Benchmarking is defined “as the continuous, systematic process of measuring ones output and/or work processes against the toughest competitors or those recognized best in the industry.”

Benchmarking is an approach of setting goals and measuring productivity based on best industry practices. Benchmarking helps in improving performance by learning from best practices and the processes by which they are achieved.

Learn about: 1. Definitions of Benchmarking 2. Concept of Benchmarking 3. Need 4. Reasons 5. Types 6. Five Generations 7. Phases 8. Stages 9. Gap Analysis Process

10. Approaches 11. Methods to be Adopted for Successful Implementation of Benchmarking Program 12. Merits and Demerits.

Benchmarking: Definitions, Concept, Need, Types, Stages, Merits, Demerits, Approaches and Gap Analysis Process

Benchmarking – Definitions

Dictionary defines a benchmark as “a standard or a point of reference against which things may be compared and by which something can be measured or judged”.

ADVERTISEMENTS:

Benchmarking is defined “as the continuous, systematic process of measuring ones output and/or work processes against the toughest competitors or those recognized best in the industry.”

Benchmarking is an approach of setting goals and measuring productivity based on best industry practices. Benchmarking helps in improving performance by learning from best practices and the processes by which they are achieved.

It involves regularly comparing different aspects of performance with the best practices, identifying gaps and finding out novel methods to not only reduce the gaps but to improve the situations so that the gaps are positive for the organization. Benchmarking is periodical exercise for continuous improvement within the organization so that the organization does not lag behind in the dynamic business environment.

ADVERTISEMENTS:

Benchmarking should not be treated as just comparison. It is necessary to have a point of reference to know how well one is doing. In a business environment with cut-throat competition it is necessary to gain edge over their competitors. Benchmarking helps organization to get ahead of competition.

Comparing the results with a competitor helps the management to get a goal that is both desirable and achievable but provides no clue on how the goals are to be achieved. It is a comparison of work progress that tells us how the competitor follows a process which produce outstanding results and this is the essence of benchmarking.

In cut-throat competition it is important for organizations to gain an edge over their competitors. Benchmarking helps organization to get ahead of competition. The data and information collected and analyzed as part of a self-assessment can be used in a benchmarking exercise.

Benchmark:

ADVERTISEMENTS:

A “benchmark” is a reference or measurement standard used for comparison. Dictionary defines a benchmark as a standard or a point of reference against which things may be compared and by which something can be measured and judged.

Benchmarking:

In simple words, benchmarking is an approach of setting goals and measuring productivity based on best industry practices.

“Benchmarking” is the continuous activity of identifying, understanding and adapting best practice and processes that will lead to superior performance.

ADVERTISEMENTS:

Example – A customer support engineer of LG (a television manufacturing company) attends a call within forty-eight hours. If the industry norm is that all calls are attended within twenty-four hours, then the twenty-four hours can be a benchmark.

Benchmarking is the process of identifying “best practice” in relation to both products (including) and the processes by which those products are created and delivered.

The search for “best practice” can take place both inside a particular industry, and also in other industries. It studies the circumstances and processes that help in superior performance. Benchmarking is a process of continuous improvement in search for competitive advantage. It measures a company’s products, services and practices against those of its competitors or other acknowledged leaders in their fields.

Benchmarking – Concept

Benchmarking is a systematic and continuous measurement process. It is a process of measuring and comparing an organization’s business processes against business process leaders anywhere in the world, to gain information which will help the organization to improve its performance. It is basically a quality practice.

ADVERTISEMENTS:

Companies choose to benchmark excellent companies whose business processes are analogous to their own. Benchmarking identifies whose practices that have enabled the successful company’s superior performance and that can be adopted to the benchmarking company’s business. This process results in two types of outputs; benchmarks or measures of comparative performance, and enables or practices that lead to exceptional performance.

Often, benchmarking has been equated to copying or imitating and it is said that benchmarking is ‘stealing shamelessly. Benchmarking was originated in Japan during the early 1960s due to the Japanese curiosity and fondness for imitation. Benchmarking has evolved through a process which has resembled the classic ‘art-transitioning-to-science’ model for the emergence of new management discipline.

The benchmarking practice has started with product- oriented reverse engineering or competitive product analysis. The former involved a tear-down and evaluation of technical product characteristics.

While the later was market-oriented and evaluate the relative capabilities of the competitive product offerings. Strategic benchmarking is similar to process benchmarking in nature but differs in scope and depth. It involves a systematic process by which a company identifies and evaluates alternatives, implements strategies and improves overall performance levels by incorporating successful strategies from companies engaged with it in a strategic alliance.

ADVERTISEMENTS:

The issues addressed in this process include building core competence to sustain competitive advantage, targeting specific shifts in strategy such as entering a new market or developing a new product, making acquisition and creating a learning and adaptive organization.

The future generation will be in global benchmarking through which distinctions in international culture, business processes and trade practices across companies are bridged and their ramifications for business process improvements are understood and utilized.

Benchmarking – Need

The essence of benchmarking is the continuous process of comparing a company’s strategy, products and processes with those of world leaders and best in class organizations in order to learn how they achieved excellence and then setting out to match and even surpass it. For many companies, benchmarking has become a key component of their TQM programs.

It is a method of identifying new ideas and new ways of improving processes and hence meeting customer expectations. A properly designed and implemented benchmarking program will take a total system approach by examining the company’s role in the supply chain (looking upstream at the suppliers) and downstream at distribution channels.

ADVERTISEMENTS:

Need of Benchmarking:

1. Benchmarking helps organizations focus on the external environment and improve process efficiency.

2. Benchmarking promotes a climate for change by allowing employees to gain an understanding of their performance what they are achieving now and how they compare to others in order that they become aware of what they could achieve.

Benchmarking – 5 Key Reasons

Key reasons for benchmarking are as follows:

1. Defining Customer Requirements:

It is not based on history or gut feeling, perception and low fit but on the basis of market reality, objective evaluation and high conformance.

ADVERTISEMENTS:

2. Establishing Effective Goals and Objectives:

It is not on the basis of lacking external focus, reactive response, and lagging industry but on the basis of credibility, inarguable, proactive and leading industry goals and objectives.

3. Developing True Measures of Productivity:

Without benchmarking this may be done by pursuing pet projects, strengths and weaknesses not understood on-route of least resistance. But with benchmarking this is carried out by solving real problems and understanding outputs of each decision based on the best industry practices.

4. Becoming Competitive:

This is not carried out on internally focused, evolutionary change, and low commitment. But it is done on the basis of concrete understanding of competition, new ideas of proven practices, technology and high commitment.

ADVERTISEMENTS:

5. Industry Best Practices to be Achieved:

This is also not done on methods not invented here, few solutions, average of industry progress and frantic catch up activity. But it is done on the basis of proactive search for change, many options, business practice breakthrough and superior performance.

Benchmarking – Top 8 Types: Internal, External, Generic, Functional, Competitive, Compatible Industry, Strategic and Global Benchmarking

1. Internal Benchmarking:

It involves looking within the organization to determine other departments, locations and projects which have similar activities and then defining the best practices amongst them. It involves seeking partners from within the same organization. For example- from business units located in different areas.

The main advantages of internal benchmarking are that access to sensitive data and information are easier; standardized data is often readily available; and usually less time and resources are needed. There may be fewer barriers to implementation as practices may be relatively easy to transfer across the same organization. However real innovation may be lacking and best in class performance is more likely to be found through external benchmarking.

2. External Benchmarking:

ADVERTISEMENTS:

External benchmarking involves seeking help of outside organizations that are known to be best in class. External benchmarking provides opportunities of learning from those who are at the leading edge, although it must be remembered that not every best practice solution can be transferred to others. In addition, this type of benchmarking may take up more time and resource to ensure the comparability of data and information, the credibility of the findings and the development of sound recommendations.

3. Generic Benchmarking:

Generic benchmarking involves comparing with organizations that have similar processes. It involves the comparison of an organization’s critical business processes and operations against best practice organization that performs similar work or deliver similar services. For example- how do best practice organization process customer’s orders? It extends the benchmarking process outside the organization and its industry to get inspiration from organizations in dissimilar industry.

4. Functional Benchmarking:

This type of benchmarking is used when organizations look to benchmark with partners drawn from different business sectors or areas of activity to find ways of improving similar functions or work processes. This sort of benchmarking can lead to innovation and dramatic improvements.

5. Competitive Benchmarking:

ADVERTISEMENTS:

It involves examining the products, services and processes of competitors and then comparing them with their own. It involves the comparison of competitors’ products, process and business results with own. It requires that the company perform a detailed analysis of its competitors’ products, services, and processes. Benchmarking partners are drawn from the same sector. However to protect confidentiality it is common for the companies to undertake this type of benchmarking through trade associations or third parties.

6. Compatible Industry Benchmarking:

Compatible industry will include those companies that are not directly competing for the same customer. It make comparisons within a general industry category. For example- a company, which is manufacturing automobile spare parts, compares itself with another company which is manufacturing automobile accessories.

7. Strategic Benchmarking:

It is similar to the process benchmarking in nature but differed in its scope and depth. It involves a systematic process by which a company seeks to improve their overall performance by examining the long-term strategies. It involves comparing high-level aspects such as developing new products and services, core competencies etc.

8. Global Benchmarking:

ADVERTISEMENTS:

It is a benchmarking through which distinction in international culture, business processes and trade practices across companies are bridged and their ramification for business process improvement are understood and utilized. Globalization and advances in information technology leads to use this type of benchmarking.

Benchmarking – Five Generations

Benchmarking is an evolutionary process and resembles the “classic art transitioning to science model” for development of new management disciplines.

This transition occurring through four generations of development from the time of Taiichi Ohno’s Supermarket Study Application and is interpreted in the light of that publication. Xerox Corporation practised the benchmarking in the late 1980s’. In response to this, Xerox became the winner of the 1989 Malcolm Baldrige National Quality Award. The first generation may be construed as product oriented reverse engineering or competitive product analysis.

The second generation competitive benchmarking was defined into a science of Xerox during the 1976-1986 decade. Competitive benchmarking moved beyond the product-oriented approach to include comparisons of processes with those of competitors. The third generation is called process benchmarking and developed during 1982-1983, as more quality leaders recognised that they could learn more easily from companies just outside their industry than from competitive studies without boundaries and restrictions.

The fourth generation is referred to as strategic benchmarking which differs from process benchmarking in terms of the scope and depth of commitment among the sharing companies. The fifth generation of benchmarking is referred to as global benchmarking, lies in global application where international trade, cultural and business process distinctions among companies are bridged and their implications for business process improvement are understood.

Today, only a few companies are systematically working on these issues as part of their strategic planning process. Thus, a fundamental shift is taking place among companies through these five generations of benchmarking.

Benchmarking – 4 Phases: Planning, Analysis, Integration and Action

The process of benchmarking involves the following four phases:

1. Planning:

(a) Identification of the factor to be benchmarked

(b) Identification of the critical performance indicators

(c) Identification of the entity that is the standard for benchmarking

(d) Identification of the modalities for collection of data.

2. Analysis:

(a) Collection and collation of data to detect gaps

(b) Measurement of gaps in performance and practices

(c) Setting up of metric targets.

3. Integration:

(a) Corroboration of the modalities of analysis and targets set among peers

(b) Development of implementation programs.

4. Action:

(a) Preparation and ‘sensitization’ of target audience for implementation

(b) Deployment of monitoring and measuring mechanism for deviations

(c) Final assessment of success of benchmarking both quantitatively and qualitatively.

During the pursuit of functional/operational excellence, approaches are to be especially defined so that the benchmarking process can be executed successfully.

Benchmarking – 6 Stages involved in the Benchmarking Process

Successful benchmarking involves a systematic and measured approach. This comprises a series of activities which enable managers to identify were improvement is needed to business performance and how these may be achieved.

Benchmarking involves establishing what makes the difference in customer’s eyes between an ordinary supplier and excellent one, finding out what is the ‘best’ that can be found and setting standards to deliver and exceed best practice.

However, enhanced business performance will only be achieved if the organisation is prepared and committed to change and if the objectives of the benchmarking process are clear and consistent with corporate goals.

A systematic approach of the benchmarking process involves six stages:

1. Identify and understand your processes.

2. Agree what and who to benchmark.

3. Collect data.

4. Analyse data and identify gaps.

5. Plan and action improvements.

6. Review.

There are a number of variations which some companies have adopted on this six step approach, but most follow the deeming principle which is often applied to total quality initiatives.

Each stage in the six step approach need to be completed before moving to the next.

Stage 1 – Identify and Understand Processes:

It is helpful to begin a benchmarking programme on a small scale so that the organisation can gain lessons from the systematic approach that is adopted. The lessons can then be applied to other parts of the business. In this way the cost of benchmarking can be kept to a minimum as benchmarking can take place on a process by process basis.

1. Understand Processes:

The preparation stage of benchmarking is the most critical. Until an organisation understands its business processes it is difficult to compare them with other parts of the organisation or with external sources.

i) Identifying Process:

Everything which happens in a company is part of a process. All processes should lead to achievement of an organisation’s aims. The first question, therefore, to ask is- ‘what is the organisation in business for?’ A process is a series of steps or sequence of activities, the end result of which is to achieve client satisfaction, i.e., providing what the customer needs, when they need it and as they expect it.

ii) Process should be Customer Driven:

The result of all processes should be to satisfy a customer requirement. A customer may be internal or external. The customer is the person who receives the output or benefits from the process.

iii) Identify Added Value Processes:

The concept of a value chain can help organisations identify the various processes within an organisation which offer value to both the internal or external customer. It is useful to map out an organisation’s process to identify critical success factors.

Benchmarking studies make a measurable impact on the bottom line when they bring about improvements to core processes. Processes can be divided into those which are primary processes. Primary processes are directly concerned with delivering a product or service to the external customer. Secondary processes support the primary processes within an organisation and are often concerned with providing a service to the internal customer.

iv) Ask Your Customers:

Organisations need to identify which of their primary processes or core activities are critical for the company to remain in business and to be successful. Customers will have a clear idea of what is important to them.

A useful starting point is to ask them:

a. What are we good at?

b. What areas do we need to improve?

An engineering company, for example carried out a survey among its customers to identify which processes were really important to them and where they could improve. It discovered that fast delivery of technically proven products was important but where improvements really needed to be made was in the organisation’s customer service process.

v) Ask Your Employees:

People working within the organisation will also have opinions on the processes within which they are working. Often the quality of service that is provided within an organisation has a direct effect on the quality of service that is provided to external customers. Employee attitude surveys, focus groups and indepth interviews can provide useful feedback on how relationships within the organisation can be improved.

Ask employees to identify factors which they perceive as critical to your success in your company and what they perceive has the biggest influence on your employees of those of your customers.

vi) Ask your Supplier:

A further input in understanding your core processes is to gain feedback from your suppliers. People who work with the organisation, yet who can also take an external perspective, can prove to be an invaluable source of information.

2. Plot Out your Process:

Once you have begun to identify the core processes in your organisation you can map out where each process links into others. On the surface, what appears to be a single process is made up of a series of activities which become more complex as you peel away the layers to discover secondary and tertiary processes which support the primary process.

The concept is one of a hierarchy of processes. If we take human resource management as a process, for example, we see that human resource management is the primary process, peeling away the covering layer.

Undereath lie the secondary processes such as:

i. Recruitment and selection

ii. Training and development

iii. Compensation and benefits

iv. Employee communication, and

v. Succession planning.

Each secondary process in turn serves as an umbrella for tertiary processes, and so on until all the layers of the inion have been peeled away.

i) Analaysing the Process:

Analysing and understanding the process in all its shapes and forms is crucial to the success of a benchmarking study. Project team members need to understand the activities that make up the process and the relationship of the process with other parts of the business. Every process has an input and output. Outputs should be measurable and customer driven for example-

a. Delivery made on time and to customer’s satisfaction.

b. Employees trained in the ten requirements of health and safety regulations.

ii) Charting the Process:

Charting the process on a step by step basis helps increase understanding of each of the activities. It helps to ‘brainstorm’ the different steps. One means of achieving this is to ‘mind map’ the process.

iii) Mind Mapping:

Mind mapping is a form of brainstorming which encourages freewheeling. It is highly participative in its approach. Mind mapping is best carried out with the use of post if type notes which can be taken off the page and ordered into a sequence once the initial brainstorm has taken place.

iv) Fishbone Diagram:

An alternative and more structured approach to mind mapping involves brainstorming activities in the process and grouping them together under headings or boxes using the outline of a fish skeleton as a framework. This provides a visual vehicle for demonstrating the interrelationships between steps in the process. It shows the process as a whole while at the same time it divides the sections.

v) Process Flow Diagrams:

An alternative approach is to prepare diagrams showing the flow of the process. This is particularly helpful where a single item is handled or moved through number of stages.

There are five categories which are used to symbolise activity:

vi) Time Elapsed Diagram:

An alternative flow diagram charts the time elapsed from the inception of the process to its outcome. In this way it is possible not only to identify the sequence of activities in a process but also where significant time delays occur.

vii) Process Mapping:

Many business find that it is helpful to map out each activity in a process using a set of conventional and proven mapping symbols. This can be particularly useful when project teams are dealing with complex activities which it would otherwise be difficult to describe. The graphic display of the process can also prove invaluable when making comparison with benchmarking partners.

It can also be used as a means of understanding areas for potential improvements before a benchmarking study begins.

The symbols used in process mapping are:

viii) Information Flow Diagrams:

A further mapping technique is the information flow diagram. This can be used to understand and clarify the flow of information, thereby identifying what information is currently available and what information is missing in the process.

The flow of information between groups in analysed and the direction of information flow indicated via one way or two way arrows.

3. Measurement of Processes:

As an understanding is gained of an organisations processes the project team needs to document the measures of performance which are in place for each step in the process. These performance indicators serve as in house standards against which the project team can make comparisons with external benchmarking factors.

Metrices should be prepared for each process. These an encompass performance indicators such as cost, time, quantity, quality or people involvement.

4. Initial Effort Brings Returns:

The initial phase of process understanding may seem to take time and effort, particularly when the temptation may be to move directly to contacting benchmarking partners and beginning a study.

Hewlett Packard adopted benchmarking as an essential part of their total quality approach. They like many other organisations, have found that the most challenging aspect of benchmarking is gaining a thorough knowledge of the process which they are going to benchmark.

Stage 2 – Identify What and Why to Benchmark:

The organisations which gain most from benchmarking are those which have a clear idea of what they want to benchmark and why.

Every aspect of an organisation can be benchmarked including:

a) Customer satisfaction

b) Speed of service

c) Human resource management

d) Internal communication and

e) Cash management

The most effective benchmarking teams limit themselves to reviewing processes which are key success criteria for business performance and which are directly linked to the organisation’s mission.

1. Deciding what to Benchmark:

Even if a company has identified that a number of processes can be benchmarked, it is often difficult to establish in which order to begin a benchmarking project and which study will bring the greatest return.

i) Analytical Hierarchy Process:

One way to select benchmarking topics is to adopt the analytical hierarchy process (AHP).

This is a five step approach involving:

a. Developing a set of decision criteria to evaluate alternative processes.

b. Establishing through consensus the weighted value of the decision criteria.

c. Ranking the processes under consideration against each of the decision criteria.

d. Making a comparison of the scores for each process.

e. Selecting the most appropriate alternative.

ii) Importance or Urgency Matrix:

Another method of deciding which subject area to take is to use an importance or urgency matrix. Here project team members place each process on a matrix. One axis represents the importance of the process to the future success of the business. The second axis represents the urgency of improving the process. The process of high importance and high urgency are those which the project team need to tackle first.

iii) Problem Checklist:

A further method of identifying processes most in need of improvement is to make a selection of suitable processes and then to log problems arising as a result of the processes over a trial period. In this way quantities data is made available to project team members to use to make a decision about which process to benchmark.

Above all project team members should remember that items of strategic importance to the organisation provide higher potential for success.

2. Who to Benchmark Against?

To benchmark successfully, care must be taken in the choice of partners. These are other business units who are prepared to co-operate in the exchange of information and learning points and who may expect reciprocal sharing from your organisation too.

There are four routes which are generally taken to establishing benchmarking partners:

i. To look inside the organisation.

ii. To gather external data in other competitive businesses.

iii. To gather external data in the same industry or similar areas.

iv. To establish partnerships with organisations who are considered ‘world best’ or ‘best in class’, irrespective of their industry sector or location.

a. Internal Benchmarking:

Advantages:

There are relatively fewer problems in comparing internal benchmarks with external ones and it is often via this process that many organisations begin to benchmark.

i) The advantages of internal benchmarking are that it is easier to deal with partners who share a common language, culture and systems than to look outside the organisation.

ii) Access to data is normally easier, as benchmarking is generally perceived as a low risk activity.

iii) Benchmarking partners can be found within your own site or different geographic locations, business units or groups of companies.

iv) As sharing a common language and working practices and systems will often be the same, communication normally proves easy. Therefore an internal benchmarking study can be a good test bed to pilot the benchmarking concept and the returns can be relatively quick.

Disadvantages:

The major disadvantage of an internal benchmarking exercise is that it can encourage complacency. If complaint levels are measured on a branch by branch or department by department level for example and a target set based on best practice within the organisation, what then becomes an acceptable standard may prove below average in comparison with other organisations. While the organisation is busy measuring internally, competitors may well be gaining market share.

b. External Benchmarking:

There are two areas where external benchmarking takes place:

i) Competitive and

ii) Similar industries

i) Competitive Benchmarking:

Competitive benchmarking can be a useful tool to determine the best practice across an industry. It is often easy to make judgements on information obtained from competitors because usually their working practices will be comparable to your own company and the market place will be well known, banks and building societies, for example, often use competitive benchmarking to identify standards of customer satisfaction.

They, like other industries, take part in surveys administered by an independent third party which determine how each company’s service quality is perceived by customers in comparison with other competitive outlets.

It is usually difficult to acquire data directly from competitors as clearly as, unsurprisingly, they can be reluctant to share information on processes which provide them with a competitive advantage. There are also legal and ethical considerations involved in gathering information from competitors. Direct dialogue with competitors can be perceived as collusion.

Third party consultancy reports are a useful source of information particularly where the data is drawn on comparable performance levels. Research agencies can also broker information on competitors based on across industry surveys.

ii) Similar Industries:

Benchmarking among industries with similar characteristics is a technique which is being used by specific disciplines to increase their business focus.

Advantage:

As there are not direct competitors, data is relatively easy to access as there is little threat to the benchmarking partner and confidentiality is assured.

Disadvantages:

Although the results of most external benchmarking studies can generally be applicable to most benchmarking sponsors, as the data may not be directly comparable lessons learnt from other organisations may be difficult to apply. The organisations acting as benchmarking partners may come from different market sectors and may be different in terms of size and geographic distribution. Likewise it is unrealistic to expect that best practice from one organisation can be applied to a different organisation with a different organisational culture.

Best Practice Benchmarking:

Recognising that companies or industries that are different can have similar core processes is a matter of mind set. Best practice benchmarking involves building on the success of other organisations who are considered ‘best in class’. Partners are selected regardless of industry sector, business type or geographical location.

The starting point for a best practice benchmarking study is to identify what is the ‘best’. This means creating a clear definition of what is understood to be the ‘best’ by your company or organisation and what is recognised as such both within the organisation and externally.

Advantages:

Best practice or generic benchmarking potentially brings the highest return in terms of improvements within an organisation as it creates an external focus away from a company’s own industry and as such helps in removing blinkers. Business which undertake best practice benchmarking report that it is often easy to obtain data as ‘best in class’ organisations are often willing to share their learning experiences.

Disadvantages:

Best practice benchmarking is potentially the most difficult. Unlike competitive benchmarking, which provides milestones against which to target improvement, setting standards to match or exceed the best involves a higher degree of change. It also involves ‘thinking out of the box’ discarding. The mind sets and paradigms of an organisation to adopt new ways of working.

Also, in comparison to competitive and external benchmarking programmes conducted in similar industries, best practice benchmarking normally takes longer. The difficulty comes in integrating the findings back into the sponsor organisation, particularly if the transferability of data is questioned.

Another disadvantage of the best practice route is when benchmarking becomes a one off activity. Best practice benchmarking needs to be undertaken on a continuous basis as ‘best in class’ is a constantly moving target.

Stage 3 – Collect the Data:

The key to success in benchmarking is to collect the right information. This should be collected both quantifiably and qualitatively.

1. Need and Constraints:

The first task of the project team in collecting data is to identify exactly what information it needs to gather and what are its constraints.

Having selected a process and thoroughly understanding its operation, the project team should have identified the following items on the checklist for data collection:

i) Objective – The project team should define the objective of the data collection stage.

ii) What does the team need to know, what would it be nice to know? – Encourage the team to brainstorm the essential requirements from the data collection phase. Point out that there is a difference between information which is essential to the project.

iii) Establish quantifiable performance measures – In order to make comparisons between partners and sponsor organisations it is imperative to establish what measures of performance will be used. Quantitative benchmarking measures which were used in a study of human resource management among ten partner companies.

iv) Agree what qualities or soft measures will be used for example company culture or communication or management style.

v) Decide how much information is needed, e.g. the number of potential partner organisations and the depth of information.

vi) Find out what resources are available in terms of time or people or money.

Many benchmarking studies concentrate on ‘hard’ performance measures and forget that often performance can only be achieved through getting the softer intangible measures correct within an organization.

When BP chemicals adopted a benchmarking approach to identify and aim for ‘best in class’ it used both hard and soft measures as, a means of comparing standards. The key performance indicators it investigated included reliability, manpower and safety. It also used absolute costs obtained from consultants’ data bases.

2. Sources of Information:

There are four major sources of information available to benchmarking project teams.

These are:

i. Desk research

ii. Third parties

iii. Direct exchange

iv. Site visits

i. Desk Research:

The first part of data collection can begin in house where sources such as company libraries, corporate publications, directories, data bases and industry journals may provide useful background information.

Other sources of information external to the organisation include market research companies’ reports, trade associations, industry networks, media reports, seminars, and conferences as well as suppliers and customers, professional, institutions and consultants.

ii. Third Parties:

In addition to examining internal documents a publicly available information, third parties such as consultants and research firms provide a useful source of data. If organisations are interested in matching up to industry standards then bringing in a consultancy with the information to hand is often a fast route to gaining information.

However, a disadvantage of using consultants to gather data is that it distances project team members from the process, and a lack of ownership of the information may enuse.

Where consultants and research firms are particularly useful, however, is in the gathering of information about competitors.

3. Contacting Potential Partners:

i. Initial Contact:

Before making initial contact with potential partners the project team should take time to consider if anyone in the team or their organisation already has contact with the potential partner or knows of anyone who is familiar with the potential partner or organisation. It is easier to make contact in this way rather than to phone or write ‘out of the blue’.

Some organisations are naturally suspicious of unsolicited approaches. They may also be hesitant about the benefits of participating in a benchmarking study, particularly if this is the first approach they have received.

To contribute to effective, efficient and ethical benchmarking, individuals need to agree for themselves and their organisations to abide by the principle of benchmarking with other organisations.

The principles of benchmarking encompass:

a. Confidentiality

b. Legality

c. Exchange

d. Use of information

e. First party contact

f. Third party contact and

g. Preparation

Team members should decide be the entry point of contact within the potential partner organisation. For example, at what level is the information which is required likely to be most readily available? What is the protocol within the potential partner organisation for this type of exercise?

ii. Direct Exchange:

Benchmarking with external companies is often associated with site visits. In fact site visits are often the last part of call in a benchmarking exercise.

Direct exchange of information can take place via such media as:

a) Telephone surveys

b) Video conferencing,

c) Tele conferencing,

d) Written questionaries.

iii. Questionaries:

Questionaries are a useful data collection tool to slicit information and opinion from benchmarking partners. In preparing a questionnaires the team should decide what questions to ask and the ability of the benchmarking audience to answer these.

The design of the questionaries should be logical, the team will need to check that the questions are clear and unambiguous and will provide relevant response.

A typical design will include:

a) Introduction, detailing objectives of your benchmarking study and details of the sponsor company.

b) Outline of measures of performance to be used.

c) Actual performance of partner organisation.

d) Description of business practices to achieve this performance.

iv. Interviews:

Gathering information by the interview process provides the project team with a useful insight into the process. Interviews can take place with benchmarking partners on a direct or indirect basis, like written questionnaires’, they provide a quantitative measures of performance. They are the fastest way to get basic details of the process and to begin to understand the intangible aspects of the partner organisation.

v. Site Visits:

Site visits are not necessary to every benchmarking study. However, they do provide project team members with a useful insight into how the process is conducted which will supplement the information from other sources on what the process in the partner organisation achieves.

The fear of many potential benchmarking partners is that site visits can be a time consuming and haphazard experience. Careful planning and preparation can overcome potential partner’s initial fears.

In preparing for the visit it is beneficial to meet with the partner organisation to explain the purpose of the visit on a face to face basis and to ensure that all aspects are arranged prior to the visit.

There are a number of protocols or ‘vising rules’ which apply to site visits:

a. Always agree a formal agenda with careful timing before each visit.

b. Discuss and agree your host’s expectation of the visit and their requirements as well as your own.

c. Offer and be prepared to sign a confidentiality agreement with the host organisation.

d. Prepare and use a questionnaire or interview checklist as a basis for discussion.

e. If at all possible, see the process in action and speak to the people involved.

f. Be open and honest in exchanges with the partner organisation and ensure that information flows both ways.

g. Record information about the process while it is fresh in your mind.

h. Make notes during the visit.

vi. Documentation:

Although a benchmarking study does not need to be bureaucratic, a small amount of documentation is needed to capture learning points and information gained from benchmarking partners, recording data also allows the project team to identify what further information is required and to follow this up with other organisations at a later date.

Also, unless information is documented time can be wasted in re-collecting key measures when further benchmarking site visits take place.

Stage 4 – Analyse Data and Identify Gaps:

1. Review Analysis of Data:

The first step is to identify the differences in the information gained from benchmarking partners. Draw up a matrix grid itemizing the performance indicators in the left hand column and list the various benchmarking partners along the top horizontal column. Then enter the data that you have captured in the appropriate column.

Quantitative differences should be relatively straight forward to calculate. It is possible to identify performance means as well as calculating differences between one benchmarking partner and another.

2. Gap Analysis:

Identifying Gaps in Performance:

Successful data analysis should result in a comparison being able to be made between different performance criteria and best practice methods. Once the analysis has been completed, therefore, the next step is to identify your own company’s performance measures and to make comparison with other benchmarking partners.

In this way target levels of performance can be discussed and agreed and a further comparison made between target performance and actual performance.

Where the internal standard is higher than the target performance this is termed a ‘positive gap’. Where the performance levels in place in an organisation are lower than the target performance or best practice this is called a ‘negative’ gap. The task of the project team is to quantify the size of the gap in actual versus target or best practice performance.

As well as quantifying this it is important to state the causes for differences in performance. What is best practice versus the current in house practices. A matrix outlining actual versus target performance, identifying best practice methods and providing a synopsis of current methods in house. This provides an easy to digest summary of the gaps in performance.

Stage 5 – Plan and Action Improvements:

Having identified both the size of gap in performance and potential causes, the next step is to identify and prioritize areas of change and to draw up a plan for improvements. Often benchmark studies identify a number of improvements that can be made. It is important to attach priorities to these so that efforts are worthwhile. There are various methods of identifying which changes need to be addressed.

1) Prioritisation:

Although it is useful to quantify the gap in performance it is also imperative to refer back to the decision making criteria which are used for identifying each process to analyse.

In this case this is customer priorities. In this example a customer satisfaction surveys was completed in which customers were asked to rank their priorities in terms of the service elements the company provided. The research survey demonstrated that speed of checking was the first priority followed by baggage handling. A third priority was on time departures.

Therefore in the example although the performance gaps for baggage handling and on time departures are larger than for speed of checking, as the latter is the first priority for customers it should be addressed by the organisation first.

2) Cost or Benefit Analysis:

A further method of deciding changes to be made is to undertake a cost or benefit analysis. This outlines the potential cost to the organisation of suggested improvements. At the same time the benefits to the organisation can be quantified, such as customer retention increased levels of customer satisfaction, lower levels of down time and increased work in progress.

3) Significant Improvement Matrix:

A consideration the project team should make in putting forward suggestions for improvement is the level of great social the improvement will involve to the organisation in comparison with the significant change it will bring towards meeting corporate objectives. A simple matrix outlining importance and upheaval can be constructed as a basis for discussion.

i. The Change Options:

There are a number of tools available to plan for improvement in the process which has been benchmarked.

a. Brainstorming:

Brainstorming is a useful technique to identify potential changes. It is the quantity not quality of ideas that are important during a brainstorming session. The session should be led by the project team leader, whose task is to record every idea, no matter how frivolous or irrelevant it may seem. Using a flip chart provides a focal point for this process. One idea should generate others, when ideas run out the team can develop variations on those already generated.

b. Scenario Development:

An alternative means of brainstorming is to develop scenarios for possible future versions of the current process. This takes the traditional format at brainstorming a stage further in that, rather than only trying to generate a list of ideas, ideas are linked to scenarios.

For example, alternative scenarios for improving the process in a manufacturing company may be:

(1) To outsource part of the manufacturing process in line with other best practices.

(2) To increase the number of machines per line, in line with competitor industries.

(3) To increase staff training and devolve responsibility in line with best practice.

ii. Preparing Recommendations:

It is probable that the targets the team sets for improvement will have to be agreed by other people throughout the organisation. When preparing recommendations it is helpful to consider who needs to agree the targets and what their decision criteria will be. For example, if a project team is reporting back to the senior management group what likely questions may they pose?

How do the targets for improvement meet the organisation’s existing mission or vision? The team also needs to consider the resources necessary to complete the project successfully. Is there the ability in house to undertake the changes? If not, how can the resources be found? What are the implications and the cost involved?

a. Preparing an Action Plan:

In putting forward recommendations for improvement the team needs to document fully what the improvements involve, how the changes will be implemented and when. The team also needs to outline who will take responsibility for implementation.

In developing a plan for improvement the benefits of the proposed improvement should be quantified for example:

(i) Increase market share

(ii) Higher client satisfaction

(iii) Higher customer satisfaction

(iv) Increased productivity and

(v) Less re-work.

Often the improvement may lead to a longer term solution yet to reach this solution involves a number of shorter term activities. These should be broken down to show each stage of the implementation plan.

Where large scale change is proposed the organisation may decide to pilot the new process as a means of testing its success. Here measures of success for the pilot must be set. After the pilot period comparison can then be made with an existing process in a similar part of the organisation.

b. Commitment:

In preparing an action plan project them should consider what commitment is needed and from whom for each part of the improvement process. Often the drivers and enablers for change are not identified before a change process takes place. The visible commitment of the project sponsor can prove invaluable. The team also needs to evaluate who else throughout the organisation at all levels will champion its cause.

c. Allocate Responsibilities:

The project team should be firm in its recommendations of who should be responsible for each stage of the implementation plan, including a timetable for review. Where possible link improvements to individuals personal objectives to ensure that there is more likelihood of changes taking place.

d. Communicate Findings:

When preparing recommendations for improvements, the project team needs to consider how its findings will be communicated and understood by everyone throughout the organisation. Initially, the number of people who will have knowledge of the benchmarking process will be few. This number will probably be restricted to project team members and members of senior management.

An awareness of benchmarking and its benefits needs to be spread throughout the business. General Electric for example, normally forms team of ten people to undertake benchmarking studies but their findings are widely circulate and also included as part of their management development school.

When recommendations are made to senior managers they probably require an outline time-table of what should happen and when. These will include specialists and other people involved in the process who were not initially on the project team.

The results of the benchmarking study need to be communicated sympathetically and in a participative manner throughout the organisation.

As benchmarking may be a new concept, the initial communication should include such information as:

(1) What are the principles of benchmarking.

(2) What has the organisation undertaken a study?

(3) How does benchmarking link with the organisation’s aims and visions for the future?

(4) Who was involved in the benchmarking study?

(5) What took place and when?

(6) What were the results of the study?

(7) What will the benefits mean to individuals in the organisation?

iii. Overcoming Resistance to Change:

Benchmarking is just one implement in an armory of tools which can be used to bring about change within an organisation. It is often best used as part of a programme of ongoing improvement. Whether the organisation is used to change or not a typical reaction of both managers and staff who may be potentially involved in the change is ‘why?’

There may be several reasons for this resistance which often manifests itself in the ‘not invented here’ syndrome. It has nothing to do with us so way bother, we are doing OK, so why change?’ The more fundamental the change the more resistance that will be encounted.

a) Blockages to Change:

A lack of commitment to change can be caused by a number of issues:

(1) Lack of understanding of the need to change.

(2) Fear of consequence of change

(3) Safety of status quo

(4) Desire for a quick fix rather than long-term improvement

(5) Lack of management focus and

(6) Lack of understanding of organisation objectives.

When any change takes place the natural human reaction is initially to deny the changes and to resist them either verbally or through behaviour (or a lack of it). Once the change begins to take place some people will be more receptive and begin to explore the possible benefits, what’s in it for them and how will it affect their working practices? Therefore deciding whether or not to be committed to change. People go through a series of responses to change.

b) Communicate the Need for Change:

Resistance to change will decrease as people become more aware of the reasons for the change. Therefore two way communication is the key to a successful improvement programme. Likewise, management must be seen to take a strong lead in the process and to be supportive of the changes.

Results of many change propgrammes have identified that middle managers are the most likely group to resist change as they feel sandwiched between the desires of senior management to bring about improvement and members of staff who may doubt the benefit of change for them. As many benchmarking studies will identify, it is often not what is done but how that brings about successful practices.

c) Leadership:

One of the fundamental issues which the project team must address in developing an action plan is who will lead the process. What style of leadership is required to bring about improvement? Is this leadership style current within the organisation? If not, what needs to change?

As organisation are moving towards flatter more customer focused structures the role of the manager has had to change from one of cop or police officer to coach. The traditional command style of management is no longer applicable and a more participative and facilitative approach is required. The project team should therefore consider management style as part of their overall recommendations.

Stage 6 – Review:

The length of time needed for the implementation phase of a benchmarking programme can vary greatly according to the complexity of the improvements that are being introduced. It would be useful to review the progress of a study at least twice, for example, during any major re-engineering programme.

At the beginning of the process managers can use competitive analyses customer information, operating performance and benchmarking to identify key processes to re-engineer. Then when re-design begins they can benchmark ‘best in class’ examples to create the new design.

Monitoring Progress:

Benchmarking studies should be monitored on a regular basis. Project teams do not have to wait until a benchmarking study is complete. Progress checks are useful throughout the development of a benchmarking study.

Two possible types of review can take place:

(i) Review of the results of the benchmarking project in terms of organisational performance and

(ii) Review of the results of the benchmarking process in terms of the learning which has been gained and how this has been applied.

At & T in the US, for example, believes so strongly in the learning which has been gained from benchmarking that it offers external workshops to those who wish to attend from outside the organisation to promote the learning it has acquired from benchmarking.

1) Reviewing Results:

At the beginning of a benchmarking study the project team will have set over all objectives and measures of success.

The key questions to be asked therefore, when undertaking a review are:

a) Has the study met its objectives?

b) What has changed and why?

c) Have the goalposts changed? (The objectives of the project may, for example, have been altered in the light of benchmarking information received.)

d) What impact have the improvements had on the organisation? (Incremental change or step change?)

e) What have been the most significant improvements brought about by this project team?

f) What evidence is there of change in the process?

g) What is the value of the changes to the organisation?

h) Were the measures that have been benchmarked correct?

i) Was the organisation willing to change?

j) What were the barriers to change?

k) How have these been overcome?

It is useful to gather information via an internal audit using interviews or questionnaires’ in response to these questions so that a formal review can take place.

In preparation for the review, project team members may find it useful to prepare a SWOT analysis:

(i) What strength has emerged a result of the process?

(ii) What weaknesses has the study thrown up?

(iii) What opportunities are there for further development?

(iv) What are the threats to further development?

Once a SWOT has been compiled project team members should identify:

a) How they can build on their strengths?

b) How to overcome weaknesses?

c) How to take advantages of opportunities? and

d) How to minimize threats?

Corrective action can then be taken.

2) Reviewing the Results of Learning:

In addition to measuring and monitoring the effectiveness of benchmarking programmes in terms of overall improvements in performance within the organization, the project team should also seek to identify what learning has taken place as a result of the process.

A review of the learning that has been achieved in one organisation, for example, identified that benefits to the team and organization of the study had been:

a) Knowledge of what performance is possible

b) Thorough understanding of own process

c) Identification and understanding of proven ways of achieving this

d) Personal development of team members

e) Motivation for change within an organization and

f) Development of network for possible future contacts.

The review of the benefits of benchmarking will help promote the techniques throughout the organisation and give employees the confidence to extend benchmarking to other areas.

At Motorola, for example, the success of benchmarking projects has encouraged. Further teams to undertake benchmarking initiatives. Benchmarking is concentrated on manufacturing technology.

Within this, benchmarking studies have addressed such areas as:

i. Automated assembly performance – benchmarked weekly against its Japanese Motorola counterpart, which in turn benchmark against the Japanese subcontractor.

ii. Warehouse performance – in particular cycle time, quality, productivity and space used against other motorola installations.

iii. Purchasing performance – both against Motorola companies and friendly companies outside the group.

iv. Salary and benefits packages – through a Motorola initiated exchange of data with other Scottish manufacturing companies.

Benchmarking – Gap Analysis Process

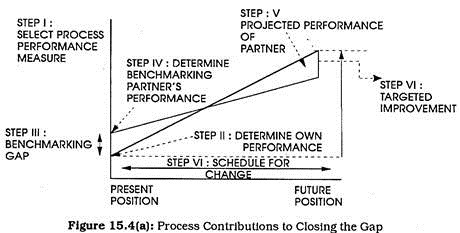

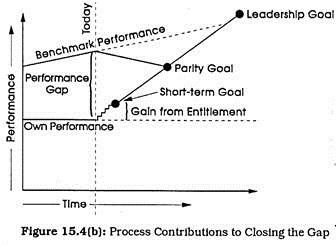

Gap analysis is the key to identifying companies for business practice emulation. Fig. 15.4 (a) and (b) show how a gap analysis chart is constructed from the output of each of the four steps in the benchmarking (PDCA cycle) process. The first step in gap analysis identifies the process performance measures. The second step identifies both one’s own company’s performance and the performance of the benchmarking partner involved in the study. Two or more companies can be involved in the process.

The third step indicates the magnitude of the performance gap between one’s own company and the leading company at the current time as well as the performance trend of the leading company. The fourth step contributes to the goal that a company sets for improvement of the process out to its planning horizon. Thus, the magnitude of improvement is that the company has selected towards becoming the “benchmark” for this process relative to its partner company.

Benchmarking – 4 Approaches

Some of these approaches are as follows:

Approach # 1. Achieving Functional Excellence in Efficiency:

This is done via the steps listed under each function:

1. Emphasize on commodity production that involves manufacturing of a single line of product. Excellence in the pursuit of economies of scale in different industrial sectors could be scanned as well.

2. Locate flexible manufacturing practices needed to attain excellence in different industries, specially, in the customer driven multi product model.

ii. Marketing:

1. Check the impact of brand loyalty on marketing practices for achieving excellence in the areas of both products and services.

2. Identify the sequence of learning and experience curve in evolving a best practice in marketing. This can be carried out through a database of marketing practices both in the manufacturing and in the services sector.

iii. Human Resources:

1. Compare the best practices for developing skill building programs.

2. Develop database on self-management and peer comprehension.

3. Check the best practices relating to rewards schemes and reduced labour turnover.

iv. Materials Management:

1. Identify best practices relating to reduction in wastage.

2. Identify best practices relating to reduction in inventory.

3. Explore best practices in identification of substitutes.

v. Information Systems:

1. Develop an information system for control.

2. Develop an information system for solutions.

3. Develop an information system for structural coordination.

vi. Research and Development:

1. Look for approaches for excellence in fundamental research.

2. Locate approaches for excellence in applied research.

3. Identify best practices to reduce gestation periods.

vii. Top Management:

1. Understand the approach used by top management worldwide with respect of strategy implementation.

2. Develop best practices regarding coordination and cooperation among various functions.

Approach # 2. Achieving Functioned Excellence in Quality:

This is done via the steps listed under each function:

i. Production:

1. Work towards optimization of cycle time.

2. Apply latest techniques for cause and effect analysis to reduce defects.

3. Use concept of robust quality.

ii. Marketing:

1. Search out best practices in customer relation management.

2. Investigate and find out best practices relating to after sales service to avoid recurrence of external failures.

iii. Human Resources:

1. Identify best practices in educational, training, and retraining programmes for quality awareness.

2. Compare practices on quality circles for the best approach.

iv. Materials management:

1. Work towards vendor rationalization and integration.

2. Attain third party certification to substitute vendor / buyer inspection.

v. Information Systems:

1. Go for online and real-time controls.

vi. Research and Development:

1. Identify best practices relating quality function deployment for prototypes.

2. Find out best practices for scaling up pilot plants.

vii. Top Management:

1. Search for best practices relating to dissemination of quality consciousness.

2. Align future goals with product plans.

3. Understand shared vision of strategy alignment and execution relating to innovation.

4. Develop framework for cross functional alignment and integration.

Approach # 3. Achieving Functional Excellence in Innovation:

This is done via the steps listed under each function:

i. Production:

1. Collaborate with research and development division for designing new product for manufacture.

2. Facilitate research and development division to introduce innovation in critical processes.

3. Provide direction for applied research and development necessary impetus through frequent discussions.

4. Align R&D spending and product development initiatives.

ii. Marketing:

1. Scan the articulated and unarticulated needs of customers for new products.

2. Test market new products.

iii. Human Resources:

1. Recruit highly motivated qualified young scientists to work under well experienced R&D scientists

2. Expose the entire organization functionally to the innovative changes occurring elsewhere in the world by –

(a) Conducting seminars in-house inviting experts

(b) Nominating key personnel to the various seminars being conducted by eminent institutions

iv. Materials Management:

1. Explore sources for new substitutes for existing raw materials and components

2. Work with R&D and design divisions for any modifications in the processes for using new substitutes

v. Information Systems:

1. Provide relevant, new, exotic, and competitive information on-time and in-time

vi. Research and Development:

1. Identify ways for continued development of new products and processes in response to the suggestions and information available from production, marketing and information divisions.

2. Keep the gestation period for product innovation to the minimum through innovative research methodologies, as the crux of sustainable competitive advantage is moving products early into the market.

3. Develop an innovation program which includes –

(a) Environmental scan (know why)

(b) Product/services (know what)

(c) Process (know how)

(d) Timelines (know when).

vii. Top Management:

1. To keep the entire organization on the toes looking for innovative information or developments in the outside world.

2. Synchronize their decision making processes with requirements of the organization for providing necessary impetus as well as adequate resources for innovation.

In the area of consultancy services especially, innovation has become a buzzword and Indian companies have resorted to this area to work towards developing continued sustainability. Tata Consultancy Services Ltd (TCS) is an example of a company that has implemented innovation with a passion as part of their strategy.

Approach # 4. Achieving Functional Excellence in Customer Relations Management:

This is done via the steps listed functional under each function:

1. Change the production policy from ‘push’ to ‘pull’ technology to accommodate customer responses.

2. Adopt just-in-time technology to optimize processes, reduce waste, reduce inventory, and also streamline employee requirements for production.

1. Avoid external failures by instituting well designed after sales service.

2. As part of after sales service, register customer responses and complaints on a regular basis.

3. Communicate customer responses to the relevant divisions for redressal and evaluation.

1. Inculcate the salient features of ‘pull’ technology into the organizational system and people.

2. Expose all functions to customer realities through customer meet programs for understanding articulated and unarticulated customer responses.

3. Provide necessary platform for expression of innovative ideas and suggestions from different levels of hierarchy in response to customer complaints.

4. Conduct seminars in customer relations management and new models that have emerged.

1. Continuously monitor the supply chain, right from the vendor through manufacturing and distribution to the ultimate customer.

1. Respond to the customer as quickly as possible.

2. Obtain as much information from the customers in a timely manner.

3. Collect, collate, and disseminate customer responses, complaints, and desires to the relevant divisions for further processing.

1. Commit to a strategy fully responsive to the customer.

2. Identify various customer driven strategies and adopt the most acceptable for the organization after due deliberation.

In conclusion, it is interesting to note that benchmarking—the process of identifying best practices—throws up many opportunities during the search. It does not confine itself to the competitive environment but to the industrial world at large both in the area of manufacturing and services. It is significant to note that when Xerox started its benchmarking, it benchmarked its practices with LL Bean for distribution practices, Deere & Company for centralized services, Procter & Gamble for marketing services and Florida Power & Light Company for quality improvement practices.

Benchmarking – Methods to be Adopted for Successful Implementation of Benchmarking Program

The following methodology is used in successful implementation of benchmarking program:

1. Identification of Need to Benchmark:

This step will define the objectives of the benchmarking exercise. It will also involve selecting the type of benchmarking. Organizations identify realistic opportunities for improvements.

2. Identification of Areas to Benchmark:

Benchmarking is a must for the few critical process such as product development, customer service, inventory control, asset base, profitability, shareholder value etc. To work properly this should commence by identifying the outcomes which drive the profits, sales and costs of the business.

Factors which might be considered are:

(a) Activities which generate the greatest costs

(b) Process which have been subject to customer complaints

(c) Processes essential to delivering the firm’s competitive advantage

3. Understanding Existing Process:

This step will involve compiling information and data on performance. This will include mapping of existing processes. Information and data is collected by different methods For example- interviews, visits, observation and filling of questionnaires.

4. Identification Best Process:

Within the selected framework, best processes are identified. These may be within the organization or outside the organization.

5. Senior Managers Commitment:

To ensure that the program enjoys the cooperation and commitment of senior managers, they should be informed of:

(a) The objectives and benefits of benchmarking

(b) The likely costs of the program

(c) The possibility that sensitive data may be revealed to outside organizations

(d) The long-term nature of benchmarking program and its expected benefits to the organization

6. Understanding the Benchmarking Process:

Before the benchmarking process put to implementation it should be discussed with process managers, operative staff, customers and suppliers.

7. Development of Appropriate Measures:

The benchmarking team should study the whole organization and its subunits and then document the activities and problems.

8. Monitor Process Measurement System:

For successful implementation of benchmarking program, proper monitor and control system should be developed. It requires the reliable data capture and management information system.

9. Selection of Appropriate Organization to Benchmark Against:

The purpose of benchmarking is to help management understand how will the firm is carrying out its activities and how its performance compares with competitors and with other organizations who carry out similar operations.

10. Obtain and Analyze Data:

The level of process performance and the trends revealed by these measures are used to establish an internal baseline for comparison with external process. The two sets of figures are compared, lessons are learnt (indicated by benchmarks), enablers are identified and adopted to suit the requirements.

11. Development of Benchmarking Program:

Differences in the operating environment should be discussed with the senior management, and operating staff. Benchmarking is not a process of pinpointing mistakes but it is a process of organizational improvement through identification and closing of benchmarking gap.

12. Evaluation of Results:

The benchmark firm will need to monitor the success of its improvement strategies. Organizations evaluate the results of the benchmarking process in terms of improvements vis-a-vis objectives and other criteria set for the purpose. It is also periodically evaluates and reset the benchmarks in the light of changes in the conditions that impact the performance.

Benchmarking – Merits and Demerits

Merits:

The important merits of benchmarking are summarized as follows:

(a) It increases customer satisfaction.

(b) It leads to significant cost savings and improvements in products and services.

(c) It helps in improving strategic planning by providing assessment of strengths and weaknesses of current process.

(d) It reduces waste and costs of poor quality.

(e) It helps in increased organizational performance by initiating continuous improvements in processes and quality.

(f) It reduces overheads through business simplification.

(g) It helps in creating a culture that values a sense of continuous improvement which has a positive bearing on the functioning of organization.

(h) It is a transmission of best practice between divisions.

(i) It can assist in overcoming complacency and drive organizational change.

(j) It helps in sharing the best practices between different companies.

(k) It provides a way to monitor the conduct of competitive strategy.

(l) It leads to greater involvement and motivation of staff.

(m) It provides advance warning of deteriorating competitive position.

(n) It helps in learning from others and builds greater confidence in developing and applying new approaches.

(o) It improves management understanding of value adding processes of their business.

Demerits:

The benchmark concept is criticized for the following reasons:

(a) It may reduce managerial motivation if they are compared with a better resourced rival.

(b) There is damage that confidentiality of data will be compromised.

(c) It increases the diversity of information which must be monitored by management. This increases the potential for information overload.

(d) Successful benchmarking firms may find that they are later overloaded with requests for information from much less able firms from whom they can learn little.

(e) In encourages management to focus on increasing the efficiency of their existing business instead of developing new lines of business.