A stock split is the division of a share into two or more parts.

Stock split adds no value but increases the number of shares in the ratio of the split.

By splitting of shares the capital of the company does not increase, but the capital is only redistributed by increased number of shares.

A stock split is a decision by the company’s board of directors to increase the number of outstanding shares of a company without changing the shareholders equity.

ADVERTISEMENTS:

A stock split is usually done by companies that have seen their share price increase to levels that are either too high or are beyond the price levels of similar companies in their sector.

The basic objective is to make shares seem more affordable to small investors even though the underlying value of the company has not changed.

Stock splits help to make shares more affordable to small investors and provide greater marketability and liquidity in the market.

Illustration:

ADVERTISEMENTS:

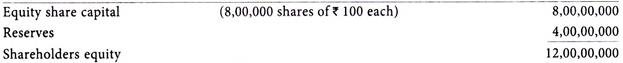

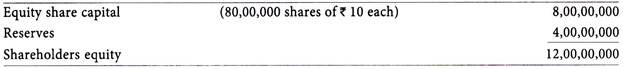

The capital structure of Jyothi Ltd. is given below: (Rs.)

In general body meeting of the company, it is decided to subdivide each equity share into 10 shares of Rs 10 each. The capital structure will stand as follows after stock splits.