List of twenty-nine commonly asked questions on senior citizen scheme with answers.

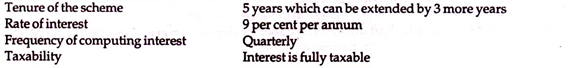

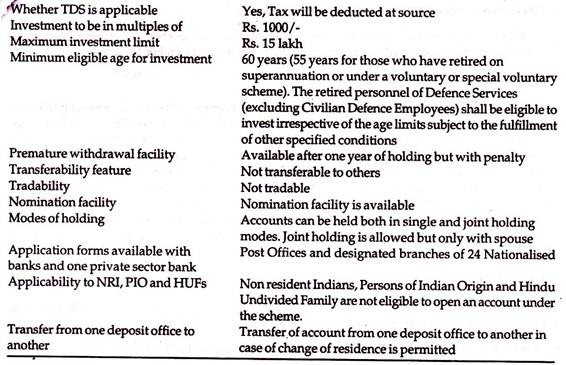

Q. 1. What are the salient features of the Senior Citizens Savings Scheme, 2004?

Ans.

Q. 2. Can a joint account be opened under the scheme with any person?

Ans. Joint account under the SCSS, 2004 can be opened only with the spouse [Rule 3 (3)]

Q. 3. What should be the age of the spouse in case of a joint account?

Ans. In case of a joint account, the age of the first applicant / depositor is the only factor to decide the eligibility to invest under the scheme. There is no age bar/limit for the second applicant / joint holder (i.e. spouse) [Rule 3 (3)]

ADVERTISEMENTS:

Q. 4. What will be the share of the joint account holder in the deposit in an account?

Ans. The whole amount of investment in an account under the scheme is attributed to the first applicant / depositor only. As such, the question of any share of the second applicant / joint account holder (i.e. spouse) in the deposit in the account, does not arise. [Rule 3 (3)]

Q. 5. Whether both the spouses can open separate accounts in their individual capacity with separate limit of Rs.15 lakh for each of them?

Ans. Yes. Both the spouses can open individual and / or joint accounts with each other with the maximum deposits upto Rs.15 lakh each, provided both are individually eligible to invest under relevant provisions of the Rules governing the scheme (Rules 3 and 4)

ADVERTISEMENTS:

Q. 6. Whether any income tax rebate / exemption is admissible?

Ans. No income tax / wealth tax rebate is admissible under the scheme. The prevailing income tax provisions shall apply (GOI letter F. No.2/8/2004/NS-II dated October 13,2004)

Q. 7. Is TDS applicable to the scheme?

Ans. Yes, TDS is applicable to the scheme as interest payments have not been exempted from deduction of tax at source. The facility of furnishing a declaration in Form No. 15H (prescribed under the Income Tax Rules, 1962) is available to a person (payee) resident in India and who is of the age of 65 years or more at any time during the previous year (since a person who has attained 65 years or more at any time during the previous year only is treated as a Senior Citizen under the provisions of Income Tax Act, 1961).

ADVERTISEMENTS:

A declaration in Form 15G can be furnished by a depositor of less than 65 years of age. In cases where a certificate under Section 197(1) of the Income Tax Act, 1961 from the Assessing Officer is furnished, the agency banks / post offices shall not deduct tax at source or, as the case may be, deduct at a lower rate as specified in the certificate. (GOI letter F. No.2/8/2004/NS-II dated March 28, 2006)

Q. 8. Whether any minimum limit has been prescribed for deduction of tax at source?

Ans. Tax is to be deducted at source if the interest paid or payable exceeds Rs.5000/- during the financial year. (GOI letter F. No.2/8/2004/NS-H dated June 06,2006)

Q. 9. What is the rate at which TDS is to be deducted from the account holder?

ADVERTISEMENTS:

Ans. The rate for TDS for a financial year is specified in Part II of Schedule I of the Finance Act for that year.

The prescribed rates for the financial year 2006-2007 are as under:

In the case of a person other than a company;

(a) Person resident in India -10 %

ADVERTISEMENTS:

(b) Others-20%

The amount so deductible shall be enhanced by surcharge calculated as per the following rate:

In the case of Individual, HUF, Association of Person and Body of Individuals – 10% if the interest paid / payable exceeds Rs.1000000/-

The amount of “TDS+Surcharge” shall be further enhanced by 2 % of “TDS+Surcharge” on account of education cess (GOI letter F. No.2/8/2004/NS-II dated June 06,2006).

ADVERTISEMENTS:

Q. 10. Whether TDS should also be recovered from the undrawn interest payable to the legal heirs of the deceased depositors?

Ans. Tax shall be deducted at source even from any interest paid / payable to the legal heir of the account holder. (GOI letter F. No.2/8/2004/NS-II dated June 06,2006)

Q. 11. Whether TDS on interest payments will be applicable with retrospective effect or prospective basis?

Ans. TDS is applicable from the very first day that SCSS, 2004 was made operational regardless of the fact that the Central Government or Reserve Bank of India or any authority might have issued any Notification / circular / clarification at a later stage (GOI letter F. No.2/8/2004/NS-II dated June 06, 2006)

Q. 12. Whether only one person or number of persons can be nominated in the accounts opened under the Scheme?

Ans. The depositor may, at the time of opening of the account, nominate a person or persons who, in the event of death of the depositor, shall be entitled to payment due on the account [Rule 6 (1)]

ADVERTISEMENTS:

Q. 13. Can a nomination be made after the account has already been opened?

Ans. Yes. Nomination may be made by the depositor at any time after the opening of the account but before its closure, by an application in Form C accompanied by the Pass book to the deposit office [Rule 6 (2)]

Q. 14. Can a nomination be cancelled or changed?

Ans. Yes. The nomination made by the depositor may be cancelled or varied by submitting a fresh nomination in Form C to the deposit office where the account is being maintained [Rule 6 (3)]

Q. 15. Can nomination be made in joint account also?

Ans. Nomination can be made in joint account also. In such a case, the joint holder will be the first person entitled to receive the amount payable in the event of death of the depositor. The nominee’s claim shall arise only after the death of both the joint holders [Rule 6 (4)]

ADVERTISEMENTS:

Q. 16. Can a person holding the Power of Attorney sign for the nominee in the nomination form?

Ans. No. The person holding the Power of Attorney cannot sign for the nominee in the nomination form (GOI letter No. F.15/8/2005/NS-II dated March 02,2006)

Q. 17. In case of a joint account, if the first holder/ depositor expires before maturity, can the account be continued?

Ans. In case of a joint account, if the first holder / depositor expires before the maturity of the account, the spouse may continue the account on the same terms and conditions as specified under the SCSS Rules. However, if the second holder i.e. spouse has his / her own individual account, the aggregate of his/her individual account and the deposit amount in the joint account of the deceased spouse should not be more than the prescribed maximum limit.

In case the maximum limit is breached, then the remaining amount shall be refunded, so that the aggregate of the individual account and deceased spouse’s joint account is maintained at the maximum limit [Rules 6 (4) and 8 (3)]

Q. 18. What happens to the accounts if both the spouses are maintaining individual accounts and not any joint account and one of them expires?

ADVERTISEMENTS:

Ans. If both the spouses have opened separate accounts under the scheme and either of the spouses dies during the currency of the account(s), the account(s) standing in the name of the of the deceased depositor / spouse shall not be continued and such account(s) shall be closed [Rule 5 of the Senior Citizens Savings Scheme (Amendment) Rules, 2004 notified on October 27,2004]

Q. 19. Whether any fee has been prescribed for nomination and / or change / cancellation of nomination?

Ans. No fee has been prescribed for nomination and /or change / cancellation of nomination(s) in the accounts under the SCSS, 2004 (GOI letter F. No.2/8/2004/NS-II dated October 13,2004)

Q. 20. What is the age limit in the case of retired on superannuation or retired Defence Personnel for investment in the scheme?

Ans. The retired personnel of Defence Services (excluding Civilian Defence Employees) shall be eligible to subscribe under the scheme irrespective of the age limit of 60 years subject to the fulfillment of other specified conditions (The Senior Citizens Savings Scheme (Amendment) Rules, 2004 notified on October 27,2004)

Q. 21. What do you mean by ‘retirement benefits’ for the purpose of SCSS, 2004?

ADVERTISEMENTS:

Ans. “Retirement benefits” for the purpose of SCSS Rules have been defined as ‘any payment due to the depositor on account of retirement whether on superannuation or otherwise and includes Provident Fund dues, retirement / superannuation gratuity, commuted value of pension, cash equivalent of leave, savings element of Group Savings linked Insurance scheme payable by employer to the employee on retirement, retirement-cum-withdrawal benefit under the Employees’ Family Pension Scheme and ex-gratia payments under a voluntary retirement scheme’ (Rule 2 (a) of the Senior Citizens Savings Scheme (Amendment) Rules, 2004 notified on October 27,2004)

Q. 22. Can deposits under the SCSS scheme be made only from amounts received as retirements benefits?

Ans. In case an investor has attained the age of 60 years and above, the source of amount being invested is immaterial [rule 2 (d)(i)]. However, if the investor is 55 years or above but below 60 years and has retired under a voluntary scheme or a special voluntary scheme or has retired from the defence services, only the retirement benefits can be invested in the SCSS [rule 2(d)(ii)].

Q. 23. Is there a period prescribed for opening deposit account under the SCSS scheme, by the senior citizen, from the retirement benefits?

Ans. If the investor is 60 years and above, there is no time period prescribed for opening the SCSS account(s).

However for those below 60 years, the time period prescribed are:

ADVERTISEMENTS:

(a) the persons who have attained the age of 55 years or more but less than 60 years and who retired under a voluntary retirement scheme or a special voluntary retirement scheme on the date of opening of an account under these rules, subject to the condition that the account is opened by such individual within three months of the date of retirement.

(b) the persons who have retired at any time before the commencement of these rules and attained the age of 55 years or more on the date of opening of an account under these rules, shall also be eligible to subscribe under the scheme within a period of one month of the date of this notification (27th October 2004), subject to fulfillment of other conditions [rule 2 of the Senior Citizens Savings Scheme (Amendment) Rules, 2004]

(c) the retired personnel of Defence Services (excluding Civilian Defence Employees) shall be eligible to subscribe under the scheme irrespective of the above age limits subject to the fulfillment of other specified conditions [rule 2 of the Senior Citizens Savings Scheme (Amendment) Rules, 2004]

Q. 24. Can an account holder obtain loan by pledging the deposit / account under the SCSS,2004 ?

Ans. The facility of pledging the deposit / account under the SCSS, 2004 for obtaining loans, has not been permitted since the account holder will not be able to withdraw the interest amount periodically, defeating the very purpose of the scheme (GOI letter F. No.2/8/2004/NS-II dated May 31,2005)

Q. 25. Is premature withdrawal of the deposits from the accounts under the SCSS, 2004 permitted?

Ans. Premature withdrawal / closure of the deposits from the accounts under the SCSS, 2004 has been permitted after completion of one year from the date of opening of the account after deducting the penalty amount as given below:

(i) If the account is closed after one year but before expiry of two years from the date of opening of the account, an account equal to one and half per cent of the deposit amount shall be deducted.

(ii) If the account is closed on or after the expiry from the date of opening of the account, an amount equal to one per cent of the deposit shall be deducted

However, if the depositor is availing the facility of account under Rule 4 (3), then he can withdraw the deposit and close the account at any time after the expiry of one year from the date of extension of the account without any deduction. [Rule 9(1) (a) (b) and (2)]

Q. 26. Are Non-resident Indians, Persons of Indian Origin and Hindu Undivided Family eligible to invest in the SCSS, 2004?

Ans. Non-resident Indians (NRIs), Persons of Indian Origin (PIO) and Hindu Undivided Family (HUF) are not eligible to invest in the accounts under the SCSS, 2004. If a depositor becomes a Non-resident Indian subsequent to his opening the account and during the currency of the account under the SCSS Rules, the account may be allowed to continue till maturity, on a non-repatriation basis and the account shall be marked as a Non-Resident account [Rule 13 and GOI letter F.No.2/8/ 2004/NS-II dated June 19,2006)

Q. 27. Can an account be transferred from one deposit office to another?

Ans. A depositor may apply in Form G, enclosing the Pass book thereto, for transfer of his account from one deposit office to another, in case of change of residence. If the deposit amount is rupees one lakh or above, a transfer fee of rupees five per lakh of deposit for the first transfer and rupees ten per lakh of deposit for the second and subsequent transfers shall be payable [Rule 11 and GOI Notification GSR..(E) dated March 23,2006)

Q. 28. What happens if an account is opened in contravention of the SCSS Rules?

Ans. If an account has been opened in contravention of the SCSS Rules, the account shall be closed immediately and the deposit in the account, after deduction of the interest, if any, paid on such deposit, shall be refunded to the depositor (Rule 12)

Q. 29. Can you please furnish the names of banks handling SCSS, 2004?

Ans. At present there are 24 Nationalised banks and one private sector bank which are handling the SCSS, 2004. The list is given below:

1. State Bank of India

2. State Bank of Hyderabad

3. State Bank of Indore

4. State Bank of Bikaner and Jaipur

5. State Bank of Patiala

6. State Bank of Saurashtra

7. State Bank of Mysore

8. State Bank of Travancore

9. Allahabad Bank

10. Bank of Baroda

11. Bank of India

12. Bank of Maharashtra

13. Canara Bank

14. Central Bank of India

15. Corporation Bank

16. Dena Bank

17. Indian Bank

18. Indian Overseas Bank

19. Punjab National Bank

20. Syndicate Bank

21. UCO Bank

22. Union Bank of India

23. United Bank of India

24. Vijaya Bank

25. ICICI Bank Ltd.

It may be noted that only designated branches of these banks have been authorized to handle SCSS, 2004.