Here is a compilation of various financial management problems along with its relevant solutions.

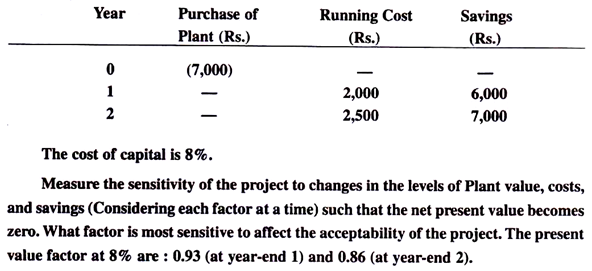

Problem 1:

ABC Ltd. is considering a project with following cash flows:

ADVERTISEMENTS:

Solution:

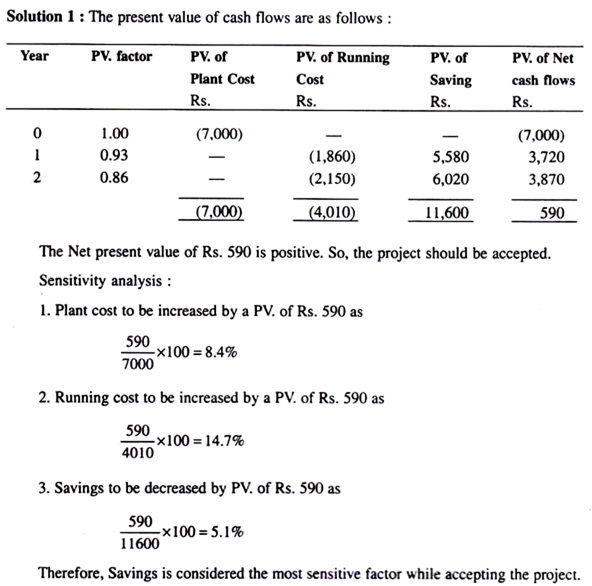

Problem 2:

ADVERTISEMENTS:

ABC Ltd. has a choice between three projects: X, Y, Z. The following information has been estimated:

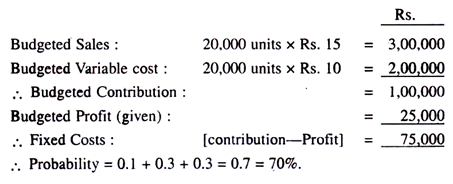

XYZ Ltd. company has estimated unit variable cost of a product to be Rs. 10 and the selling price is Rs. 15 per unit. Budgeted sales for the year are 20,000 units.

ADVERTISEMENTS:

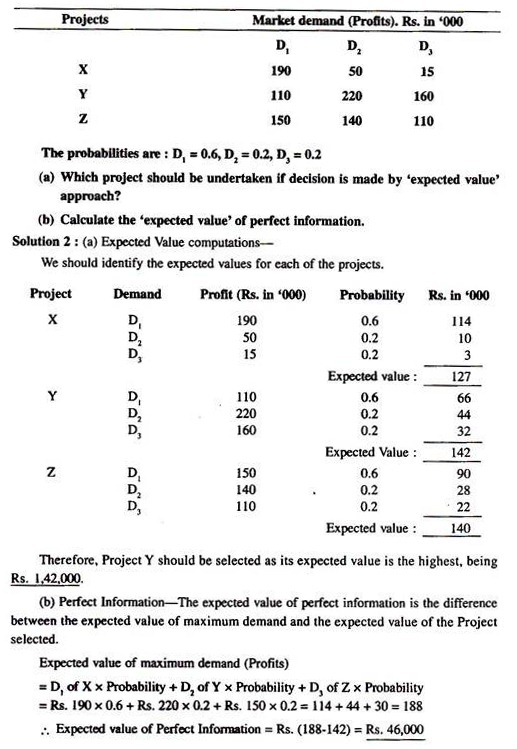

Estimated fixed costs per annum are as follows:

What is the probability that the company will equal or exceed its target profit of Rs. 25,000 for the year?

Solution:

ADVERTISEMENTS:

Here, the outcome for fixed costs are mutually exclusive events. If fixed costs are Rs. 50,000 or Rs. 60,000 or Rs. 70,000, these are exclusively such events and they cannot be anything else.

So, the probability of fixed costs will be as follows:

Problem 4:

ADVERTISEMENTS:

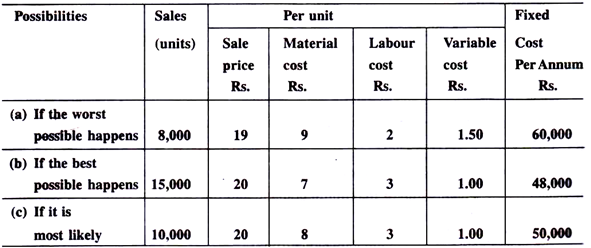

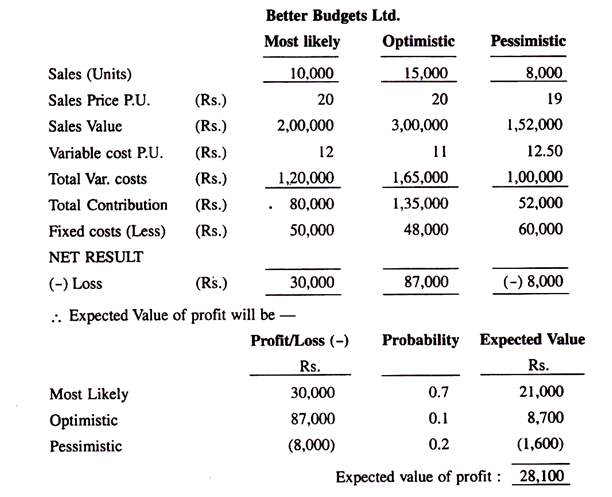

Better Budgets Ltd. are preparing their budgets for the year 200X. In the preparation of the budget, they would not like to take any chance, but would like to envisage all sorts of possibilities and incorporate them in the budget.

Their considered estimates are as under:

ADVERTISEMENTS:

There is a 20% probability that the worst will happen, a 10% probability that the best will happen, and a 70% probability that the most likely outcome will occur.

What will be the ‘expected value’ of profit as per Budget for 200X?

Solution:

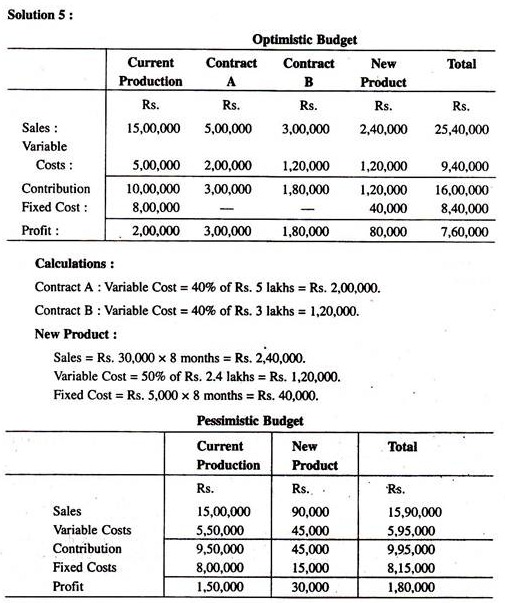

Problem 5:

ADVERTISEMENTS:

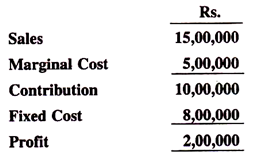

Frustrated Ltd. observes that the sales for the past few years and its profits have been around in the following figures:

In preparing the budget for the year 200X, there is uncertainty about several points of importance as under:

1. It has submitted offers for two contracts, each to overseas customers.

For each of these contracts, the variable costs (including selling & distribution costs) would be 40% of sales value. Total fixed cost would be unaffected by the contracts. The company hopes to win both contracts, but thinks it more likely that it will win contract A but not contract B.

ADVERTISEMENTS:

2. A new product is due to be introduced in the year 200X. Expected sales are Rs. 30,000 per month with variable costs 50% of sales and fixed costs Rs. 5,000 per month. The most likely date for the introduction of new product is middle of the year 200X, but could be introduced at the end of fourth month or as late as the end of ninth month.

3. Although it is expected on balance that sales price and costs will not go up, there is a reasonable possibility that variable costs on the current production range will go up by 10%.

Prepare a pessimistic and optimistic budget for the company for the year 200X.

Solution:

ADVERTISEMENTS:

Calculations:

Current Production: Variable Cost goes up by 10%

ADVERTISEMENTS:

Variable Cost = Rs. 5 lakhs + 10% of Rs. 5 lakhs = Rs. 5, 50,000.

New Product: Sales = Rs. 30,000 x 3 months = Rs. 90,000.

Variable Cost = 50% of Rs. 90,000 = Rs. 45,000.

Fixed Cost = Rs. 5,000 x 3 months = Rs. 15,000.

Sensitivity factors:

(i) ‘More likely to win Contract A’ is clearly stated and so Contract A is not included in the Pessimistic Budget.

ADVERTISEMENTS:

(ii) Similarly, there is no certainty to win Contract B, and therefore, Contract B is also not considered in the Pessimistic Budget.

However, if the Contract B is won at a later date (of course, remote possibility), the profit of Rs. 1, 80,000 (shown in the Optimistic Budget) would accrue.

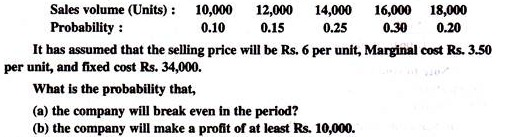

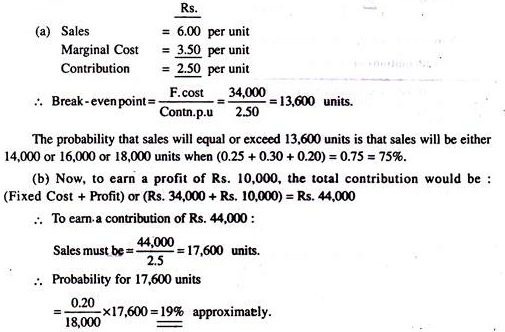

Problem 6:

A company has estimated the following demand level of its product:

Solution:

Problem 7:

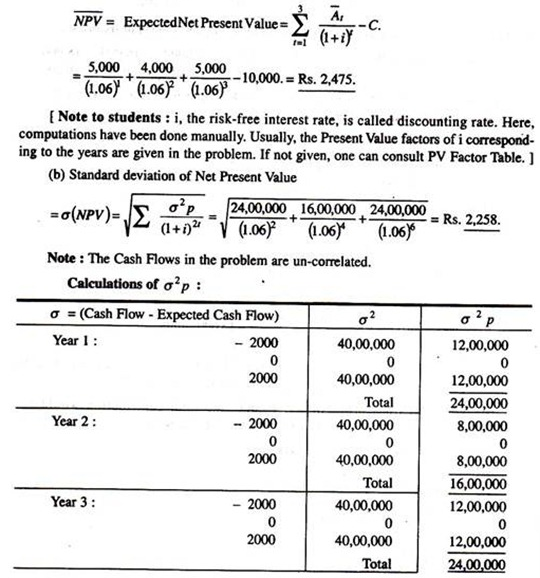

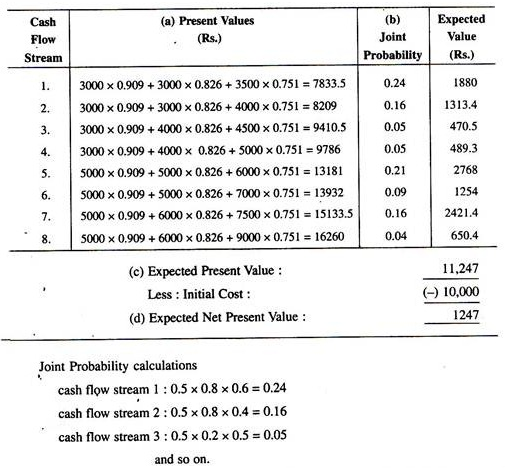

A project involving an initial outlay of Rs. 10,000 has the following benefits associated with it:

Solution:

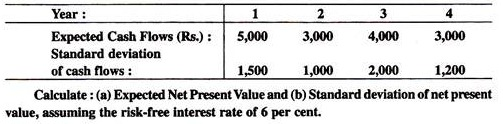

Problem 8:

An investment project involves a current outlay of Rs. 10,000. The mean and standard deviation of cash flows, which are perfectly correlated, are as follows:

Solution:

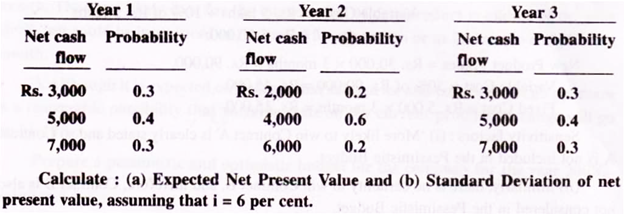

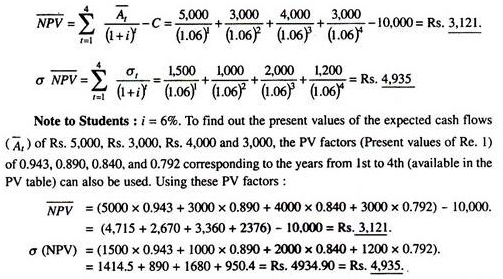

Problem 9:

A problems involves an outlay of Rs. 10,000. The cash inflows expected to be generated by the project are as follows:

Solution: