After reading this article you will learn about Financial Management in Public Sector Undertakings:- 1. Introduction to Public Sector Undertakings 2. Capital Expenditure Decisions in Public Sector Undertakings 3. Budgeting 4. Pricing 5. Guidelines 6. Profitability and Efficiency 7. Role of Financial Advisor 8. Public Enterprise Policy.

Contents:

- Introduction to Public Sector Undertakings

- Capital Expenditure Decisions in Public Sector Undertakings

- Budgeting by Public Sector Undertakings

- Pricing by Public Sector Undertakings

- Guidelines for Public Sector Undertakings

- Profitability and Efficiency of Public Sector Undertakings

- Role of Financial Advisor in Public Sector Undertakings

- Public Enterprise Policy in Public Sector Undertakings

1. Introduction to Public Sector Undertakings:

Before independence participation of public sector undertakings in economic development of the country was almost nil. The Railways, Posts and Telegraphs, Aircraft, Port Trusts, Ordinance factories were the only undertakings under government control.

ADVERTISEMENTS:

It was only after the Industrial Policy of 1956 that public sector undertakings got a phi 1 lip. The socialistic pattern of development adopted by the government also encouraged the settings up of public undertakings.

Public sector undertakings play a dominant role at present. These undertakings include departmental enterprises, financial institutions and non-departmental enterprises or government companies.

There has been appreciable growth in investment in Public Sector Enterprises (PSEs) over the years. In 1951, there were only 5 public sector enterprises with an investment of Rs. 29 crore which has increased to Rs. 2,74,114 crore in 242 enterprises as on March 31, 2001. According to the Public Enterprise Survey 2001-02, there were 230 working PSEs with a total investment of Rs. 3,24,532 crore.

The contribution of PSEs during 2000-01, there were 230 working PSEs with a total investment of Rs. 3,24,632 crore. The contribution of PSEs during 2000-01 in country’s total production of lignite was 100%, in coal about 97%, in petroleum about 81% and in non-ferrous metals viz., primary lead and zinc about 80%. The internal resources generated by PSEs during 2000-01 were Rs. 37,802 crore.

ADVERTISEMENTS:

The PSEs have also been making substantial contribution to augment the resources of Central Government through payment of dividend, interest, corporate taxes, excise duties etc., thereby helping in mobilisation of funds to meet financing needs for planned development of the country. During 2000-01, contribution to the Central Exchequer by the PSEs through these resources amounted to Rs. 60,978 crore.

2. Capital Expenditure Decisions in Public Sector Undertakings:

The Government of India decided way back in 1961 that financing pattern would have a debt-equity ratio of 1:1. Every new project will have half the investment in equity capital and the other half in debts. A decision about capital expenditure involves a number of organisations.

The following organisations are involved in taking up of new schemes, deciding about expansions, modifications, diversifications, etc.,:

ADVERTISEMENTS:

(i) Board of Directors of the Undertaking

(ii) Administrative Ministry

(iii) Public Investment Board (PIB)

(iv) Planning Commission

ADVERTISEMENTS:

(v) Finance Ministry

(vi) Bureau of Public Enterprises (BPE), and

(vii) Director General of Technical Development (DGTD).

Every capital expenditure proposal is first discussed at Board of Directors level of concerned enterprise. The Board can decide only upto a certain amount. The proposals requiring more investments are recommended by the board to the concerned Administrative Ministry.

ADVERTISEMENTS:

After a proper study at Ministry the proposal is either sent to Public Investment Board or Project Appraisal Division (PAD) depending upon the cost involved. PAD evaluates proposals requiring Rs. 1 crore or more whereas PIB deals with proposals of Rs. 5 crores or more. At this level various aspects of the proposal such be as technical, financial, economic, managerial, profitability etc. are evaluated.

After scrutiny at ministry level the proposal goes to the Investment Planning Committee of the Planning Commission. The Advisor (Industries) also examines the proposal and then it is recommended to be included in 5-year plan.

The Finance Ministry has to raise funds for various schemes. The Civil Expenditures Division and Bureau of Public Enterprises in the Department of Expenditure under the Ministry of Finance are engaged in scrutinising the proposals of public enterprises. Unless the clearance is given by the Department of Expenditure, the Administrative Ministry cannot incur any expenditure.

The Director General of Technical Development offers technical advice to the Administrative Ministries. In case of foreign collaborations, Foreign Exchange Board is approached. The approval of f Parliament is also required for major investment decisions.

ADVERTISEMENTS:

ADVERTISEMENTS:

3. Budgeting by Public Sector Undertakings:

Proper budgeting system is followed ad by public sector undertakings. They prepare budgets like Revenue Budget, Capital Expenditure Budget, Cash Budget etc. The Revenue Budget is a projected profit and loss account for the current year and the next year. It is based on production estimates, sales forecasting, cost of production budget, capacity availability budget, expenditure estimates etc.

Capital Expenditure Budget is prepared to forecast future capital expenditure decisions. The expansion, diversification plans etc. are followed for the future period. Cash Budget is based on the estimates of generating and utilising cash. Cash budget takes into account the expenses and incomes shown in revenue budget.

Most of the undertakings prepare budgets for their own use. But undertakings like Railways, LIC, ONGC, etc. submit their budget estimates to Parliament every year. The budgets of the concerns are first approved by the Board of Directors and then sent to the Administrative Ministry, Bureau of Public Enterprises and Planning Commission.

ADVERTISEMENTS:

There is no budgetary control system followed in public undertakings. A proper budgetary control system ensures the implementing of budgets. Any deviation from the budget is promptly reported to top management. To ensure efficiency, there should be a systematic budgetary control system in public enterprises.

4. Pricing by Public Sector Undertakings:

The fixing of price for the products manufactured by public sector enterprises has always remained a problem area. These units are not earning adequate profits and have not created surplus for expansion etc. There has always been a controversy about the fixing of prices. Should these enterprises earn profits like units in private sector? Should their price structure adhere to utility concept?

In public sector enterprises there has been administered pricing i.e. price fixed by the administration and not by the market forces of demand and supply. The price fixation should have some objective and principles. If the prices are not fixed rationally then these can cause either profit or loss.

If prices are higher than increased profits will conceal the inefficiency of the unit. On the other hand if prices are low then there may be losses and efficient units will be penalised. Low prices will not allow the units to create surpluses which are must for further financing of expansion and diversification.

There are two approaches in price fixation i.e. public utility approach and rate of return approach. Public utility approach emphasises ‘no profit no loss’ view. Since public sector units are engaged in basic industries and their products are an important input for other industries, so their prices should be kept low.

ADVERTISEMENTS:

There is a feeling that public sector units should follow the pattern of private sector in fixing prices. However, there many be some discrimination consideration in favour of some consumers or sections of society.

5. Guidelines for Public Sector Undertakings:

ARC recommended the following guidelines for fixing of prices by public sector enterprises.

(a) Public enterprises in the industrial and manufacturing areas should aim at earning surplus so that they are able to generate funds for capital development.

(b) The notional price and income policy of the private sector should be kept in mind while fixing prices.

(c) In case of public utility services the objective is to create more output rather than a rate of return on investment.

ADVERTISEMENTS:

(d) PEs should ensure-their full capacity utilisation.

6. Profitability and Efficiency of Public Sector Undertakings:

Profitability and efficiency are related to each other. The normal yardstick of efficiency is profitability. If a concern is earning profits then we call it profitable and on the other if there are no profits then it will be called inefficient. This yardstick cannot be applied in case of public enterprises.

The main aim of public enterprises is to serve a social cause and profitability comes next. Moreover these enterprises are providing a basic infrastructure for the development of industry. So the efficiency of public enterprises should be judged in this context.

Profits is the surplus over cost. In private sector the main aim is to maximise profits. The public enterprises in India should also earn profits because they get certain benefits as compared to the units in developed countries. The labour cost, which is an important element of cost, is very low in India because of abundant supply.

The government provides concessional funds to these undertakings which should also reduce their cost. Even in marketing the products of these units are given preference by government departments. There is an urgent need for the generation of sufficient funds not only for their expansion and diversification but also to spare funds for plan expenditure of the government.

ADVERTISEMENTS:

Reasons for Low Profitability:

Inspite of many favourable factors most of the public sector units are incurring losses. There was loss of Rs. 203 crores (after tax) in 1980-81 while these units showed a profit of Rs. 2,368 crores in 1990-91. If we compare these profits with the massive capital employed in these units (Rs. 1,01.797 crores) then this figure stands no where.

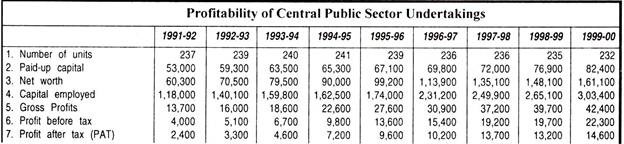

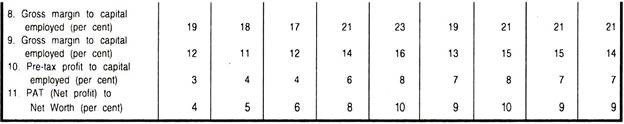

The table given below shows the comparative profitability of Central Public Sector Undertakings from the year 1991-92 to 1999-2000.

The main reasons for bad performance of these units are:

ADVERTISEMENTS:

(i) Initial heavy costs at the time of plan and implementation stage.

(ii) Longer gestation period of public sector units.

(iii) Large unutilised capacity. The installed capacities are large but actual utilised capacity is very low and overhead expenses are very high.

(iv) Heavy social costs. These units spend heavy amounts in constructing townships, providing educational and medical facilities to the employees.

(v) Low priced products. The prices of the products of these enterprises are deliberately kept low because many of these products become inputs for other industrial units.

(vi) High expense ratio. There is no control over the expenses of these units. There are heavy bureaucratic managements and over staffing in other areas.

ADVERTISEMENTS:

(vii) The losses are also due to inefficiency of managements.

The top positions in these units are manned by civil servants. There is a lack of professional people in these organisations. The civil servants are often transferred so these is lack of accountability. The efficiency of management is a major reason for low profitability in these units.

Some steps should be taken to improve the performance of public sector units. There is a need to professionalise management. There is a need to control operating and non-operating costs. Efforts should be made to improve capacity utilisaton in these units. The enterprises should he run on commercial and competitive lines. All such efforts can certainly improve the performance of public sector units.

7. Role of Financial Advisor in Public Sector Undertakings:

The financial advisor has a place of significance in public sector units. The financial advisor was appointed by the Ministry of Finance as its nominee in the unit. His concurrence in all financial matters was necessary. These persons generally belonged to all-India accounting services and were nominated in the same way as the chief executive, the Board of Directors having no say in his appointment and tenure.

The role of financial advisor has been a matter of controversy. He considered himself a an outsider. On the recommendation of a study team the power to appoint a financial advisor now rests with the Board of Directors. He works as an advisor to the chief executive. He advises on all financial matters of the enterprise. He heads the Department of Finance and Accounts.

He is normally assigned the following functions:

(i) Financial concurrence.

(ii) Payment of bills and accounting thereof.

(iii) Sales and commercial activities.

(iv) Cost accounting, cost control and management accounting

(v) Budgeting and budgetary control.

(vi) Tax planning.

(vii) Trustee for Provident Fund, Gratuity Fund etc.

(viii) Internal Checking and Internal Audit.

The type of functions performed by the financial advisor is very important. The success or failure of the organisation is linked to the performance of these functions. Proper care should be taken while appointing a financial advisor.

8. Public Enterprise Policy in Public Sector Undertakings:

There is a consensus that the Government should not be operating commercial enterprises. The reasons for this include scarcity of public resources, inefficient and loss making operations of existing public sector enterprises. Accordingly, as part of the liberalisation process, government has started reforms in public sector enterprises.

The main elements of Governments Policy towards Public Sector Undertakings (PSUs) are:

(a) Bring down Government equity in all non-strategic PSUs to 26 per cent or lower, if necessary;

(b) Restrictive and revive potentially viable PSUs;

(c) Close down PSUs which cannot be revived; and

(d) Fully protect the interest of workers.

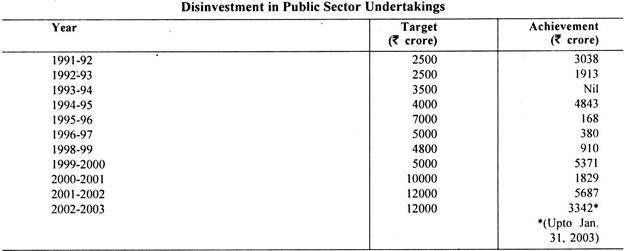

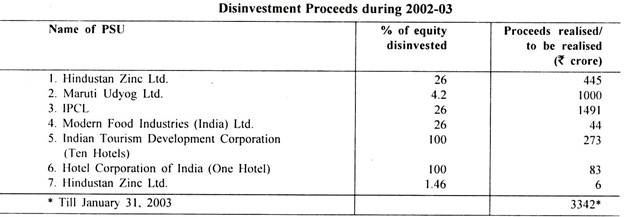

The current direction of privatisation policy is summarised in a suo-motu statement laid in both the Houses of Parliament on December 9, 2002, Government has announced its policy that the main objective of disinvestments is to put national resources and assets to optimal use and in particular to unleash the productive potential inherent in our public sector enterprises.

The policy disinvestment specifically aimed at:

(i) Modernization and upgradation of Public-Sector Enterprises.

(ii) Creation of new assets.

(iii) Generation of employment,

(iv) Retiring of public debt.

(v) To ensure that disinvestment does not result in alienation of national assets, which through the process of disinvestment, remain where they are. It will also ensure that disinvestment does not result in private monopolies.

(vi) Setting up a Disinvestment Proceeds Fund.

(vii) Formulating the guidelines for the disinvestment of natural assets companies.

(viii) Preparing a paper on the feasibility and modalities of setting up Assets Management Company to hold, manage and dispose the residual holding of the government in the companies in which government equity has been disinvested to a strategic partner.

(ix) Government is taking the following specific decisions:

(a) To disinvest through sale of shares to the public in Bharat Petroleum Corporation Limited (BPC).

(b) To disinvest in Hindustan Petroleum Corporation Limited (HPCL) through strategic scale.

(c) To allot, in both cases of BPCL and HPCL, a specific percentage of shares to the employees of the two companies at a concessional price.