This article throws light upon the four main guidelines for the issue of bonus shares. The guidelines are: 1. Conditions for Bonus Issue 2. Restriction on Bonus Issue 3. Bonus Shares only against Reserves, etc. if Capitalised in Cash 4. Completion of Bonus Issue.

Guideline # 1. Conditions for Bonus Issue:

Subject to the provisions of the Companies Act, 1956 or any other applicable law for the time being in force, a listed issuer may issue bonus shares to its members if:

(a) It is authorised by its articles of association for issue of bonus shares, capitalisation of reserves, etc.: Provided that if there is no such provision in the articles of association, the issuer shall pass a resolution at its general body meeting making provisions in the articles of associations for capitalisation of reserve;

(b) It has not defaulted in payment of interest or principal in respect of fixed deposits or debt securities issued by it;

ADVERTISEMENTS:

(c) It has sufficient reason to believe that it has not defaulted in respect of the payment of statutory dues of the employees such as contribution to provident fund, gratuity and bonus;

(d) The partly paid shares, if any outstanding on the date of allotment, are made fully paid up

Guideline # 2. Restriction on Bonus Issue:

(a) No issuer shall make a bonus issue of equity shares if it has outstanding fully or partly convertible debt instruments at the time of making the bonus issue, unless it has made reservation of equity Shares Of the same class in favour of the holders of such outstanding convertible debt instruments in proportion to the convertible part thereof.

(b) The equity shares reserved for the holders of fully or partly convertible debt instruments shall be issued at the time of conversion of such convertible debt instruments on the same terms or same proportion on which the bonus shares were issued.

Guideline # 3. Bonus Shares only against Reserves, etc. if Capitalised in Cash:

ADVERTISEMENTS:

(a) The bonus issue shall be made out of free reserves built out of the genuine profits or securities premium collected in cash only and reserves created by revaluation of fixed assets shall not be capitalised for the purpose of issuing bonus shares.

(b) Without prejudice to the provisions of sub-regulation (1), the bonus share shall not be issued in lieu of dividend.

Guideline # 4. Completion of Bonus Issue:

(a) An issuer, announcing a bonus issue after the approval of its board of directors and not requiring shareholders’ approval for capitalisation of profits or reserves for making the bonus issue, shall implement the bonus issue within fifteen days from the date of approval of the issue by its board of directors.

Provided that where the issuer is required to seek shareholders’ approval for capitalisation of profits or reserves for making the bonus issue, the bonus issue shall be implemented within two months from the date of the meeting of its board of directors wherein the decision to announce the bonus issue was taken subject to shareholders’ approval.

ADVERTISEMENTS:

(b) Once the decision to make a bonus issue is announced, the issue cannot be withdrawn.

Accounting Treatment for the Issue of Bonus Shares:

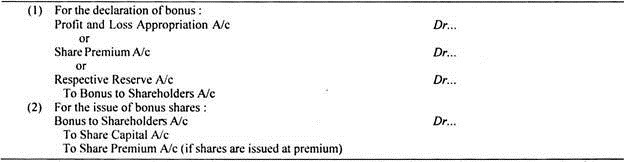

(a) When the unissued shares of the company are issued to its existing shareholders as fully paid bonus shares, the following journal entries should be recorded:

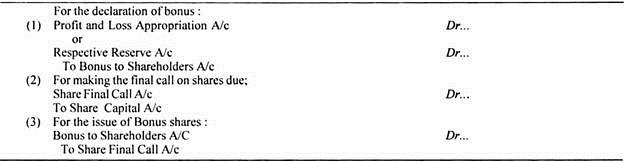

(b) When the existing partly paid shares are converted into fully paid shares as a result of bonus issue, the following journal entries shall be made: