Read this essay to learn about Book-Keeping. After reading this essay you will learn about:- 1. Introduction to Book-Keeping 2. Systems of Book-Keeping 3. Books of Accounts Maintained.

Essay # 1. Introduction to Book-Keeping:

The knowledge of Book-keeping and accounts is very essential for an engineering student. In future he would either own a commercial concern or would serve a government or a commercial concern. Therefore, he must be well acquainted with the subject.

“Book-keeping” is the art of recording business transactions systematically. It is very simple and is the art of reducing each transaction to its simplest term.

“Transaction” means the exchange of money or money’s worth between one party and another.

ADVERTISEMENTS:

Proper book-keeping show all purchases, sales and returns, quantity and value of goods available in the stock, transaction with creditors and debtors information about assets and liabilities, cash available, profit and loss account etc.

Book-keeping (or sometimes known as Account-keeping) informs us regarding:

(i) The financial effect of each business transaction.

(ii) Combined effect of all transactions.

ADVERTISEMENTS:

(iii) Correct financial status of the firm.

(iv) All purchases and sales.

(v) Quantity and value of goods available.

(vi) Assets and liability of the firm.

ADVERTISEMENTS:

(vii) Cash availability.

Essay # 2. Systems of Book-Keeping:

As business is carried out with a view to make profit, it is important that the financial effects of each business transaction are properly recorded.

There are two systems of maintaining accounts:

(a) Single Entry System.

ADVERTISEMENTS:

(b) Double Entry System.

(a) Single Entry System:

Small business houses maintain simple accounts. This system is called Single entry system. This is mostly used in government departments also.

(b) Double Entry System:

A transaction affects two parties one receiving benefit, the other party giving the benefit.

Every account has, therefore, two sides:

ADVERTISEMENTS:

(i) Debtor side.

(ii) Creditor side.

An account is Debtor (Dr) when he receives, and Creditor (Cr) when he gives.

Thus every transaction affects two accounts — one on the Debtor side and the other on Creditor side.

ADVERTISEMENTS:

This system is, therefore, known as Double Entry System of Accounts. This system is mostly used in commercial concerns.

Essay # 3. Books of Accounts Maintained in Book-Keeping Process:

The following is a general picture of entries in a Book-keeping process:

It consists of four Journals and one ledger.

(i) The four Journals are:

ADVERTISEMENTS:

(a) The Sales Journal.

(b) The Purchase Journal.

(c) The Cash Journal.

(d) General Journal (All entries which cannot be recorded into any of the above three journals are entered in this).

(ii) Ledger:

In the ledger there are separate pages for each record (Account) we wish to keep.

ADVERTISEMENTS:

It means that there will be separate pages for account of the following:

Cash, Purchases, Sales, Expenses, Proprietors accounts:

There will also be separate pages for each customer and for each creditor.

The Book-keeper’s work consists of recording transactions as they occur in Journal to which it belongs and then “Posting” in the Ledger, that is copying these entries to their respective accounts (pages).

At the end of each year, the balance of each account in the ledger is obtained and listed on a sheet of paper called “Trial Balance”.

From the Trial Balance at the end of the year a statement is prepared showing all the tilings the business owns such as Cash, Merchandise Inventory, Customer’s Balances, Notes receivable etc. (These are called Assets).

ADVERTISEMENTS:

Alongside this a list of business Debt is prepared such as Notes Payable, Creditors’ Balances etc. (These are called Liabilities). The difference between assets and liabilities shows the net profit of the business.

(i) Journal and Ledger:

Each transaction in a business is recorded on the date and time of occurrence in a book called Journal.

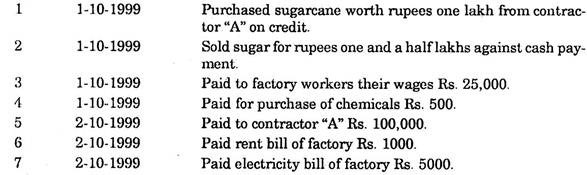

For example the following transactions took place in a Sugar Factory’ on 1st and 2nd October, 1999:

Now each of the transaction given above is explained below:

1. Sugar account (say Purchases A/c) receives and “A” gives. Purchase is to be debited and “A” is to be credited.

ADVERTISEMENTS:

2. Payment is received in cash. So cash amount receives and sugar or say sales account gives.

3. Wages are paid in cash. Wages account receives and cash account gives.

4. Chemicals or say Expenses Account receives and cash account gives.

5. Contractor “A” receives and cash account gives.

6. Rent and Electricity Account receives and cash account gives.

The account which receives is debited and which gives is credited in Journal. The entry of the each transaction is given below.

ADVERTISEMENTS:

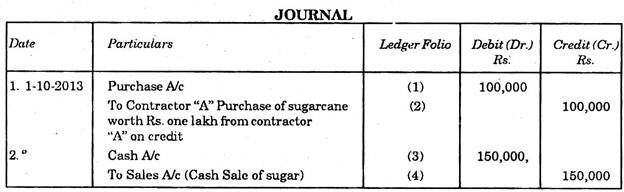

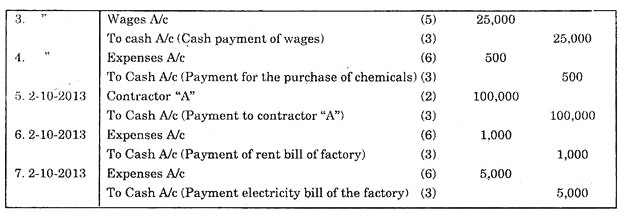

The following are the Journal entries of the above transactions:

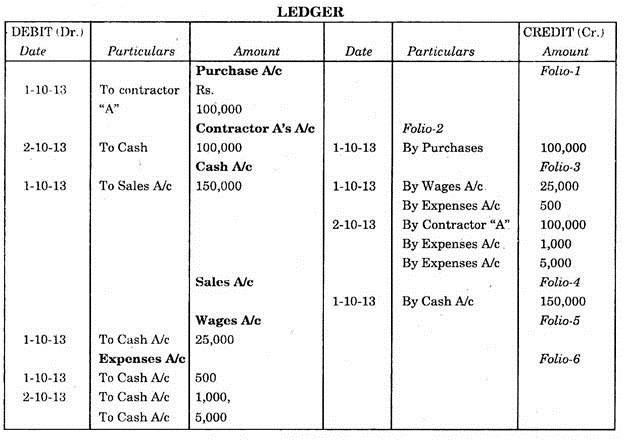

In the Journal so many accounts have given and taken. For each account it is necessary to know as to how much it has received and how much it has paid. This is done by posting each Journal entry in the ledger. For each account a page or portion is allotted in the Ledger. Debit entry in the Journal is posted on the debit side and credit entry on credit side.

The Journal entries made above are posted in the Ledger as below:

For the sake of example we have posted transactions of only two days in the Journal and Ledger Similarly transactions are posted for half year or full year as we fix for closing the accounts.

ADVERTISEMENTS:

In big business, transactions are many and to reduce the work of Journal some subsidiary registers like cash, sales, purchases etc. are maintained. Posting in ledger is made directly from these registers.

(ii) Final Accounts:

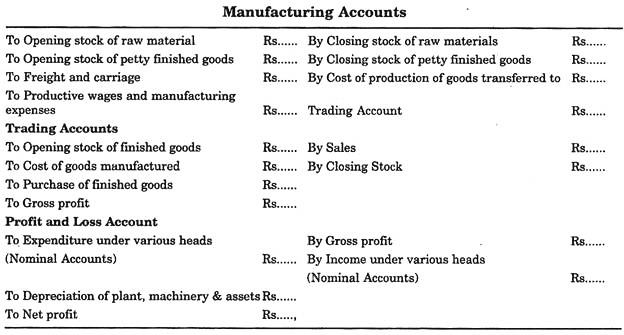

The object of accounts is to exhibit profit or loss during a fixed period. From the Ledger Balance a trial balance is prepared. It is a statement of balances of various accounts for the purpose of testing accuracy. From the balance of various accounts, manufacturing account, trading account, profit and loss account, balance sheet is prepared. This is called preparation of Final Account.

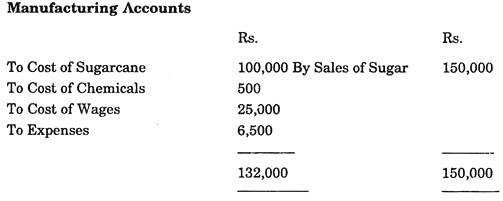

From the Ledger balances given above we can roughly know as below:

Roughly, there is a profit of Rs.18,000 in 2 days. In actual practice we have to prepare manufacturing and profit and loss account for half year or one year and transactions are numerous. Manufacturing account is prepared only when manufacturing process is done, otherwise. Trading Account (purchase and sales in finished form) is maintained.

The entries commonly made are shown below for general understanding:

(iii) Balance Sheet:

The Balance Sheet of a business shows the assets (right and properties) and liabilities (what is belonging to others). A business takes cash from proprietors, which is called capital. Loans are raised for business. Credit purchases are made for business.

Business is responsible to pay to them and, therefore, the balances at the end of the period are liability and are shown on the liability side of the Balance Sheet. Lands, building, plant, machinery, furniture, balance of finished goods, patents, debtors and cash balance are assets and are shown on assets side of the Balance Sheet. The balances are carried over to next half year to year’s accounts and this completes the accounts of a period.

In addition to General Accounts, described above cost account are also maintained. Cost accounts enable us to know the cost of a contract or process or jobs or per unit of manufacture so as to control the sale price.

(iv) Works Accounts:

The term “works” is used in wide sense. Any act of construction, repair, supply or manufacture is called works.

For example, construction or repair of a college building or manufacture or purchase of steel gates for it is works.

Before a work is started four basic rules, given below, are to be followed:

(a) Administrative Approval.

(b) Expenditure Sanction.

(c) Technical Sanction.

(d) Allotment of Funds.

(а) Administrative Approval:

In an engineering department, incharge of work first of all prepare an approximate estimate, preliminary plan and design and get approval of the department, for the work to be executed.

For example, Education Department requires a college building. The engineering department will prepare a rough estimate and plan and get the approval of the Education Department.

(b) Expenditure Sanction:

If the Government agrees to construct college building, they sanction expenditure on the work.

(c) Technical Sanction:

After the above two stages, detailed estimate and plan is prepared by officers of engineering department. The estimate is sanctioned by higher officers after detailed technical checking and is, therefore, called “Technical Sanction.” If during construction, plan is changed, a revised estimate is sanctioned.

(d) Allotment of Fund:

Construction of a work may take many years. For each year some money is allotted in budget. This is called allotment of funds.

Maintenance of Work Accounts:

The following procedure is adopted in maintaining the works account:

Measurement Book:

Work done by the contractor is measured and length x breadth x height or depth is noted in the Measurement Book. The content or area as the case may be, is calculated and noted in it. On the basis of measurement in Measurement Book and on the fulfillment of all the conditions of the contract, payment is made to the contractors and suppliers.

Procedure of Payments:

After noting in the Measurement Book, claims of the contractor are prepared in bill forms and are paid after checking at different levels.

Sometimes advances are given to contractors. The recoveries of advances and materials supplied from Stores are made from contractor’s bill. Contractors for supplies and small works are paid only once after the completion of their work or supply. For works which take many months in completion, the contractor is paid a running bill once a month.

After completion of the work final bill is paid. From running bills about 10% amount is recovered as security deposits so as to make recoveries out of it for defects found in the work. If the work is found satisfactory during a fixed period after completion of the work, the security money is refunded to the contractor.

(v) Accounts in Workshops and Factories:

An estimate of cost is prepared for each job received in factory and acceptance of the indenting officer is taken on it. A job card is opened for each job. A register of all the jobs is maintained. The foreman maintains a labour allocation chart of all the workmen put on various jobs during the day. The cost of labour is filled in the job card. Similarly, value of store issued is also noted on it.

For each machine, working rate per hour is fixed. In the job card working charges of each machine is also filled in. These are direct charges on jobs. General staff like Timekeeper, Foremen, Chowkidar, Storekeeper etc., work for all the jobs. The expense on them is called indirect charges. Similarly, rent, electricity charges are paid for all the jobs.

All such charges are collected and distributed by fixing a percentage rate. When all these charges are noted in the job card a percentage of departmental charges and profit is also added. The total cost of a job is debited to work or is recovered.