The following points highlight the top three alternatives to dividend of a company. The alternatives are: 1. Buyback of Shares 2. Stock Split 3. Bonus Issue.

Alternative # 1. Buyback of Shares:

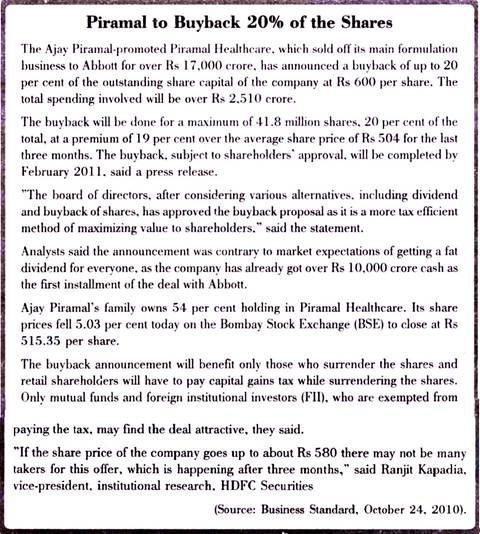

Buyback is reverse of issue of shares by a company where it offers to take back its shares owned by the investors at a specified price; this offer can be binding or optional to the investors.

Advantages:

A. Unused Cash:

ADVERTISEMENTS:

If they have huge cash reserves with not many new profitable projects to invest in and if the company thinks the market price of its share is undervalued. Example – Bajaj Auto went on a massive buy back in 2000 and Reliance’s recent buyback. However, companies in emerging markets like India have growth opportunities. Therefore applying this argument to these companies may not be logical.

This argument is valid for multinational companies (MNC), which already have adequate R & D budget and presence across markets. Since their growth potential may be limited, they can buy back shares as a reward for their shareholders.

B. Tax Gains:

At present, short-term capital gains are taxed at 15% and long-term capital gains are not taxed. There is no tax on dividends received by the shareholders but DDT – Dividend Distribution Tax has to be paid by the company while distributing the dividends @ 15% plus surcharge @ 1.125% plus education cess @ 2% plus SAH education cess of 1% of income tax. Total 16.60875%. (F.Y 2010-11)

ADVERTISEMENTS:

C. Market Perception:

By buying their shares at a price higher than prevailing market price company signals that its share valuation should be higher.

Recently the prices of RIL and REL (Reliance Industries Ltd and Reliance Energy Ltd) have not fallen, as expected, despite the spat between the promoters. This is mainly attributed to the buyback offer made at higher prices.

D. Future Dividends per Share can be Raised:

ADVERTISEMENTS:

With earnings remaining unaffected and less number of shares available against which earnings are to be distributed, the EPS and corresponding DPS goes up.

What are the methods in which buyback can happen?

Share buyback can take place in 3 ways:

1. Shareholders are presented with a tender offer where they have the option to submit a portion of or all of their shares within a certain time period and at usually a price higher than the current market value. Another variety of this is Dutch auction, in which companies state a range of prices at which it’s willing to buy and accepts the bids. It buys at the lowest price at which it can buy the desired number of shares.

ADVERTISEMENTS:

2. Through book-building process.

3. Companies can buy shares on the open market over a long-term period subject to various regulator guidelines like SEBI

In both 1 & 2 promoters can participate in buyback and not in 3.

Restrictions on Buyback by Indian companies:

ADVERTISEMENTS:

Some of the features in government regulation for buyback of shares are:

1. A special resolution has to be passed in general meeting of the shareholders

2. Buyback should not exceed 25% of the total paid-up capital and free reserves

3. A declaration of solvency has to be filed with SEBI and Registrar of Companies

ADVERTISEMENTS:

4. The shares bought back should be extinguished and physically destroyed;

5. The company should not make any further issue of securities within 2 years, except bonus, conversion of warrants, etc.

These restrictions were imposed to restrict the companies from using the stock markets as short term money provider apart from protecting interests of small investors.

Valuation of Buyback:

ADVERTISEMENTS:

There are two ways companies determine the buyback price:

1. They use the average closing price (which is a weighted average for volume) for a period immediately before to the buyback announcement. Based on the trend and value a buyback price is decided

2. Shareholders are invited to sell some or all of their shares within a set price range. The low point of the range is at a discount to the market price, while the top of the price range is set at a premium to the market price. Investors are given more say in the buyback price than in the above arrangement. Still this method is rarely used. Generally, the price is fixed at a markup over and above the average price of the last 12-18 months.

Theoretical Pricing of the Buyback Issue:

A company should fix its buy back price so that an investor who does not accept the buy-back offer is not discriminated against in terms of his wealth with reference to an investor who accepts the buyback offer.

Post buy back share price = (N × Po)/(N – N1)

ADVERTISEMENTS:

N = No. of shares outstanding before the buy back

Po = Current Market Price

N1 = No. of shares bought back

Alternative Theoretical Pricing:

Since cash has a value and it goes out the theoretical ex-buy back price = (N × Po) – Cash/(N – N1)

Alternative # 2. Stock Split:

It is a reduction in the face value of shares. A stock split is a decision by the company’s board of directors to increase the number of shares that are outstanding by issuing more shares to current shareholders. For example, in a 2-for-1 stock split, every shareholder with one stock is given an additional share. So, if a company had 10 million shares outstanding before the split, it will have 20 million shares outstanding after a 2-for-1 split. The market price gets adjusted with such stock split

ADVERTISEMENTS:

Advantages:

A stock split does not change the wealth of the shareholder, it reduces the market price per share and thereby make it within the reach of the small investor. For example – If a share with a Face value of Rs. 10 is quoted at Rs.550, and it is split in the ratio of 5:1, then the shareholder would have 5 shares for every one share and the market price per share will fall to Rs. 110. It becomes attractive due to low price perception giving a better valuation for the shares, thus an alternative to dividend.

Alternative # 3. Bonus Issue:

A bonus issue involves the capitalization of reserves. In a bonus issue, an amount from reserves is transferred to equity by allotting shares at par value. For example – a bonus issue of 4:1 means that for every share 4 more share would be issued.

Advantages:

i. Share capital gets increased according to the bonus issue ratio.

ADVERTISEMENTS:

ii. Liquidity in the stock increases.

iii. Effective Earnings per share, Book Value and other per share values stand reduced.

iv. Markets take the action usually as a favorable act.

v. Market price gets adjusted on issue of bonus shares.

vi. Accumulated profits get reduced.

Theoretical pricing of the after bonus issue:

ADVERTISEMENTS:

Post bonus share price = (N × Po)/(N + N1)

N = No. of shares outstanding before the bonus issue

Po = Current Market Price

N1 = No. of bonus shares issued