To find out the cost of materials issued from stores several methods are used. The choice of method should be based on the nature of material and the type of business.

Following are some important methods, which are commonly used: 1. “First-in-First Out” Method 2. “Last-in-First-Out” Method 3. Average Price Method 4. Fixed Price Method 5. Actual Cost Method 6. Current Value Method 7. Inflated Price Method.

1. “First-In-First-Out” Method:

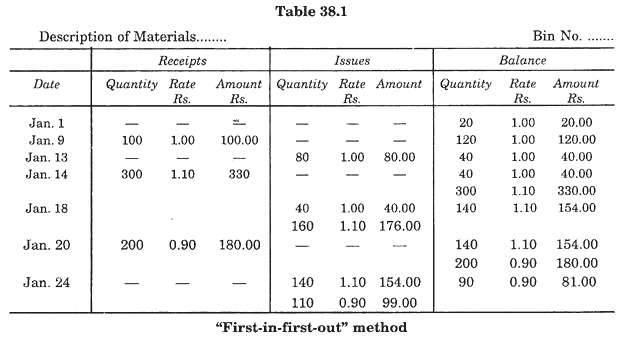

This is also known as original cost method. In this system goods received are entered in the stores record at actual cost plus other charges such as freight, taxes, insurance etc. In this system, the materials first received are issued first. Materials from second lot are issued only when first lot is exhausted. The prices are charged at the cost at which that lot was purchased.

Applications:

ADVERTISEMENTS:

This method is suitable:

(i) Where size and cost of material is large.

(ii) Where at any time more than 2 or 3 lots are not likely to remain in stock. (iii) Where the production is rapid.

Advantages:

ADVERTISEMENTS:

(i) In this method, actual cost of material consumed is considered.

(ii) It is simple in use and do not require lengthy calculations.

Disadvantages:

In this method there is no consideration of the current market prices.

Table 38.1 will show that how this method is applied:

2. “Last-In-First-Out” Method:

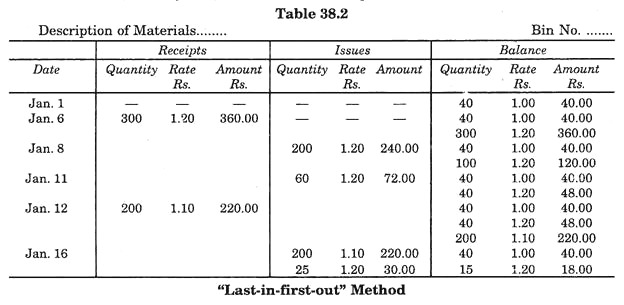

As the name suggests, in this system the material of the last lot of a particular item is first issued and hence the price of material issued is charged at the rate of material received in the last lot (the newest lot price). If the last lot exhausted then the price of the remaining last lot is considered.

Application:

ADVERTISEMENTS:

This system is applicable, where production is rapid.

Advantages:

This system is applicable, where current cost is charged.

Disadvantage:

ADVERTISEMENTS:

Old stock is not exhausted first, which always remains in stock and hence liable to deteriorate or to become out of date.

This method can easily be understood with the help of Table 38.2:

3. Average Price Method:

In this method average cost of material is charged for the product.

ADVERTISEMENTS:

These are several ways of determining the average price but generally following two methods are in use:

(a) Simple average method.

(b) Month end average method.

(a) Simple Average Method:

ADVERTISEMENTS:

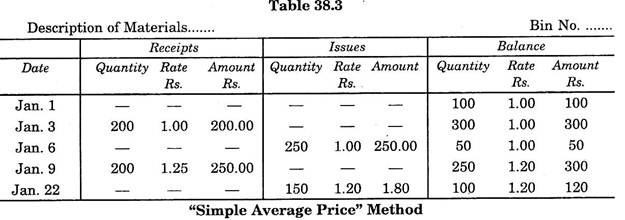

It means the average cost of material in hand on the date of issue from stores. Each time, when the material is issued, average cost is calculated. Therefore, new calculations are necessary after every entry to obtain the mean price.

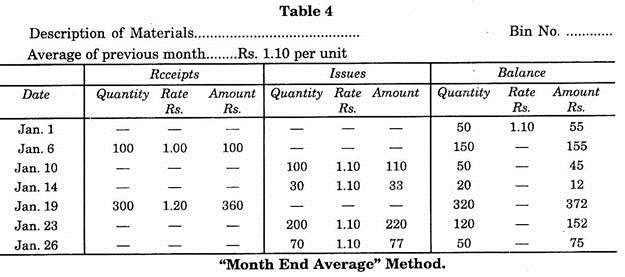

(b) Month End Average Method:

In this method average cost of each type of material is calculated at the end of each month and is charged for all the issues during the following months.

Tables 38.3 and 38.4 will explain the correct procedure of charging the cost by these two methods.

Average cost of the material during January, as per Table 38.4, will be

Now this rate, i.e. Rs. 1.15/unit will be charged during the month of February.

4. Fixed Price Method:

In this method, issued material is charged at a predetermined estimated price for a fixed period. Mostly for one year one rate is charged. Therefore, receipts and issues are recorded in quantities only which make store-keeping easy. This method is also known as “Standard Price” method. Price is generally fixed on the basis of past experience and future trends.

Application:

This system is mostly used where the fluctuations in the market price are very less and few.

5. Actual Cost Method:

In this method actual cost is charged for the material to be issued from the store.

ADVERTISEMENTS:

Application:

This system is generally used where purchasing is done only for the specific purpose, such as spare parts, special Dies, Jigs and Fixtures and other special equipment.

6. Current Value Method:

This method charges current market price for the materials irrespective of the purchased price. This helps in estimating the actual cost of product by which tenders can stand market competition.

This system involves a great difficulty in finding out actual market price at every issue from the stores and, therefore, not so common.

7. Inflated Price Method:

In this system, the charged cost of the material is slightly raised (Inflated) by small percentage of the actual purchase price. All other methods have not taken into account the wastage of material in stores which is unavoidable. Therefore, certain percentage is charged for normal wastage on the purchase price. Thus cost of material issued is raised by some percentage to recover the wastage cost.