Here is an essay on ‘Business Integration’ for class 11 and 12. Find paragraphs, long and short essays on ‘Business Integration’ especially written for school and college students.

Essay on Business Integration

Essay Contents:

- Essay on the Need for Business Integration

- Essay on the Forms of Business Integration

- Essay on the Motives for Cross Border Integration

- Essay on the Methods of Payment in Business Integration

- Essay on Tax Planning through Merger

- Essay on the Causes of Merger Failures

Essay # 1. Need for Business Integration:

ADVERTISEMENTS:

The business integration in the form of mergers, acquisitions, takeovers, joint ventures, strategic alliances etc. have become imminent in today’s business. Integration of companies are implicit in free enterprise system because of their obvious advantages – infusion of better management, consolidating capacities to economic level by forward and backward linkages and healthy growth of capital market.

The concept of business integration has assumed greater significance in the context of the ongoing program of liberalization and globalization. Previously integration of one company with another was viewed, as a sign of failure of the former. The laws and regulations previously allowed the acquisition of only sick, dying, moribund, impossible, unviable and almost hopeless units.

The acquirer was driven mostly by the tax benefits of the loss carry forward. There are now more economic reasons and wider choices for integration. The principal economic rationale of a business integration is that the value of the combined entity is expected to be greater than the sum of the independent values of the integrated entities.

The most plausible reasons for business integration are strategic benefits, economies of scale, economies of scope, utilization of surplus funds, complementary resources, tax shields, economies of integration, managerial effectiveness etc. Though, the terms merger, absorption, amalgamation, acquisition and takeover have specific meanings, we call all of them as ‘business integration’ in our further discussion unless specifically mentioned.

Essay # 2. Forms of Business Integration:

A. Horizontal Integration:

ADVERTISEMENTS:

When two or more corporate firms dealing in similar lines of activity combine together then horizontal integration takes place. The purpose of horizontal integration is elimination or reduction in competition, putting an end to price cutting, economies of scale in production, research and development, marketing and management etc.

A horizontal integration is one that takes place between two companies which are essentially operating in the same market. Their products may or may not be identical. The horizontal integration takes place between business competitors who are manufacturing, selling, distributing the similar type of products or providing similar type of service for profit.

Horizontal integration results in reduction of competitors in the same industry. This type of integration enables to derive the benefit of economies of scale and elimination of competition. But this will increase the monopolistic tendency in the market. Less number of players in the industry will lead to collusion to reap abnormal profits by setting the prices of finished products at higher level than the market determined price.

ADVERTISEMENTS:

For example, merger of Tata Oil Mills Company Ltd. (TOMCO) with Hindustan Lever Ltd. (HLL) is a horizontal integration. Both the companies have similar products. A TV manufacturing company taking over a company manufacturing washing machines will also be a horizontal takeover, because both the companies are in the market for consumer durables.

B. Vertical Integration:

When a firm acquires its ‘upstream’ from it to or firm’s ‘downstream’, then vertical integration occurs. In the case of ‘upstream’ type of integration, it extends to the suppliers of raw materials and in case of ‘downstream’ type of integration, it extends to those firms that sell eventually to the consumer.

The purpose of such integration is the lower buying cost of materials, lower distribution costs, assured supplies and market, increasing or creating barriers to entry for potential competitors. A vertical integration is one in which the company expands backwards by integration with a company supplying raw materials or expands forward in the direction of the ultimate consumer.

In a vertical integration, there is a merging of companies engaged at different stages of the production cycle within the same industry. The vertical integration will bring the firms together who are involved in different stages of production, process or operation. Vertical integration may take the form of forward or backward integration.

ADVERTISEMENTS:

A vertical integration allows for smooth flow of production, reduced inventory, reduction in operating costs, increase in economies of scale, elimination of bottlenecks etc. This may also result in monopolistic tendency.

For example, the integration of Reliance Petrochemicals Limited (RPCL) with Reliance Industries Limited (RIL) is an example of vertical integration with backward linkage as far as RIL is concerned. Similarly, if a cement manufacturing company acquires a company engaged in civil construction it will be a case of vertical integration with forward linkage.

C. Conglomerate Integration:

In marked contrast, conglomerate integration is a type of combination which a firm established in one industry combines with another firm in another unrelated industry. Such integration moves for diversification of risk constitutes the rationale. In a conglomerate integration, the concerned companies are in totally unrelated lines of business.

This type of integration involves the integration of companies entirely involved in a different set of activities, products or services. The merging companies are neither competitors nor complementary to each other. This form of integration is resorted to increase economic power, profitability, diversification of activities.

ADVERTISEMENTS:

For example, Mohta Steel Industries Limited merged with Vardhaman Spinning Mills Limited. Conglomerate integration are expected to bring about stability of income and profits, since the two units belong to different industries. Adverse fluctuations in sales and profits arising due to trade cycles may not hit all the industries at the same time.

Essay # 3. Motives for Cross Border Integration:

There has been a substantial increase in the quantum of funds following across nations for business integration activities.

The companies go in for international acquisitions for a number of strategic or tactical reasons such as the following:

1. Growth Orientation:

ADVERTISEMENTS:

To escape small home market, to extend markets served, to achieve economy of scale.

2. Access to Inputs:

To access raw materials, to ensure consistent supply of raw materials, to access technology, to access latest innovation, to access cheap and productive labour.

3. Unique Advantages:

To exploit the company’s brands, reputation, design, production and management capabilities.

4. Defensive Strategy:

To diversify across products and markets, to reduce earnings volatility, to reduce dependence on exports, to avoid home country political and economic instability, to compete with foreign competitors in their own territory, to circumvent protective trade barriers in the host country.

5. Client Needs:

ADVERTISEMENTS:

To provide home country clients with service for their overseas subsidiaries e.g., banks and accountancy firms.

6. Opportunism:

To exploit temporary advantages e.g., a favourable exchange rate making cross border acquisition cheap.

Essay # 4. Methods of Payment in Business Integration:

The methods of payment in business integration and its benefits and drawbacks are discussed in brief as follows:

A. Cash:

Where one company purchases the shares or assets of another for cash, the shareholders of the latter company cease to have any interest in the combined business.

1. From the point of view of selling shareholders, they take a certain cash sum and will be liable to capital gains tax on the disposal of their shares.

ADVERTISEMENTS:

2. From the point of view of the purchasing company, its cash holdings will decrease. It has sometimes been suggested that the use of cash will give a better chance of success providing the earnings of the company which is purchased are greater than the earnings which would be made by using cash in other ways.

B. Loan Stock:

The consequences of exchanging loan stock against shares are as follows:

1. In this case the selling shareholders, either directly or indirectly, exchange shares in one company for loan stock in another company. Hence an equity investment is exchanged for a fixed interest investment, which may or may not be an advantage, depending upon the relative values of the securities and the circumstances of the individual investor. Any liability to capital gains tax will be deferred until ultimate disposal of the loan stock.

2. From the point of view of the shareholders of the company which is purchasing the shares or net assets, there may be an advantage with the increased level of gearing. In addition, interest on the loan stock will be deductible for corporation tax purposes.

C. Ordinary Shares:

A share for share exchange is often the method used in combinations involving large companies. Here the shareholder merely exchanges his shares in one company for shares in another company.

1. From the point of view of the selling shareholders, this may have many benefits, although the extent to which they exist will depend upon the exact terms of the combination and the relative values of the shares.

ADVERTISEMENTS:

The selling shareholder continues to have an interest in the combined businesses with the benefits and will not be subject to capital gains tax on the exchange. Against this the value of the security which he receives is not certain but will depend upon market reaction to the combination.

2. From the point of view of the combined companies, a share exchange does not affect their liquidity. The extent to which it is beneficial for the existing shareholders of the company must depend upon the relative values of the shares.

D. Convertible Loan Stock:

The issue of convertible loan stock has become more common and has sometimes been used in connection with business combinations. In such a case, the shareholders in one company exchange their shares for convertible loan stock in another company.

1. From the point of view of a selling shareholder, he exchanges an equity investment for a fixed interest security, but one which is convertible into an equity investment at some time in the future. Thus, if in the future share prices move in his favour he will be able to take up his equity interest. While, if they move against him, he will be able to retain his fixed interest investment. Again, any liability to capital gains tax is deferred until ultimate disposal of the convertible stock or equity shares issued in exchange.

2. From the point of view of the company, issuing such securities, the interest on the loan stock is deductible for taxation purposes. The debt is self-liquidating if loan holders convert loan stock into ordinary shares. If loan holders do convert, the tax deductibility is, of course, lost and in addition there is a reduction in gearing and possible dilution of the existing shareholders’ interest.

Essay # 5. Tax Planning through Merger:

Tax Benefits of Merger:

ADVERTISEMENTS:

Some tax benefits are available under various provisions of Income-tax Act, 1961 for amalgamating companies. Under section 2( IB) of the Income-tax Act, amalgamation includes ‘not only the merger of one existing company with another existing company but also the merger of two or more existing companies to form a third company’. In other words, the amalgamated company may either be an existing company or a company newly formed to avail of the benefits provided under the tax laws.

To avail of the benefit of amalgamation under the Income-tax Act, 1961, the following requirements specified under section 2(1B) of the Act must be complied with the following:

1. All the property of the amalgamating company becomes the property of the amalgamated company.

2. All the liabilities of the amalgamating company becomes the liabilities of the amalgamated company.

3. Shareholders holding not less than three-fourths in value the shares in the amalgamating company become the shareholders in the amalgamated company.

Under section 72A of the Income-tax Act, 1961, amalgamation results in the reduction of tax liability of amalgamated company. The accumulated losses and unabsorbed depreciation of the amalgamating company shall be deemed to be loss (not being a loss sustained in speculation business) and depreciation of the amalgamated company for the previous year in which the amalgamation is effected.

ADVERTISEMENTS:

But the eligibility for carrying forward and tax concession is contingent upon the amalgamated company holding continuously for a minimum period of five years from the date of amalgamation atleast three-fourths in the book value of the fixed assets of the amalgamating company and subject to the condition that the amalgamated company continues the business of amalgamating company for a minimum period of 5 years from the date of amalgamation.

Other Tax Benefits:

The other tax benefits are as follows:

1. Under section 47(vi) of the Income-tax Act, transfer of assets to the transferee company pursuant to a scheme of amalgamation is not a ‘transfer’ and does not attract capital gains tax.

2. Similarly, shares allotted to shareholders of the transferor company are not a transfer for attracting capital gains.

3. The provisions of the Income-tax Act says that acquisition of the property of the company in winding-up by another company does not amount to amalgamation.

4. Distribution of share of property by a company in winding-up to another company shall not be regarded as amalgamation.

ADVERTISEMENTS:

5. When the amalgamating company transfers depreciable assets to the amalgamated company, then the amalgamated company can claim depreciation on the written-down value of the transferred assets in the books of amalgamating company.

Taxation Aspects of Takeover:

No special tax benefits are available in case of takeover deals. By acquiring substantial voting power by the acquirer in the target company, holding and subsidiary company relationship is established. When the holding company sells such shares, would attract capital gains tax depending on the short-term or long-term holding period under the provisions of the Income-tax Act, 1961.

Essay # 6. Causes of Merger Failures:

The empirical evidence shows that all mergers didn’t end up with beneficial results.

The reasons for failures and the pitfalls of integration are discussed below:

1. Poor Strategic Fit:

The two companies having different strategies and objectives will not fit together. It may lead to conflict with one another.

2. Cultural and Social Differences:

The cultural and social differences among the human resources of the two entities may create serious complications while working together.

3. Insufficient Due Diligence:

Due diligence is to be observed by the officials in the top hierarchy. If such officials fails to do their duty, the merging process may give negative results and undue delays.

4. Failure to Integrate Properly:

The integration of two companies requires a very high level of quality management. Integration is often poorly managed with little planning and design, leads to failure of merger process.

5. Payment of Excessive Consideration:

Sometimes excess premium is paid for the target company on expectation of synergies and if synergies are not realized then the premium paid to acquire the target is never recouped.

6. Limited Focus:

Purely financially motivated mergers, such as tax driven mergers on the advice of accountants, can be hit by adverse business consequences.

7. Unrelated Business Activities:

When the company has top class management with cash rich business and financial information system, it can go for a company with unrelated business activities, when the chances of successful takeover is bright. But in normal practice, the companies with unrelated business activities are not the potential target companies.

8. Financial Misinformation:

It would be a serious mistake if the takeovers were conducted without a proper audit of the financial affairs of the target company, and without evaluation of its costs, assets and liabilities and its financial and technical competencies.

9. Without Objective Evaluation:

The risk of failure will be higher if there is no detailed evaluation of target company’s business conditions is carried out by competent professionals.

10. Delays in taking Management Control:

If the management of the target company is not possessed by the acquirer immediately, it would be difficult to achieve the goals set for acquisition.

11. Preparation for Unpleasant Surprises:

While merging the business of target company, the management of the acquirer company should keep in view that the activities of the target company may not appear exactly what they appear from outside. Practical difficulties should be smoothed out gradually when the acquirer comes into control of the target company.

12. Incompatibility of Partners:

An acquisition of a weak company by the strong company will always lead to positive results. But an alliance between two strong companies or two weak companies may lead to incompatibility and friction in merger process.

13. Ego Clash:

The differences of opinion among the directors who sit in a common board room after merger, may lead to ego clash.

14. Changing Business Models:

Forces fitting a low cost business into a high cost system gives negative results.

15. Quick Results:

The expectation of results too quickly may not be able to achieve to the expectation. This may cause to downgrade the confidence of the acquirer.

16. Diverging from Core Activity:

In some cases it reduces the buyer’s efficiency by deflecting it from its core activity and too much time is spent on new activity neglecting the old activity.

17. Loss of Identity:

Merger should not result in loss of identity which is a major strength for the acquiring company.

Problem:

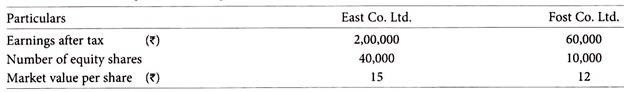

East Co. Ltd. is studying the possible acquisition of Fost Co. Ltd. by way of merger.

The following data are available in respect of the companies:

(i) If the merger goes through by exchange of equity share and the exchange ratio is based on the current market price, what is the new earnings per share for East Co. Ltd.?

(ii) Fost Co. Ltd. wants to be sure that the earnings available to its shareholders will not be diminished by the merger. What should be the exchange ratio in that case?

Solution:

(i) Calculation of New EPS of East Co. Ltd.

Number of equity shares to be issued by East Co. Ltd. of Fost Co. Ltd.

= 10,000 shares × Rs.12/Rs.15 = 8,000 shares

Total number of shares in East Co. Ltd. after acquisition of Fost Co. Ltd.

= 40,000 + 8,000 = 48,000 shares

Total earnings after tax after acquisition

= 2,00,000 + 60,000 = Rs.2,60,000

EPS =Rs.2,60,000/48,000 equity shares = Rs. 5.42

(ii) Calculation of Exchange Ratio which would not diminish the EPS of Fost Co. Ltd. after its merger with East Co. Ltd.

Current EPS:

Exchange ratio is to be = 6/5 = 1.20

Number of new shares to be issued by East Co. Ltd. to Fost Co. Ltd. = 10,000 x 1.20 = 12,000 shares

Total number of shares after acquisition = 40,000 + 12,000 = 52,000 shares

EPS after Merger = Rs.2,60,000/52,000 shares = Rs.5

Total earnings of Fost Co. Ltd. = No. of Shares x EPS = 12,000 × Rs.5 = Rs.60,000