In this article we will discuss about the reasons for the replacement or retirement of an asset in a firm.

To remain competitive, necessitates the timely replacement of existing assets and their eventual retirement.

Replacement does not mean that an asset has to be duplicated at the end of its economic life, nor does it imply a like-for-like substitution.

Instead, ‘replacement’ in this context is synonymous with ‘displacement’, which simply means that an existing asset is displaced by a more economic one.

ADVERTISEMENTS:

The term ‘retirement’ means that an asset is definitely disposed off. In some instances this might entail selling a group of assets as a going concern, in which case one is really concerned with divestment decisions.

Reasons for the Replacement or Retirement of an Asset:

The two basic reasons for replacing and ultimately retiring an asset are:

(a) Physical impairment, and

(b) Technological obsolescence.

ADVERTISEMENTS:

(a) Physical Impairment:

Physical deterioration can lead to a loss in the value of the service rendered by an asset and/or an increase in its consumption of resources needed to provide a prescribed level of service.

(b) Technological Obsolescence:

Obsolescence is the change in the technical characteristics of new assets which enhances their value relative to older assets and it results from product, labour and process innovations.

Appraisal of Replacement Decisions:

ADVERTISEMENTS:

The economy of replacing a functionally efficient asset, therefore, rests with the conservation of energy, effort, material and time, which is realized by its replacement, and the same holds true for retirement decisions.

To appraise the economic merits of replacement/retirement decisions, we must answer four basic questions:

1. Is it worth making any new investment to replace an existing asset?

2. What is the optimal life of the proposed investment?

ADVERTISEMENTS:

3. What would be the economic advantage of the newly proposed asset if it were operated for its optimal economic life, compared with the economic merits of the existing asset?

4. When would be the most economic moment to make the replacement?

Illustration:

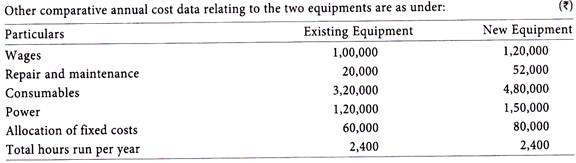

A factory engaged in the manufacture of electronic goods has a ten-year old equipment depreciated on straight-line method. The useful life of the equipment was estimated to be 20 years with a residual value of Rs. 3 lakhs (original cost of the equipment being Rs. 23 lakhs). The output of the equipment is 1,200 units per hour.

ADVERTISEMENTS:

The management now proposes to install a new equipment worth Rs. 50 lakhs which has an estimated life of 15 years and a residual value of Rs. 5 lakhs. The payment terms for the new equipment include a part exchange provision of Rs. 6 lakhs in respect of the existing equipment. The output of the new equipment is 3,000 units per hour.

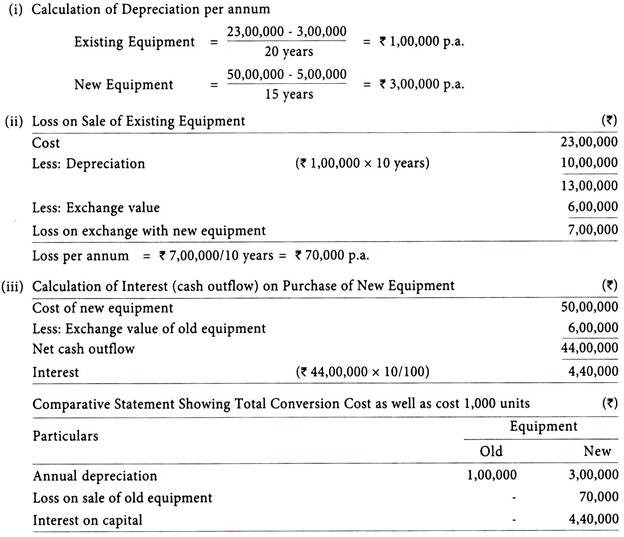

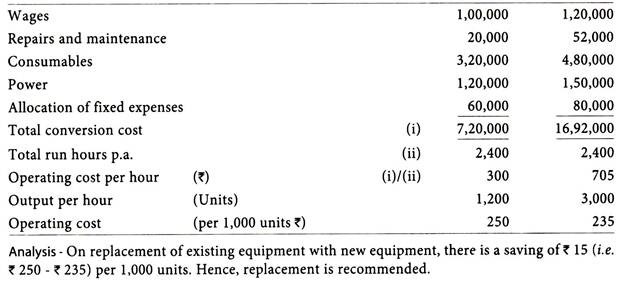

You are required to prepare a comparative schedule showing total conversion cost as well as cost per 1,000 units after considering interest @ 10% on net cash outflow for procuring the new equipment and also for providing for the yearly recovery of the loss suffered in the transaction.

Solution:

ADVERTISEMENTS: