This article provides a full proof formula to calculate break even point.

BEP can be calculated in a number of ways, depending on the nature of the information available.

Let us use the following symbols in our calculation:

P: Selling price per unit

ADVERTISEMENTS:

q: sales volume

f: fixed cost me

v: per unit variable cost.

Now for BEP, Sales = Total cost = Total Fixed cost + Total Variable cost.

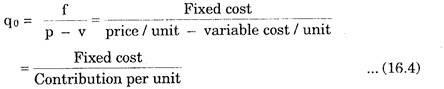

(A) Break-Even Point in Units:

ADVERTISEMENTS:

i.e. If q0 denotes the level of volume, where there is break-even, then

Total sales = p.q0

Total cost = f + q0v

Thus for break-even

Example 1:

A factory, producing only one item, which it sells for Rs. 10.50 per unit, has a fixed cost equal to Rs. 50,000 and variable cost Rs.6.50 per unit. How many units must be produced to break-even? How many units must be produced to procure a profit of Rs. 10,000? What would be the profit if 20,000 units are produced and sold?

Solution:

(i) Here f = 50,000

ADVERTISEMENTS:

p = 10.50 per unit

v = 6.50 per unit.

Thus the break-even point from (16.4) is

Q = f/p-v = 50,000/10.50-6.50 = 12,500 units

ADVERTISEMENTS:

(ii) Let q units be produced for a profit of Rs. 10,000.

Then total revenue = Price/unit x output = 10.50 q

Total cost = fixed cost + (output) (variable cost/unit)

= 50,000 + q (6.50)

ADVERTISEMENTS:

Profit = Total revenue – total cost

= 10.50 q -50,000 -6.50q

i.e. 10,000 = 4q – 50,000 or 4q = 60,000

q = 15,000 units

ADVERTISEMENTS:

(iii) Profit = Total revenue -total cost

= 10.50 (20,000) – [50,000 + 6.50 (20,000)] .

= 20,000 (10.50 – 6.50) – 50,000 i

= 80,000 – 50,000 = Rs. 30,000.

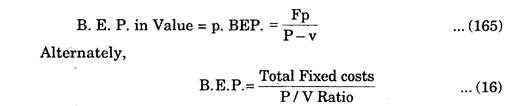

(B) Given Total Sales (S), Fixed Cost (F) and Total Variable Cost (V):

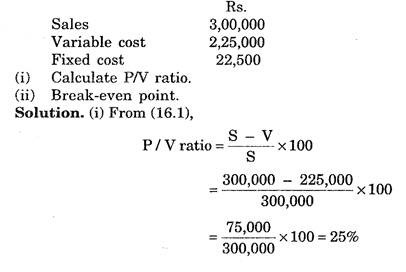

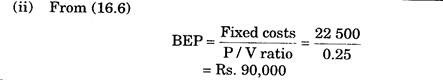

Example 2:

ADVERTISEMENTS:

The following figures relate to a small manufacturing company.