this case the exporter has to get the Export license pay all the dues at the loading port. The importer has to get the import license and clear the goods at the destination port and pay taxes as applicable at the unloading port. The risk shift over point occurs the moment importer takes the delivery of the goods at the quay of the named port of destination.

In the case of DDU the exporter should deliver the goods at the selected place on the named port, bearing all the costs up to that point, and the importer has to do the custom clearance, pay the duties, and bear the expenses for unloading and taking possession of the goods.

The risk changes at the destination port, from the exporter to the importer, when the exporter hands over the goods at the destination port and place to the importer.

Lastly in the case of DDP the exporter bears all the risks and costs and clearances for making the goods available to the importer at the named port exit point and place for the importer to unload and take possession and move away with the goods.

In this case the local taxes as applicable in the destination country (the country of the importer) are excluded from the exporter’s responsibility, but a clause has to be added in the contract.

The risk shift point occurs when the exporter places the goods at the disposal of the importer at the exit point at the destination port at the importer’s collecting vessel/vehicle in unloaded condition. The unloading is importer’s responsibility.

(g) Extensions:

Sometimes a rider clause is attached to cover additional risks. Like CIF is a delivery term specifying that the cost insurance and freight is covered in the offered prices. But in a war like situation in any part of the globe a rider clause can be added to it to cover the additional risk.

Like CIF + war risk insurance, or in the case of bulk cargoes this term can be further modified like CIF FO, the term FO means FREE OUT that is the charges for unloading the bulk cargo from the ship on to the docks.

There is another variant which can be attached to any term it is coded as “C” meaning commission to be paid to the trader and the term is mentioned as FOBC3 or CIFC3, the fig 1 indicates that the price is inclusive of 3 % commission for the trader involved.

(h) The Incoterms are not the Law:

These terms in themselves are not the law, but when accepted by both the importers and the exporters, than it become the legal document and can be taken up for redressal in a court of law.

(i) Usage:

Specific usage of the specific terms.

(a) FCA, CPT. and CIP are used for the general, Multimodal/Containerized transport.

(b) FOB, CFR, and CIF are used for the maritime transportation.

(j) Basic Terminology:

There are some basic terms used in the transaction or carriage of the goods, like;

Contract:

This document specifies mainly the item, quantity, specification, price, delivery time and payment terms binding on the buyer and the seller.

Country of Origin:

This indicates the country in which the goods are produced and or from which the seller has to dispatch them.

Carrier:

This term specifies the owner/charter who enters into a contract of carriage with a shipper. It also includes the mode of transport to be used i.e. road, rail, air or sea.

Expenses:

This term indicates as to who bears the costs involved up to the carriage, for the carriage and after the carriage.

Insurance:

This means the insurance cover during the period the goods are in transit from the point of origin up to the point of destination.

Commercial Invoice:

This document pertains to the authentication for the sale of goods from the exporter to the importer.

Bill of Lading:

This is the key document for the conduct of export trade. It links up the goods, payment, and the carrier under a contract.

This document, in its negotiable form, is very important for the related bankers for them it is their security for the credit amount, however when it is in non- negotiable form then it serves no security to the related bankers unless they are named as consignee and they take steps to ensure that this designation in irrevocable.

This refers to a document issued by or on behalf of the carrier as an evidence of contract of carriage as well as the proof of the goods on board the carrier or on board. This document also transfers the ownership of the contracted goods from the seller to the buyer and this document also enables the buyer to release the payment to the seller in a way as defined in the contract document.

(k) Different Forms of Bill of Lading:

According to ICC guidelines, the various forms of the B/L are as follows:

(i) On-Board/Shipped B/L:

A B/L confirming that the cargo is on board the ship in good condition.

(ii) Received for Shipment B/L:

It only signifies that the goods have been received but not loaded on board. It is common with the container shipments delivered to ports terminals. In this case the B/L must be converted by subsequent ON-BOARD notation if circumstances so warrant.

(iii) Clean B/L:

It is a B/L, which contains no mention indicating that the goods have been wholly or partially lost/damaged.

(iv) Dirty/Foul/Claused B/L:

It is a B/L, which contains a mention that the goods have been partially or wholly lost or damaged.

(v) Straight B/L:

It is a non-negotiable B/L, consignee only needs to identify himself to pickup the goods.

(vi) Order B/L:

It is a negotiable B/L issued – to the order- of a specific party, which is commonly the shipper.

(vii) Through B/L:

It is a B/L used when the shipment will involve multiple transport stages involving different carriers.

(viii) Direct B/L:

It is a B/L for direct transportation between loading and discharging ports.

(ix) Multimodal B/L:

It is also called the combined transport B/L. It is issued to cover transport- involving variety of transportation mediums like road, rail, sea/air rail and road respectively involving the destination point.

(x) Fiata FBL:

It is a standard for of B/L issued by a freight forwarder; considered under UCP 500- along with other forwarder bills in which the agents accept full responsibility as a cameras acceptable as a clean on board B/L issued by a career.

(xi) House B/L:

A B/L issued by freight forwarder in his own name covering the group of consignments.

(xii) Freight Pre Paid B/L:

It indicates that the shipper has paid the freight.

(xiii) Liner B/L:

A B/L, which is subject to the terms and conditions of a shipping line.

(xiv) Short-Form B/L:

In this case the B/L does not contain the full terms and conditions of the contract carriage. Instead it contains an abbreviated version of the carrier’s conditions with a reference to the full set of the conditions.

(xv) Stale B/L:

The B/L must be presented within a prescribed number of days. A B/L, which is presented not with the specified date, is called Stale B/L.

(xvi) Waybill:

It is a non-negotiable transport document.

Shipment and Arrival Contracts:

There are two types of contracts for the international trade. The Shipment Contracts and the Arrival Contracts.

Shipment Contracts:

The E, F and C terms (EXW, FCA, FAS, FOB, CFR, CIF, CPT, and CIP) are called the shipment terms since the exporter transfers the risks to the importer after he has shipped the goods or placed them at the disposal of the importer. The contracts thus entered into between the importers and the exporters are termed as the “shipment contracts”.

Such contracts are tilted towards the exporter since he gets away from the risks of the high seas. If the cargo is lost in transit then the exporter has no obligation towards the importer and the importer has to get compensation from the insurance company, extent of which would depend 011 the type of cover that he had taken for his consignment.

The system of the documentary credit has its roots in this type of business transactions. In shipment contracts the delivery takes place in the country of the exporter. If the exporter arranges for the insurance cover even than it does not mean that he undertakes the delivery obligation upto the destination point.

His risk and obligations finishes at the point of delivery as covered under the shipment terms. In such cases the resulting losses or damage to the goods (in transit) has to be the responsibility of the importer.

For safety sake the exporter may insist upon inclusion of specific clause in the delivery terms (in the event he arranges for the insurance) that resulting losses and damage to the goods after they have passed the delivery point must rest with importer.

Arrival Contracts:

The D-terms (DAF, DES, DEQ, DDU, and DDP) are also called the arrival terms since they mean that the goods are delivered at the discharging port of the importer by the exporter. The contracts thus entered using these D-terms are called as the “arrival contracts”.

In these contracts the exporter is fully responsible till the goods are delivered at the named port of the importer, so he (exporter) assumes total risk for the goods during the transit period from the shipment port to the destination port.

If the goods are lost during transit then he is legally bound to replace and/or compensate the importer to the extent the damage has occurred. It is a different matter that the exporter in such cases will get compensation from the insurance company. The most important point is at which stage the risk got transferred from the exporter to the importer.

There are two critical points, one at which the division of the risk takes place, one at the loading port when the goods pass the rail of the ship and second when the goods arrive at the destination port. The exporter has paid for the carriage till the destination port, so it is natural that he bears the risk from the time the goods pass the rail of the ship to till the destination port.

DDU is in contrast to this. In this case the exporter bears full risk till the goods are delivered at the destination port. If the goods are lost or damaged in transit than the exporter must replace them or compensate the importer. It must be noted that in the arrival contracts the delivery takes place in the country of the importer.

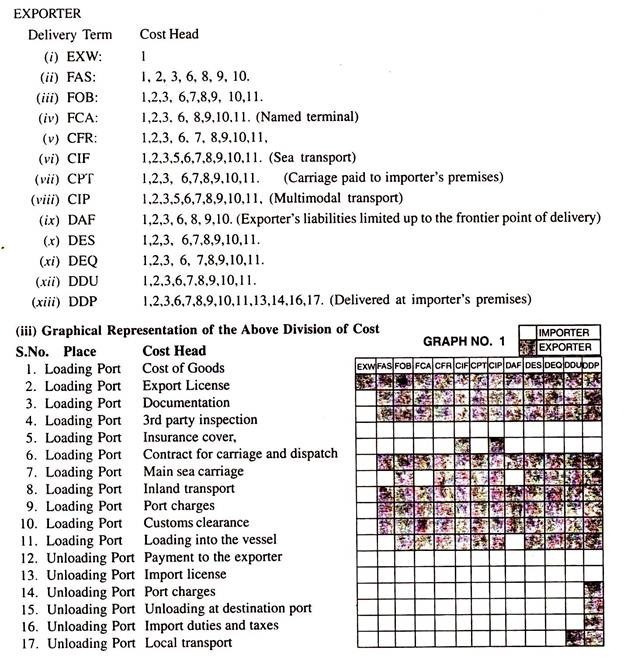

The Various Cost Headings:

The movement of the goods from the exporter’s premises up to the importer’s premises involves various cost heading; some are to be borne by the exporter and the others by the importer. The net sum of the total cost heads is fixed, if it increases for one party, it decreases for the other party.

As we move from the EXW to the DDU the net cost headings and the cost to the exporter increases and proportionately it decreases to the importer but it doesn’t mean that the importer pays less or the imports gets more. As far as the importer is concerned the net cost of the goods to him is the total cost-heads of all the individual elements.

On the other hands the net cost to the exporter is the cost of his goods on EXW basis and that is what he wants to get paid for but if he performs any additional activity than he charges it to the importer. For a better understanding of the INCOTERMS we must understand these cost heads.

General Actions Done in the Country of Origin and Destination:

(i) Loading Port/Country of Origin:

1. Cost of the goods (material cost, processing cost, overheads, internal inspection, packing material, packing, and profit margins).

2. Cost for arranging export license.

3. Cost of documentation.

4. Cost of the 3rd party inspection

5. Arrangement for Insurance cover.

6. Contract for carriage and dispatch. (Always Exporter’s except EXW)

7. Arrangement for main sea carriage.

8. Cost of inland transport up to the loading port.

9. Port charges.

10. Customs clearances.

11. Loading into the vessel.

(ii) Unloading Port Activities/Country of Destination:

12. Payment to the exporter.

13. Arrange for the import license

14. Port charges.

15. Unloading at the destination port.

16. Import duties and taxes.

17. Local transport

(ii) The division of the costs between the exporter and the importer depends on the specific delivery term used in the contract. In the table following hereunder the various cost heads are listed against the respective delivery term for exporter’s a/c. What is not mentioned for the exporter will be for the importer a/c.

The Risk Shift Points under Various Delivery Terms:

The risk shifts from the exporter to the importer when the delivery of the goods under the contract has been done as per the contract and the moment importer takes over the possession of the goods the risk shifts from the exporter to the importer.

As such when discussing the risk transfer factor take the delivery and possession points in to consideration.

In the following paragraph such risk transfer points are mentioned for the easy understanding of the students:

(i) EXW:

The exit point of the exporter’s premises.

(ii) FAS:

Loading port, at the wharf.

(iii) FOB:

Ship’s rail at the loading port.

(iv) FCA:

Delivery of the goods to the nominated carrier at the loading port.

(v) CFR:

Ship’s rail at the loading port.

(vi) CIF:

Ship’s rail at the loading port.

(vii) CPT:

Delivery to the nominated carrier (or first carrier in case more than one).

(viii) CIP:

Delivered to the nominated earner (or Is’ carrier in case more than one).

(ix) DAF:

The frontier customs exit point of the exporter’s country.

(x) DES:

Onboard the exporter’s carrier, at the unloading port.

(xi) DEQ:

On the quay at the unloading port.

(xii) DDU:

The selected point and place by the importer for taking delivery.

(xiii) DDP:

The selected point and place by the importer for taking delivery.

Insurance Obligations under Incoterms:

The terms CIF and CIP clearly stipulates the insurance obligations under the INCOTERM but even under these terms the exporter takes out the insurance policy on the minimum terms, and leaves it up to the importer to get extra policy cover at his (importer’s) own a/c.

As far as the EXW is concerned there is no need for the exporter to get any cover but it is for the importer to get full cover from the exporter’s premises up to the destination point or his premises.

Similarly for DDP (reversal of EXW) the importer has to take out policy to the extent the goods are in his possession after delivery, but the exporter has to get the full cover from his premises up to the destination point (port terminal or premises) in the importer’s country.

For the rest of the 9 terms it is left to the parties to decide on mutual consultation, or otherwise, how to safeguard their interests against the loss and damage to the goods. Here again they may take out policies at least up-to-the-point/from-the-point of risk respectively.

Sale of Goods in Transit:

In case the importer intends to sell the contracted goods in transit, than normally he o uses the CFR or the CIF terms. Because in these two terms the exporter ships the goods after concluding the carriage contract with the carrier, thereby getting the B/L which can be used by the exporter for sale in transit. In this case the importer becomes the exporter and the first party, which buys the goods, becomes the importer.

It must be noted that in case of sale in transit, the goods are still on board the vessel and the first party, or any number of subsequent parties, cannot know the condition of the goods, but since the carrier issued the clean transport documents after accepting the goods on board from the exporter, it is understood that the goods were in good condition.

So the importer’s interests are protected against the loss or damage to the goods by the issuer of the transport documents.

Transfer of Risk and Transfer of Property Rights:

These are two different terms, risk relates to the loss and damage to the goods, rights relates to the ownership to the goods. Transfer of risk occurs when the goods are delivered to the importer dependant on the specific delivery term used for the transaction.

It is possible that the exporter retains the title to the goods even after the risk has been shifted to the importer, but the moment the importer releases the payment to the importer, he (importer) assumes the title to the property (goods) and the property right are shifted from the exporter to the importer.

Element # 8. Currency:

A. Understanding Basic Financial Terms:

The international trade is carried out for earning (and investing) the hard currency, which can be stored and exchanged as per the needs. The international currency, or as a matter of fact any currency can also be treated at par with other commodities like brand names, durability, market position, demand and supply etc.

This requires a serious consideration on part of the exporters and importers to understand the term currency in its full identity and use it judiciously for the conduct of their global trade.

In order to develop the basic concept and understanding of the currencies it would be better for the students, especially those without any financial educational back ground, to understand the terminology used in foreign exchange sector. Some of the most commonly used terms are discussed here under.

(i) Foreign Exchange Rate System:

Foreign exchange rate is the nominal price of one nation’s money in terms of another. In other words, if we take the US $ as the standard currency than the numbers of the Indian Rupees that can buy a US $. There is no perfect system to fix exchange rate. The general tendency is to use a system, which promotes stability, certainty and retards inflation.

(ii) The Spot Rate, Future Rates and the Future Sport Rates:

The spot rate and the future rates are the two most common foreign exchange rates quoted by the national and or other banks dealing with the foreign currency trade. The spot rate means the today’s exchange rate or the numbers of the Indian rupees that you have to pay to buy each US $.

The future rate or the forward rate is the exchange rate available today for delivery at a specified future date, generally it is 30/60/90/ 180 and even 360 days. Here some finer line of difference exists between the forward rate and the future rate. In broader terms both appear to be similar but in concept only.

The bankers generally use the forward rate when you negotiate to buy specific fund to finance your trade. On the other hand the future rate is referred to by the currency dealers in the similar fashion as the futures trade in commodities.

The two may be same but not necessarily be the same. The forward rate is influence by the interest rates charged and expected to charge by the banking system. The future rates are influence by the demand and supply situation in the currency market.

The above two rates are different from the expected future spot rates. This rate reflects the expectation the market has about the price of a currency at a specified future date from now. This represents only the expectancy and not the certainty.

(iii) Depreciation:

When the spot exchange rate of a currency increases, the currency is said to have depreciated.

(iv) Appreciation:

When the spot exchange rate of a currency decreases the currency is said to have appreciated.

(v) Premium:

When the future exchange rate is higher than the spot exchange rate of a currency then that currency is said to be at a forward premium. In this case the other currency like Indian rupees if it is tied up with US $ than the Indian rupee will be at future discount.

(vi) Discount:

When the future exchange rate is lower than the spot exchange rate, then the currency is said to be at future or forward discount. As explained in the earlier point, if the Indian rupee is linked up with US $ than in that case it will be at premium as compared to the US $.

(vii) PPP (Purchasing Power Parity rate):

It refers to the correlation between one country’s price level or the inflation rate relative to another country, and the prevailing exchange rate between the two countries.

(viii) Foreign Exchange Market:

It refers to the market where one can trade in foreign currencies.

(ix) Floating Exchange Rate:

The rate affected by the demand and supply situation in the market. Since the rate is not fixed so it is called the floating exchange rate.

(x) Currency Risk:

The gain or loss associated due to the floating exchange rate is called the currency risk.

(xi) Transaction Exposure:

The fluctuation of the currency exchange rates in-between the contract date and the money realization date.

(xii) Inflation:

The reduction in the purchasing power of a currency is referred to as the inflation.

(xiii) Devaluation:

It means the adverse reduction in the exchange rate on one currency as compared to the other currency. When one currency is devalued the exports become easier and imports difficult.

(xiv) Gold Standard:

It means the quantity of gold against a country’s unit currency. It is associated with the exchange rate system. The international practice is to state the value of gold in terms of the US Dollar.

B. What is a Hard Currency?

The international business is carried out in hard currencies like the US Dollar and Sterling Pound; however it can also be in Japanese Yen and German Mark.

A hard currency is the one which can be trusted by majority of the international trading communities as dependable and freely exchangeable with minor fluctuations, the country issuing that currency must be financially solid and has depth of financial and commercial transactions world over, the country has political stability, and the country’s financial institutions are free from any restrictive controls.

For the beginners in the intentional business it would be sufficient to treat the currency as a commodity, which can be bought and sold like any other commodity. The money can also be of specific brands like you have many brands in soft drinks, the brands in money are the names of the currency like the Indian Rupee, US Dollar, French Frank, Italian Lira etc.

It is up to the customers to decide which brand of the soft drink they want to have, similarly it is up to the trading institution or the individual to decide which brand of currency they or he wants to use for his business.

C. Decision for Specific Currency:

The decisions for specific currency are based on following factors:

i. It must serve as a universal medium of exchange (for trading).

ii. It must be a unit of account (for invoicing and fixing exchange rate parities.).

iii. It must have value backup. (For building up financial assets like currency reserves with the confidence that the value is storable and exchangeable in future).

If a currency meets the above pre-requisites then it would be suitable for use in the international business. It will also be marked as the hard currency.

D.What is foreign exchange market:

It refers to the market where one can trade in foreign currencies. There is no fixed floor or the central trading area but the individuals, dealers, banks and the financial institutions trade in it through personal and/or the electronic mediums.

This market is open 24 hours a day because when one market in a particular country or region closes another opens up in another country or region. 90% of the world trade is conducted in the US $ so this is the currency mostly traded in the foreign exchange market world over.

This market facilitates financial transactions in three different ways:

i. It provides credit or financing for the international business (L/C & drafts).

ii. It assists in the clearing functions (international clearing in our case). Clearing is a process under which a financial transaction between importers and exporters are settled by the intervention of the banks (issuing bank and negotiating bank).

The funds are transferred on paper from the importers to their local bank (issuing bank). From the local bank the funds are transferred to a New York bank, and finally to the bank of the exporter (negotiating bank).

iii. This market also facilitates hedging for currency risk reduction (spot markets and future markets).

e. Which Currency to be used for International Business Transactions:

(i) There are two types of currencies involved in any international contract, one in which the price of the commodity is mentioned, and the second in which the payment is made by the importer to the exporter. As such there are two options available for the contracting parties; the first one is the “currency of account” meaning the currency in which the price is mentioned in the contract.

The second one is the “currency of payment” meaning the currency in which the payment is to be made to the exporter (this also refers to the currency of the place). If both are the same then there is no problem on either side. But in case both are different then there is some amount of risk involved.

The risk is the exchange rate variation. Under such conditions the exporter and the importer should sort out at the time of negotiation for the contract as to who will bear the currency fluctuation risk.

If nothing is contained in the body of the contract then the importer has the option to pay either in the currency of account or in the currency of payment or the currency of the place of the importer. However in the later case the currency of place must be freely convertible.

In the international trade, depending on the market situation, the importer and or exporter can decide the type of currency that they want to deal with. The currency for price is dependent on the exporter and the currency for payment is dependent on the importer.

It is advisable for the contracting parties to clearly mention in the contract the currency of price and the currency of payment. Generally the currency of payment is considered as the currency of price, unless otherwise agreed upon differently by the contracting parties

(ii) It is up to the importer or the exporter to decide which currency can give him the maximum benefit. If the importer so desires it can be in any currency of his choice. The exporter has to be careful while quoting in currency other than the internationally accepted hard currencies (US $, Euro, Yen, FF).

The best option for the importer/exporter is to consult their bankers for fixing the exchange rate between the currency of the palace and the other hard currencies especially if the realization of the proceeds is on extended period of time.

(iii) There are many agencies to provide the currency fluctuation risk coverage. As far as possible use a currency, which is stable and suffers least fluctuation. The US $ is more or less the most common currency for the international trade.

Element # 9. Price:

It may be defined as the value of a commodity or service expressed in terms of money. The survival of the organization depends on this very factor. The price in its generic term does nothing but a value indicator, but when applied to competitive market conditions of demand and supply, it shows up its worth.

As an exporter or an importer you have to be very careful about the ultimate price to the final customer for getting a positive result. Therefore whether as an exporter you quote on EXW or DDP terms you have to take into consideration the impact of your price on the market and the final customer or the point of consumption.

If the importer asks you for an EXW or FOB price than he has some idea of the various price loading factors up to the point of sale in the target market. An exporter who is concentrating only on the price asked for is just working on the surface of the market, but the exporter who studies the market and then decides on the pricing strategy has better chances of success.

This exercise is required irrespective of whether you are working on the consumer goods or the industrial goods though for the consumer goods segment this exercise needs micro level studies as compared to the other segment where macro level studies would be sufficient.

In order to understand the price structure we better understand its various units or the single elements, analysis of these elements will help us to decide the pricing strategy (also for the export marketing) for the market and/or the customer specific.

A. Elements of Price:

There are basically 26 elements which constitute full spectrum of price starting from the basic raw materials right up to the point of consumption or sale. These elements add-on value.

Added together they indicate the price in the target overseas market/customer. For simplicity purposes the operating fixed overheads of running the business are not included in this list.

The elements are:

(i) Raw material cost.

(ii) Transportation cost up to the production place.

(iii) If the raw materials are stocked at a warehouse than the warehousing cost plus the transportation and material handling cost up to the production place.

(iv) Inspection cost.

(v) Processing cost.

(vi) In-house inspection cost.

(vii) Documentation cost (including costs for export license and other formalities).

(viii) Packing cost.

(ix) Local taxes and duties.

(x) Pre-shipment inspection costs.

(xi) Local transportation up to the loading port.

(xii) Port charges.

(xiii) Customs clearance costs.

(xiv) Loading charges.

(xv) Dispatch and demurrages.

(xvi) Ocean/air transportation cost.

(xvii) Insurance cost.

(xviii) Unloading at destination port charges.

(xix) Financing costs.

(xx) Import license and other documentation cost.

(xxi) Import duties and taxes.

(xxii) Inland transportation cost up to the point of sale or up to the point of further processing or, up to the warehouse plus further transportation as the case might be.

(xxiii) Local wholesaler/distributor/retailer margins.

(xxiv) Consumer packing and labeling costs.

(xxv) Inventory cost.

(xxvi) After sales service cost.

(xxvii) The profit margin.

All the above elements have a price tag; some are for the exporter and some for the importer. As far as the ultimate customer is concerned he bears the sum total of (i) to (xxv) cost elements.

The price calculation, whether for an exporter or an importer, has to be based keeping these elements into consideration. For an exporter it would be easy to know the elements that are within his territory or control, but he has to research to find out the other elements for arriving at the optimum calculated price (OCP) for his commodities.

The importer depending on the facilities and logistical controls that he has under his command primarily decides the sharing of the cost elements. That is why, in general, when he asks for EXW price then he is confident to competitively controls the rest of the elements.

And when he asks for the DDP price then he is not confident to competitively control the rest of the price elements. However this is not the rule. There are specific cases when the exporter wants to exercise control over the movement of the goods in the destination market, in that case he opts for DDP terms instead of any other term.

B. Factors Affecting the Export Pricing Strategy:

Pricing is perhaps the most difficult factor for the international business. The starting point in any case is the corporate policy and main objective, once a decision is taken to enter a market than there are various variables, which affect your pricing strategy.

What then you quote for a specific market is largely affected not only by your competitors in the market but also by the market situation itself at that particular point of time. In general there are several factors (besides the corporate policy) which affect your pricing strategy, like;

a. Pointers affecting the strategy:

(i) Rate of Return,

(ii) Market stabilization,

(iii) Demand led pricing,

(iv) Competition led pricing,

(v) Product differentiation,

(vi) Market feelers,

(vii) Market penetration,

(viii) Effect of the product life cycle, and

(ix) Killer pricing to block fresh blood in the market.

b. Pointers Directed by the Market Forces:

The above pointers will help in evolving a set strategy for the market specific thereafter one has to take into consideration eight major factors for arriving at the optimum price level:

(i) The net cost to the company,

(ii) Estimated price range,

(iii) Target price,

(iv) Total market potential,

(v) Targeted potential,

(vi) The product specific market position,

(vii) Movement of the competitors,

(viii) Market potential and strategic importance to the organization,

(ix) Strengths and weaknesses of the product, and

(x) Point of production and distribution (competitors).

c. Pointers due to compatibility/technical innovation:

In addition to the above there are two more points which one must take into consideration:

(i) Compatible products (technically and commercially).

(ii) Anticipated innovations (production, distribution & financing).

d. Local Laws, currency fluctuation, level of inflation, prevalence of non-money payment system, fair trade practices etc.:

Whether one is quoting for the industrial products or on different delivery/payment terms, due consideration to above four pointers has to be given to arrive at the net market price in the target market otherwise total exercise would be a futile effort.

Further, a price fixed is not an end to the exercise, rather it is the beginning of a constantly varying and adjusting exercise which can help in market entry, stability, expansion and consolidation.

C. How to Make an Export Offer:

The thumb rule is to consider only what is inquired in the inquiry-sheet from the importer. The price in this case is of prime importance. The price as arrived after due consideration to the above factors has to be quoted to the overseas importer.

The offer sheet must reflect the unit price, total value, delivery terms, the payment method, the currency involved, quantity, quality, etc. Therefore when you mention a price make sure that it covers these factors fully and without any ambiguity.

Example:

Price Us $ 2350 / MT CIF Kobe Japan for payment by L/C at sight for shipment Mar99 in 20ft container x 10 covering 190 MT 8.00MM SS bright bars conforming to AISI 304.

This example is very elaborate. What does it indicate?

Unit price = US $ 2350

AISI304 = Specification/standard

Unit weight = Metric Ton

Currency = US Dollars

Delivery terms = CIF

Port of destination = Kobe Japan

Payment method = Letter of Credit

Payment terms = At sight basis

Shipment = Mar 99

Delivery mode = Containerized cargo

Quantity = 190 MT

Type of containers = 20 ft type

Total Containers = 10 nos.

Once your price has been negotiated and accepted by the importer than you mention it as US $ 2350/MT CIF Kobe Japan in the contract sheet. Other points as mentioned above are covered in their respective points in the body of the contract. So when you are mentioning the price make sure it refers to the unit value, in a hard currency, includes the delivery term, and the payment option.

Also if your price is subject to certain minimum quantity to be ordered of for specific delivery period than you must mention the same in your price very clearly and boldly. Anything, which is not mentioned directly, would lead to problems sooner or later depending upon which becomes the aggrieved party, the exporter or the importer.

Remember your and your organization’s survival depends on this very point of price, hence be meticulous, systematic, thorough and double check your doubly checked price calculations before letting it known to the importer.

This is one-way communication and commitment, once communicated it cannot be re-tracked unless rejected by the importer or its validity expires for acceptance. But since we are discussing on the contract formation hence it is the final stage and needs careful handling.

Element # 10. Payment:

Finance is at the heart of any business. In the domestic market the controls are well within the reach of the buyers and the sellers but when we deal at the international levels the distances involved create a certain degree of risk for the receipt and dispatch of the fund and the commodities.

It is here that various payment methods are used to protect both the importers and the exporters. There are some methods, which provide protection to the exporter, and some to the importer. Still there are some methods, which provide collective protection to both including the bank involved as the third party.

The international payment methods have reached a well-accepted level of perfection and acceptability. It has evolved into a study and a management discipline in itself.

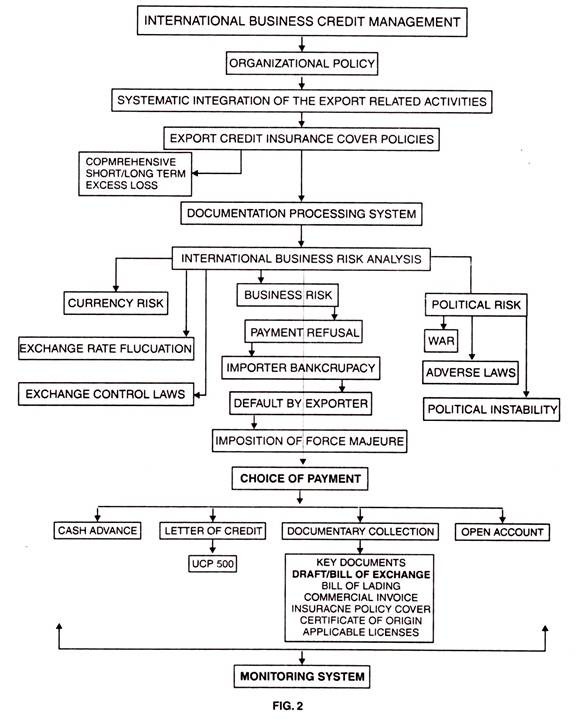

A. Credit Management:

It is the central point of the international business. The firms with sound credit management system become operationally viable and are able to protect their interests as against those with no such system who are destined to vanish from the international scene sooner or later. The total concept of credit management is summarized in the structure given in figure 2.

This structure gives the full spectrum of the credit management system that an organization must adopt for proper and judicious utilization of the financial resources.

B. Understanding the Associated Terminology:

(i) Exporter:

(a) Beneficiary:

The one who receives the payment.

(b) Consignment:

The goods meant for sale/export in ready to dispatch condition.

(c) Consignor:

The one who ships the goods/consignment.

(d) Shipper:

The one in whose name the contract has been entered and makes the dispatch under his name.

(ii) Importer:

(a) Applicant:

The one who makes an application for making the payment to the bank.

(b) Account party:

The one who submits an application to the bank to make the payment, for banking purposes he opens an account with the Bank and hence he is termed as the account party.

(c) Opener:

The one who opens an account with the bank to make the payment to the beneficiary.

(iii) The Bank:

(a) Advising Bank:

The bank which notifies the exporter that a credit has been opened in his favour. This bank performs functions like confirming, negotiating and paying. This bank is normally located in the exporter’s country.

(b) Confirming Bank:

This bank endorses the irrevocable undertaking to the credit. This endorsement permits payment to the exporter by a bank (in the exporter’s own country or the bank which is nominated by the exporter) on presentation of conforming documents.

The confirming bank makes the payment to the exporter without recourse which means that even if no reimbursement is received from the issuing bank, the confirming bank cannot recover funds from the exporter.

(c) Issuing Bank:

The bank which agrees to issue credit upon receipt of the importer’s application on behalf of the exporter. It commits to make irrevocable undertaking to pay to the exporter/ beneficiary the specified value subject to the contract conditions.

(d) Negotiating Bank:

This is the bank which negotiates with recourse the exporter’s documents. The term recourse means if the issuing bank fails to reimburse the negotiating bank, the negotiating bank will recover the funds advanced to the exporter.

(e) Nominated Bank:

This is the bank which is authorized in a credit to pay, issue a deferred payment undertaking or even accept drafts. In the case of freely negotiable type of credit than any bank can become a nominated bank. A nominated bank is bound to pay only when it adds its confirmation to the credit in which case it becomes a confirming bank.

(f) Paying Bank:

The bank which pays to the exporter against presentation of the “in order” credit documents. The risk with this type of bank is that it cannot recover funds from the issuing bank if it pays to the exporter against credit documents which has discrepancy. This bank has the right of refusal for payment if it finds out that the issuing bank do not have sufficient deposit in the account to recover the draft.

(g) Draft:

It is a bill of exchange for making payment to the exporter by the importer. This document contains all (he instructions for the exporter’s bank and the importer’s bank clarifying who pays to whom how much where and when.

(h) International Banking:

Each country has its own currency managed by a central bank like the RBI in India. The local currency is not some times the internationally accepted currency so it has to be converted into internationally acceptable currency. These central banks do this job as (he prime source and action centers. The cluster of such banks forms the international banking system.

(i) Sight Drafts:

If a draft is drawn at sight the documents are released to the buyer or the drawee upon payment of the draft. If the payment is released against documents then the system is called “Payment against Documents” (DP), and if the payment is released against the cash than the system is called “Cash against Documents” or CAD.

(j) Time Drafts:

A draft payable in a fixed time period is referred to as the time draft. The documents are released to the importer upon acceptance of the draft. This system is called DA or “Documents against acceptance”. The actual payment is made at the maturity of the draft.

(k) Functions of the exporter’s Bank:

Collection (clean collection and documentary collection) and data processing.

C. Commentary on Payment Operations:

(i) The framework set up by the RBI governs the export sales proceeds. It prohibits direct receipt by the exporters from the overseas importers in the form of Currency notes, TC, Drafts. RBI also does not permit reimbursement of export sale proceeds against any other outstanding dues to the importer or its nominee in any form, unless otherwise categorically approved by RBI.

The proceeds must be in currencies permitted by RBI, the most common such currencies are the US Dollar, British Sterling Pound, Japanese Yen, German Mark, French Franks, Italian Lira, AMU and Euro etc.

(ii) The salient features of the payment system are the security mechanism, finance, credit management and policy, risk management, payment mechanism, exchange risks management, documentation, export credit insurance coverage including currency risks and business risks.

The terms of payment depend upon the total volume involved, type of business, destination, country, nature of goods, importer’s credit worthiness, political and economic situation in the importing country, the currency regulations in the importing country, the delivery period and lastly on the financial conditions of the exporter himself.

(iii) There are a number of options available to an exporter and importer, usage depends on the said conditions and individual preferences. The cost of payment method has to be taken into account.

The most secure method will be the most expensive and the least secure one will be most economical. In all its forms there are only two major risks at each side. The importer has the risk relates for goods and the exporter’s risk relates for payment.

(iv) The various methods used for international trade payment system are the;

I-Open Account

II-Cash in advance

III-Collection (documentary collection/ clean collection)

IV-Documentary credits (L/C. UCP 500)

I. Open Account:

For an importer Open Account terms are the most advantageous since there is no need for blocking payment till the goods are received inspected and even sold. The goods are shipped directly to the importer without calling for payment. This is very similar to “buy now pay later” mode of business.

This is a sort of credit sale. This method is generally used for the domestic trade, but in the case of foreign trade this method is used only when the importer and exporter have developed good faith on each other or between the branches of a larger organization.

This method has highest risk for the exporter. Export proceeds are settled through pre-determined periodic remittances. The exporter in this case must have enough financial reserves. For organizations intending to use this type of payment terms they must get Reserve Bank’s written permission to do so.

This is also one of the simplest forms of payment. In this case the exporter ships the contracted goods with an invoice before receipt of payment. The importer gets the goods before making any payment and has time to check and take safeguard action if the goods received are not conforming to the contract.

This is economical in the sense the importer can avoid all the banking charges for opening a credit line on the exporter. The exact time of payment is mutually decided between the importer and the exporter. In this case the exporter is totally dependent on the importer for release of payment.

II. Cash in Advance:

In the case of cash in advance the exporter takes no risk or minimal of risk. However the importer takes the highest risk. The cash in advance can be as small as 20 to 30% of the contract amount or full amount depending on the business conditions.

If the market situation is such that the importer has no other way of getting the required goods or if the time is very limited and the goods are of standard nature or are one of the mass produced type, than the exporter can dictate terms and can demand for full advance payment.

This facility of advance payment the importer can offer to the exporter through exchange of legally binding undertaking or if the amount is say 20 to 30% of the contract amount than by including the Red Clause in the L/C.

The cash in advance can also be replaced by the provision of a documentary instrument like bank guarantee. This method is ideal for the exporter. In this form of payment the exporter gets full (or part) payment before making the shipment. This is highly exporter friendly payment term.

The importer totally depends on the exporter for receipt of the goods as ordered. The main disadvantage with this system is that the importer receives the goods after he has made the payment and will be wasting lots of time and money in getting the right goods in the case the goods shipped are not conforming to the specified quality, quantity and time period of shipment.

The importer can get some protection if he stipulates strict pre-shipment inspection covering both quality and quantity of the goods to be shipped, and adds a special clause in the contract imposing penalty for delayed shipment.

The standard clause is 0.5% per week for the quantity delayed subject to maximum 10 weeks failing which the importer reserves the right for risk import at the exporter’s a/c. This form is not very practical in a highly competitive market.

III. Documentary Collection:

The various parties involved in the collection process are the drawer, the remitting bank, the collecting bank and the drawee.

(i) In this form the shipping documents are attached with a draft. The remitting bank forwards the documents under its cover (collection instructions of the exporter) to the collecting bank. The importer receives the documents only after he complies with the “collection instructions” of the exporter (collecting bank endorses the B/L in favour of the importer) and the title to the goods changes from the exporter to the importer.