After reading this article you will learn about:- 1. History of Merchant Banking in India 2. Merchant Banking Regulations 3. Government Policy.

History of Merchant Banking in India:

Merchant banking services, in India, were started only in 1967 by National Grindlays. Bank followed by Citi Bank in 1970. The State Bank of India was the first Indian commercial bank to set up a separate merchant banking division in 1972.

Later, the ICICI set up its merchant banking division in 1973 followed by a number of other commercial banks like Canara Bank, Bank of Broada, Bank of India, Syndicate Bank, Punjab National Bank, Central Bank of India, UCO Bank, etc.

The FERA regulations in 1973, which required a large number of foreign companies to dilute their shareholdings in India, gave a boost to the merchant banking activities in India. Since then, a number of development banks and financial institutions such as IFCI and IDBI have also entered this field.

ADVERTISEMENTS:

Some leading banks have floated wholly owned subsidiaries for carrying out these activities. Private brokers and financial consultancy firms have also been quite active in the field of merchant banking. They, infact, have given a tough competition to the commercial banks in the operations of merchant banking.

Thus, at present merchant banking services in our country are provided by the following types of organisations:

(i) Commercial banks and their subsidiaries.

(ii) Foreign banks including National Grindlays Bank, Citi Bank, Hongkong Bank etc

ADVERTISEMENTS:

(iii) All India Financial Institutions and Development Banks such as, ICICI, IFCI, IDBI.

(iv) State Level Financial Institutions, such as, State Industrial Development Corporations (SIDC’s) and State Financial Corporations.

(v) Private Financial Consultancy Firms and Brokers, such as J.M. Financial and Investment Services Ltd.; DSP Financial Consultants, Fnam Financial Consultants, Kotak Mohindra, Ceat Financial Services, etc.

(vi) Technical Consultancy Organisations

ADVERTISEMENTS:

(vii) Professional Merchant Banking Houses, such as VMC Project Technologies.

Merchant banking in India can be categorised in four broad sections:

1. To provide long-term source of funds required by the corporate sector. The merchant banker primarily came into being as corporate counsellors for restructuring base of capital, thereafter for issue management and underwriting of the same.

2. Project counselling which includes credit-syndication and the working capital.

ADVERTISEMENTS:

3. Capital structuring.

4. Portfolio management.

The buoyancy in the capital market in 1980s created a lot of scope for merchant banking activities in our country. The year 1985 was an epoch-making year in the history of merchant banking when a large number of issues were oversubscribed by several times and the importance of merchant banking activities was made evident in managing issues and their underwriting.

Deregulation and liberalisation of the industry in India has accounted for changes in the financial sector. With the passage of time merchant banking activities have changed in line with the changing need pattern of the enterprises in the wake of economic development.

ADVERTISEMENTS:

Since August 1990, merchant bankers engaged in issue management, corporate advisory services, underwriting and portfolio management have to obtain authorisation from the Securities and Exchange Board of India (SEBI) after meeting the requirements of capital adequacy norms. In 1993, there were 568 merchant bankers in our country out of which 312 were authorised by the Securities and Exchange board of India.

The number of registered merchant bankers with SEBI increased to 422 at the end of August 1994. The total number of merchant bankers in all categories increased to 1163 by the end of 1997-98. As the liberalisation policy continues and the financial market is expanding rapidly, the future for the country’s merchant bankers seems to be buoyant. But their roles are changing with the change in the needs of the customers.

Merchant Banking Regulations:

SEBI (Merchant Bankers’) Regulation Act, 1992 defines a ‘merchant banker’ as “any person who is engaged in the business of issue management either by making arrangements regarding selling, buying or subscribing to securities or acting as manager, consultant, adviser or rendering corporate advisory service in relation to such issue management”.

At present no organisation can act as a ‘merchant banker’ without obtaining a certificate of registration from the SEBI.

ADVERTISEMENTS:

However, It must be noted that a person/ organisation has to get himself registered under these regulations if he wants to carry on or undertake any of the authorised activities, i.e., issue management assignment as manager, consultant, advisor, underwriter or portfolio manager.

To obtain the certificate of registration, one had to apply in the prescribed form and fulfill two sets of norms (i) operational capabilities and (ii) capital adequacy norms.

Classification of Merchant Bankers:

The SEBI has classified ‘merchant bankers’ under four categories for the purpose of registration:

ADVERTISEMENTS:

1. Category I Merchant Bankers:

These merchant bankers can act as issue manager, advisor, consultant, underwriter and portfolio manager.

2. Category II Merchant Bankers:

Such merchant bankers can act as advisor, consultant, underwriter and portfolio manager. They cannot act as issue manager of their own but can act co-manager.

3. Category III Merchant Bankers:

They are allowed to act as underwriter, advisor and consultant only. They can neither undertake issue management of their own nor they act as co-manager. They cannot undertake the activities of portfolio management also.

ADVERTISEMENTS:

4. Category IV Merchant Bankers:

A category IV merchant banker can merely act as consultant or advisor to an issue of capital.

Capital Adequacy Norms:

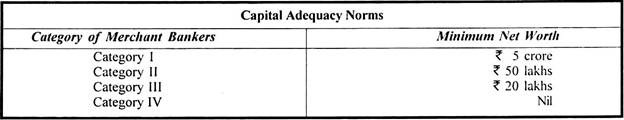

SEBI has prescribed capital adequacy norms for registration of the various categories of merchant bankers. The capital adequacy is expressed in terms of minimum net worth, i.e., capital contributed to the business plus free reserves.

The following are the capital adequacy norms as laid down by SEBI:

Fees:

ADVERTISEMENTS:

According to the SEBI (Merchant Bankers) Amendment Regulations, 1999, w.e.f. 30.9.1999, every merchant banker shall pay a sum of Rs. 5 lakhs as registration fees at the time of grant of certificate by the Board. The fee shall be paid by the merchant banker within 15 days of receipt of intimation from the Board.

Further, a merchant banker to keep registration in force shall pay renewal fee of Rs. 2.5 lakhs every three years from the fourth year from the date of initial registration.

Government Policy for Merchant Banking:

The Government issued policy guidelines for merchant bankers to ensure sufficient physical infrastructure, necessary expertise, good financial standing, professional integrity and fairness in their transactions. The merchant bankers have to be competent to serve the investors also.

On 1st March, 1993 new policy guidelines have been issued by SEBI for the merchant bankers to ensure greater transparency in their operations and to make them accountable so as to protect the investor’s interest. The guidelines relate to pre-issue obligations, underwriting, advertisements and post-issue obligations of the merchant bankers.