In this article we will discuss about the various components of employee compensation. Employee compensation is one of the most strategic and important functions of human resource management.

It continues to evolve as part of a system of all the combined rewards that employers offer to employees. Components of compensation means components of remuneration to employees. An average employees in the organized sector is usually entitled to various benefits.

Compensation is a payment made in cash to the employee in return of the contribution that he/she makes in the organization. Compensation may have a base pay as well as variable pay components. Salary and wages are most common form of compensation given to the employees.

Some of the components of employee compensation are:-

ADVERTISEMENTS:

1. Base Pay Structure 2. Variable Pay Programs 3. Benefits 4. Rewards & Recognition 5. Dearness Allowance 6. House Rent Allowance 7. Other Allowances 8. Incentives 9. Fringe Benefits/Perquisites 10. Wages and Salary 11. Non-Monetary Benefits.

Basic Components of Employee Compensation and Compensation Management

Components of a Employee Compensation – Base Pay Structure, Variable Pay Programs, Benefits, Rewards & Recognition

It is important to understand the laws of the land and taxation policy to understand the components of compensation and compensation strategies. Organizations always pay for the work done (job) and less for the individuals, job is the nucleus for determining compensation. Each organization will have its own way of defining jobs and determining hierarchy of jobs.

However for simplicity the components of jobs shall look like:

1. Base Pay Structure (Fixed component);

ADVERTISEMENTS:

2. Variable Pay Programs;

3. Benefits;

4. Rewards & Recognition.

Component # 1. Base Pay Structure (Fixed Component):

Salaries and wage are the periodic assured payments made to the employees. Salaries are generally paid to the permanent employees on the monthly basis, whereas wages are paid to temporary or contractual workers on the daily basis.

ADVERTISEMENTS:

Base Pay is the fixed component and generally consists of the following:

Normally 40 percent of the base pay is basic and rest of the base pay falls under various other, categories. This breakage is governed by the tax laws of the land. In India, for instance, if everything is given to an employee in the form of basic the whole shall be taxed, whereas if the base pay is broken into sub-components like HRA certain tax-exemptions may be obtained.

ii. HRA (House Rent Allowance):

ADVERTISEMENTS:

Calculated as a percentage of basic. HRA limits are fixed by the government and are uniformly applicable. If a company decides to pay more than the limit decided by the company it can however the excess shall be taxed as is the basic. If a company pays HRA component then it must collect proofs of rent-paid (rental receipts) from the employee.

It is calculated as a percentage of basic. The payment of dearness allowance facilitates employees and workers to face the price increase or inflation of prices of goods and services. The onslaught of price increase has a major bearing on the living conditions of the labor.

The increasing prices reduce the compensation to nothing and the money’s worth comes down based on the level of inflation. The payment of dearness allowance, which may be a fixed percentage on the basic wage, enables the employees to face the increasing prices.

ADVERTISEMENTS:

Leave Travel allowance or LTA is paid by certain companies. However again proofs of travel expenses must be collected by the company from the employees.

Medical Allowance/Reimbursements, etc.

Component # 2. Variable Pay Programs:

ADVERTISEMENTS:

Variable pay programs are generally classified differently for sales and non-sales.

i. Variable Pay Plans for Sales:

Variable pay plans for sales represents a pay-mix that may be a 70-30 or 60-40 or 50-50 plan. Here the 30, 40 or 50 represents the variable portion of the pay and is linked to the targets. Targets could be product-based, territory-based, revenue-based, and profitability-based or based on new business creation.

However payment of the variable portion does not always follow a linear scale. Supposedly the target is USD 100 million of sales. It is possible that till USD 50 million there may be no variable pay. If the person achieves USD 75 million (threshold level) then he/she may get 50% of the variable portion growing up to 100% of the variable portion when he/she achieves USD 100 million in sales.

ADVERTISEMENTS:

Variable pay plans do not come with an upper cap i.e., if the same guy exceeds USD1 100 million of sales will he get more than the plan as variable pay? Well the answer is Yes! Generally, a person in a 50-50 plan makes upto 70% or 80% variable pay.

ii. Variable Pay Plans for Non-Sales:

Such pay plans are for those employees who either are those who need incentives to propel their work or are those whose performance can be improved by giving them incentives like insurance plans, credit cards, mutual funds etc. Generally the variable portion in non-sales is lesser than in case of sales.

The variable pay is based on jobs and levels of job. Sometimes such plans may be covered under company-wide plans and the entire variable portion may be broken under employee performance, functional performance (i.e. performance of the function in which that employee works) and organizational performance.

The various variable-pay components very briefly have been discussed below:

ADVERTISEMENTS:

Bonus is generally post-facto. The bonus can be paid in different ways. It can be fixed percentage on the basic wage paid annually or in proportion to the profitability. The Government also prescribes a minimum statutory bonus for all employees and workers.

There is also a bonus plan which compensates the Managers and employees based on the sales revenue or Profit margin achieved. Bonus plans can also be based on piece wages but depends upon the productivity of labor.

Commission to Managers and employees may be based on the sales revenue or profits of the company. It is always a fixed percentage on the target achieved. For taxation purposes, commission is again a taxable component of compensation. The payment of commission as a component of commission is practiced heavily in target based sales. Depending upon the targets achieved, companies may pay a commission on a monthly or periodical basis.

Companies may also pay employees and others a combination of pay as well as commissions. This plan is called combination or mixed plan. Apart from the salaries paid, the employees may be eligible for a fixed percentage of commission upon achievement of fixed target of sales or profits or Performance objectives. Nowadays, most of the corporate sector is following this practice. This is also termed as variable component of compensation.

ADVERTISEMENTS:

Incentive is clearly defined, target-related and upfront. Piece rate wages are prevalent in the manufacturing wages. The laborers are paid wages for each of the quantity produced by them. The gross earnings of the labor would be equivalent to number of goods produced by them.

Piece rate wages improve productivity and is an absolute measurement of productivity to wage structure. The fairness of compensation is totally based on the productivity and not by any subjective factor. The CANTT productivity planning and Taylor’s plan of wages are examples of piece rate wages and the related consequences.

The latest trend in the compensation planning is the lump sum bonus for the incoming employee. A person, who accepts the offer, is paid a lump sum as a bonus. Even though this practice is not prevalent in most of the industries, Equity research and investment banking companies are paying sign-on-bonuses to attract scarce talent.

ADVERTISEMENTS:

Profit sharing is again a novel concept nowadays. This can be paid through payment of cash or through ESOPS. The structuring of wages may be done in such a way that, it attracts competitiveness and improved productivity.

Stock options are given to employees for two primary purposes – one to have long-term interest of the employee and second to link individual performance to organizational performance.

Generally stock options may be given under three categories:

a) ESOPs or Employee Stock Options;

b) RSUs or Restricted Stock Units;

ADVERTISEMENTS:

c) ESPP or Employee Stock Purchase Plans.

a) ESOPs or Employee Stock Options:

Suppose an employee is given ESOPS in the following way – ‘A’, an employee is given 2000 stocks of Rs.100 (Grant price). He is allowed to sell 50% of the stocks after 2 years and the rest of the stocks after another 2 years. Let’s say after two years the price of stock is Rs.110/- (vested price).

Then the employee actually gets only 1000 × 10 = 10000/- rupees only. In such a scenario if the price of the stock fell below 100/- rupees then the employee does not get anything. ESOPs worked well when stock prices were rising continuously. However when share prices started to drop then the relevance of ESOPs declined.

b) RSUs or Restricted Stock Units:

These are different from ESOPs. When stocks are given to the employees it is deemed at zero value. So whatever is the stock price the employee ends-up making some money. Taking forward the earlier example if after two years the price of stock is Rs.90/- then the employee still gets 90000/- rupees, on trading his options.

ADVERTISEMENTS:

c) ESPP or Employee Stock Purchase Plans:

This is more like a benefit. When the company is doing well then it gives option to employees to purchase shares on some discount.

Component # 3. Benefits:

The benefits could be the one that are legally-mandated ones or the ones that are ‘good-to-have’ for competitive-edge. The benefits may be monetary or non-monetary, long-term or short-term, free or at concessional rates and may include education, housing, medical, or recreational facilities, provided individually or collectively, inside or outside the organizational premises.

The benefits should always be given with a genuine concern for the employees and hence:

a) Most of the benefits should be broad-based and should uniformly apply to all the employees; and

b) Must be designed keeping in mind the genuine benefit that it shall provide to the employees.

This meant that this benefit did not reach majority of the employees. The company tweaked the benefit slightly to include the employee’s parents as well. This increased the value of the benefit considerably.

Companies are increasingly taking the employees to a ‘total rewards perspective’ that involves considering base pay, variable pay, employment benefits and work-life balance together. Despite this the benefits that a company provides to its employees have remained threadbare or minimum owing to the prevailing tough economic conditions. However in future there is chance of the revival of benefits.

Benefits may include:

i. Paid Time Off (Also Referred to as PTO):

It is earned by employees while they work.

They may be:

a) Holidays (governed by the law),

b) Leaves (governed by the shop and establishment act) like Casual Leaves, Sick Leaves, Earn or privilege leaves, etc.

The insurance programs may include health insurance, life insurance, personal accident insurance, disability insurance, family-health insurance, etc.

Fringe benefits include a variety of non-cash payments that are used to attract and retain talented employees and may include educational t assistance, flexible medical benefits, child-care benefits, and non-production bonuses (bonuses not tied to performance).

These may include:

a) Company cars

b) Paid vacations

c) Membership of social/cultural clubs

d) Entertainment tickets/allowances.

e) Discounted travel tickets.

f) Family vacation packages.

g) Reimbursements

Employees, depending upon their gradations in the organization may get reimbursements based on the Expenses incurred and substantiated. Certain expenses are also paid based on expenses incurred during the course of business. In many cases, employers provide advances to the employees for incurring certain expenses that are incurred during the course of the business.

Some examples are:

i. Travel expenses;

ii. Entertainment expenses;

iii. Out of pocket expenses; and

iv. Refreshments expenses.

h) Sickness benefits/pregnancy-

The increasing social consciousness of corporate had resulted in the payment of sickness benefit to the Employees of companies. This also includes payments during pregnancy of women employees. The expenses incurred due to injury or illness are compensated or reimbursed to the employees.

In certain companies, the death of an employee is compensated financially. Companies are also providing financial benefits to the family of the bereaved employees covering these cost through appropriate insurance policies like, Medical and life insurance.

Social security benefits are aimed at protecting employees against all types of social risks that may cause undue hardships to them in fulfilling their basic needs. Such benefits have a welfare objective and refer to all such services, amenities and facilities to the employees that improve their working conditions as well as standard of living of the employees and their families.

In India, the social security is generally governed by the state and is provided through the five Central Acts:

(i) The Employees’ State Insurance Act, 1948;

(ii) Employees’ Provident Funds & Miscellaneous Provisions Act, 1952;

(iii) The Workmen Compensation Act;

(iv) The Maternity Benefit Act; and

(v) The Payment of Gratuity Act.

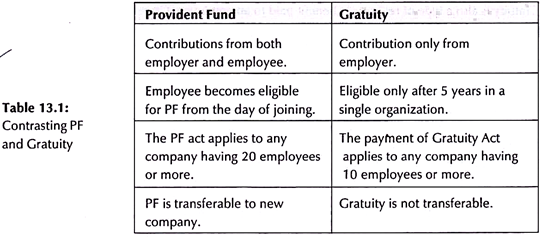

The social security besides medical facilities, compensation benefits and insurance coverage to the employees, also include the retirement benefits i.e., those relating to the provident fund and gratuity provisions.

Provident Fund contributions are determined in India by the Employees Provident Fund and Miscellaneous Provisions Act, 1952. The act provides for the social security, pension fund and deposit-linked insurance fund for the employees.

The Employee Provident Act is a kind of social security legislation that covers three schemes:

a) Provident Fund (PF)

b) Pension Scheme (PS); and

c) Employee Deposit-linked Insurance Scheme (EDLI)

The PF Act is a central act and the government can set up a central board, an executive committee, state board, appellate tribunals, officers etc. to implement the Act. Under Section 6, 6A and 6C, the PF fund gets contributions from both the employer and the employee. In case of EPS and EDLI contributions are generally made fully by the employer. EPS also gets contributions from the central government.

Gratuity is also a type of retirement benefit paid to an employee. Gratuity is linked to the number of years of service and is paid only to employee upon separation only if he/she completed five years of service in the company.

Gratuity payments are determined by the Payment of Gratuity Act 1972.

Under section 4 of the act – Gratuity shall be payable to an employee on the termination of his employment after he has rendered continues service for not less than five years:

a) On his superannuation,

b) On his retirement, or

c) On his death or disablement due to accident or disease.

Provided that the completion of continuous service of five years shall not be necessary where the termination of the employment of any employee is due to death or disablement.

Provided further that in the case of death of the employee, gratuity payable to him shall be paid to his/her nominee, or if no nomination is made, to his heirs, and where any such nominee or heir is a minor, the share of such minor shall be deposited with the controlling authority who shall invest the same for the benefits of such minor in such a bank or financial institution, as may be prescribed, until such minor attains majority.

Gratuity is calculated by using the following formulae:

Case A (where employee is covered under the Payments of Gratuity Act)-

Gratuity = Last drawn salary × 15/26 (number of years of service)

Case B (where employee is not covered under the Payment of Gratuity Act)-

Gratuity = Last drawn salary × 1/2 (number of years of service)

Rounded off to nearest full year e.g., 20 years 10 months, 25 days = 20 years

Gratuity Ceiling:

A ceiling (upper limit) of Rs.10 lakh applies to the aggregate of gratuity received from one or more employers in same or different years. Death- cum-retirement gratuity received by employees of central or state government and local authorities is exempt without limit.

Component # 4. Rewards & Recognition:

At the end of the day we are all human beings and like to compete and do better than others. This creates a natural urge to be rewarded and recognized. While designing the rewards and recognition plans the ‘why’ and ‘what’ kind of people to be covered in such plans needs to be answered. Generally the rewards and recognition, pyramids looks like.

Components of Compensation Management – Basic Wage, Dearness Allowance, House Rent Allowance, Other Allowances, Incentives and Fringe Benefits

Employee compensation is one of the most strategic and important functions of human resource management. It continues to evolve as part of a system of all the combined rewards that employers offer to employees. Compensation is considered as part of a total rewards system which mainly includes basic wage, dearness allowance, house rent allowance, other allowances, incentives and fringe benefits.

Component # 1. Basic Wage:

Basic wage is fixed on the basis of weightage given to jobs in an organizational context at various levels on the basis of skills, efforts, qualifications, etc. which are required to perform those jobs. Determination of weightage given to each job is done on the basis of studies carried out by industrial engineers along with other experts. Practices prevailing in other similar organizations are also taken into consideration.

Component # 2. Dearness Allowance:

Employees are employed with a particular wage or salary rate. In due course of time due to price increase, the real income of employees goes down. It means with the same level of wages employees are unable to buy goods and services, which they were able to buy before increase in prices. Dearness allowance is paid to employees by way of compensating them for the loss of real income caused to them by increase in the cost of living due to increase in prices.

Component # 3. House Rent Allowance:

Organizations are set up in various types of locations such as urban centres; industrial belt, etc. where houses are not available at a reasonable rent.

If the employees are required to pay house rent as per the prevailing market rates, a substantial portion of their wages will go as house rent and the employees will not be left with sufficient money to meet their other requirements.

Hence HRA is paid to the employees enabling them to pay house rent for a suitable accommodation. It varies according to the cost of living in different cities and places.

Employees are paid HRA as per their slabs in their wages and salaries. This allowance is not considered as wages. The HRA shall also not be reckoned for any direct payment like gratuity, overtime, provident fund, etc.

Component # 4. Other Allowances:

Apart from the basic, dearness allowance, many other allowances are paid to employees to compensate them adequately so that the total package of remuneration provides them suitable compensation package.

The various allowances given to the employees are:

(i) Leave Travel Allowance (LTA):

Employees while working, seldom get opportunity to visit places where they can go and spend some time along with the members of their families to get relaxed and reenergized for the work to be continued with zeal and enthusiasm. For such purpose employees are also willing to visit their native places.

Many organizations have introduced schemes commonly called Leave Travel Assistance (LTA)/Leave Travel Concession (LTC), etc. and this facility facilitates the employees to go to their home town or places for relaxation and reenergizing.

Organizations have different types of practices for various categories of employees. Normally employees who have completed a few years of service satisfactorily are entitled to LTA/LTC.

(ii) Washing Allowance:

While employees are working in various industrial processes, various kind of dirt gets accumulated on their body and uniform. If the employees do not keep themselves clean, they are likely to get different types of diseases. A particular amount is paid as washing allowance to certain categories of employees and they are expected to keep themselves clean.

In some organisation duty uniforms are provided to front line employees who directly come in touch with customers. These employees are given washing allowance and are expected to keep their uniforms clean and make better presentation before the customer.

Once washing allowance is provided, the employers are in a position to enforce a standard of cleanliness on the workforce which will ultimately force the employees to keep themselves clean and in due course of time, the organisation will have its own standard of cleanliness.

(iii) Conveyance Allowance:

For smooth and efficient functioning of any organisation, employees are required to come to workplace in time. Employees who neither have got a residence in the housing colony nor at any nearby places, commutes everyday distance by various means while coming to work place. While commuting employees loose hilt of time and energy and after reaching work place they find themselves exhausted.

In order to facilitate employees to come to the work place comfortably and in time, employers provide conveyance allowance to the employees for availing better transport service, or maintaining and using own vehicle. The conveyance allowance is paid to employees for the days in which he receives normal wages. This however is not paid for days on which he is on leave without pay.

(iv) Shift Allowance (SA):

Some organizations are required to work continuously under shift system because of the nature of production or service they have. Normally there are three shifts 6 A.M. to 2 PM., 2 P.M. to 10 PM. and 10 PM. to 6 A.M. In order to establish balance among employees, so far shift duty is concerned; the employees are rotated among these three shifts. It implies that all employees will get by rotation duties at night shift equally.

However there are organizations where a few employees are required to work more in nightshifts and rotations are not possible. They are paid an additional allowance called night shift allowance because they do jobs frequently during night hours which is strenuous. The rate of SA varies from organisation to organisation.

(v) Cash Handling Allowance:

There are organizations where one particular category of employees handles a lot of cash (currencies and coins) of various denominations. Their job is to receive/pay, transfer cash amount. While doing so, they are required to count cash correctly.

Sometimes by way of genuine error, they receive less money, pay more money and also receive bad currencies and coins. In such situation they are required to compensate the loss caused to the employers due to such error. Thus an element of risk is involved. In order to cover this risk element, these employees receive this allowance on regular basis.

(vi) Lunch Allowance and Dinner Allowance:

Those employees who are required to do the organization’s work away from the usual place of duty during the lunch or dinner period are paid lunch and dinner allowance.

(vii) Education Allowance:

The education allowance is paid to the employees to make the package more attractive and facilitate greater spirit to educate their children.

(viii) Underground Allowance:

All employees working in underground operations are entitled to this allowance because the underground job is more strenuous and risky.

(ix) Outstation Allowance:

This allowance is paid to all employees on outstation duty.

(x) Servant Allowance:

In order to enable the executives to work in a relax mind and free from household duties, they are provided servants or allowance enabling them keep servants.

(xi) Social Security Allowance:

This allowance is paid to employees to help them to protect themselves and their families in unforeseen situations in life. The employers get their employees insured under various types of social security schemes. The amount for the insurance schemes is paid by the employers.

(xii) City Compensatory Allowance:

In cities due to high prices the cost of living remains higher. Employees posted in these cities are paid city compensatory allowance by way of compensating them against loss of real income caused to them due to higher consumer price index prevailing there. This allowance varies in rates according to consumer price index prevailing in various categories of cities.

(xiii) Overtime Allowance:

Daily working hours for workers are prescribed under various Acts. Workers working for more than the prescribed hours are entitled to receive overtime payments, which is normally double the ordinary rate of wages.

Component # 5. Incentives:

Incentive compensation is performance-linked remuneration paid with the aim to encourage employees to work more and perform better. Both individual incentives and group incentives are used. Bonus, profit-sharing, commissions on sales are some examples of incentive compensation.

Component # 6. Fringe Benefits/Perquisites:

Different types of benefits are paid particularly to senior managers. Provident funds, pensions, gratuity, encashment of earned leave, company house, company car, leave travel concession (LTC), medical aid, interest free loan, holiday homes, entertainment, stock options, etc. are examples of such benefits.

Components of Compensation Management – Wages and Salary, Incentives, Fringe Benefits, Perquisites and Non-Monetary Benefits

Components of compensation means components of remuneration to employees. An average employees in the organized sector is usually entitled to various benefits. These benefits include both financial and non-financial benefits. Specifically, the components of remuneration to an employee’s comprise wages or salaries, incentives, fringe benefits, perquisites and non-monetary benefits.

1. Wages and Salary:

Wages and salary are generally paid on monthly basis, though many times, wages are paid on hourly or daily basis, whereas in the case of salary, the number of hours worked is not at all considered. Wages and salary are subject to annual increments. They differ from job to job, depending upon the nature of the job.

They also differ from employee to employee depending upon the nature of the job, seniority and merit. However, employees working in the same job such as teachers, clerks, etc. get the same salary but wages may differ from employee to employee when number of hours worked also differs.

2. Incentives:

Incentives which are also called ‘payments by results’ are paid to the employees in addition to wages and salaries. Incentives depend upon productivity or efficiency of the workers, sales effected, profit earned or cost reduction efforts.

Incentives schemes may be classified as – (i) individual incentive schemes and (ii) group incentive schemes. Individual incentive scheme is applicable to specific individual employee’s performance but group incentive scheme is applicable to a group of workers who are required to complete collectively a given work in a given time. The incentive amount paid to the group is divided among the group members on equitable basis.

3. Fringe Benefits:

Fringe benefits which are given to employee include such benefits as provident fund, gratuity, medical care, hospital allowance, accident relief, health insurance, canteen benefits, recreation, leave-travel allowance, etc.

4. Perquisites:

Perquisites are the allowances given executives and other higher level officers. They include such allowances as company car, club membership, paid holidays, furnished residential bungalows, stock option schemes, foreign travel benefits etc.

5. Non-Monetary Benefits:

Non-monetary benefits include such benefits which are given in kind and not in terms of money. They include such benefits as recognition of merit, issue of merit certificates, job responsibilities, growth prospects, competent supervision, comfortable working conditions, job-sharing, flexi-time etc.

Basic Components of Compensation – Financial and Non Financial Incentives

Compensation refers to the whole range of financial and non-financial incentives offered by an organisation to their employees in return for their services.

The various components are explained as under:

i. Basic Compensation:

It refers to the basic pay in the form of wages, salaries, and allowances paid to the employees. Wage represents hourly rate of pay, while salary refers to fixed monthly rate of pay. Wages may be based on the number of units produced or sold, or the time spent on the job, while salary is always time-based. Wages may be based on hourly, daily, weekly or even monthly basis.

Wages are generally paid to manual workers or in other words the blue-collar jobs, while salary is paid to white-collar workers such as office employees, supervisors, managers, professionals and technical staff. Salary is generally paid on weekly, monthly or yearly basis. Thus, the time period for which salaries are paid is generally higher than in case of wage payments.

Wages are generally paid for manual or physical work while salary compensates an employee for the mental work done by them. Besides wages and salaries allowances also become part of the basic compensation. These are paid to employees to compensate them for expenditures incurred by them in connection with performance of the job duties connected with employment, such as travel allowance.

ii. Supplementary Compensation:

It includes all other monetary incentives paid to employees for performance results. These are paid to reward the employees for their performance on the basis of their productivity, sales, profits, or cost reduction initiatives.

These include fringe benefits and other non-monetary benefits explained as under:

a. Fringe Benefits:

These benefits are offered to attract promising job applicants in the organisation and to retain the existing employees. These include benefits and services in the form of medical care, subsidised food, transportation, paid holidays, group insurance, retirement benefits, furnished home, club membership, chauffeur driven car etc.

b. Non-Monetary Benefits:

These are the benefits which provide psychological and emotional satisfaction to employees. These can be provided to the employees in the form of an enriching the content or context of the job, making their jobs more challenging, recognition of merit, comfortable working conditions etc. These incentives provide positive reinforcements and try to motivate the employees to perform to the best of their capacity.

Basic Components of Compensation Management – 4 Important Components

Compensation is a payment made in cash to the employee in return of the contribution that he/she makes in the organization. Compensation may have a base pay as well as variable pay components. Salary and wages are most common form of compensation given to the employees.

Benefits on the other hand are other than such payments, also given to the employee in recognition of his/her contribution. Benefits have a welfare principle associated with them. Thus compensation is an integral part of human resource management which helps in motivating the employees and improving organizational effectiveness.

The increasing competitiveness of the labor market and turnover of employees have resulted in nightmare in compensation planning. Apart from this, the growing demands of the employees and competitive salaries offered by multinational companies have almost resulted in a compensation war in certain industries.

Based on above description of compensation, we may identify its various components as follows:

1. Wage and Salary:

Wage and salary are the most important components of compensation and these are essential irrespective of the type of organisation. Wage is referred to as payment to workers particularly, hourly-rated payment.

Salary refers to as remuneration paid to white-collar employees including managerial personnel. Salary is paid on the basis of fixed period of time and normally not associated with productivity of an employee at a particular time.

2. Incentives:

Incentives are also called ‘payments by results’. Incentives are paid in addition to wages and salaries. Incentives depend upon productivity, sales, profit, or cost reduction efforts.

There are:

(i) Individual incentive schemes, and

(ii) Group incentive programmes.

Individual incentives are applicable to specific employee performance. Where a given task demands group effort for completion, incentives are paid to the group as a whole. The amount is later divided among group members on an equitable basis.

3. Fringe Benefits:

Fringe benefits include such benefits which are provided to the employees either having long-term impact like provident fund, gratuity, pension; or occurrence of certain events like medical benefits, accident relief, health and life insurance; or facilitation in performance of job like uniforms, canteens, recreation, etc.

4. Perquisites:

These are normally provided to managerial personnel either to facilitate their job performance or to retain them in the organisation. Such perquisites include company car, club membership, free residential accommodation, paid holiday trips, stock options, etc. Executives are rarely required to spend money from their pockets. Their holidays, servants, telephone bills and even electricity and gas bills are taken care of by their companies.