This article throws light upon the top two measures used for measuring shareholders value creation. The measures are: 1. Economic Value Added (Eva) 2. Market Value Added (MVA).

Shareholders Value Creation: Measure # 1. Economic Value Added (Eva):

Economic value added is a measure of performance evaluation that was originally employed by Stern Stewart & Co. It is very popular measure today which is used to measure the surplus value created by an investment or a portfolio of investments. EVA has been considered as a better measure of divisional performance as compared to the Return on Assets ROA or ROI.

It is also being used to determine whether and investment positively contributes to the shareholders wealth. The economic value added of an investment is simply equal to the after tax operating profits generated by the investment minus the cost of funds used to finance the investment.

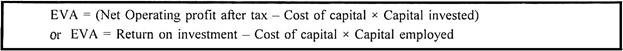

EVA can be calculated as below:

According to this approach, an investment can be accepted only if the surplus (EVA) is positive. It is only the positive EVA that will add value and enhance the shareholders wealth. However, to calculate the economic value added we need to estimate the net operating profit after tax and cost of funds invested.

Suppose an investment generates net operating profit after tax of Rs. 20 lakhs and the cost of financing investment is Rs. 16 lakhs. The economic value added by the investment shall be? 4 lakh and it should be accepted.

Shareholders Value Creation: Measure # 2. Market Value Added (MVA):

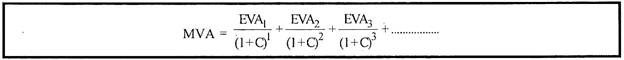

The market valued added (MVA) is the sum total of all the present values of future EVAs.

The market value added (MVA) can also be defined as the difference between the current market value of the firm and the book value of capital employed by the firm. The market value of the firm is simply the sum of market value of its equity and debt. In case, the market value of a firm exceeds the book value of capital employed, it is said to have a positive MVA.

ADVERTISEMENTS:

In the same manner, if the value of capital employed exceeds the market value of the firm, it is said to have a negative MVA.