Everything you need to know about the sources of working capital. Working Capital is defined as the “excess of current assets over current liabilities and provisions.”

According to Shubin “working capital is the amount of funds necessary for the cost of operating the enterprise. Working capital in a going concern is a revolving fund. It consists of cash receipts from sales which are used to cover the cost of operation”.

Thus, in general working capital is the difference between the book value of the current assets and the current liabilities.

Some of the sources of permanent working capital are:- 1. Shares 2. Debentures 3. Public Deposits 4. Ploughing Back of Profits.

ADVERTISEMENTS:

Some of the sources of temporary working capital are:- 1. Indigenous Bankers 2. Trade Credit 3. Commercial Banks 4. Installment Credit 5. Advances 6. Factoring/Account Receivable Credit 7. Accrued Expenses 8. Deferred Incomes 9. Commercial Paper .

Some of the common sources of working capital are discussed as follows:- Loan from Financial Institutions 2. Retained Earnings 3. Sale of Capital Assets 4. Invoice Discounting 5. Installment Credit 6. Factoring 7. Bank Loans 8. Trade Finance 9. Letter of Credit 10. Bank Overdraft.

Additionally, learn about the advantages and disadvantages of the sources of working capital.

Top 10 Sources of Working Capital

Sources of Working Capital – With Advantages and Disadvantages

The working capital requirement of a concern can be classified as – 1. Permanent working capital requirements 2. Temporary working capital requirements.

Sources of Permanent Working Capital:

ADVERTISEMENTS:

A new firm can raise required finance only through external finance such as issue of equity shares, preference shares, debentures, term loans, public deposits etc. An existing company may have its internal sources like undistributed profits and reserves. But, even they have to raise finance from external sources when the need is not met by their internal sources.

The issue of shares is the most common method of raising long term funds. Every company uses this method of financing.

The capital of a company is divided into units of a fixed value. These units are called shares. In other words, a share is a fractional part of the capital of a company. According to sec 2(6) of the Company’s Act, 1956 “A Share is the share in the capital of the company and includes stock except where a distinction between stock and share is expressed or implied”.

ADVERTISEMENTS:

A person who holds one or more shares is called a shareholder or a member of the company. A shareholder receives dividend from the company as a consideration for investing his money into the company. However, the payment of dividend is not compulsory. The power to recommend dividend rests in the board of directors of the company.

Preference shares are those shares who have got preferential rights over other type’s shares regarding payment of dividend and repayment of capital in the event of liquidation or winding up. Preference shareholders are entitled for a fixed rate of dividend on preference share capital.

Preference shareholders do not have voting rights as they have no say in the management of the company. However, they can vote if their own interests are affected. Those investors who want their money to fetch a constant rate of return in case of low earning will prefer to invest in preference shares.

ADVERTISEMENTS:

Advantages of Preference Shares:

Preference shares provide a number of advantages which are discussed below:

a) Advantages to the company:

1. A company does not have any legal obligation to pay dividend on preference shares, i.e., preference dividend is payable only if there are divisible profit.

ADVERTISEMENTS:

2. Preference share is a permanent source of capital for the company.

3. Preference share can be issued without creating any charge over the assets of the company.

4. Redeemable preference shares have the added advantage of repayment of capital whenever there are surplus funds with the company.

5. There is no dilution of control because preference shares do not carry any voting rights.

ADVERTISEMENTS:

b) Advantages to the Shareholders:

1. It is a superior security over equity shares.

2. It earns a fixed rate of dividend.

3. It provides preferential right in regard to payment of dividend.

ADVERTISEMENTS:

4. It also provides preferential right in regard to repayment of capital in the event of liquidation of the company.

Disadvantages of Preference Shares:

Although a preference share offers a number of advantages, they suffer from the following limitations.

a) Disadvantages to the company:

1. Preference dividend is not a deductible expense while calculating the taxable profits of the company.

2. A cumulative preference share becomes a permanent burden so far as the payment of dividend is concerned.

ADVERTISEMENTS:

3. It is an expensive source of finance as compared to debentures.

b) Disadvantages to the Shareholders:

1. The rate of dividend on preference shares is lower as compared to the equity shares.

2. Preference share do not have any charge on the assets of the company.

3. Preference share do not have any voting rights.

4. The market prices of preference shares fluctuate much as compared to that of debentures.

ADVERTISEMENTS:

According to the Companies Act 1956, equity shares are those which are not preference shares. They do not carry any preferential rights either in respect of dividend or in respect of repayment of capital at the time of liquidation of the company. Equity shares are also known as ordinary shares or common shares, and they represent the owner’s capital in a company.

The holders of these shares are the real owners of the company. They have control over the working of the company. They are paid dividend after paying it to the preference shareholders. The rate of dividend on these shares depends upon the profits of the company. They may be paid a higher rate of dividend in case of huge profits and allow rate of dividend in case of less profits.

Equity shares are the main sources of finance and it is contributed by owners of the company. In the case of new companies, the promoters must contribute to equity shares first and then the balance of shares is issued to the public. When an existing company issues new equity shares to the existing shareholders, it is called as rights issue. When a company distributes the profits to the shareholders in the form of equity shares they are called as bonus shares.

There are several advantages of financing through equity shares:

ADVERTISEMENTS:

1. Financing through equity shares does not impose any obligation to pay a fixed rate of dividend. No fixed dividends are payable to equity shareholders. These depend on the profits made by the company.

2. The company can easily raise, establish and strengthen its financial base with the help of equity shares.

3. Equity shares are of small face value, everybody can become members of the company.

4. Equity shareholders are the real owners and they have voting rights. Equity shares holders can vote in the matters requiring their consent. Equity shareholders can vote and elect the directors who manage the company.

5. An equity share is a permanent source of capital. Equity shares can assist capital formation.

6. Equity shares increase the credit worthiness of the company as they are sold as wider as possible in the society.

ADVERTISEMENTS:

7. Equity shares do not carry any charge over the assets of the company. It is easy to raise possible permanent funds since there is no obligation to return or creation of any charge against the assets of the company.

8. Equity shares holders are the real gainers by way of increasing dividend and capital appreciation in case of profits.

9. Financing through equity shares also provide flexibility in utilization of profits of the company.

10. Existing equity shareholders have the right to be offered to the new equity shares of their existing company.

Disadvantages of equity shares:

ADVERTISEMENTS:

1. If the company issues only equity shares, it cannot enjoy the benefits of trading on equity. When the equity share capital is very high, the policy of trading on equity may decline.

2. Excess of equity shares may cause over capitalization. Equity shares‘cannot be redeemed even if there is a danger of over capitalization.

3. The cost of issue of equity share is higher than that of preference shares or debentures.

4. Investors who have a desire for a fixed income have no attraction for equity shares.

5. Excessive reliance on financing through equity shares can put obstacles in management by manipulation and organizing equity share holders themselves. Sometimes a group of equity shareholders may try to control the whole management.

6. The element of risk is very high in case of equity shareholders.

7. The equity share capital is generally considered as less liquid.

8. Uncertainty of return may keep out the conservative investors.

9. Shareholders may feel that they get less profit.

2. Debentures:

A debenture is a document issued by a company as an evidence of a debt due from the company with or without a charge on the assets of the company. It is an instrument issued by a company under its common seal acknowledging a debt due by it to its holders.

According to section 2(12) of the Companies Act, 1956, “Debenture includes debenture stock, bonds and any other securities of a company whether constituting a charge on the assets of the company or not”.

The persons to whom the debentures are issued are called Debenture holders. Debenture holders are not the owners of the company. They are just the loan creditors of the company.

The following are the advantages of raising capital through issue of debentures.

a) Advantages to the Company:

1. Debentures provide funds to the company for a long period of time.

2. The debentures enable the company to take advantage of trading on equity.

3. The rate of interest payable on debentures is lower than the rate of dividend payable on shares.

4. Financing through debentures does not result into dilution of control because debenture holders do not have voting rights.

5. The interest on debentures is a tax deductible expense. Hence the company can reduce its tax burden.

6. Debentures provide flexibility in capital structure of a company i.e. debentures can be redeemed by the company whenever it has surplus funds.

b) Advantages of Debenture Holders:

1. Debentures provide a fixed and stable return to its investors.

2. Debentures are comparatively a safe investment because debenture holders have floating charge on all the assets of the company.

3. A debenture is usually more liquid investment because the investor can sell his investment at any time or mortgage it to obtain loans from financial institutions.

In spite of many advantages debenture financing suffers from the following limitation.

a) Disadvantages to the Company:

1. Payment of fixed interest and repayment of principal amount on maturity is a permanent burden on the company.

2. Cost of raising finance through debenture is also high because of heavy stamp duty.

3. Debentures are not suitable for companies, whose earnings are not stable.

b) Disadvantages to the Debenture Holders:

1. Debentures do not carry any voting rights. Hence debenture holders do not have any say in the management of the company.

2. The interest on debentures is fully taxable.

3. Debenture holders are merely creditors and not the owners of the company.

Many companies accept deposits from the general public. This mode of raising funds is becoming more popular these days on account of bank credit becoming costlier.

Advantages of raising funds through public deposits:

1. It is less costly method for raising short term as well as medium term funds required by the business.

2. The procedure for raising funds through public deposits is more simple and convenient.

3. There is no need for creation of any charge on the assets of the company for raising funds through public deposits.

4. The company can take advantage of trading on equity as the maturity period of deposits and the rates of interest are fixed.

Disadvantages of raising funds through public deposits:

1. The quantum of funds that can be raised through public deposits is limited.

2. Raising funds through public deposits is not reliable and definite source of finance.

3. The maturity period of public deposits is also short.

4. A heavy reliance on public deposits for medium term financing by companies may adversely affect the shares and debentures to general public.

The Major Internal Source of Finance:

A new firm can raise required finance only through external finance such as issue of equity shares, preference shares, debentures, term loans, public deposits etc. However an established concern can generate required finance for its future growth and expansion programme through its internal sources such as retained earnings or Ploughing back of profits.

The Ploughing back of profits is a financial management technique under which an organization can retain certain amount of profits for reinvestment in the company. The process of retaining certain amount of profit every year and utilizing the same in the business is known as Ploughing back of profits or retained earnings.

It is an economical source of financing because an organization need not incur any expenditure to raise this source of financing. From all the practices of financial management, this system of Ploughing back of profits is desirable as it helps in the financial and economic stability of the concern.

Need For Ploughing Back of Profits:

The need for Ploughing back of profits or retained earnings arises due to the following reasons:

1. For expansion of business.

2. For replacement of an old asset.

3. For contributing towards fixed and working capital needs of the company.

4. For redemption of debts or debentures.

5. For development of existing business.

Advantages of Ploughing Back of Profits:

The tool of Ploughing back of profits provides a number of advantages to the company, shareholders and the society at large. The main advantages of Ploughing back of profits are discussed below.

1. It acts as a very economical method of financing because the company need not incur any expenditure in order to avail this source of finance.

2. It allows the financial structure to remain flexible because the company does not depend upon outsiders for raising funds required for expansion.

3. It helps the company in smooth and undisturbed running of the business.

4. It makes the company self-dependent i.e., not to depend upon outsiders such as, banks, financial institutions, debentures, public deposits etc.

5. It enables a company to follow, stable dividend policy.

6. It enables the company to redeem certain long term debts or debentures in order to reduce the fixed burden of payment of interest every year.

7. It also enables the company to replace certain old assets which have become obsolete.

b) Advantages to Shareholders:

1. With the re-investment of profits in the business, the earning capacity of a concern is enhanced and the shareholders of the company are benefited.

2. It enables the shareholders to retain their control, because the company need not issue new shares for the future capital requirements.

3. Ploughing back of profits provide an assurance of a minimum rate of earning to the shareholders.

4. It helps in increasing the value of shares because Ploughing back of profits enables a company to adopt a stable dividend policy. Payment of stable dividends earns a good name for the company and the value of shares goes up in the market.

5. Ploughing back of profits provides an opportunity for evasion of super tax in a company, where the number of shareholders is small.

6. Ploughing back of profits adds to the stability of business enterprises which is essential for smooth running of the business enterprise.

c) Advantages to the Society:

1. Retained earnings acts as a very economical method of financing for expansion and modernization of business enterprises. It increases the industrial production of the nation.

2. Ploughing back of profits increases the rate of capital formation which indirectly promotes the economic development of the country.

3. It helps to decrease the rate of industrial failures in the country.

4. Ploughing back of profits facilitates increased productivity and cheaper production of goods and services.

5. Ploughing back of profits facilitates greater, better and cheaper production of goods and services.

Disadvantages of Ploughing Back of Profits:

Although Ploughing back of profits offers many advantages, it suffers from the following limitations:

1. Ploughing back of profits may lead to over capitalization.

2. Excessive retention of retained earnings may create dissatisfaction among the shareholders.

3. Directors having vested interest may speculate in the shares by manipulating dividends. By paying lower dividends in the name of Ploughing back of profits, Directors can purchase shares at reduced prices.

4. Management may not utilize the retained earnings to the advantage of shareholders at large as they have the tendency to misuse them by investing in unprofitable opportunities.

Excessive retention of profits may frustrate the shareholders as they are deprived of the freedom to invest their earnings in better opportunities.

Sources of Temporary Working Capital:

The main sources of temporary working capital are:

1. Indigenous Bankers:

Private moneylender and other country bankers used to be the main sources of finance prior to the establishment of commercial bank. Now a day with the development of commercial banks they have lost their monopoly. But even today some business houses have to depend upon indigenous bankers for obtaining loans to meet their working capital requirements.

2. Trade Credit:

Trade credit refers to the credit extended by the supplier of goods in the normal course of business. The trade credit arrangement of a firm with its suppliers is an important source of short-term finance. The credit worthiness of a firm and the confidence of its supplier are the main basis of securing trade credit. Every firm must utilize this source to the fullest extent, because this source is cost free. i.e., borrower need not pay any interest.

3. Commercial Banks:

Commercial banks are the most important source of short- term capital. The different forms in which the banks normally provide loans and advances are as follows-

a. Loans:

When a bank makes an advance in lump sum against some security, it is called a loan. In case of a loan a specified amount is sanctioned by the bank to the customer. The entire loan amount is paid to the borrower either in cash or by credit to his account. The borrower is required to pay interest on the entire amount of loan from the date of sanction.

b. Cash Credit:

Cash credit is an arrangement by which a bank allows his customer to borrow money up to a certain limit against some tangible securities. A customer can withdraw from his cash credit limit according to his need and interest is calculated on the daily balance and not on the entire amount.

c. Over Draft:

Over draft is an arrangement by which a current account holder is allowed to withdraw more than the balance to his credit up to a certain limit. The interest is charged on daily over drawn balances.

d. Discounting of Bill of Exchange:

Purchasing and discounting of bills of exchange is the most important form in which the banks lend money without any collateral security.

4. Installment Credit:

This is another method by which the possession of goods is taken immediately. The payment is made in installment over a predetermined period of time. Generally interest is charged on the unpaid price but in any case, it provides fund for some time and is used as a source of short-term working capital by many business houses.

5. Advances:

Some business houses get advances from the customers and middlemen against order and this source is a short-term source of finance. It is a cheap source of finance and in order to minimize their investment in working capital the manufacturing industries prefer to take advances from their customers.

6. Factoring/Account Receivable Credit:

Another method of raising short-term finance is through account receivable or credit offered by commercial banks and factors. A commercial bank may provide finance through discounting the bills or invoices of its customers. Thus, a firm gets immediate payment for sales made on credit through factoring.

Factoring is an arrangement by which the factor purchases, on a continuous basis, all the debts of the suppliers of goods and services to customers. It is a contract between the supplier and factor with regard to the realization of supplier’s credit sales. The factor may assume risk of non-payment by the customer also. He charges a predetermined commission for his services.

The factoring mechanism works like as follows:

1. Seller enters into an agreement with the factor.

2. Factor makes an enquiry about sellers business.

3. Buyer negotiates terms of purchase with the seller.

4. Seller sells the goods to the buyer.

5. Buyer receives the goods with invoice and instructions from the seller to make payment to the factor.

6. On receipt of copies of safe documents, the factor makes a certain percentage, say 80% of payment of the price.

7. The factor receives the payment from the buyer on due date.

8. Factor remits the balance amount to the seller after deducting his commission.

The factor minimizes the credit risk of the seller by assuming the responsibility of realizing the receivables without recourse. The seller is relived from the pressure of chasing behind the customers for payment. Thus, he can concentrate all his efforts on his business. Cash flow is assured because the seller gets the payment from the factor without any delay. It improves the liquidity position of the seller. Factoring services minimizes the dependence on bank loans which are difficult to get in countries like India. A factor is highly skilled in all finance matters.

They handle sales ledgers and other related tasks more professionally. They reduce the debt burden of the sellers. Factoring helps to eliminate certain expenses and improves the profitability of the firm. It improves the financial position of the seller. It brings financial discipline among the customers through regular realization of dues. Efficient administration of sales ledgers, liquidity position, and reduction of credit risk enhances the seller’s status and minimizes the bad debt reserves.

7. Accrued Expenses:

Accrued expenses, which have been incurred but not yet paid. These simply represent a liability that a firm has to pay services already received by it. Thus, all accrued expenses can be used as a source of short-term finance.

8. Deferred Incomes:

Deferred incomes are incomes received in advance before supplying services. They represent funds received by a firm for which it has to supply goods or services in future. These funds increase the liquidity of a firm and constitute an important source of short-term finance.

9. Commercial Paper:

Commercial paper represents unsecured promissory notes issued by firms to raise short-term funds. It is an important money market instrument in advanced countries like U.S.A. Commercial paper is a cheapest source of raising short-term finance as compared to the bank credit. Commercial paper is usually bought by investors including Banks, Insurance Companies, Unit Trust of India and firms to invest surplus funds for a short period.

Features of Commercial papers:

1. Commercial papers are unsecured. They are backed by the credit worthiness of the issuing company.

2. They are negotiable by endorsement and delivery.

3. They are safe and liquid assets.

4. Purchase and sale of commercial papers is a simple procedure.

5. They are issued to finance current transactions and seasonal financial needs of trade and industry.

6. They are also issued as a means of interim financing.

Commercial Paper Market in India:

In March 1989, the Reserve Bank of India announced the decision to introduce commercial papers in India. The Reserve Bank of India issued guidelines on 1st Jan 1990 and they were revised from time to time to meet the changing requirements. Commercial papers were introduced to facilitate highly rated corporate borrowers to obtain short term credit in different ways.

Any private sector or public sector company can issue commercial papers. They are issued at a discount to their face value and the discount rate is determined by the issuing company. The issuing company is expected to pay the stamp duty. Commercial papers enjoy secondary market in India.

Working capital is utilized to manage routine operations such as purchase of inventory such as raw materials, semi-finished products, paying employees, sundry debtors, and also funds needed for other short term expenditures. Further working capital is also needed to pay for planned and unexpected expenses, meet the short-term obligations of the business, and to build the business. No business can run successfully without proper working capital management. Working capital may be procured from different sources.

Some of these common sources of working capital are discussed as follows:

Source # 1. Issue of Shares:

A share is a financial instrument that represents a portion of the ownership of the business for a financial investment in the business. Issue of shares is the most important source of raising long term funds. Most companies collect fixed capital by issuing shares. Generally, there are two types of shares, these includes equity and preference shares.

Source # 2. Issue of Debentures:

A Debenture represents the borrowed capital of the company. Fixed capital is also collected from issue of debentures, a debenture is defined as a certificate of acceptance of loans which is given under the company’s stamp and carries an undertaking that the debenture holder will get a fixed return (fixed on the basis of interest rates) and the principal amount whenever the debenture matures.

Source # 3. Loan from Financial Institutions:

A loan paid back over an agreed period (term) where principal and interest are paid off in monthly repayments. This interest may be fixed or variable. Banks and other commercial lenders are popular sources of loans. Commercial finance companies may be considered when the business is unable to secure financing from other commercial sources.

Source # 4. Retained Earnings:

Retained earnings are a part of undistributed profits earned by the company. Since, the company does not distribute all of its profits to the shareholders. This saved profit is called retained earnings. It is very economical because no interest payment is to be made. Retained earnings are the cheapest source of fixed capital.

Source # 5. Sale of Capital Assets:

Another way of raising funds is the sale of a firm’s assets that are no longer needed, selling land, buildings, or machinery can cater to long term and bigger finance needs. A major drawback in this type of financing is the benefits of useful assets which are sold can no more accrue to the business.

Source # 6. Invoice Discounting:

Invoice or bill discounting is a process in which goods and services sold to customer on the basis of credit is en cashed through a bank before the maturity date of the bill at a value less than the par value of the bill. While discounting a bill, the Bank buys the bill before it is due and credits the value of the bill after a discount charge to the business concern’s account.

The bank then collects full value on the draft or bill of exchange when payment comes due. The amount of the discount in the form of interest depends on the amount of time left before the bill matures, and on the perceived risk attached to the bill.

Source # 7. Installment Credit:

Installment credit is a form of finance to pay for goods or services over a period through the payment of principal and interest in regular payments. The loan is made on the basis of the borrower’s integrity and ability to pay.

Source # 8. Factoring:

It is an arrangement in which a business sells of accounts receivable on a contract basis to an agency known as a factor in order to obtain cash payment before the accounts come due. The factor also undertakes exclusive responsibility for credit analysis of new accounts, payments collection, and credit losses. A factoring agreement normally states the exact conditions and procedures for the purchase of an account.

The factor, like a lender against a pledge of accounts receivable, chooses accounts for purchase, selecting only those that appear to be acceptable credit risks. Where factoring is to be on a continuing basis, the factor will actually make the firm’s credit decisions because this will guarantee the acceptability of accounts. Factoring is normally done on a notification basis, and the factor receives payment of the account directly from the customer.

Source # 9. Bank Loans:

In order to meet temporary working capital requirement another channel is borrowing Short-term loans from banks. These loans are to be repaid within a shorter duration from the time they are borrowed. Usually bank loan involves high rate of interest.

Source # 10. Trade Finance:

Trade credit is an important external source of working capital for a company, in trade finance or credit an arrangement between two firms in made in which one firm grants credit to another firm for the purchase of goods or services without making immediate full payment.

It is credit obtained through open-account purchases represented by an accounts payable by the buyer and an accounts receivable by the seller. For example, a credit of 2/10 net 30 indicates 2% cash discount if paid within 10 days, otherwise due in 30 days, this translates into a 37% annual interest rate if the cash discount is foregone.

Source # 11. Commercial Papers:

Commercial paper is a short-term financial instruments issued in the form of an unsecured promissory by large corporations with high credibility to get funds on order to meet short term debt obligations. Commercial Paper was introduced in India in 1990 with an objective to enable highly reputed and creditworthy corporate borrowers to raise short term funds. Commercial paper generally matures in a short period of time and usually does not exist for more than 270 days.

Source # 12. Letter of Credit:

A letter of credit is a promise to pay document that a financial institution issues to a seller of goods or services which says that the issuer will pay the seller for goods/services after performing specific actions that the buyer and seller agree to. The issuer then seeks reimbursement from the buyer or from the buyer’s bank. In the event that the buyer is unable to make payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

Thus the document is essentially a guarantee to the seller that it will be paid by the issuer of the letter of credit regardless of whether the buyer ultimately fails to pay.

Source # 13. Bank Overdraft:

A bank overdraft is an arrangement between business and concern and bank in which bank allows a business concern to withdraw from account when the available balance goes below zero. In other words a bank overdraft is when business concern is able to spend more than what is actually in their bank account.

Thus a bank overdraft is also a type of loan as the money is technically borrowed, usually interest charge for this facility is high and the bank can change limit at any time or ask for money to be paid back sooner than expected.

Sources of Working Capital – Short-Term and Long-Term Sources from which Funds can be Raised

An essential ingredient of working capital management is determining the financing mix, or in other words, how current assets will be financed. The source of finance is selected on the basis of the type of working capital to be financed, that is, whether it is permanent working capital or temporary working capital.

Broadly speaking, there are two sources from which funds can be raised for current asset financing:

1. Short-term sources such as current liabilities and

2. Long-term sources such as share capital, long-term borrowings, retained earnings, etc.

These are briefly discussed in the following paragraphs:

1. Short-Term Financing:

Short-term sources can be further divided into internal and external sources of working capital finance. Short-term internal sources include tax provisions, dividend provisions, etc. Short-term external sources include short-term working capital financing from banks such as bank overdrafts, cash credits, trade deposits, bills discounting, short-term loans, inter corporate loans, commercial paper, etc.

Tax and dividend provisions are current liabilities and cannot be delayed. The funds that are included in these provisions act as working capital till the point these are not paid. Short-term working capital finance availed from banks and financial institutions is costly compared to long-term sources in terms of rate of interest but have a great time flexibility.

Due to time flexibility, the finance manager can use the funds and pay interest on the money which his business utilizes and can pay them any time when cash is available. Overall, in comparison to long-term sources where you have to hold funds even when not required, these’ facilities prove cheaper.

Some of the short-term external sources are discussed below:

(a) Inter Corporate Loans:

These are unsecured short-term funds raised by one firm from another firm. They are dependent on personal contacts. They are for a very short period of time, that is, 3 months or 6 months and are not regulated by any law. They involve high risk, but are useful in solving temporary capital crisis.

(b) Commercial Paper:

It is an unsecured promissory note issued by large banks and corporation that enjoy sound credit ratings. These are issued at a discount and are backed by a corporation’s promise to pay face value on the maturity date of the commercial note. The rate of discount is decided by the issuer and is not regulated. They were introduced in India in 1990 and can be issued for maturities between a minimum of 7 days and a maximum of up to one year from the date of issue. They can be sold either directly or through a dealer. They can be issued in denominations of Rs.5 lakh or its multiples.

(c) Trade Credit:

It is a primary source of financing working capital in India. It is an arrangement in which a firm buys goods or services without making immediate cash payment. If a firm buys raw materials from the suppliers on credit basis, it gets the raw material for utilization immediately with the facility to make the delayed payment. By accepting the delay in payment, the suppliers of raw material finance the requirement of working capital. It is an essential element of capitalization in an operating business because it can reduce the capital investment required to operate the business if it is managed properly.

As this arises in the normal course of business, it is also called spontaneous or transactional source of funds. The biggest benefit of spontaneous sources as working capital is its effortless raising and the insignificant cost compared to traditional ways of financing. The cost factor and the quantum depend on the terms of such credit, viz., maximum credit limit, period of credit, and discount on cash payment.

Each supplier will have a maximum credit limit defined for the buyer, depending on the business capacity and creditworthiness of the buyer. Similarly, the credit period is defined say 30 days, 45 days, etc. Discount on cash payment is allowed to the buyer if the payment is made immediately on buying the materials. This discount is an opportunity cost of the payment made by the buyer.

(d) Bank Overdraft:

An overdraft is an agreement by a bank to allow a firm to borrow up to a certain limit. The firm will borrow as much or as little as it needs up to the overdraft limit and the bank charges daily interest at a variable rate on the debt outstanding. The bank may also require security (or collateral) as a protection against the risk of non-payment by the firm. An overdraft is a flexible source of finance as a firm uses it only when the need arises. However, an overdraft is technically repayable on demand, even though a bank is likely to give a prior notice of its intention to withdraw agreed overdraft facilities.

(e) Loan:

It is a fixed amount of debt finance borrowed by a firm from a bank, with repayment to be made in the near future, for example, after one year. The firm pays interest on the loan at either a fixed or a floating (that is, variable) rate at regular intervals, for instance, quarterly.

A short-term bank loan is less flexible than an overdraft, since the full amount of the loan must be borrowed over the loan period and the firm takes on the commitment to pay interest on this amount, whereas with in overdraft, interest is paid only on the amount borrowed and not on the agreed overdraft limit. The two are similar with respect to the security that the banks may require for extending the overdraft or short-term loan facility.

(f) Letter of Credit:

It is a document that a financial institution issues to a seller of goods or services which says that the issuer will pay the seller for goods/services the seller delivers to a third-party buyer. The issuer then seeks reimbursement from the buyer or from the buyer’s bank. The document is essentially a guarantee to the seller that it will be paid by the issuer of the Letter of Credit, upon the failure of the buyer to pay. In this way, the risk that the buyer fails to pay is transferred from the seller to the issuer of a Letter of Credit.

(g) Purchasing and Discounting of Bills:

Purchasing and discounting of bills is an important form of bank lending without any collateral security. The seller draws a bill of exchange on the buyer of goods on credit. Such a bill may be either a clean bill or a documentary bill, which is accompanied by documents of title to goods such as a railway receipt.

The bank purchases the bills payable on demand and credits the customer’s account with the amount of bill less discount. At the maturity of the bills, bank presents the bill to its acceptor for payment. In case the bill discounted is dishonored by non-payment, the bank recovers the full amount of the bill from the customer along with expenses in that connection.

Apart from these, advance payments, accrued expenses (the expenses, which have been incurred but not yet due and hence not yet paid) and deferred income (Incomes received in advance before supplying goods) are also sources of short-term finance.

2. Long-Term Financing:

In contrast to short-term borrowings, long-term debt is used to finance business investments that have longer payback periods. For example, the purchases of machinery, which may help the firm, produce goods over a 5-year period. The long-term financing may be from external or internal sources. Retained earnings and depreciation provisions are internal sources of finance. The external sources of finance are shares, debentures, term loans and public deposits.

These are briefly discussed below:

(a) Shares:

Issue of shares is the most important source for raising the permanent or long-term capital. A firm may issue equity shares or preference shares. Preference shares carry preferential rights in respect of dividend at a fixed rate and with regard to the repayment of capital at the time of winding up the firm. Equity shares do not have any fixed commitment charge and the dividend on these shares is to be paid subject to the availability of sufficient profits. As far as possible, a firm should raise the maximum amount of permanent working capital by the issue of shares.

(b) Debentures:

A debenture is an instrument issued by the firm acknowledging its debt to its holder. It is also an important method of raising long-term or permanent working capital. The debenture-holders are the creditors of the firm. A fixed rate of interest is paid on debentures. The interest on debentures is a tax deductible charge against profit and loss account.

(c) Term Loan:

It is a loan with a repayment period of more than one year. It is usually taken by firms with longer investment or payback horizons, such as the building of a new factory or purchase of new production equipment. A bank term loan is usually repaid via periodic installments. A loan may be secured by collateral of some specified real estate property (mortgage).

(d) Public Deposits:

These are the fixed deposits accepted by a business enterprise directly from the public. This source of raising short-term and medium-term finance was very popular in the absence of banking facilities. In the past, public deposits were accepted by textile industries in Ahmadabad and Mumbai for periods of 6 months to 1 year.

But now-a-days even long-term deposits for 5 to 7 years are accepted by the business houses. Public deposits as a source of finance are a very simple and convenient source of finance. They have taxation benefits, allow trading on equity, do not require securities and an inexpensive source of finance. But it has certain limitations such as it is uncertain, unreliable and not very flexible.

(e) Retained Earnings:

This involves ploughing back of profits, which means reinvesting surplus earnings in its business. It is an internal source of finance and is most suitable for an established firm for its expansion, modernization and replacement etc. This is the cheapest source of finance. There is no need to keep securities and there is no dilution of control.

It ensures stable dividend policy and gain confidence of the public. But excessive ploughing back of profits may lead to monopolies, misuse of funds, over capitalization and speculation, etc. Short-term sources of finance are usually cheaper and more flexible than long-term ones, for example, an overdraft is more flexible than a long-term loan on which a firm is committed to pay fixed amounts of interest every year.

However, short-term sources of finance are riskier than long-term sources from the borrower’s point of view in that they may not be renewed (an overdraft is, after all, repayable on demand) or may be renewed on less favourable terms (for instance, when short-term interest rates have increased).

Another source of risk for the short-term borrower is that interest rates are more volatile in the short-term than in the long term and this risk is compounded if floating rates of short-term debt (like in case of an overdraft) is used. A firm must balance profitability and risk in reaching a decision on how the funding of current and non-current assets is divided between long-term and short-term sources of funds.

The finance manager has to mix funds from these two sources optimally to ensure profitability and liquidity for an enterprise. The mixing of finances from long-term and short term should not result in either idle or shortage of cash funds.

Determining the Financing Mix:

There are two fundamental decision issues underlying sound working capital management – (i) the optimal level of investment in current assets and (ii) the appropriate mix of short-term and long-term financing used to support this investment in current assets.

In turn, these decisions are influenced by the trade-off that must be made between profitability and risk.

The approaches for determining the appropriate working capital financial mix are:

(a) Moderate Approach

(b) Conservative Approach

(c) Aggressive Approach.

(a) Moderate Approach:

The moderate approach for determining an appropriate financing mix uses hedging or matching of two offsetting transactions that are simultaneous but opposite in nature. The loss arising out of one transaction is likely to offset the gain in the other due to the financing mix.

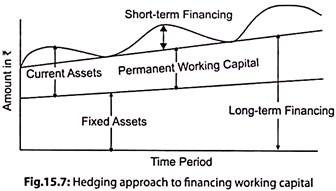

The term hedging refers to ‘a process of matching maturities of debt with the maturities of financial needs’. According to this approach, the maturity of sources of funds should match the nature of the assets to be financed. This approach is, therefore, also known as matching approach. However, exact matching is not always possible because of the uncertainty about the expected lives of the assets.

The requirements of total working capital are classified into two categories:

(i) Permanent or fixed working capital, which is the minimum amount required to carry out the normal business operations. It does not vary over time.

(ii) Temporary or seasonal working capital, which is required to meet special exigencies. It fluctuates over time.

The hedging approach suggests that the permanent working capital requirements should be financed with funds from long-term sources while the temporary or seasonal working capital requirements should be financed with short-term funds. For instance, if the permanent or fixed investment per month is Rs.45,000, any investment over and above this, is a seasonal requirement (it could range between Rs.0 and Rs.5,000) and is a temporary investment.

The permanent portion of current assets required (that is Rs.45,000) should be financed from long-term sources and temporary or seasonal requirements in different months (could be Rs.1,000, Rs.1,500, Rs.5,000 and so on) should be financed from short-term sources.

This is depicted in Fig. 15.7:

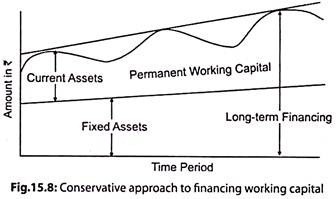

(b) Conservative Approach:

This approach suggests that the estimated investments in current assets should be fully or majorly be financed from long-term sources. The short-term sources should be used only for contingencies. According to this approach, the entire estimated requirement—whether it is Rs.45,000 or Rs.50,000 in a month may be completely financed from long-term sources.

The short-term funds will be used only to meet emergencies or for a very small portion of temporary working capital. Since the long-term financing is used for fixed as well as peak level requirements, when the working capital requirement is less than its peak level, the firm invests the spare cash resources in marketable securities.

This helps the firm to earn some income while maintaining liquidity position. Fig. 15.8 given below represents a firm that finances both—permanent and temporary working capital needs through long-term sources.

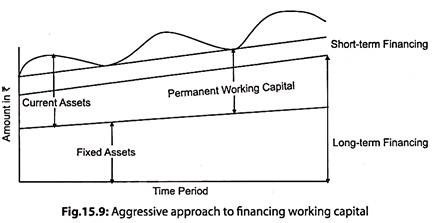

(c) Aggressive Approach:

The aggressive approach aims at earning greater returns by minimizing the cost of financing the asset requirements. It suggests the maximum use of short-term of sources. Therefore, temporary working capital and a part of permanent working capital may be financed by short term sources.

In extreme cases, the entire estimated requirements of currents, asset whether permanent or temporary and even a part of fixed assets may be financed from short-term sources. This approach makes the finance-mix more risky, less costly and more profitable.

This is depicted in Fig. 15.9:

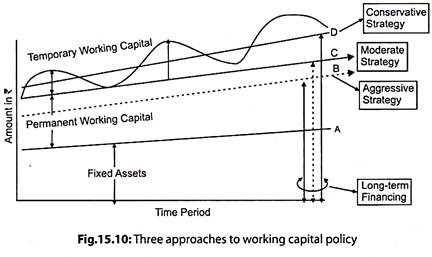

These three working capital approaches are best explained with the help of Fig. 15.10 – The line A represents the fixed assets, the distance between line A and line C represents the permanent working capital and the seasonal or temporary working capital is represented by the curve.

The extent of utilization of long-term financing for the three strategies is summarized below:

Conservative working capital strategy represented by line D uses long-term sources of finance for fixed assets, permanent working capital and a part of temporary capital. The balance of temporary capital is financed by short-term sources.

Moderate working capital strategy represented by line C uses long-term sources of finance for fixed assets and permanent working capital. The entire temporary capital is financed by short-term sources.

Aggressive working capital strategy represented by line B uses long-term sources of finance for fixed assets and a part of permanent working capital only. The entire temporary capital and a part of permanent working capital is financed by short-term sources.

The comparison of the three approaches is given below:

Comparative Analysis of Moderate, Conservative and Aggressive Working Capital Approach:

Moderate Working Capital:

(i) Cost of Financing – Since the length of finance matches the life duration of the asset, the cost of financing is lower.

(ii) Liquidity – Liquidity is neither high nor low. It attempts to strike a balance between liquidity and cost of idle funds.

(iii) Profitability – Because of exact matching, profitability is greater than conservative and lesser than aggressive.

(iv) Risk – Net working capital is nil, so risk is high as the firm is vulnerable to sudden shocks.

(v) Temporary and Permanent Working Capital – Temporary working capital is financed by short-term sources and permanent working capital is financed from long-term sources.

(vi) Frequency of Arranging Funds – High

Conservative Working Capital:

(i) Cost of Financing – All or most working capital needs are financed by long-term sources so cost of financing is higher.

(ii) Liquidity – Liquidity is high, because of heavy usage of long-term funds. It can take advantage of sudden opportunities.

(iii) Profitability – Low because of too much idle and costly funds.

(iv) Risk – The net working capital is very high, so the risk is low as the firm is able to absorb shocks.

(v) Temporary and Permanent Working Capital – Both financed from long-term sources either fully or majorly.

(vi) Frequency of Arranging Funds – Low

Aggressive Working Capital:

(i) Cost of Financing – All or most working capital needs are financed by short-term sources so cost of financing is the least.

(ii) Liquidity – Liquidity is low due to greater dependability on short-term funds even for a part of long-term assets.

(iii) Profitability – High as the interest cost is minimized.

(iv) Risk – The risk is the highest due to high dependence on short-term finance.

(v) Temporary and Permanent Working Capital – Both financed from short-term sources either fully or majorly.

(vi) Frequency of Arranging Funds – Highest

Thus, conservative strategy is associated with lower profitability and lower risk. On the contrary, aggressive strategy is associated with higher profitability and higher risk. The moderate strategy is somewhere between the two. Executing the moderate strategy in its true sense is not practically possible. The management’s attitude towards risk would decide the policy they adopt to determine the financing mix. It should be noted that the working capital policies of a firm can be characterized as aggressive, moderate or conservative only by comparing them with the working capital policies of similar firms.

There are no absolute benchmarks of what may be regarded as aggressive or otherwise, but these characterizations are useful for analyzing the ways in which individual firms approach the operational problem of working capital management.

There is a conflict between short-term and long-term financing. Short-term financing is less expensive and more flexible as it is easy to repay short-term funds when they are not required. Even when short-term rates are higher, the situation is likely to be only temporary. Over an extended period of time, a higher interest cost is associated with long-term debt than with short-term borrowings, which are continually rolled over (refinanced) at maturity.

For instance, a long-term loan that is available at 15% for 5 years may have a higher total cost as compared to a working capital loan at 18%.This is because, unlike long-term loan, the rate of interest of 18% will be payable only for the period for which the loan facility is availed of. Moreover, the use of short-term debt as opposed to longer-term debt is likely to result in higher profits because the debt is paid off during periods when it is not needed. However, there is a risk of borrowing again and again.

Also, the short-term funds may not always be readily available. As a result, the firm runs into the risk of borrowing at unfavourable terms. In some cases, the firm may need to disrupt operations if it is unable to raise the required funds thus leading to its failure. On the other hand, the risk of failure is much less if long-term funds are used.

But then, they are not as flexible and the total cost of long term funds (after considering the rate of interest and the period for which it is taken) is higher. The finance manager generally chooses a combination of long-term and short-term funds in such a way that he maximizes the return and minimizing the risk while doing so.

Lowering the level of investment in current assets, while still being able to support sales, would lead to an increase in the firm’s return on the total assets. To the extent that the explicit costs of short-term financing are less than the long-term financing, the greater the proportion of short-term debt to total debt, the higher is the profitability of the firm.