After reading this article you will learn about:- 1. Meaning of Credit 2. Mechanisms of Operating Credit 3. Advantages 4. Disadvantages.

Meaning of Credit:

Cash transaction is one in which cash is not paid at the time of purchase of a commodity or service. A credit transaction means that the buyer will pay for the commodity to the seller at a future date. Thus credit implies the postponement of payment or deferring of a payment.

(i) Transfer of a commodity from one party to another.

(ii) Postponement of its payment to a future date.

The seller must have confidence in the buyer that the buyer has the intention to pay and he will pay the price of the commodity at a later date as promised by him. In modern industrial economy, the whole economic structure is built with the credit mortar.

ADVERTISEMENTS:

The manufacturer gives his production to wholesaler on credit, the wholesaler sells it to retailer on credit and the consumer buys it from the retailer wholly or partially on credit. Credit is organised through the credit institutions and instruments.

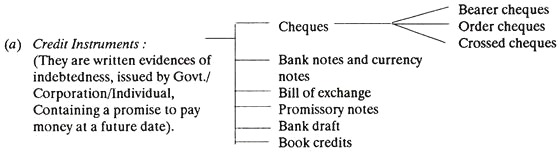

Mechanisms of Operating Credit:

(b) Credit Institutions:

(They consist of banks with clearing houses):

ADVERTISEMENTS:

A cheque is a credit instrument so long as it is not presented for encashment. A cheque is a written order on a specified bank made by the depositor to pay a certain amount to a person who possesses the cheque or in whose name the cheque has been cut. A bearer cheque is made payable to the person who-so ever presents it at the Bank for encashment. An order cheque is made payable to a certain person only in whose name cheque is.

It is the responsibility of the Bank to see that the payment is made to the right person. A crossed cheque cannot be encashed at the bank counter; it can only be deposited in the Bank account of the person in whose name the cheque is.

Crossed cheques are highly safe. A Bank note or a currency note is a promise by the bank or government to pay a certain sum of money on demand to the bearer of the note. When issued by a bank it is known as a Bank note and when issued by Government it is known as a Currency note.

A bill of exchange is an order from a creditor to the debtor to pay the stated amount of money to himself or to a specified person or to the bearer after a definite period of time. A bill of exchange differs a cheque in the sense that whereas cheques can be encashed on demand while bills are payable after a stated period of time.

ADVERTISEMENTS:

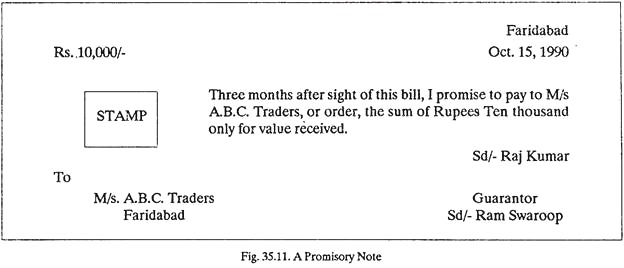

A promissory Note is a promise of the borrower to the lender to pay a certain sum of money only to the lender or to the bearer of the promissory note, after stated period of time (Fig. 35.11). A promissory note is perhaps supported by the guarantee of some third person in whom the lender may have confidence.

A Bank Draft is a kind of cheque. It is an order to pay money, drawn by one office of a bank upon another office of the same bank’ for a sum of money payable to order on demand, inside or outside the country. A payment made by a cheque may dishonour but that made by a draft cannot, because the bank gives draft to a person only after it has received the amount (of draft) from that person.

Book Credit when a businessman sells on credit or a bank advances money, the transaction is entered into the account books of the businessman or of the bank and are legally recognised as evidences or credit. Hundies are indigenous credit instruments and are in use in Inda for a long time. A hundi is more like a bill of exchange. It is accepted, endorsed and transferred just like a bill.

ADVERTISEMENTS:

A hundi is usually written in a local language and regulated by local customs and traditions. Hundies are issued by the borrower in the name of creditor with the promise to return his money on demand or after the stated period of time. The interest is paid to the creditor on the very day the money is borrowed at the rate mutually decided by the two parties. The commission is paid to the broker.

Important types of hundies are:

(i) Darshni hundies which are payable on demand.

(ii) Muddati hundies which are payable after the expiry of the term specified.

Advantages of Credit System:

ADVERTISEMENTS:

(1) Credit encourages saving instinct and the formation of capital.

(2) Credit encourages production by allowing to flow the capital, formed by collecting small personal savings, into the hands of entrepreneurs to carry on their business.

(3) Credit enables to tide over temporary financial difficulties.

(4) A good credit policy minimises fluctuation in prices.

ADVERTISEMENTS:

(5) Credit gives rise to credit instruments which economise the use of metallic money and thus substitute a cheap medium of exchange for a more expensive one.

Disadvantages of Credit System:

(i) Credit enables a man of doubtful ability to start a speculative business and thus ruin himself and those who have given credit to him.

(ii) Credit may lead to extravagance and indebtedness endangering the smooth progress of society.

(iii) The greatest danger of credit is the liability of credit to be over-issued.